Solar Federal Rebate 2024 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit

Federal Solar Tax Credit Guide For 2024 Forbes Home Home Improvement Solar Solar Tax Credit By State Advertiser Disclosure Solar Tax Credit By State In 2024 The Ultimate Federal Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Solar Federal Rebate 2024

Solar Federal Rebate 2024

https://sunstainable.com.au/wp-content/uploads/2022/08/solar-rebate-Melbourne.jpg

The Federal Rebate For Solar Will Keep Your Installation Affordable New York Power Solutions

https://newyorkpowersolutions.com/wp-content/uploads/2022/12/Federal-Rebate-for-Solar.jpg

What s Next For The Missouri Solar Rebate Renewable Energy Law Insider

https://www.renewableenergylawinsider.com/wp-content/uploads/sites/165/2013/12/solar9-1024x707.jpg

The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit also covers other types of An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence

Located in the United States An existing home that you improve or add onto not a new home In most cases the home must be your primary residence where you live the majority of the year You can t claim the credit if you re a landlord or other property owner who doesn t live in the home Business use of home So if you spend 24 000 on a system you can subtract 30 percent of that or 7 200 from the federal taxes you owe You must take the credit for the year the installation is completed If

Download Solar Federal Rebate 2024

More picture related to Solar Federal Rebate 2024

How To Claim Solar Rebate In WA Energy Theory

https://energytheory.com/wp-content/uploads/2023/04/JAN23-How-to-Claim-Solar-Rebate-WA.jpg

30 Federal Solar Tax Rebate Extension Announced For Solar Installations In Florida Newswire

https://cdn.newswire.com/files/x/bc/b8/aa7c5e885eb71a7a5f40ca76b67f.jpg

Things You Need To Know About The Solar Federal Tax Credit

https://www.sunlogix.com/wp-content/uploads/2020/03/2020-solar-federal-tax-credit-1536x1024.jpg

Photovoltaic Technology Basics Soft Costs Basics Systems Integration Basics Solar Energy Research Areas Concentrating Solar Thermal Power Manufacturing and Competitiveness Photovoltaics Soft Costs Systems Integration Equitable Access to Solar Energy Solar Workforce Development Solar Energy Research Database Solar Energy Resources According to our 2023 survey of homeowners with solar respondents paid an average of 15 000 to 20 000 for their solar panel systems When you factor in the 30 federal solar tax credit the

The tax credit is currently set at 30 of your total solar panel system installation cost Tax credits help to reduce the amount of money you owe in taxes So for example if you claim a tax credit of 4 000 the total amount you owe in income taxes will be reduced by 4 000 It s important to note that this is not a tax deduction which On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

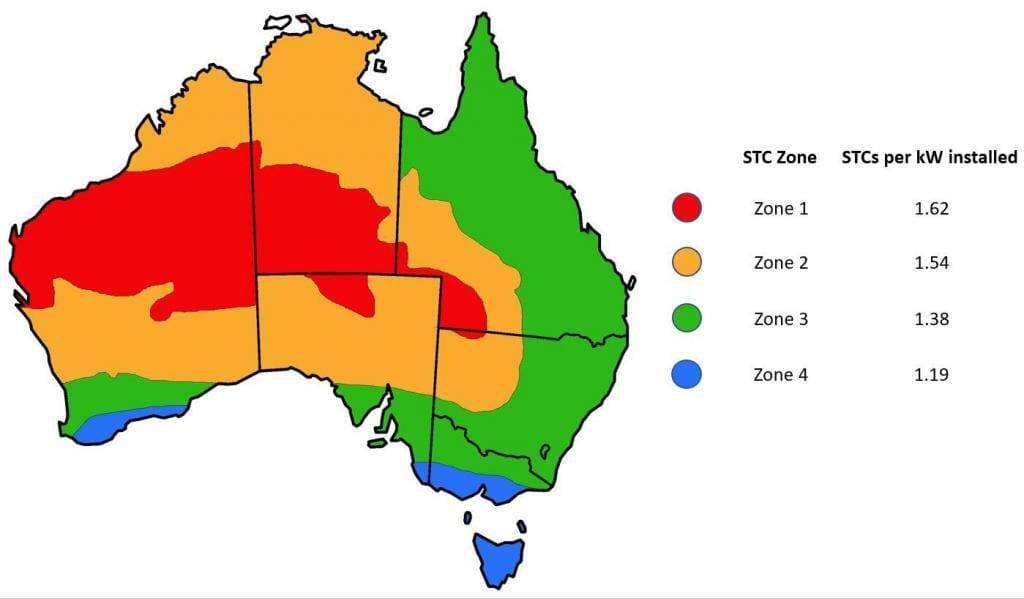

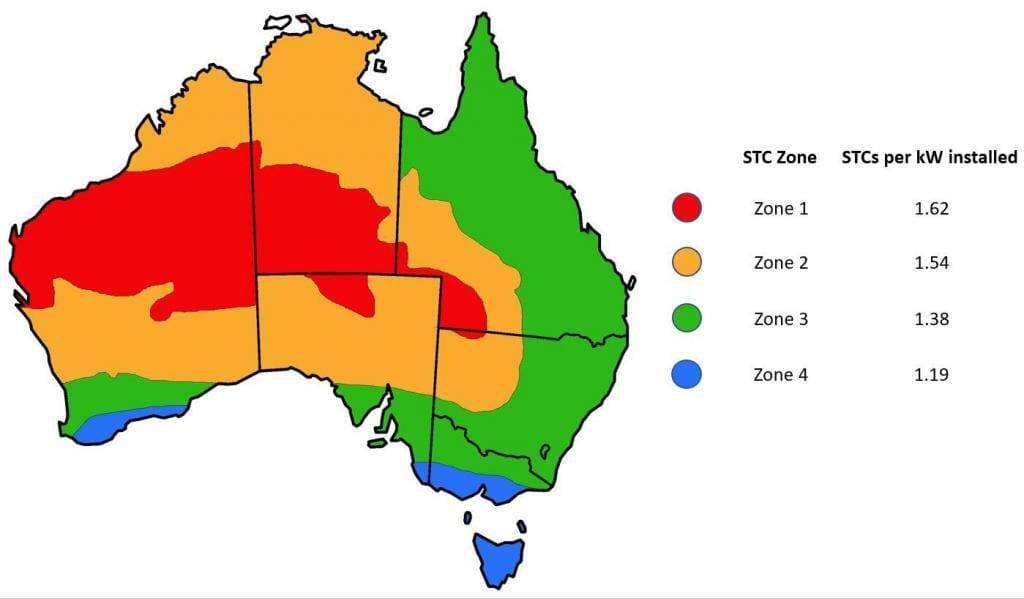

Federal Incentives Solar Rebates For Solar Power Solar Choice

https://www.solarchoice.net.au/wp-content/uploads/STC-Zones-in-Australia-as-of-1st-January-2019-1024x599.jpg

Space Solar Rebate Guide 2023 Edition Space Solar

https://www.spacesolar.com.au/wp-content/uploads/2021/06/shutterstock_349794935-scaled.jpg

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit

https://www.forbes.com/home-improvement/solar/solar-tax-credit-by-state/

Federal Solar Tax Credit Guide For 2024 Forbes Home Home Improvement Solar Solar Tax Credit By State Advertiser Disclosure Solar Tax Credit By State In 2024 The Ultimate Federal

2021 Energy Federal Tax Credit And Rebate Programs Epic Energy

Federal Incentives Solar Rebates For Solar Power Solar Choice

Solar Tax Credits Rebates Missouri Arkansas

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

What To Know About The Solar Federal Tax Credit Toplead

How To Apply For A Rebate On Your Solar Panels REenergizeCO

How To Apply For A Rebate On Your Solar Panels REenergizeCO

Solar Energy Rebate

How Do You Get A Solar Rebate

Alcon Rebate Form 2023 Printable Rebate Form

Solar Federal Rebate 2024 - Thanks to the new tax credits and rebates they ll come at a significant discount for qualified households Households with income less than 80 of AMI 840 rebate up to 100 of equipment and installation costs Households with income between 80 150 AMI 840 rebate up to 50 of equipment and installation costs