Turbotax Miscalculation Recovery Rebate Credit 2024 Miscalculation of Recovery Rebate Credit I filed on TurboTax for the 5th year in a row on 2 9 2021 Somehow I got nothing on my return and in addition had to pay 1 to the IRS My return was accepted and 1 withdrawn from my bank account That isn t necessarily the issue though

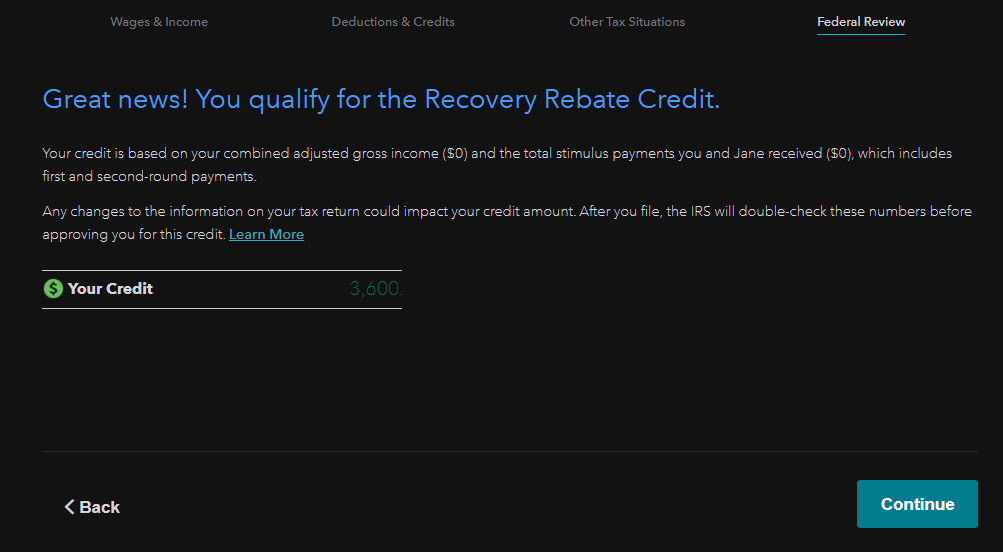

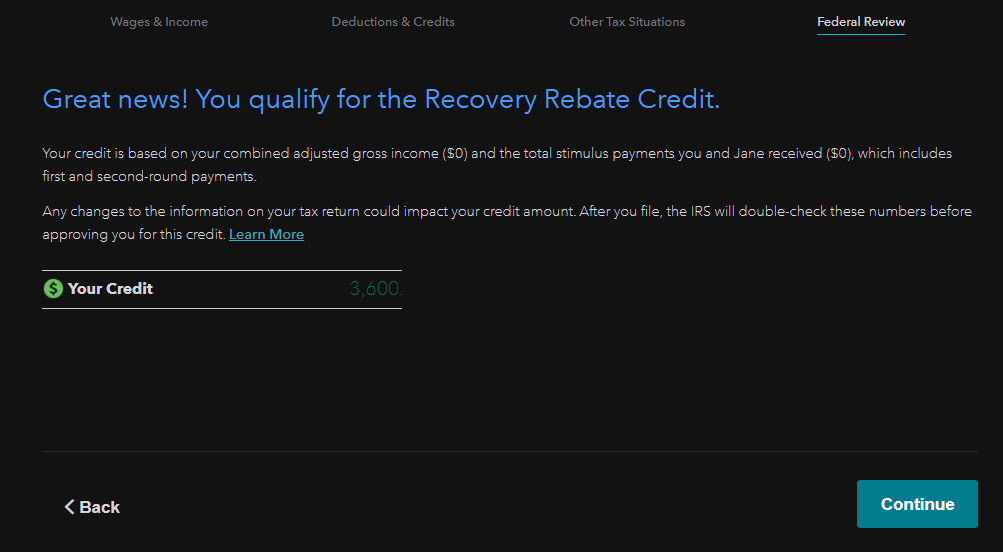

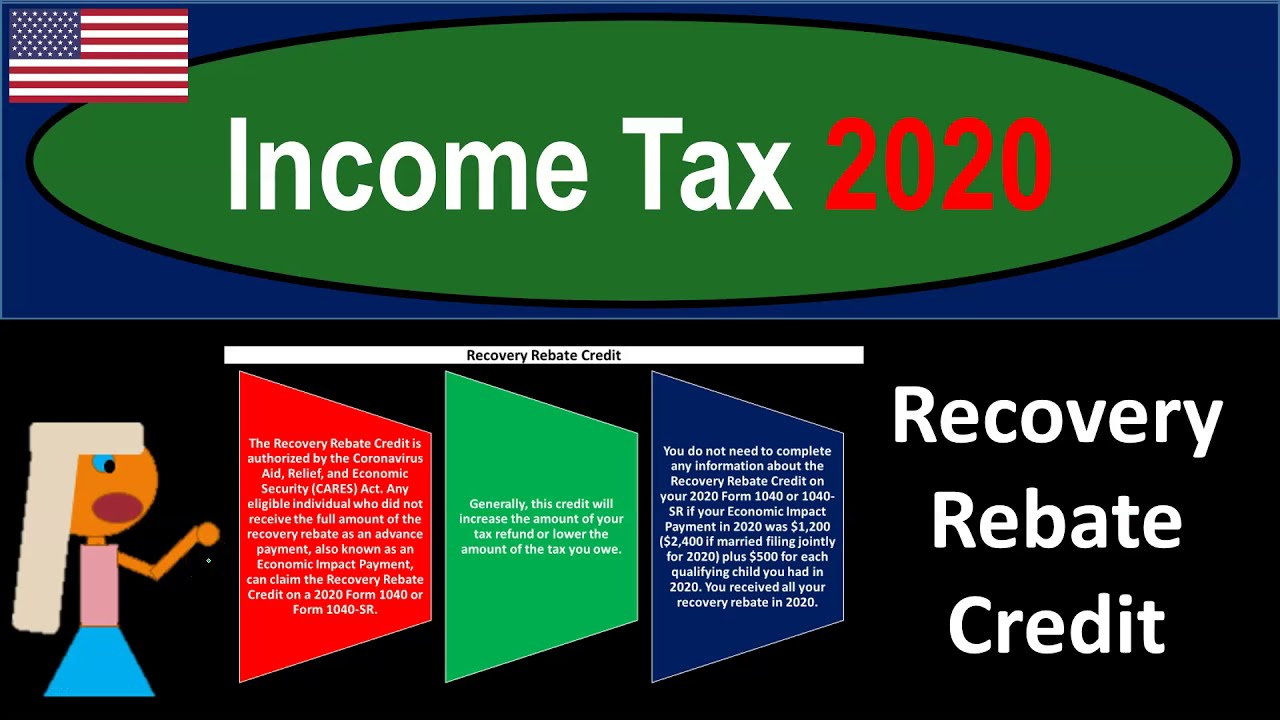

Miscalculation of 2020 Recovery Rebate Credit TurboTax Make it Right My family situation Married Filing Jointly 1 dependent born 2019 so on the full year 2020 When I entered in the amount of stimulus my family received in 2020 I put in the following information First round 2 900 Second round 1 800 screenshot from today People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return They were issued in 2020 and early 2021

Turbotax Miscalculation Recovery Rebate Credit 2024

Turbotax Miscalculation Recovery Rebate Credit 2024

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-worksheet-turbotax-studying-worksheets-30.png?fit=924%2C568&ssl=1

How To File Recovery Rebate Credit Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-1.png

Turbotax Recovery Rebate Credit Error 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/where-to-enter-recovery-rebate-credit-in-turbotax-recovery-rebate-15.jpg

