Inflation Reduction Act Of 2024 Ev Rebate The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 30D tax credit The IRA also added a new credit for previously owned clean vehicles under 25E of the Code

What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead 1 Q If I signed a contract to purchase an electric vehicle prior to enactment of the Inflation Reduction Act before August 16 2022 but have not yet taken possession of the vehicle will the changes in the Inflation Reduction Act impact my tax credit No

Inflation Reduction Act Of 2024 Ev Rebate

Inflation Reduction Act Of 2024 Ev Rebate

https://static.twentyoverten.com/60dcacac52410e1095fd898c/TPPpgK25c7/Inflation-Reduction-Act-of-2022-pic.jpg

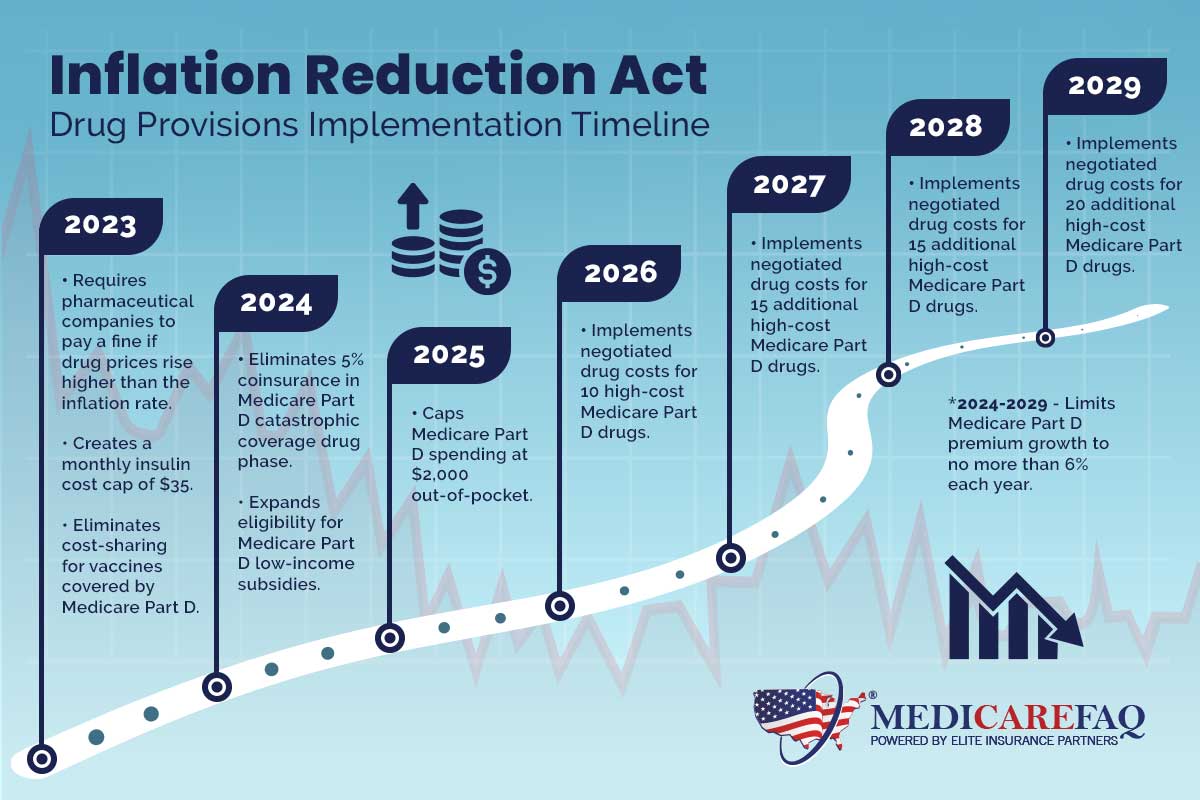

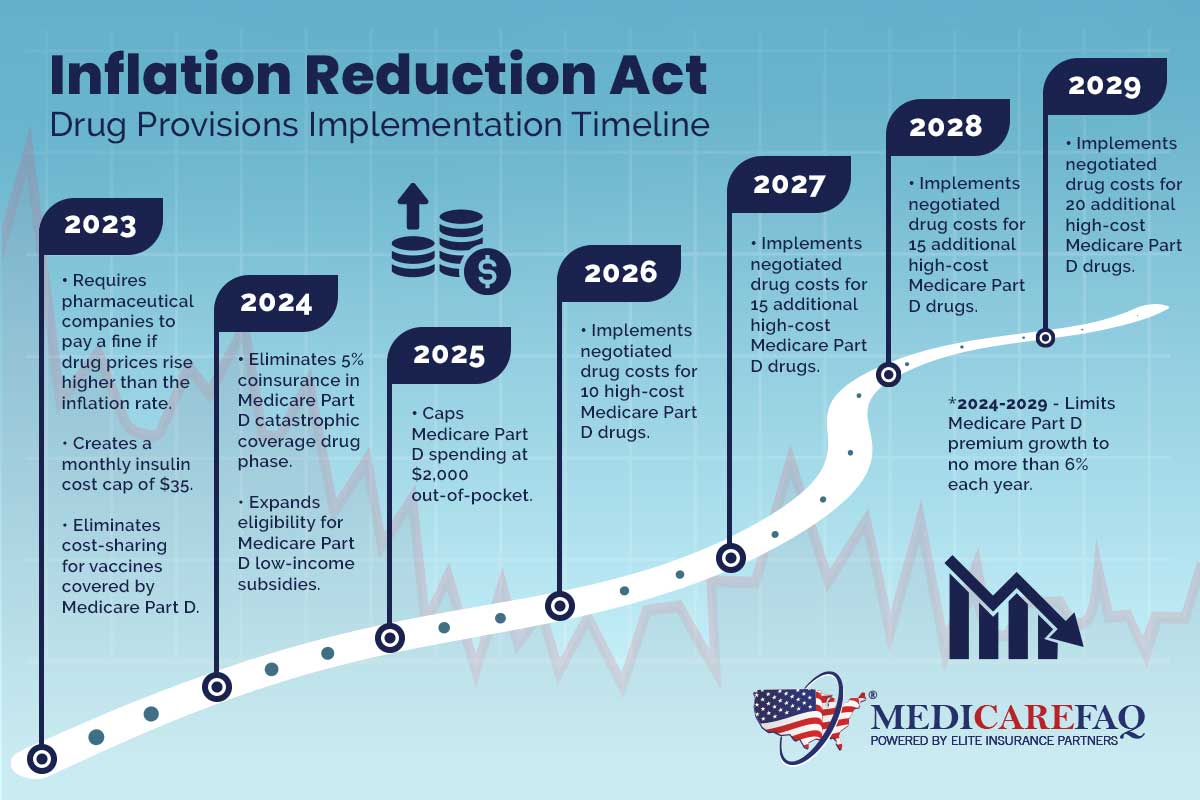

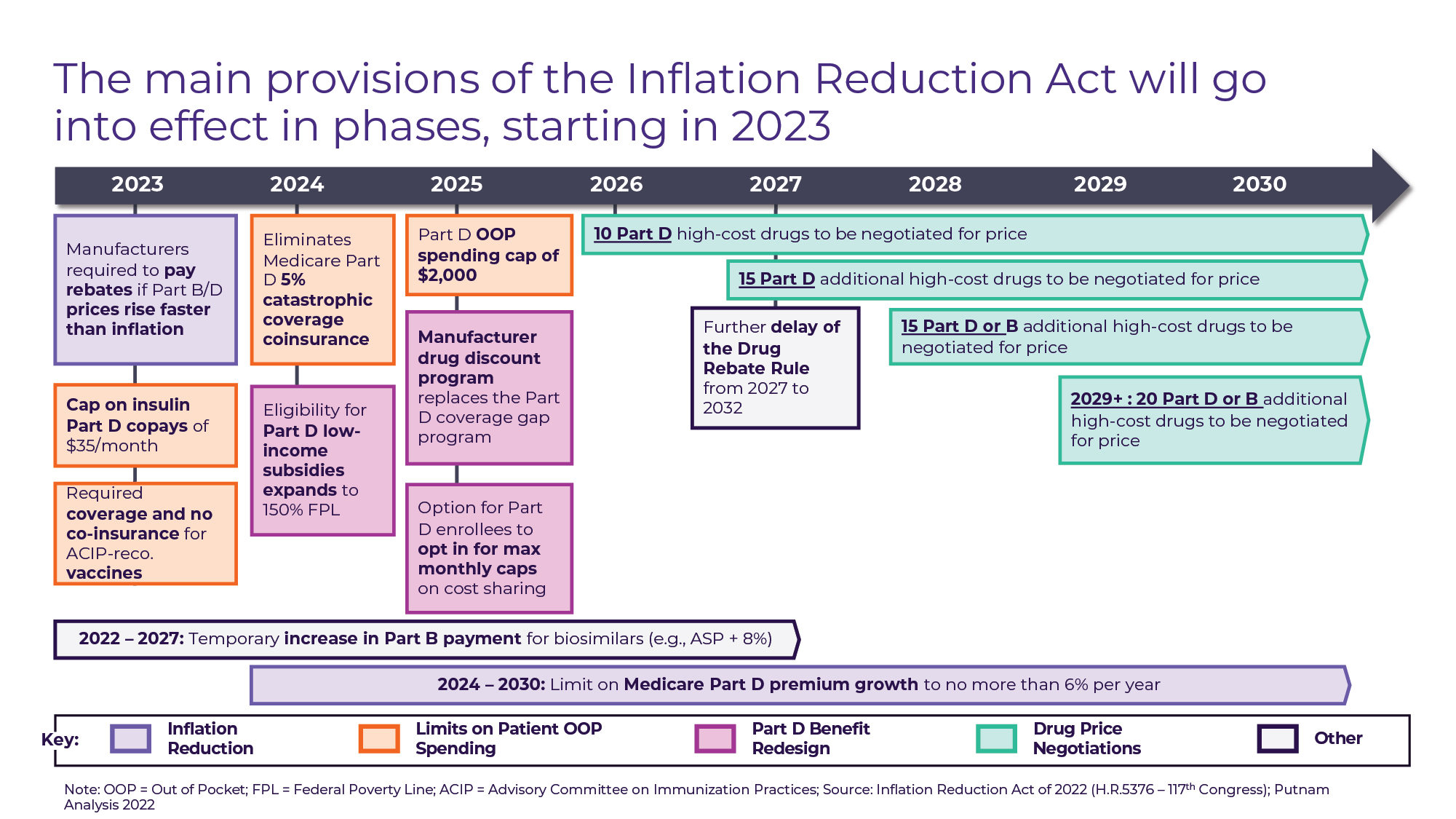

The Inflation Reduction Act And Medicare Part D

https://www.medicarefaq.com/wp-content/uploads/inflation-reduction-infographic.jpg

