Nys Homeowners Tax Rebate Credit 2024 All New York residents are eligible to receive a no cost home energy assessment that can reveal how efficiently your home is operating and where energy is being wasted An assessment will provide you with recommendations to save energy and improve the efficiency comfort and safety of your home Get a Free Assessment

To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit The maximum credit allowed is 350 Note If you itemize deductions on your New York State income tax return you must reduce the amount you claim by the amount of this credit For more information see Form IT 196 New York Resident Nonresident and Part Year Resident Itemized Deductions and its instructions Additional information

Nys Homeowners Tax Rebate Credit 2024

Nys Homeowners Tax Rebate Credit 2024

https://townsquare.media/site/497/files/2022/06/attachment-RS28849_ThinkstockPhotos-623211702-scr.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

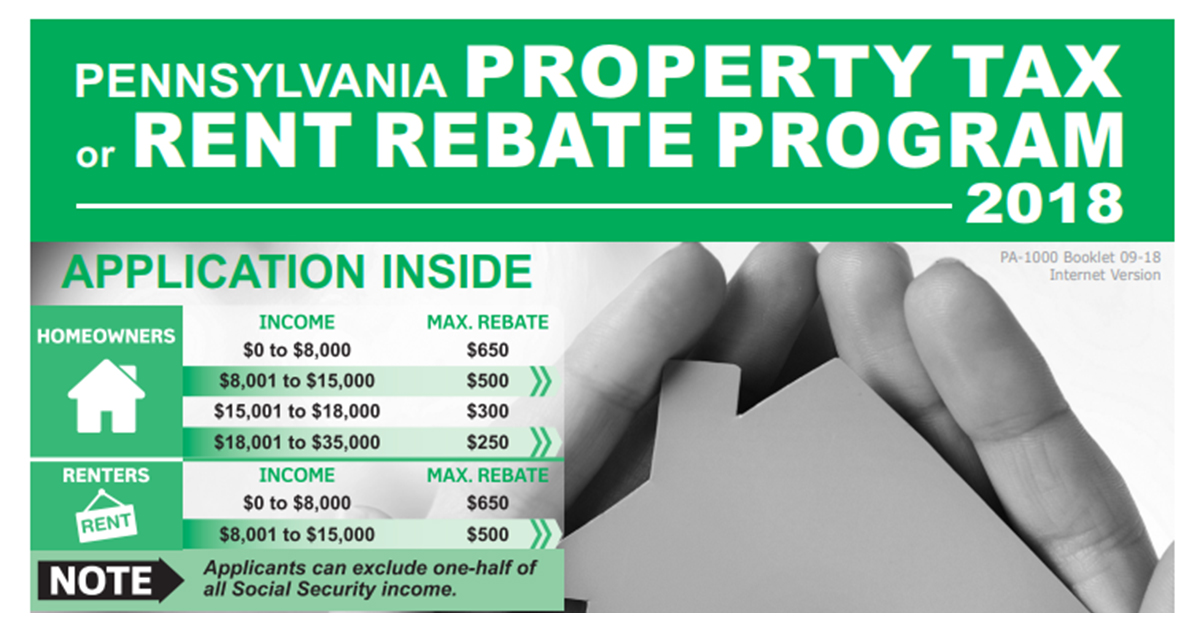

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

https://dsj.us/wp-content/uploads/2022/06/homeowners-tax-rebate-checks.jpg

The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state Homeowners used this lookup to determine the amount they would receive for the homeowner tax rebate credit HTRC Please note by law we cannot issue checks for the HTRC that are less than 100 Ready For homeowners within New York City If you are a New York City homeowner see New York City t o find the amount of your HTRC check

Who is eligible You are entitled to this refundable credit if your household gross income is 18 000 or less you occupied the same New York residence for six months or more you were a New York State resident for the entire tax year you could not be claimed as a dependent on another taxpayer s federal income tax return The New York Department of Taxation and Finance will soon begin sending direct financial assistance to 1 75 million New Yorkers who received the Empire State Child Credit and or the Earned Income Credit on their 2021 state tax returns including a gas tax moratorium and a homeowner tax rebate credit Our families have felt the effects of a

Download Nys Homeowners Tax Rebate Credit 2024

More picture related to Nys Homeowners Tax Rebate Credit 2024

NYS 2023 Homeowner Tax Rebate Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/NYS-2023-Homeowner-Tax-Rebate.jpg?fit=996%2C728&ssl=1

Nys Tax Rebate Checks 2023 Tax Rebate

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-new-stimulus-checks-up-to-1-050-are-going-out-soon-to-nys-homeowners-from-nys-taxation-rebate-checks-2023-post.png?w=979&ssl=1

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

https://i.ytimg.com/vi/ZN9k_nErOQE/maxresdefault.jpg

The FY 2024 Budget infuses New York s Emergency Rental Assistance Program with 391 million to support additional tenants and families including NYCHA and other public housing residents and recipients of federal Section 8 vouchers This funding will complement other investments in the Budget to support public housing residents such as a 135 ALBANY N Y In June Governor Kathy Hochul announced the one time Homeowner Tax Rebate Credit would be sent out available to eligible New Yorkers The state s Department of Taxation and

A school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit Note By law we can t issue checks for the Homeowner tax rebate credit that are less than 100 If the amount of the credit calculated was less than 100 you will not receive a check To learn more please visit our Homeowner tax rebate credit Accelerates a 1 2 Billion Dollar Middle Class Tax Cut and Provides a Homeowner Tax Rebate Credit for Almost 2 5 Million New Yorkers Provides Up to 250 Million in Tax Credits and Relief for Small Businesses COVID 19 Related Expenses and Exempts 15 Percent in Eligible Small Business Income from Taxation Through a Tax Relief Program

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1920&h=1080&crop=1

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In NYS 2023 Budget WRGB

https://cbs6albany.com/resources/media2/16x9/full/1024/center/80/6df365a4-868a-491a-b350-4442a687917a-large16x9_thumb_196074.png

https://www.nyserda.ny.gov/All-Programs/Inflation-Reduction-Act/Inflation-Reduction-Act-homeowners

All New York residents are eligible to receive a no cost home energy assessment that can reveal how efficiently your home is operating and where energy is being wasted An assessment will provide you with recommendations to save energy and improve the efficiency comfort and safety of your home Get a Free Assessment

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit

When Will The Hudson Valley Receive Their Homeowners Tax Rebate

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

Nys Rebate Check For Property Tax Tax Rebate

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

Nys School Tax Relief Checks Printable Rebate Form

Nys Star Tax Rebate Checks 2022 StarRebate

Nys Star Tax Rebate Checks 2022 StarRebate

Nys Homeowners Tax Rebate Credit 2024 - Who is eligible You are entitled to this refundable credit if your household gross income is 18 000 or less you occupied the same New York residence for six months or more you were a New York State resident for the entire tax year you could not be claimed as a dependent on another taxpayer s federal income tax return