2024 Mlr Rebate Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

MLR rebates are based on a 3 year average meaning that rebates issued in 2023 will be calculated using insurers financial data in 2020 2021 and 2022 and will go to people and businesses Total MLR reimbursements are projected to be 1 1 billion in 2023 which is about the same level as last year When an employer receives a MLR rebate check they will need to consider if any portion of the rebate is considered plan assets under the Employee Retirement Income Security Act ERISA

2024 Mlr Rebate

2024 Mlr Rebate

https://png.pngtree.com/png-clipart/20220922/original/pngtree-yellow-2024-text-png-image_8627343.png

How To Watch Paris 2024 Olympics Free Online TechRadar

https://cdn.mos.cms.futurecdn.net/WuaxJbxagCi59x4UGEjtK.jpg

Buy Appointment Book 2023 2024 Weekly Appointment Book 2023 2024 8 X 10 Jul 2023 Jun

https://m.media-amazon.com/images/I/91JorPYWOEL.jpg

Instruction 1 Enter the date the Notice is sent which must be on or before September 30 of the year subsequent to the MLR reporting year that produced the rebate 2 Enter the subscriber s name and mailing address 2a enter the subscriber s first and last name 2b enter the subscriber s street address On December 7 2011 the Department of Health and Human Services HHS issued final rules on the calculation and payment of medical loss ratio MLR rebates to health insurance policyholders Rebates are scheduled to begin being paid during 2012 The following questions and answers provide information on the federal tax consequences to a health

Step 1 The employer must determine the plan to which the MLR rebate applies Generally rebates apply only to a specific plan option such as an HMO PPO or an HDHP So only those contributing to the cost of plan for that coverage option would benefit from the rebate If a rebate relates to two separate plan options then the rebate should be Drawing on the lessons of the guidance described above the Department of Labor directly addressed the treatment of MLR rebates in the context of employer sponsored group health plans in Tech Rel

Download 2024 Mlr Rebate

More picture related to 2024 Mlr Rebate

NWC Tryouts 2023 2024 NWC Alliance

https://nwcalliancesoccer.demosphere-secure.com/_files/tryouts-2023-2024/NWC 2023-2024.JPG

Buy 2024 Wall 2024 Jan 2024 Dec 2024 12 X 24 Open 12 Month Wall 2024 With Unruled

https://m.media-amazon.com/images/I/81J20wwDaLL.jpg

Side Events Opportunity Festival 2024

https://www.xxox.no/wp-content/uploads/2023/01/XXOX_Horizon_2024_WhitePink.png

How to maximize your 2024 tax refund according to a CPA 02 34 Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax In order to determine whether its MLR met the applicable standard an issuer is required to submit to CMS by July 31st of the year following the end of an MLR reporting year an Annual MLR Reporting Form concerning premium revenue and expenses related to the group and individual health insurance coverage that it issued in the MLR reporting year

This check is an MLR rebate which insurance companies are required to distribute annually by September 30 th each year It s important to note that employers are required to follow certain rules with regards to handling of the MLR rebate check How an employer may use the rebate amount will depend on how coverage premiums are paid On April 19 2012 the Internal Revenue Service IRS issued a set of Frequently Asked Questions FAQs explaining the tax treatment of premium rebates under the Medical Loss Ratio MLR

Buy Sports Illustrated Swimsuit Planner 2023 2024 Sports Illustrated Swimsuit 2023 2024

https://m.media-amazon.com/images/I/61Mvg6PqcYL.jpg

Buy 2024 Vertical 11x17 2024 Wall Runs Until June 2025 Easy Planning With The 2024

https://m.media-amazon.com/images/I/613cLQocDQL.jpg

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

https://www.kff.org/private-insurance/issue-brief/medical-loss-ratio-rebates/

MLR rebates are based on a 3 year average meaning that rebates issued in 2023 will be calculated using insurers financial data in 2020 2021 and 2022 and will go to people and businesses

2024 Annual Meeting Save The Date

Buy Sports Illustrated Swimsuit Planner 2023 2024 Sports Illustrated Swimsuit 2023 2024

Buy Fridge 2023 2024 For Refrigerator By StriveZen 12x16 Inches Large Monthly Magnetic