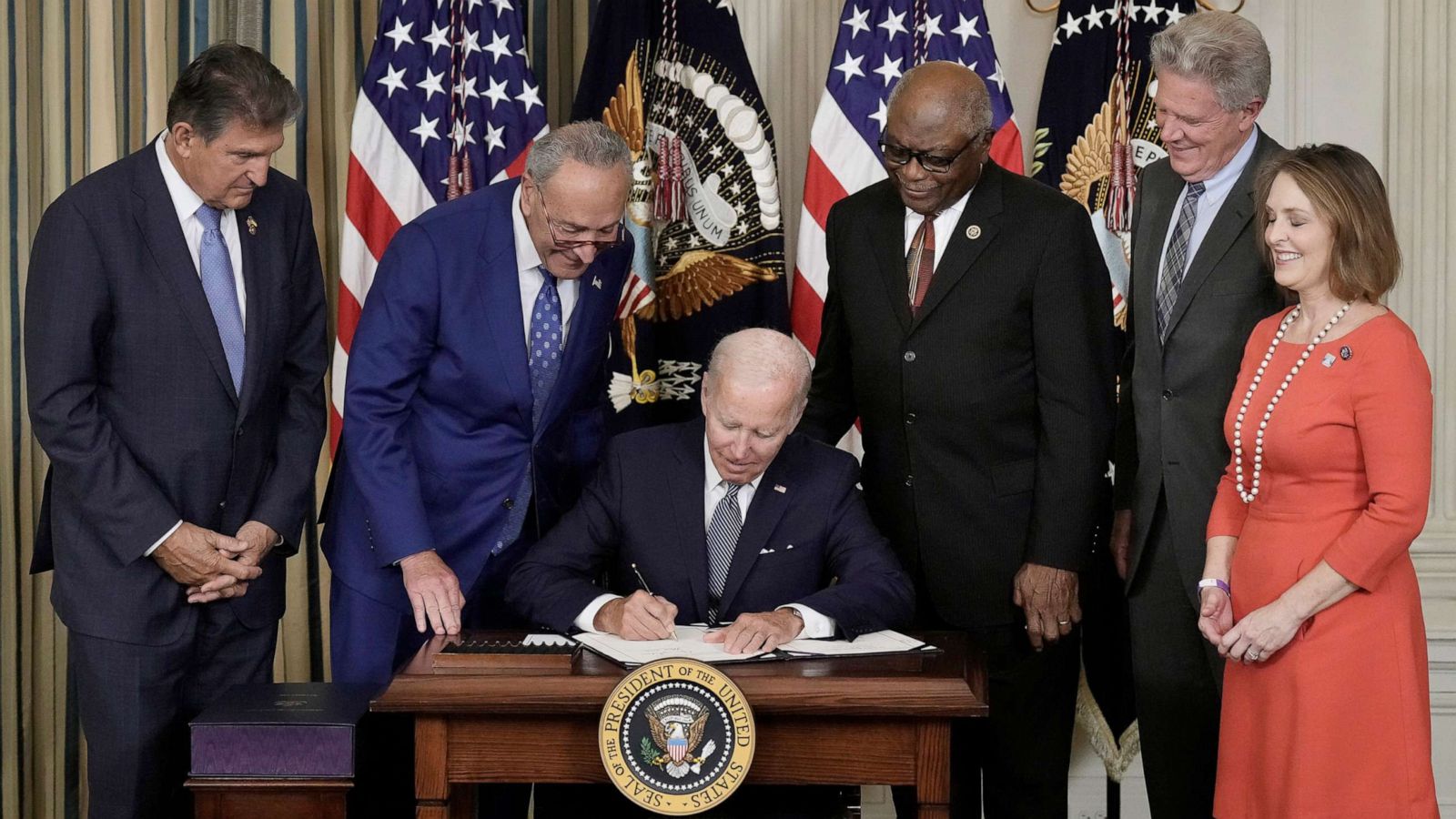

Inflation Reduction Act Gridmatic

https://www.gridmatic.com/wp-content/uploads/2022/08/signing-inflation-reduction-act-01-gty-iwb-220817_1660745706279_hpMain_16x9_1600.jpeg

Last year the Inflation Reduction Act introduced a new set of modernized tax credits for new and used electric and plug in hybrid cars But starting January 2024 they ll be less like The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel cell vehicles and associated equipment such as chargers

Under the Inflation Reduction Act consumers can choose to transfer their new clean vehicle credit of up to 7 500 and their previously owned clean vehicle credit of up to 4 000 to a car The Inflation Reduction Act of 2022 Public Law 117 169 amended the Qualified Plug in Electric Drive Motor Vehicle Credit IRC 30D now known as the Clean Vehicle Credit and added a new requirement for final assembly in North America that took effect on August 17 2022 For new electric fuel cell electric and plug in hybrid electric

