Home Owners Tax Rebate Check 2024 The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

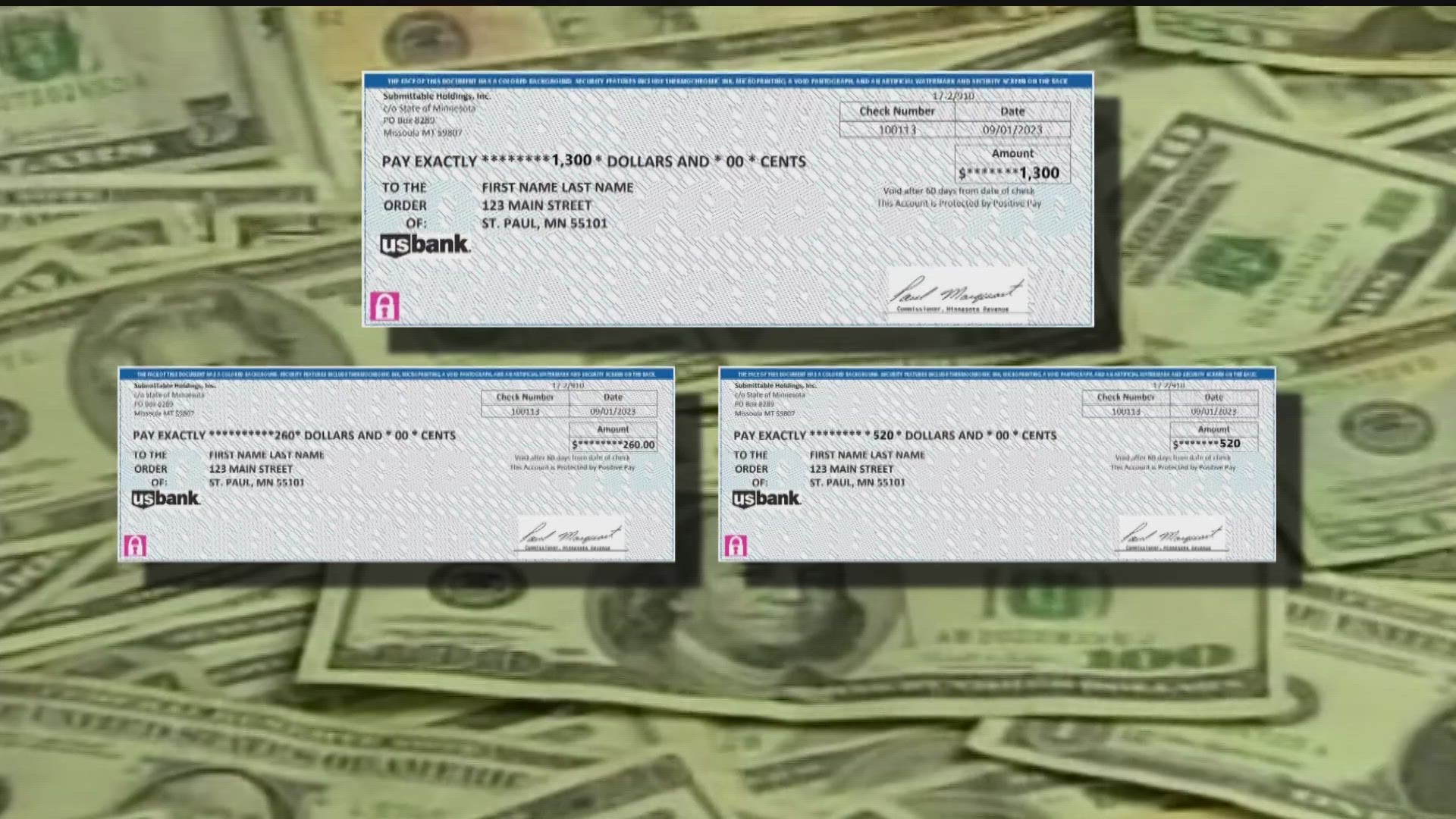

In 2024 Gov Josh Shapiro said that older residents would receive more financial help courtesy of his signed Act 7 of 2023 The law expanded the Property Tax Rent Rebate to provide a larger tax Minnesota rebate checks were sent beginning in mid August of last year to about 2 5 million Minnesota households The one time payments of up to 1 300 sometimes called Walz checks or

