Income Tax Rebate In Budget 2024 MoneyWatch 2024 tax refunds could be larger than last year due to new IRS brackets Here s what to expect By Aimee Picchi Edited By Alain Sherter January 24 2024 5 00 AM EST CBS News

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline The Tax Relief for American Families and Workers Act of 2024 aims to provide tax relief to American families workers and businesses It increases the nine percent low income housing tax credit ceiling by 12 5 percent for calendar years 2023 through 2025 Additionally the act lowers the bond financing threshold to 30 percent for projects

Income Tax Rebate In Budget 2024

Income Tax Rebate In Budget 2024

https://i.ytimg.com/vi/Ib9IdrMgw84/maxresdefault.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

The Tax Relief for American Families and Workers Act of 2024 Part 1 Tax Relief for Working Families Calculation of Refundable Credit on a Per Child Basis Under current law the maximum refundable child tax credit for a taxpayer is computed by multiplying that taxpayer s earned income in excess of 2 500 by 15 percent The left leaning Center on Budget and Policy Priorities projected that the changes which would apply for tax years 2023 2024 and 2025 would lift as many as 400 000 children above the poverty

Less than a month away from the presentation of the interim Union Budget 2024 a senior finance ministry official has said that no rebate is expected on income tax for the upcoming Union Budget 2023 had increased the threshold for income tax rebate from Rs 5 lakh to Rs 7 lakh for assessees opting for the new direct tax regime Any increase in tax rebate under

Download Income Tax Rebate In Budget 2024

More picture related to Income Tax Rebate In Budget 2024

Union Budget 2023 24 Highlights Vision Priorities Tax Slabs

https://s3-ap-south-1.amazonaws.com/adda247jobs-wp-assets-adda247/articles/wp-content/uploads/2023/02/01150822/Budget-2023-24.jpg

Fortune India Business News Strategy Finance And Corporate Insight

https://images.assettype.com/fortuneindia/2023-02/3b8dd321-a9ba-4a6c-916b-573958eeef52/Tax_03160_copy.JPG?w=1250&q=60

Union Budget 2020 How Income Tax Rebate Tax Exemption And Tax Deduction Are Different Here s

https://imgeng.jagran.com/images/2020/jan/29_08_2019-income_tax_195287911580362220002.jpg

Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax L ess than a month away from the presentation of the interim Union Budget 2024 a senior finance ministry official has said that no rebate is expected on income tax for the upcoming financial year