Download Inflation Reduction Act Of 2024 Ev Rebate

More picture related to Inflation Reduction Act Of 2024 Ev Rebate

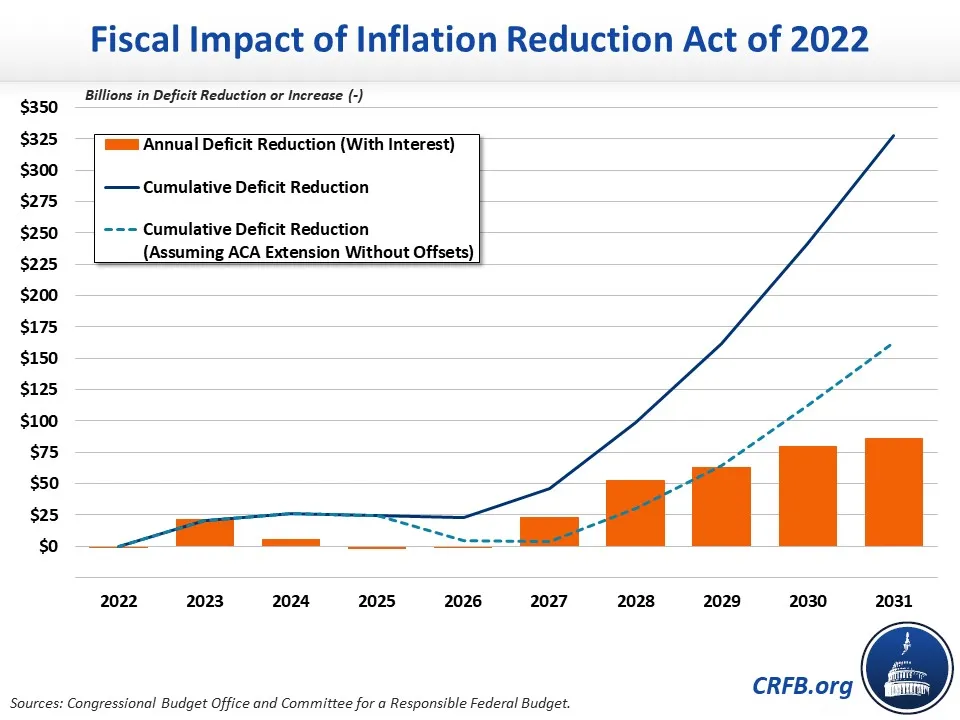

What s In The Inflation Reduction Act Committee For A Responsible Federal Budget

https://www.crfb.org/sites/default/files/styles/media_image_default/public/images/CBO Score of Inflation Reduction Act Chart.jpg.webp?itok=Y6xXa639

