2024 State Of Illinois Tax Rebate The Illinois Department of Revenue IDOR announced that it will begin accepting and processing 2023 tax returns on January 29 the same date the Internal Revenue Service begins accepting federal income tax returns For more information see the Illinois Department of Revenue Announces Start to 2024 Income Tax Season press release

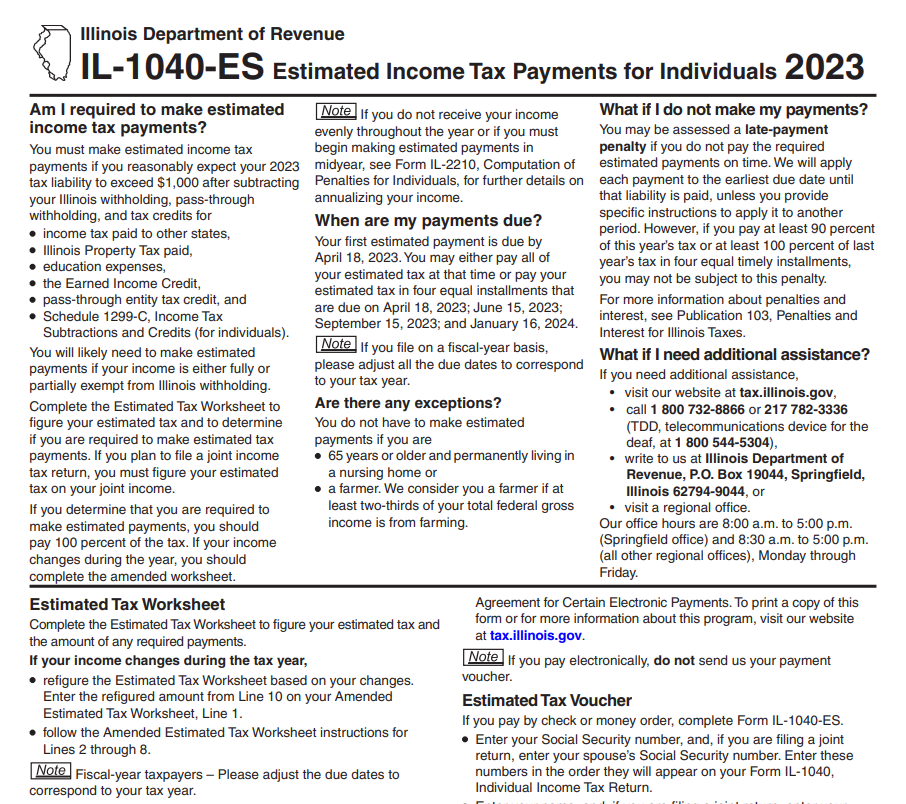

What is the effective date of the change The statute is effective for all payments except quarter monthly payments made on or after January 1 2024 What are the effects of this change On and after January 1 2024 if you do not agree with a protestable assessment for a sales use or excise tax or fee you have two options Assistance for Taxpayers To receive assistance Illinois taxpayers may call 1 800 732 8866 or 217 782 3336 For the latest updates and information visit IDOR s website Federal Income Tax

