What Is The Child Care Credit For 2022 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school

What is the child and dependent care tax credit The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child It explains how to figure and claim the credit You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent who isn t able to care for themselves The credit can be up to 35 of your employment related expenses

What Is The Child Care Credit For 2022

What Is The Child Care Credit For 2022

https://images.squarespace-cdn.com/content/v1/5a4d154ba8b2b071ba7efb47/1515772885380-YO73ESYL23L7G3ZMZM8F/Carecredit+Financing.png?format=1000w

Care Credit Application South Shore Family Health Center

https://images.squarespace-cdn.com/content/v1/6080b336ab79963237e8b280/1619050879538-DBHVJJI1EPOAYOFOU5TL/Care+Credit+Link+Image_2.jpg

Employer Provided Child Care Credit Helps Manufacturers Help Their

https://hwco.cpa/wp-content/uploads/2023/02/ChildCareTaxCredit_article.png

The child tax credit is a nonrefundable tax credit available to taxpayers with dependent children under the age of 17 The credit can reduce your tax bill on a dollar for dollar basis If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit on your 2023 or 2024 taxes of up to 35 of Up to 3 000 of qualifying expenses for a maximum credit of 1 050 for one child or dependent or

What is the child and dependent care credit The child and dependent care credit is a tax break that may help U S families pay for the care of eligible children and other dependents so that they can work or search for employment The credit can apply to costs for adult caregivers babysitting daycare or even summer camp The Child and Dependent Care Credit was supercharged through the 2021 American Rescue Plan with the pandemic aid bill boosting how much parents can

Download What Is The Child Care Credit For 2022

More picture related to What Is The Child Care Credit For 2022

How To Use Care Credit For Dental Services 1 DENTIST IN CALIFORNIA 95035

https://milpitassquaredental.com/wp-content/uploads/2022/04/how-to-use-care-credit.jpg

How To Calculate Your Child Care Credit For Tax Year 2023 ACT Blogs

https://www.actblogs.com/wp-content/uploads/2022/12/Child-Care-Credit-1140x641.webp

Tax Incentives And 529 Student Savings Plans For Parenting In The U S

https://www.hkstanfield.com/blog/wp-content/uploads/2023/08/childcare.png

Thanks to a temporary change codified in the American Rescue Plan parents or guardians can now claim a maximum credit of 4 000 50 of 8 000 in The Child and Dependent Care Credit is a tax credit you may be able to claim for child care expenses you paid for your dependent child under 13 no age limit for a disabled dependent so that you and your spouse if filing a joint return can work or actively look for work

The child and dependent care credit is a tax credit offered to taxpayers who pay out of pocket expenses for childcare The credit provides relief to individuals and spouses who pay for The credit for child and dependent care expenses is a nonrefundable credit that allows taxpayers to reduce their tax liability by a portion of the expenses The maximum expense amounts are 3 000 for one qualifying person and

What Families Need To Know About The CTC In 2022 CLASP

https://www.clasp.org/wp-content/uploads/2022/04/CTC20_f202220Infographic_final_crop.png

What The New Child Tax Credit Could Mean For You Now And For Your 2021

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

https://www.irs.gov/newsroom/child-and-dependent...

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school

https://www.nerdwallet.com/article/taxes/child-and...

What is the child and dependent care tax credit The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child

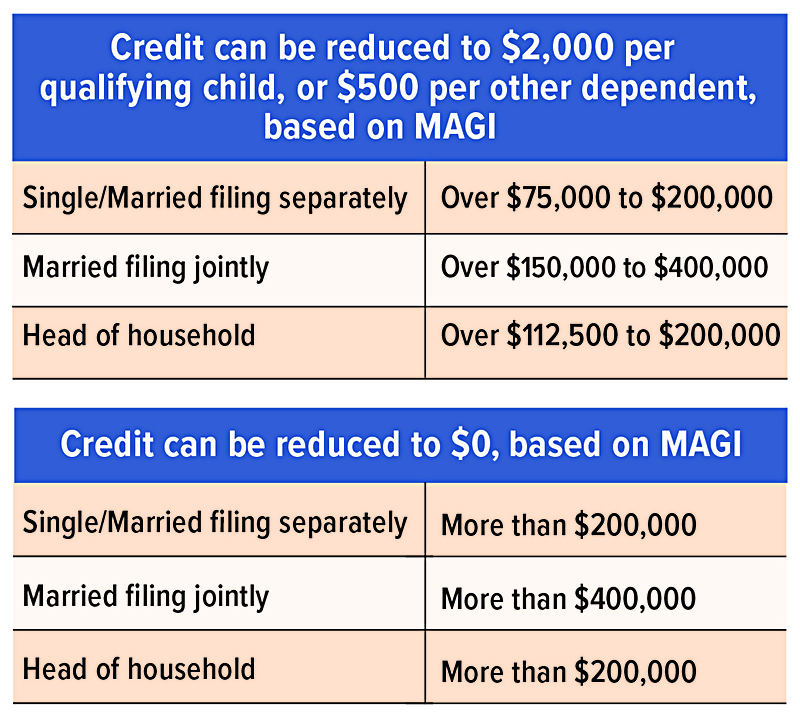

Does The Child And Dependent Care Credit Phase Out Completely Latest

What Families Need To Know About The CTC In 2022 CLASP

Child Care Health And Safety Checklist Daycare Child Minding

National Child Care And Protection Policy Training Gauteng

Child Tax Credit For 2021 Will You Get More

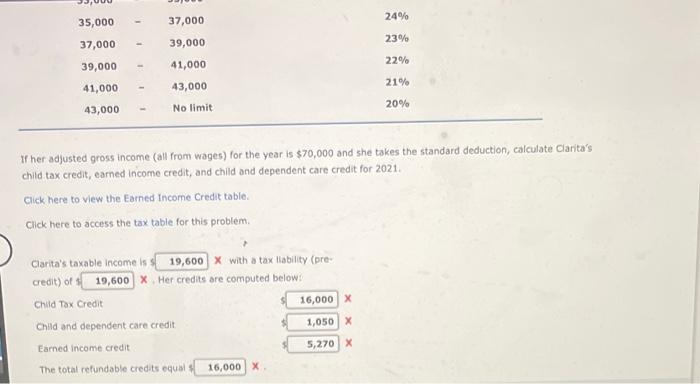

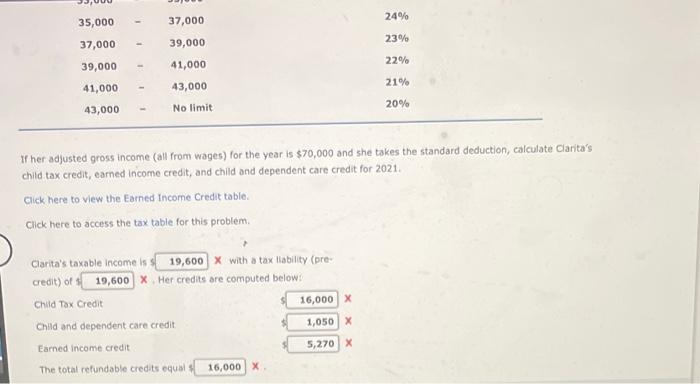

Solved Problem 7 11 Child And Dependent Care Credit LO 7 2 Chegg

Solved Problem 7 11 Child And Dependent Care Credit LO 7 2 Chegg

New 2023 IRS Income Tax Brackets And Phaseouts

188bet

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

What Is The Child Care Credit For 2022 - If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit on your 2023 or 2024 taxes of up to 35 of Up to 3 000 of qualifying expenses for a maximum credit of 1 050 for one child or dependent or