Home Owners Tax Rebate Check 2024

Home Owners Tax Rebate Check 2024

https://klewtv.com/resources/media2/16x9/full/1015/center/80/bcd0e069-efe3-406d-b87f-b52ab4b43fd3-large16x9_IdahoTaxRebateCheckpic.jpg

Are You Owed A Tax Rebate Check Your Personal Tax Account Which News

https://media.product.which.co.uk/prod/images/1500_750/gm-b69d2de8-9d0b-4e4f-be0d-bcfe5f13b9d4-restricted-istock000070807539large.jpeg

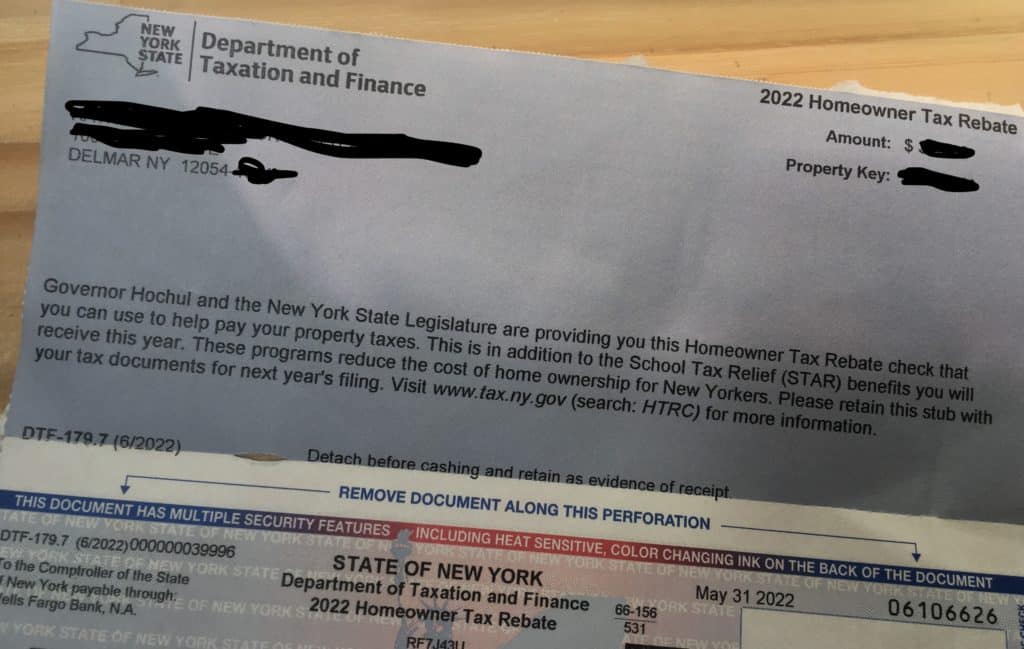

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2022/06/FUVtPL9WIAM9l1Zggggg-1024x649.jpg