2024 State Of Illinois Tax Rebate

2024 State Of Illinois Tax Rebate

https://tlfc.com.au/app/uploads/2023/05/2024-Budget-BW.jpg

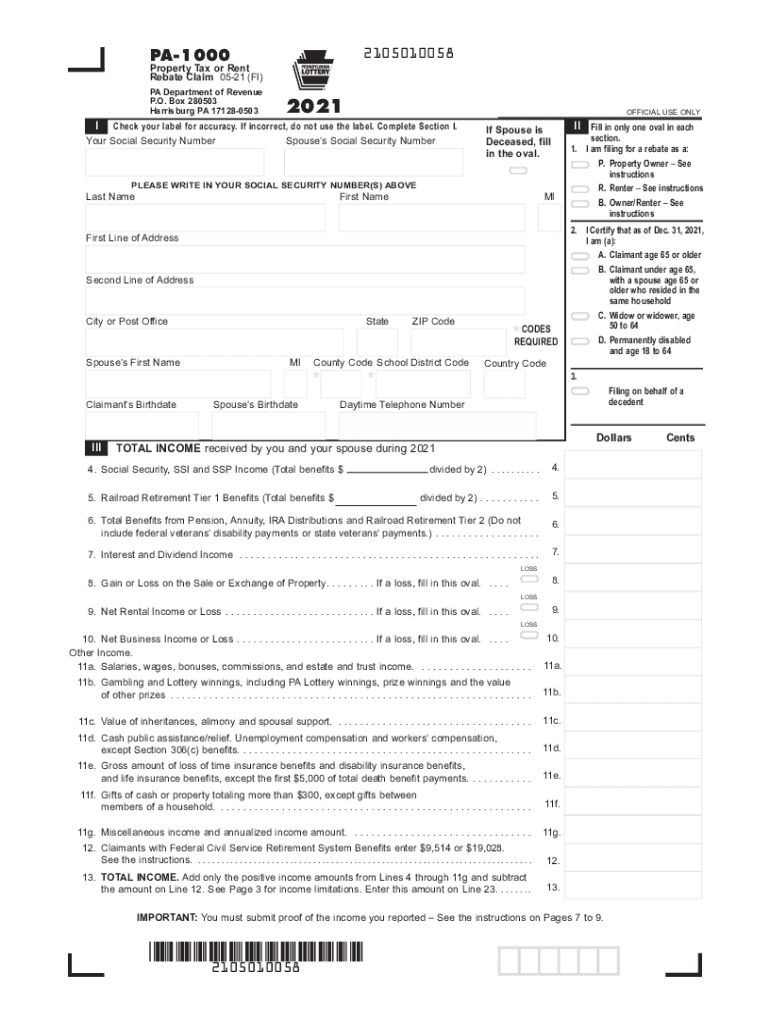

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

Homeowner Renters District 16 Democrats

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

The Illinois Department of Revenue IDOR announced on Thursday Jan 25 that it will begin accepting and processing 2023 tax returns on Monday Jan 29 the same date the Internal Revenue Service IRS begins accepting federal income tax returns We encourage taxpayers to file electronically as early as possible as this will speed processing January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to

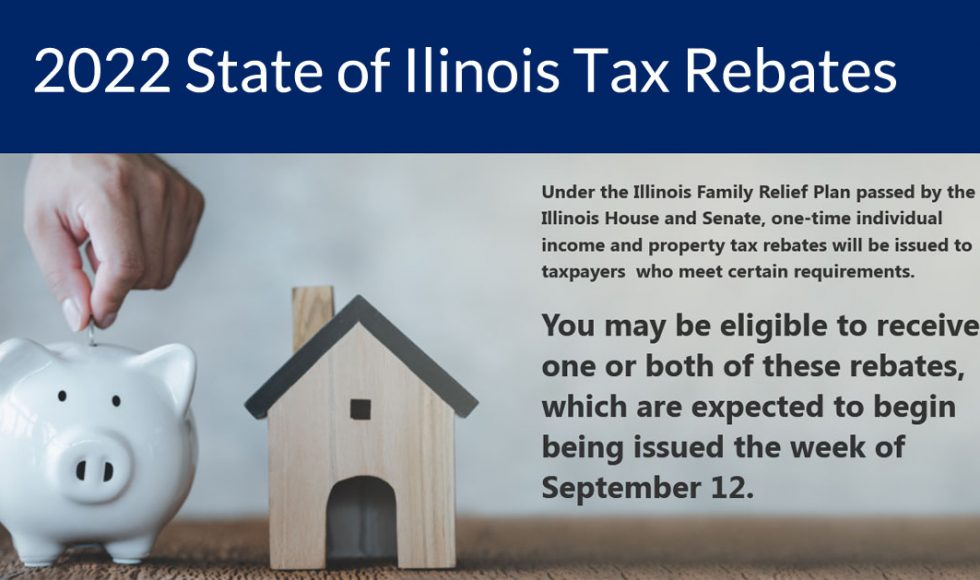

To receive both the property tax and income rebates or just the income tax rebate by itself you must file IL 1040 including Schedule ICR Illinois Credits as well as Schedule IL E EIC Taxpayers who did not file or are not required to file their 2021 IL 1040 individual income tax returns but want to claim both the property tax and individual income tax rebatesmust file Form IL

Download 2024 State Of Illinois Tax Rebate

More picture related to 2024 State Of Illinois Tax Rebate

Illinois Income Tax Rebate 2023 Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Illinois-Income-Tax-Rebate-2023.jpg

Illinois Tax Rebate 2023 Everything You Need To Know Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/03/Illinois-Tax-Rebate-2023.png