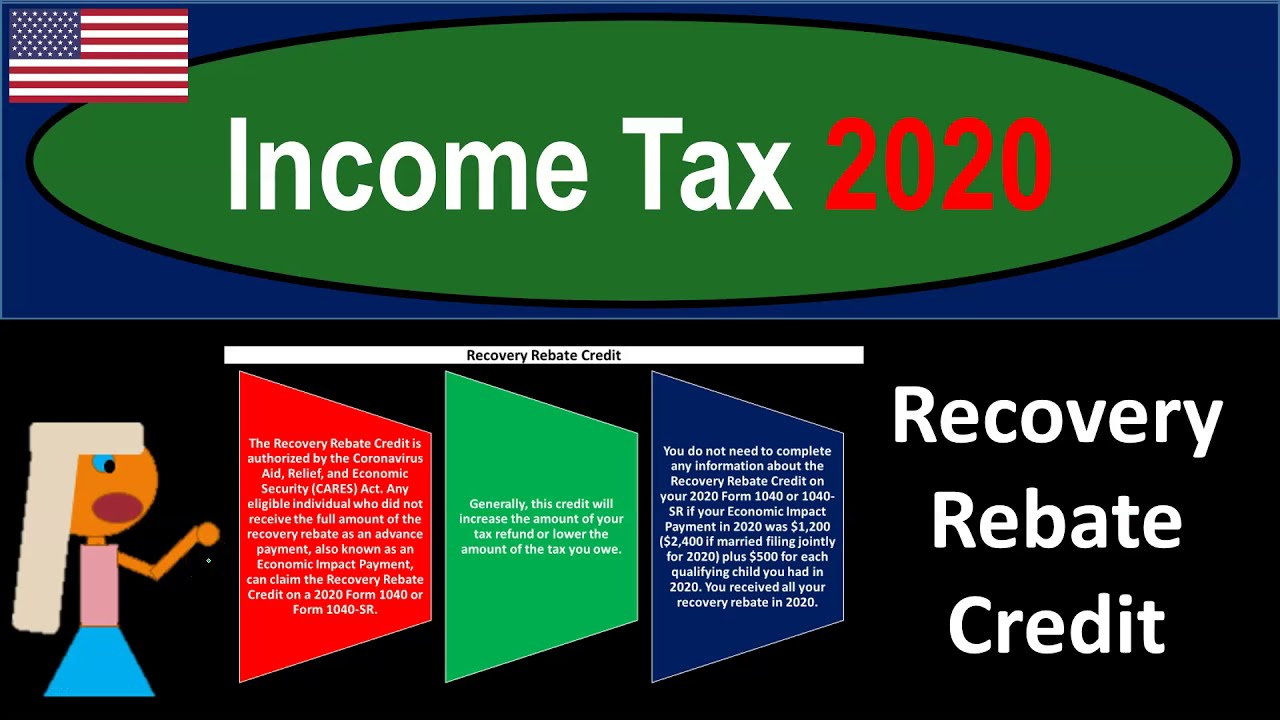

WASHINGTON As people across the country file their 2020 tax returns some are claiming the 2020 Recovery Rebate Credit RRC The IRS is mailing letters to some taxpayers who claimed the 2020 credit and may be getting a different amount than they expected What is the 2020 Recovery Rebate Credit The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial stimulus payment provided up to 1 200 per qualifying adult and up to 500 per qualifying dependent

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program This is the return you will file in 2022 Do I qualify for a Recovery Rebate Tax Credit Generally you are eligible to claim the Recovery Rebate Credit if you Were a U S citizen or U S resident alien in 2020 Were not claimed as a dependent

Download Turbotax Miscalculation Recovery Rebate Credit 2024

More picture related to Turbotax Miscalculation Recovery Rebate Credit 2024

Recovery Rebate Credit Form Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/2022-tax-form-1040es.jpg

Recovery Rebate 2023 Turbotax Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-worksheet-turbotax-studying-worksheets-6.jpg

How To Claim Stimulus Check 2021 Turbotax It S Not Too Late Claim A Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-stimulus-check-2021-turbotax-it-s-not-too-late-claim-a.jpg?resize=1536%2C1025&ssl=1

The second full stimulus payment was 600 for single individuals 1 200 for married couples and 600 per dependent If you earned more than 99 000 198 000 for married couples you got no TurboTax guaranteed 100 accuracy US En United States English United States Spanish Canada English Canada French TURBOTAX Expert does your taxes Back Expert does your taxes An expert does your return start to finish Full Service for personal taxes Full Service for business taxes Do it yourself

