Work From Home Tax Rebate 2024 To apply for working from home tax relief you need to follow the steps on the government s website There are two different times to claim at the end of the tax year or

As of the 2023 24 tax year you can claim 6 per week which adds up to 312 for the entire year if you worked from home for the full 52 weeks This allowance is expected to remain the same If you work from home for a substantial portion of your working time you can claim a deduction for the actual expenses caused by the fact that you work in the remote workspace

Work From Home Tax Rebate 2024

Work From Home Tax Rebate 2024

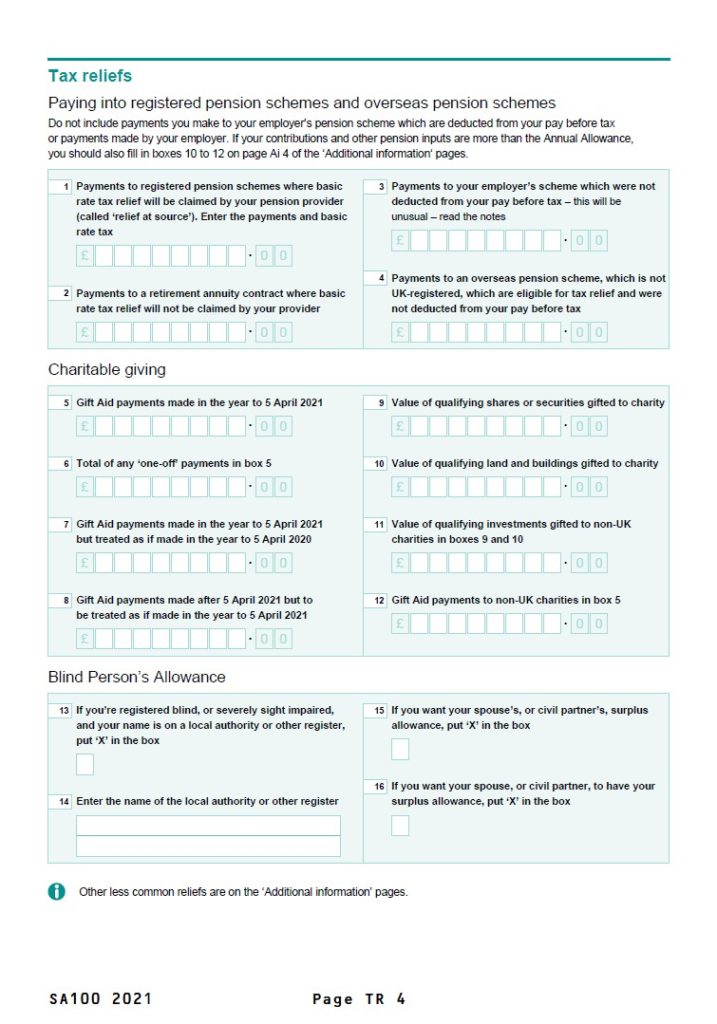

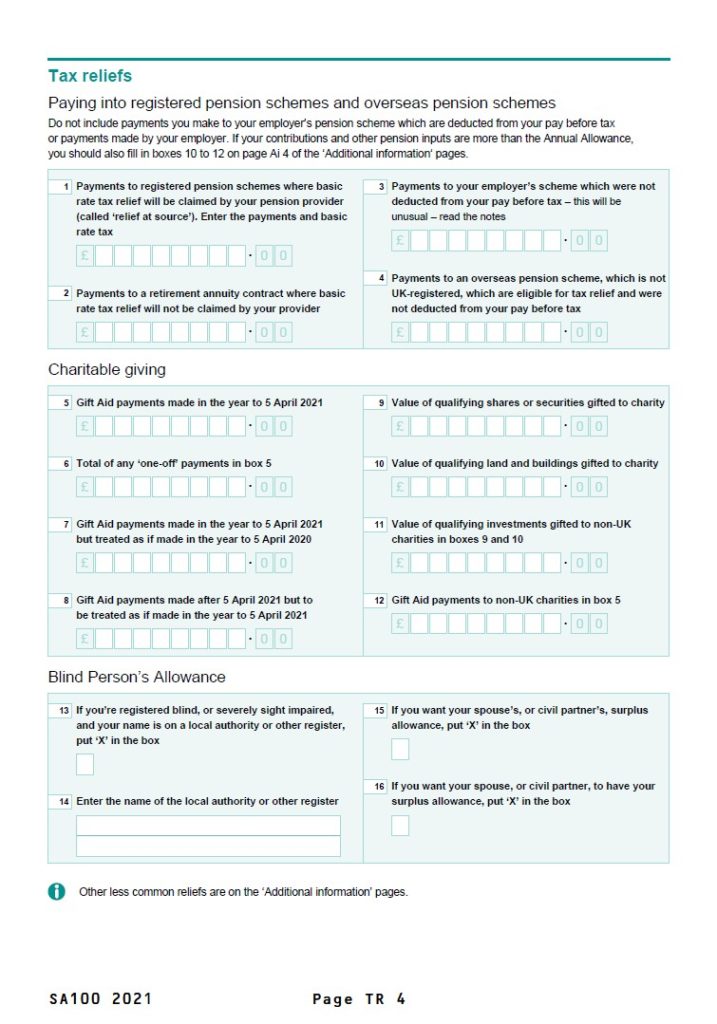

https://printablerebateform.net/wp-content/uploads/2021/07/Work-from-Home-Tax-Rebate-Form-2021-717x1024.jpg

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

How you claim depends on what you re claiming for Find out if you re eligible and how to claim tax relief if you work from home on uniforms work clothing and tools for vehicles you In Tax Credits and Relief select Your job and then select Remote Working Relief You can complete your 2023 Income Tax Return from 1 January 2024 Remote

If you worked from home during the 2020 21 and 2021 22 tax years but failed to apply for the rebate you can still do so because claims can be backdated In the article we If your employer does not pay you a working from home allowance for your expenses you can make a claim for tax relief during the year or after the end of the year You will get money back

Download Work From Home Tax Rebate 2024

More picture related to Work From Home Tax Rebate 2024

Homeowner Renters District 16 Democrats

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

Tax Rebate Service No Rebate No Fee MBL Accounting

https://mblaccounting.co.uk/wp-content/uploads/2021/04/Tax-Rebate.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

Yes you can claim working from home tax relief for the 2024 25 tax year and the previous four tax years What is the deadline to apply for WFH tax relief HMRC confirms that Millions of workers were able to claim tax relief on expenses they incurred from working from home during the Covid 19 pandemic but the rules have changed since then

The process for claiming tax relief for working from home is fairly straightforward You can easily apply for the rebate yourself Claims for working from home tax relief can be You can make a claim for relief for working from home for this tax year and the previous 4 tax years For example the deadline to submit a claim for the 2020 2021 tax year is 5 April 2025

Printable Rebate Form For Old Style Beer Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/2100/21003/2100371/rebate-form_print_big.png

MA Tax Rebate 2023 How To Apply Eligibility And Amount Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/MA-Tax-Rebate-2023.jpg

https://blog.pleo.io › en › working-from-home-tax-relief

To apply for working from home tax relief you need to follow the steps on the government s website There are two different times to claim at the end of the tax year or

https://www.entrepreneurblog.co.uk › hmrc-working...

As of the 2023 24 tax year you can claim 6 per week which adds up to 312 for the entire year if you worked from home for the full 52 weeks This allowance is expected to remain the same

Primary Rebate South Africa Printable Rebate Form

Printable Rebate Form For Old Style Beer Printable Forms Free Online

My Work From Home Tax Rebate Disappeared After I Used A Website That Looked Like HMRC Mirror

Empty Home Tax Rebate Axe Plan Pondered For West Norfolk

Property Tax Rebate Pennsylvania LatestRebate

Big Update On Income Tax Rebate In Union Budget 2023 No Tax Upto 7 Lakh YouTube

Big Update On Income Tax Rebate In Union Budget 2023 No Tax Upto 7 Lakh YouTube

Work From Home Tax Deductions Explained Tax Accounting Adelaide

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

Work From Home Tax Rebate 2024 - How you claim depends on what you re claiming for Find out if you re eligible and how to claim tax relief if you work from home on uniforms work clothing and tools for vehicles you