Illinois Tax Rebate 2022 Cray Kaiser

https://craykaiser.com/wp-content/uploads/2022/09/Illinois-Tax-Rebate.png

The maximum for the individual income and property tax rebates is 300 with up to three dependents qualifying as a dependent for the income tax rebate Who is eligible for 2022 Illinois The property tax rebate is a maximum of 300 per household that is equal to the credit claimed for residential real estate property taxes on the 2021 Illinois income tax return The individual income tax rebate is 50 per individual 100 for couples who file married filing jointly provided their federal adjusted gross income is less than

December 21 202317 min read By Manish Bhatt Benjamin Jaros Latest Updates See Full Timeline Thirty four states will ring in the new year with notable tax changes including 17 states cutting individual or corporate income taxes and some cutting both The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum credit of 300 State of Illinois The income tax rebate works in a similar manner allowing individuals to claim a credit of 50 each with an additional 100 per dependent up to 300

Illinois Electric Vehicle Rebate State Launches EV Program To Residents Offering Up To 4K For

https://cdn.abcotvs.com/dip/images/12010375_070122-wls-electric-vehicle-rebate-img.jpg?w=1600

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/468/470/468470575/large.png

https://tax.illinois.gov/research/news/illinois-department-of-revenue-announces-start-to-2024-income-ta.html

The Illinois Department of Revenue IDOR announced that it will begin accepting and processing 2023 tax returns on January 29 the same date the Internal Revenue Service begins accepting federal income tax returns For more information see the Illinois Department of Revenue Announces Start to 2024 Income Tax Season press release

https://tax.illinois.gov/research/publications/bulletins/fy-2024-15.html

What is the effective date of the change The statute is effective for all payments except quarter monthly payments made on or after January 1 2024 What are the effects of this change On and after January 1 2024 if you do not agree with a protestable assessment for a sales use or excise tax or fee you have two options

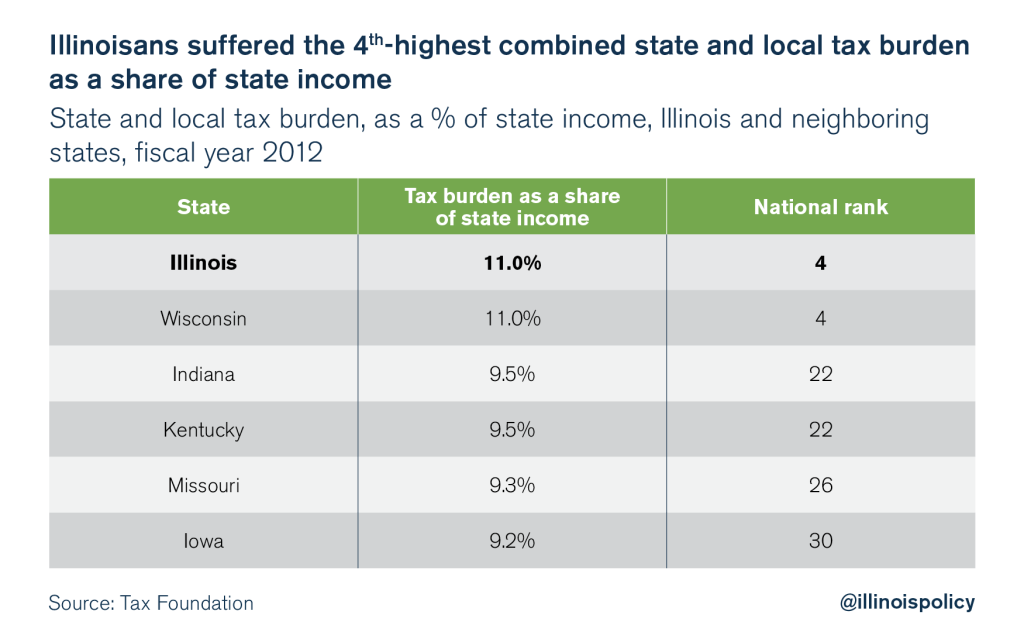

Illinois Is A High tax State Illinois Policy

Illinois Electric Vehicle Rebate State Launches EV Program To Residents Offering Up To 4K For

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Tax Rebate FAQs Rep Thaddeus Jones

Il W 4 Form 2023 Printable Forms Free Online

Il W 4 Form 2023 Printable Forms Free Online

Illinois State Income Tax Fill Out Sign Online DocHub

Missouri State Tax Rebate 2023 Printable Rebate Form

IL Tax Rebates Set To Go Out Next Week See If You Qualify Across Illinois IL Patch

2024 State Of Illinois Tax Rebate - Taxpayers who did not file or are not required to file their 2021 IL 1040 individual income tax returns but want to claim both the property tax and individual income tax rebatesmust file Form IL