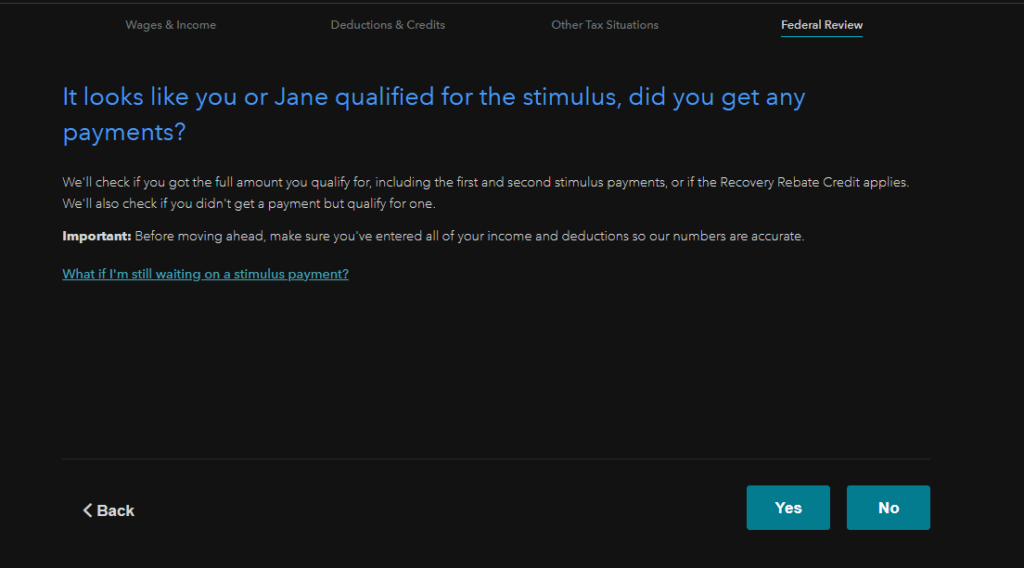

Recovery Rebate Credit With this option enabled the Recovery Rebate Credit Worksheet won t be added to your returns automatically During final review a diagnostic will generate informing you that stimulus payments should be entered if the client didn t receive all EIP they were entitled to You can always add the worksheet to a return TurboTax Live Assisted Basic Offer Offer only available with TurboTax Live Assisted Basic and for those filing Form 1040 and limited credits only Roughly 37 of taxpayers qualify Must file between November 29 2023 and March 31 2024 to be eligible for the offer Includes state s and one 1 federal tax filing

How To Claim Stimulus Recovery Rebate Credit On TurboTax

https://www.irsofficesearch.org/wp-content/uploads/2021/02/recovery-rebate-credit.png

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-turbotax-studying-worksheets.jpg?resize=1536%2C864&ssl=1

https://ttlc.intuit.com/community/after-you-file/discussion/miscalculation-of-recovery-rebate-credit/00/2126995

Miscalculation of Recovery Rebate Credit I filed on TurboTax for the 5th year in a row on 2 9 2021 Somehow I got nothing on my return and in addition had to pay 1 to the IRS My return was accepted and 1 withdrawn from my bank account That isn t necessarily the issue though

https://ttlc.intuit.com/community/taxes/discussion/miscalculation-of-2020-recovery-rebate-credit-turbotax-make-it-right/00/2339594

Miscalculation of 2020 Recovery Rebate Credit TurboTax Make it Right My family situation Married Filing Jointly 1 dependent born 2019 so on the full year 2020 When I entered in the amount of stimulus my family received in 2020 I put in the following information First round 2 900 Second round 1 800 screenshot from today

Stimulus Checks Tax Return Irs Turbotax QATAX Recovery Rebate

How To Claim Stimulus Recovery Rebate Credit On TurboTax

What Is The 2020 Recovery Rebate Credit And Am I Eligible TurboTax Tax Tips Videos

Miscalculation On Your Form 1040 Recovery Rebate Credit

Stimulus Check Irs Turbotax STIMUQ Recovery Rebate

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets Recovery Rebate

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets Recovery Rebate

Recovery Rebate Credit For Single Person Recovery Rebate

20 2020 Recovery Rebate Credit Worksheet Worksheets Decoomo

What Is A Recovery Rebate Tax Credit The TurboTax Blog

Turbotax Miscalculation Recovery Rebate Credit 2024 - If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you don t usually file taxes to claim it Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund