Irs Recovery Rebate Credit Error 2024 The vast majority of those eligible for Economic Impact Payments related to Coronavirus tax relief have already received them or claimed them through the Recovery Rebate Credit The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively

The fastest way to get your tax refund is to file electronically and have it direct deposited contactless and free into your financial account You can have your refund direct deposited into your bank account prepaid debit card or mobile app and will need to provide routing and account numbers IR 2024 21 Jan 25 2024 The Internal Revenue Service renewed calls today for businesses to review their eligibility for the Employee Retention Credit as the agency s law enforcement arm Criminal Investigation CI begins a series of educational sessions for tax professionals

Irs Recovery Rebate Credit Error 2024

Irs Recovery Rebate Credit Error 2024

https://www.usatoday.com/gcdn/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

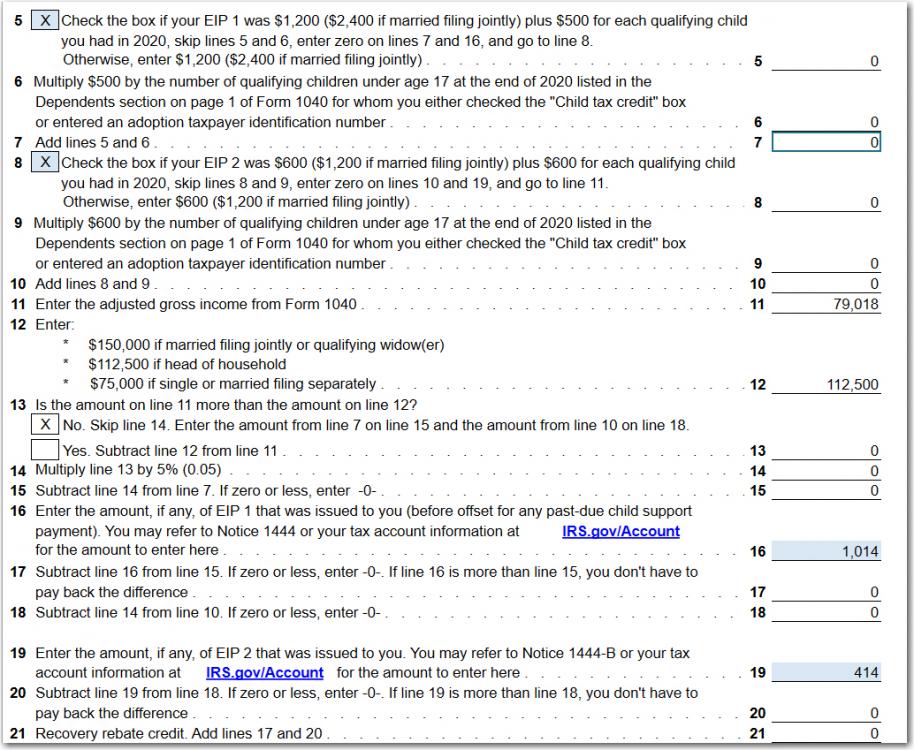

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit SOLVED by TurboTax 716 Updated November 23 2023 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction is needed the IRS will calculate the correct amount of the Recovery Rebate Credit make the correction to the tax

If you didn t get the full first and second Economic Impact Payment you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return to claim it Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Download Irs Recovery Rebate Credit Error 2024

More picture related to Irs Recovery Rebate Credit Error 2024

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

https://www.atxcommunity.com/uploads/monthly_2021_02/199195342_Line30JF.thumb.jpg.e31662de98fd0de6ecee8a30cd267c75.jpg

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/how-to-use-the-recovery-rebate-credit-worksheet-ty2020-print-view.png

2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help Qualified taxpayers can also find free one on one tax preparation help nationwide through the Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs Use the VITA Locator Tool or The second full stimulus payment was 600 for single individuals 1 200 for married couples and 600 per dependent If you earned more than 99 000 198 000 for married couples you got no

TIGTA determined that on 181 743 returns the IRS miscalculated the recovery rebate credit amount including 117 314 returns for which the calculated recovery rebate credits were 218 7 million more than the taxpayers were entitled to and another 64 429 returns where the recovery rebate credit was a total of 80 million less than the The IRS has issued a reminder to those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before the deadline I know what you re thinking

Why Did Irs Change My Recovery Rebate Credit Useful Tips

https://stimulusmag.com/wp-content/uploads/2022/12/why-did-irs-change-my-recovery-rebate-credit.png

Irs Recovery Rebate Credit For College Students IRSUKA Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-recovery-rebate-credit-for-college-students-irsuka.jpg?fit=1920%2C1080&ssl=1

https://www.irs.gov/newsroom/irs-reminds-eligible-2020-and-2021-non-filers-to-claim-recovery-rebate-credit-before-time-runs-out

The vast majority of those eligible for Economic Impact Payments related to Coronavirus tax relief have already received them or claimed them through the Recovery Rebate Credit The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-h-correcting-issues-after-the-2021-tax-return-is-filed

The fastest way to get your tax refund is to file electronically and have it direct deposited contactless and free into your financial account You can have your refund direct deposited into your bank account prepaid debit card or mobile app and will need to provide routing and account numbers

Recovery Rebate Credit Worksheet Federal Tax Credits TaxUni Recovery Rebate

Why Did Irs Change My Recovery Rebate Credit Useful Tips

IRS Updates Info On Recovery Rebate Credit And Pandemic Response Scott M Aber CPA PC

IRS Letters Due To The 2020 Recovery Rebate Credit Financial Symmetry Inc

IRS Ends Up Correcting Tax Return Mistakes For Recovery Rebate Credit

Irs Recovery Rebate Credit Number IRSYAQU

Irs Recovery Rebate Credit Number IRSYAQU

IRS Reducing Correcting Recovery Rebate Credit Claims Scott M Aber CPA PC

Recovery Rebate Credit On 2022 Form 1040 Recovery Rebate

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For People Moving Overseas And

Irs Recovery Rebate Credit Error 2024 - As with the stimulus checks calculating the amount of your recovery rebate credit starts with a base amount For most people the base amount for the 2021 credit is 1 400 For married couples