Tolminator 2024

2024 Campaign Kick Off The Birmingham Jewish Federation

2024 9GAG

2024 9GAG

2024 Candidates Tournament

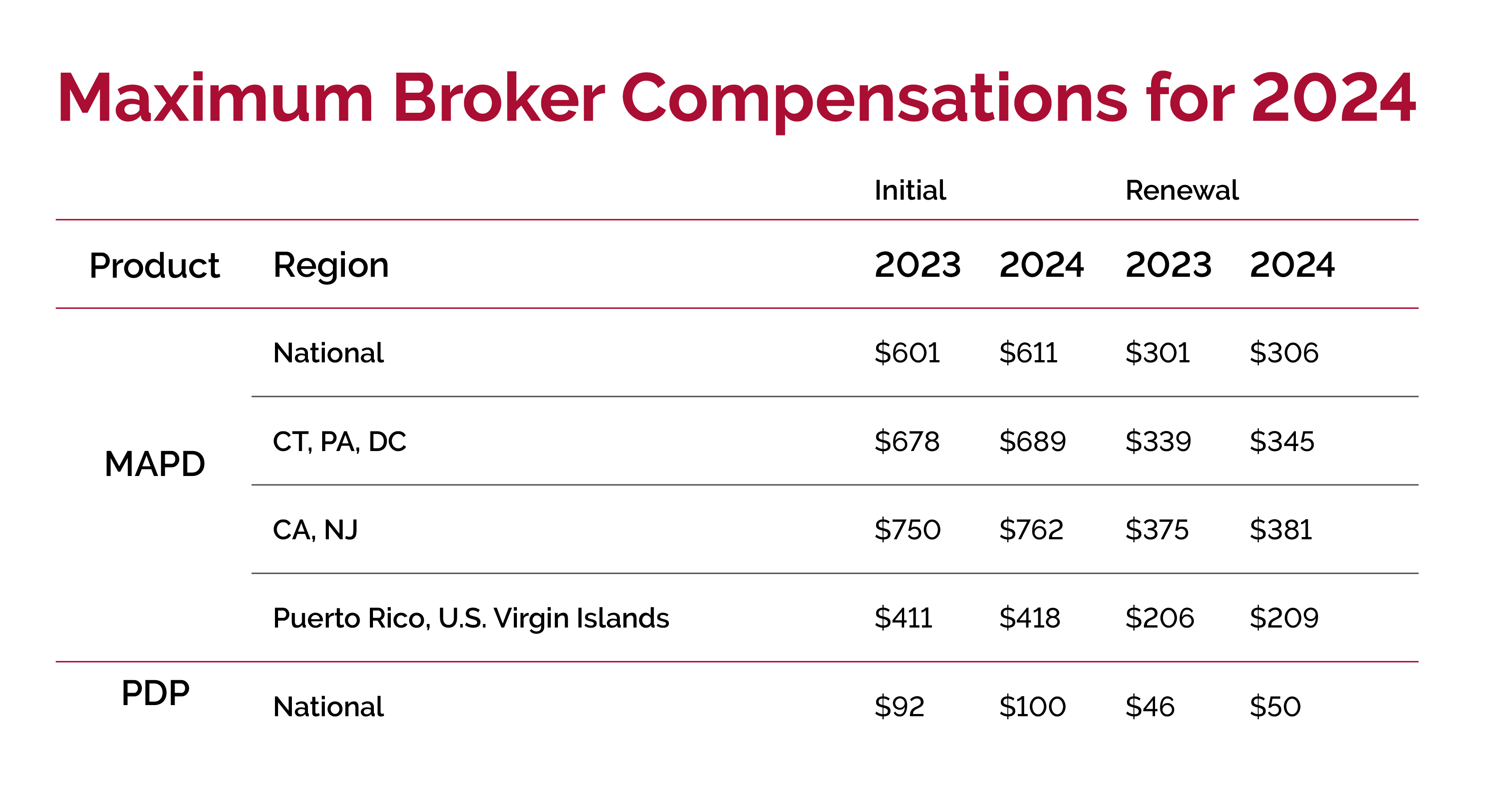

2024 Medicare Advantage Commissions

Buy The New 2023 2024 Calender Planner 2023 2024 With Weekly Monthly Spreads 16 month 2023

2024 Mlr Rebate - Step 1 The employer must determine the plan to which the MLR rebate applies Generally rebates apply only to a specific plan option such as an HMO PPO or an HDHP So only those contributing to the cost of plan for that coverage option would benefit from the rebate If a rebate relates to two separate plan options then the rebate should be