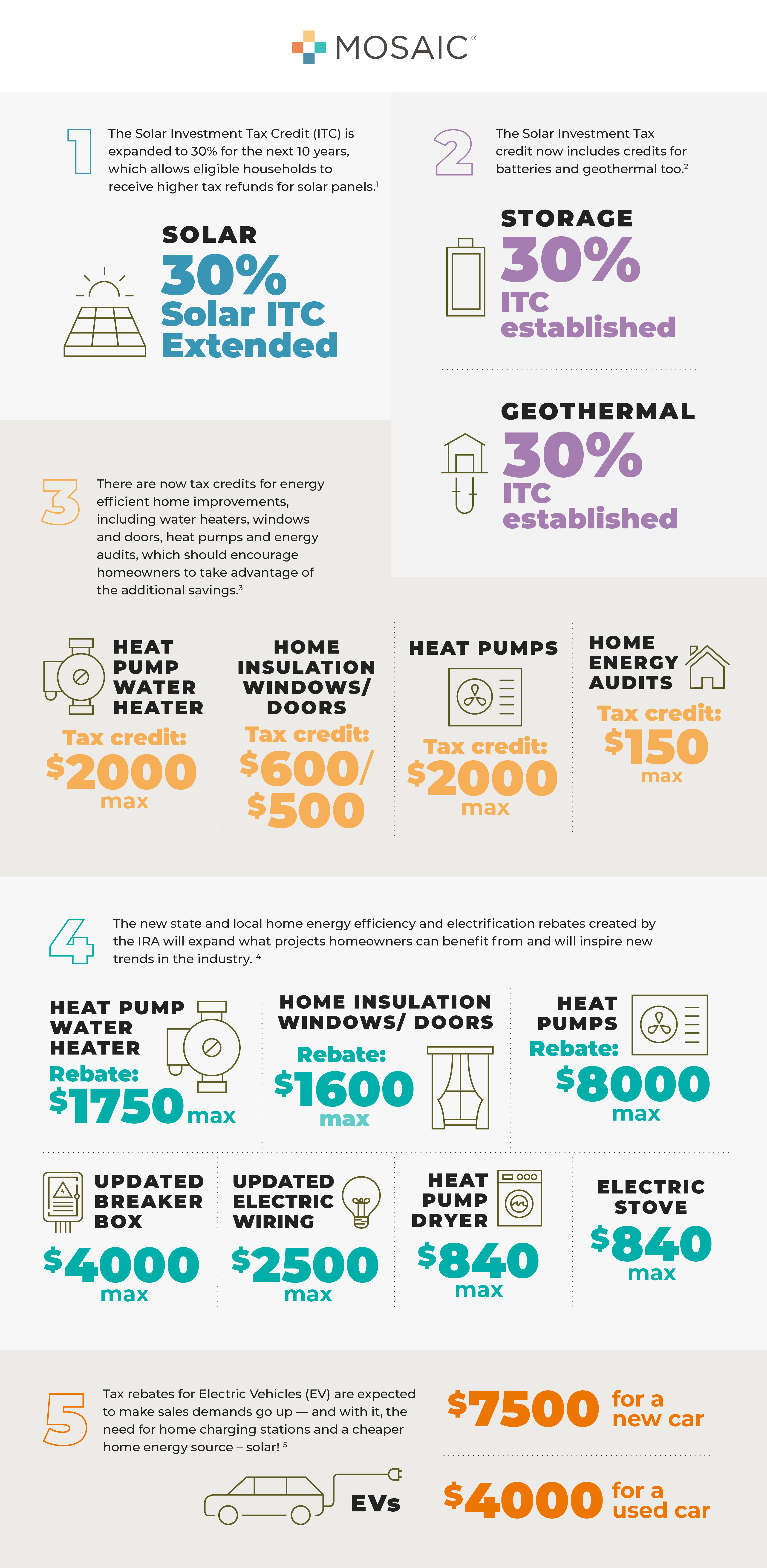

5 Ways The IRA Will Benefit Homeowners and Contractors

https://joinmosaic.com/wp-content/uploads/2022/12/IRA-benefits-infographic_final.png

The Inflation Reduction Act EV Tax Credits Explained History Computer

https://history-computer.com/wp-content/uploads/2022/08/shutterstock_1668063934-scaled.jpg

Today s guidance marks a first step in the Biden Administration s implementation of Inflation Reduction Act tax credits to lower costs for families and make electric vehicles more affordable WASHINGTON Following President Biden s signing the Inflation Reduction Act into law today the U S Department of the Treasury and Internal Revenue Service published initial information on What is the Inflation Reduction Act s EV tax credit Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The

A new federal tax credit of 4 000 for used EVs priced below 25k Subject to other requirements like lower annual income see below Revised credit applies to battery electric vehicles with an July 20 2023 iStock Courtney Lindwall Contributor The Inflation Reduction Act directs an unprecedented 369 billion toward fighting climate change As a result we ll all see innumerable