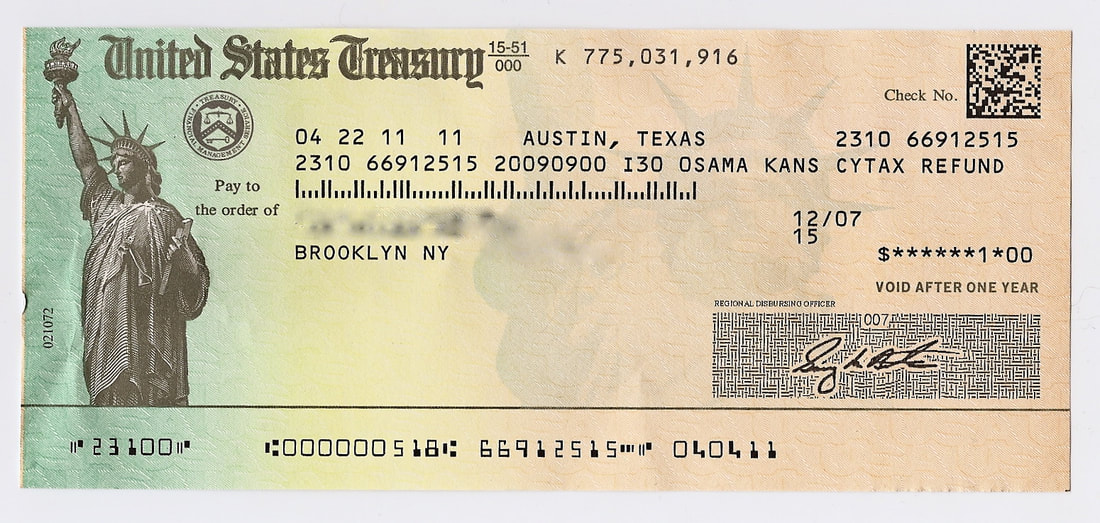

POPULAR FORMS INSTRUCTIONS Form 1040 Individual Tax Return Form 1040 Instructions Instructions for Form 1040 Form W 9 Request for Taxpayer Identification Number TIN and Certification When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married filing

Sacramento The California Franchise Tax Board FTB kicked off the 2024 tax filing season by providing taxpayers with important information on cash back tax credits disaster loss relief and the advantages of filing electronically Taxpayers must pay any taxes owed by April 15 to avoid penalties The FTB started accepting state tax returns this month New York state homeowners have until December 31 to apply for a rebate that could offer a check of 1 400 or more CHARLY TRIBALLEAU AFP via Getty Images Those who qualify for the Enhanced STAR

Download Home Owners Tax Rebate Check 2024

More picture related to Home Owners Tax Rebate Check 2024

Tax Rebate Service No Rebate No Fee MBL Accounting

https://mblaccounting.co.uk/wp-content/uploads/2021/04/Tax-Rebate.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

There s a 14 000 cap on the dollar amount of rebates offered under the program For instance low income homeowners can get up to 100 of electrification projects covered up to the cap of It s not exactly the same program though This year s ANCHOR rebates will be based on tax returns filed in 2020 and for New Jersey seniors the payout will be 250 higher This increase is

What are the new stage 3 tax cut brackets Pay a 16 per cent tax rate on each dollar earned between 18 201 45 000 Pay a 30 per cent tax rate on each dollar earned between 45 001 135 000 Pay To be eligible for a homeowner tax rebate credit in 2022 you must have had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit Note You did not need to calculate your income to receive the homeowner tax rebate credit

Tax Rebate Checks Come Early This Year Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2018/09/check-2-2.jpg

When Will We Get The Extra Tax Rebate Checks In Montana Details

https://townsquare.media/site/990/files/2023/03/attachment-032923-MT-Tax-Rebate-.jpg?w=980&q=75

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

https://www.newsweek.com/will-there-new-stimulus-payment-2024-rebate-1856477

In 2024 Gov Josh Shapiro said that older residents would receive more financial help courtesy of his signed Act 7 of 2023 The law expanded the Property Tax Rent Rebate to provide a larger tax

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check CNYcentral

Tax Rebate Checks Come Early This Year Yonkers Times

Property Tax Rebate Pennsylvania LatestRebate

MN Tax Rebate Check Proof DocumentCloud

Minnesota Tax Rebate Checks From Montana Company Are Legitimate Kare11

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

PA Rent Rebate Form Printable Rebate Form

Tax Largie Inc Blog TAX LARGIE INC

KTP Company PLT Audit Tax Accountancy In Johor Bahru

Home Owners Tax Rebate Check 2024 - Eligibility for the Homeowner Tax Rebate Credit Qualified for a 2022 STAR credit or exemption Income less than or equal to 250 000 for the 2020 income tax year