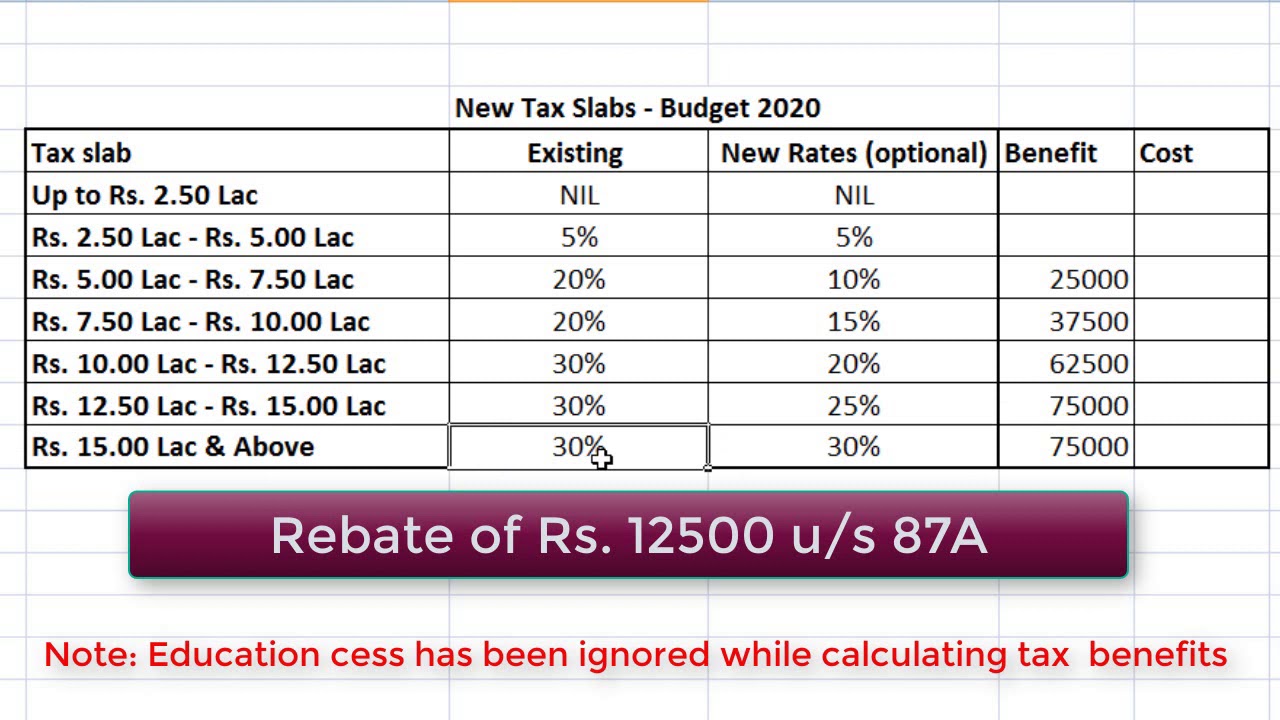

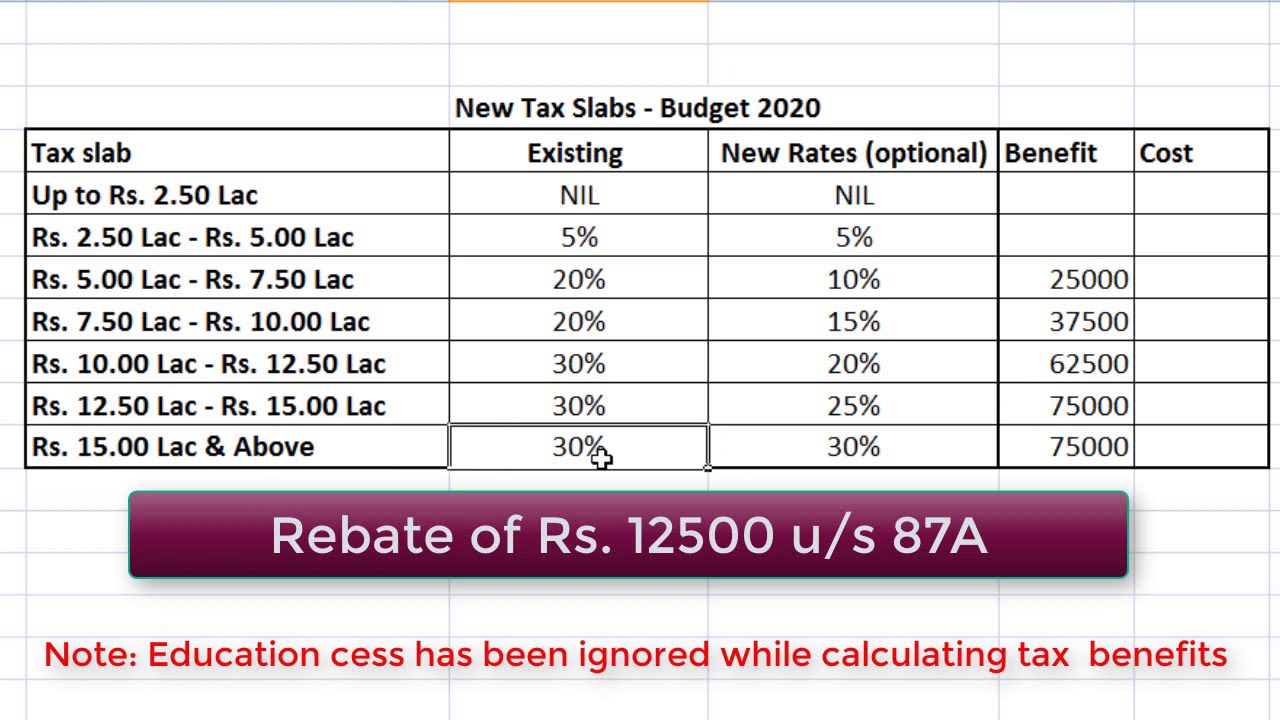

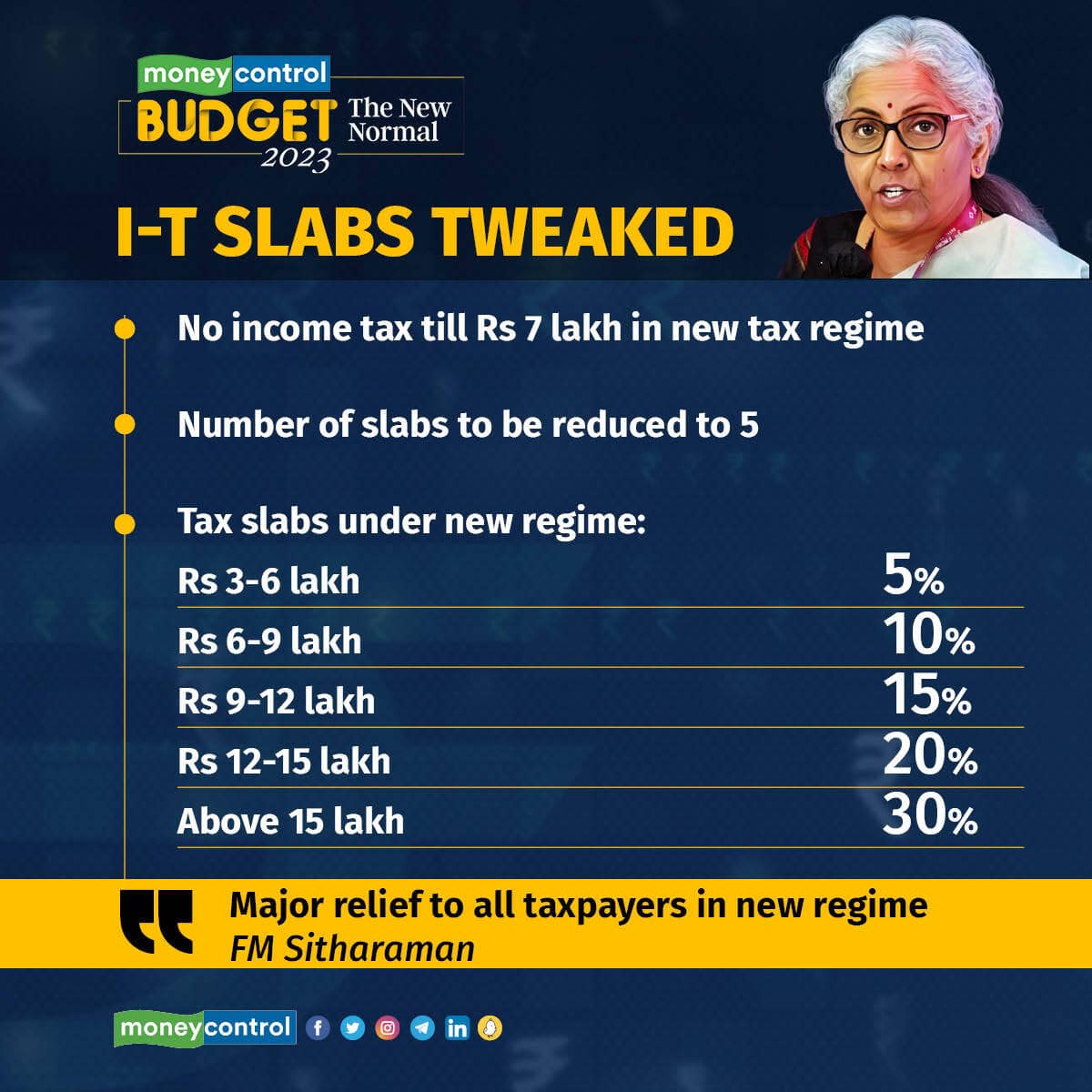

Likewise when you invest in PPF NSC tax saving FD you can claim tax deduction under section 80C up to a maximum of 1 50 000 2 Rebate Rebate is a reduction in the total income tax What is the surcharge amount under the revised new tax regime Is that change applicable only for those with an income more than 5 crores The surcharge rate has been reduced to 25 from 37 for taxpayers earning income more than Rs 5 crores under the new tax regime

Income Tax Rebate Union Budget 2023 MAHITIKANAJA

https://lh3.googleusercontent.com/--vEDMTclBJw/Y9psaES2CUI/AAAAAAABisY/qE1Oqa697PIgW5YnFf00HlA5xndNCcHzQCNcBGAsYHQ/s1600/1675258957715462-0.png

Income Tax Slab Budget 2023 LIVE Updates Highlights Tax Rebate New Tax Regime Vs Old

https://www.financialexpress.com/wp-content/uploads/2023/01/income-tax-budget-2023.jpg?w=1024

https://www.cbsnews.com/news/tax-refund-2024-what-to-expect-when-will-i-get/

MoneyWatch 2024 tax refunds could be larger than last year due to new IRS brackets Here s what to expect By Aimee Picchi Edited By Alain Sherter January 24 2024 5 00 AM EST CBS News

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And Rebate

Income Tax Rebate Union Budget 2023 MAHITIKANAJA

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And

New Income Tax Slabs Budget 2023 Highlights Big Rebate On Income Tax NO Tax On Income Up To Rs

Budget 2023 Here Are The Fresh New Income Tax Regime Slabs India Today Union 2023 Slabs Is

Budget For Fiscal Year 2023 24 Tax Waivers Counted In Subsidy Account The Financial Express

Budget For Fiscal Year 2023 24 Tax Waivers Counted In Subsidy Account The Financial Express

New Slabs More Rebate 5 Big Personal Income Tax Changes In Budget 2023

Income Tax Budget 2023 Highlights New Income Slabs Rates Explained Salaried Taxpayers Must

Applicability Of Higher Rebate Limit And Slab Changes In Old And New Income Tax Regimes Know

Income Tax Rebate In Budget 2024 - Union Budget 2023 had increased the threshold for income tax rebate from Rs 5 lakh to Rs 7 lakh for assessees opting for the new direct tax regime Any increase in tax rebate under