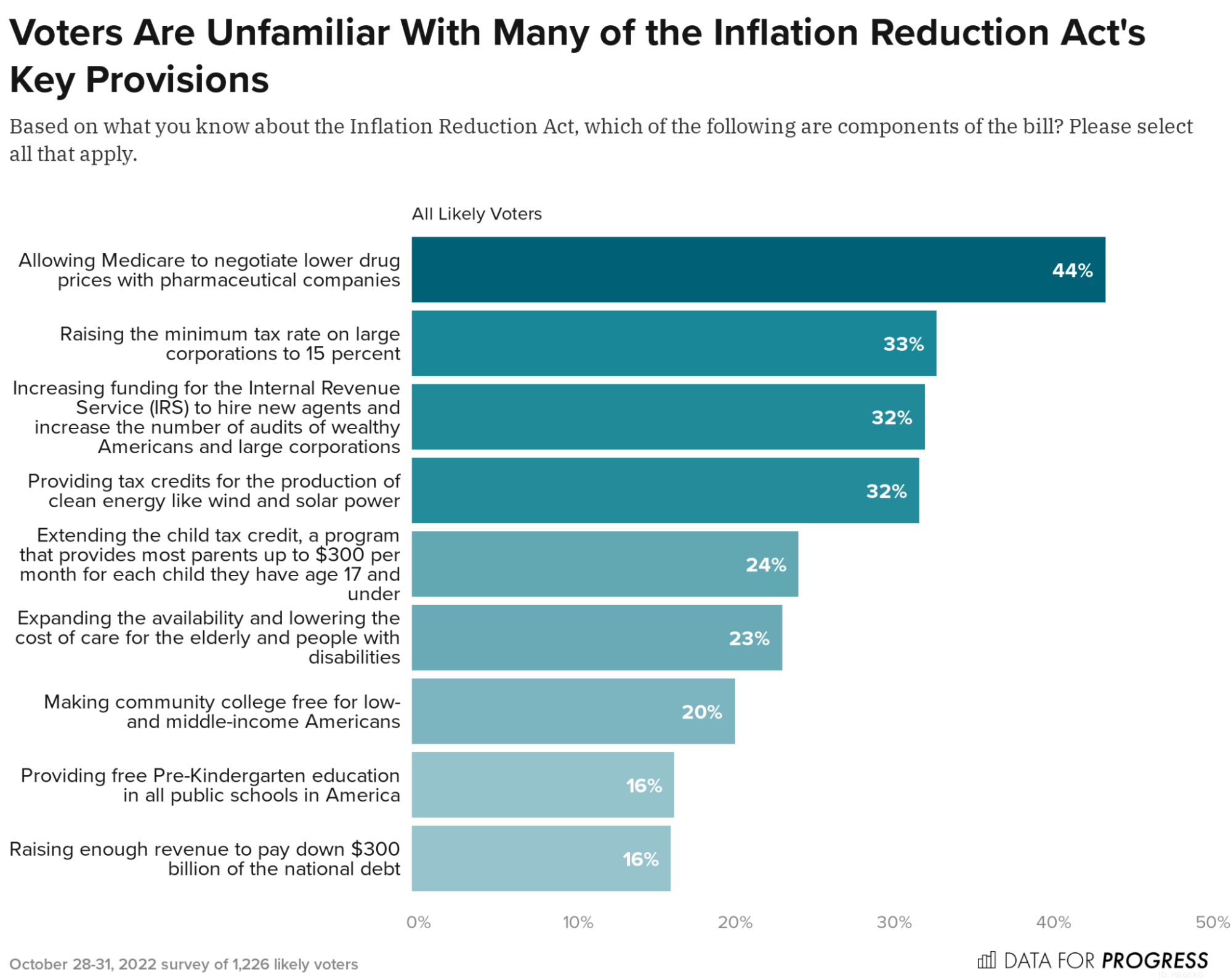

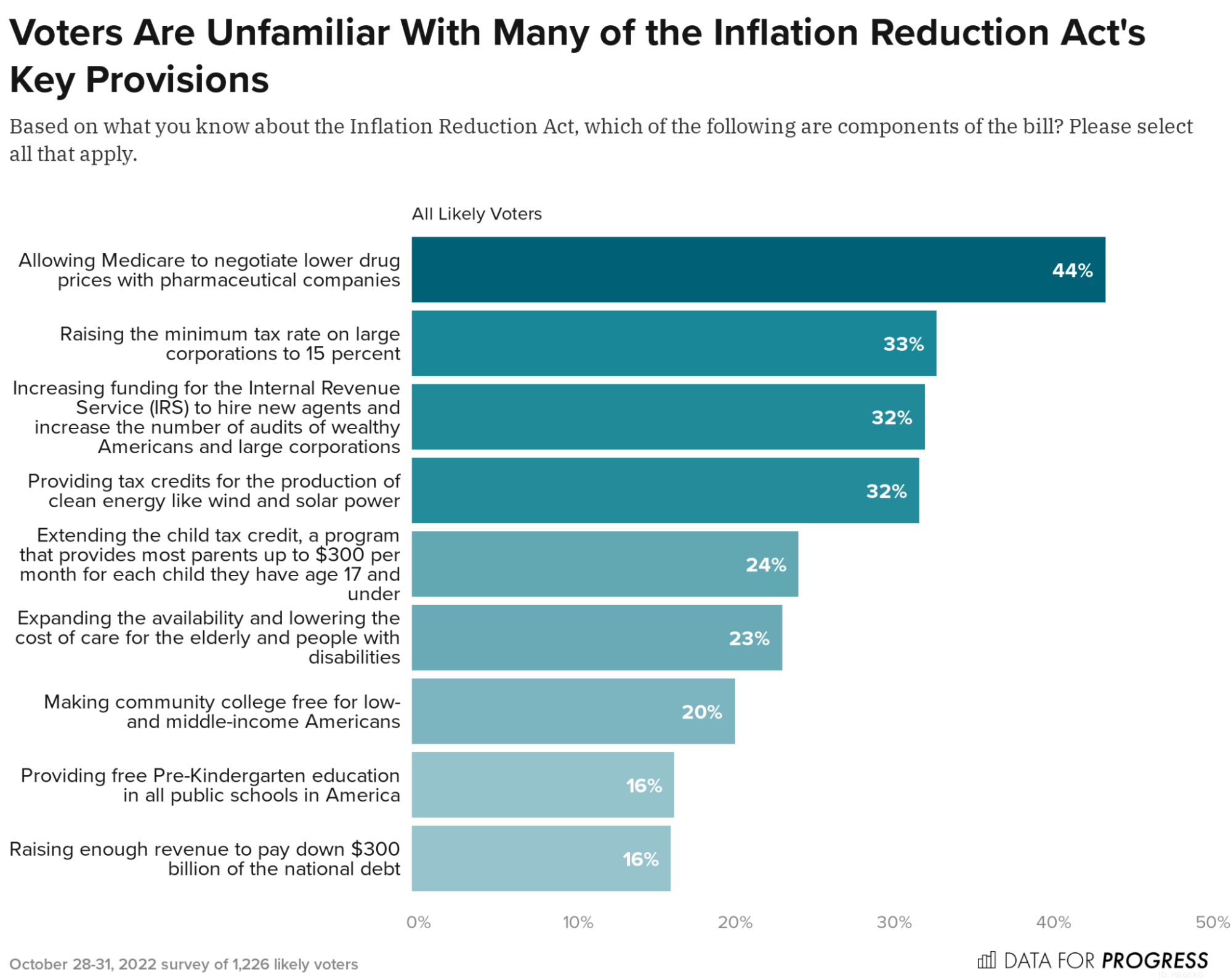

On The Inflation Reduction Act Voters Have Heard Very Little

https://images.squarespace-cdn.com/content/v1/5aa9be92f8370a24714de593/42d06ec1-2a4a-4251-b9b7-e2183769a5b8/image4.png?format=2500w

Siting Policy Finding A Home For Renewable Energy And Transmission Energy Innovation Policy

https://energyinnovation.org/wp-content/uploads/2022/07/Inflation-Reduction-Act-emissions-reductions-to-2030.png

https://www.irs.gov/newsroom/topic-b-frequently-asked-questions-about-income-and-price-limitations-for-the-new-clean-vehicle-credit

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 30D tax credit The IRA also added a new credit for previously owned clean vehicles under 25E of the Code

https://www.npr.org/2023/12/28/1219158071/ev-electric-vehicles-tax-credit-car-shopping-tesla-ford-vw-gm

What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead

Inflation Reduction Act Key Takeaways Entegrity Energy Partners

On The Inflation Reduction Act Voters Have Heard Very Little

The Inflation Reduction Act Is A Victory For Working People AFL CIO

Biden Marks Anniversary Of Inflation Reduction Act Previewing 2024 Message

The Inflation Reduction Act A Tale Of Two Drugs Putnam

2022 Inflation Reduction Act Tri County A C And Heating

2022 Inflation Reduction Act Tri County A C And Heating

Inflation Reduction Act Heat Pump Rebate Novak Heating

3 Ways To Exploit The Inflation Reduction Act Seeking Alpha

I Heart Amana Inflation Reduction Act I Heart Amana

Inflation Reduction Act Of 2024 Ev Rebate - EV Charging Equipment Tax Credit The federal tax credit on charging equipment has been extended through 2032 For individual residential uses the tax credit remains unchanged at 30 up to 1 000 For commercial uses the tax credit Is 6 with a maximum credit of 100 000 per unit up from 30 000 per property