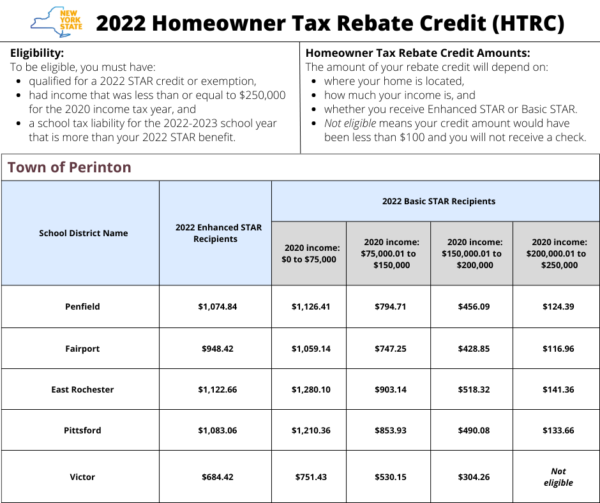

Nys Homeowner Tax Rebate 2024 To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit

The amount of the credit is the product of the amount of real property tax which exceeds 6 of the taxpayer s qualified gross income QGI and a specified rate based on the taxpayer s QGI To claim the credit the computed amount must exceed 250 The maximum credit allowed is 350 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Homeowners used this lookup to determine the amount they would receive for the homeowner tax rebate credit HTRC Please note by law we cannot issue checks for the HTRC that are less than 100

Nys Homeowner Tax Rebate 2024

Nys Homeowner Tax Rebate 2024

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-600x503.png

NYS Homeowner Assistant Fund NYC MEA NYC Managerial Employees Association The ONLY Advocates

https://nycmea.org/wp-content/uploads/2021/12/NYS_homeownerfund.png

NYS Homeowner Tax Rebate Credit Checks Being Mailed Out

https://townsquare.media/site/497/files/2022/06/attachment-RS28849_ThinkstockPhotos-623211702-scr.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

The Inflation Reduction Act IRA helps New Yorkers get the latest clean energy technologies and equipment that will save energy for years to come From the cars we drive to the ways we heat and cool our homes the IRA is helping New Yorkers choose clean energy technologies that improve their health safety and quality of life Did you know The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state

The FY 2024 Budget adds 50 million for a Homeowner Stabilization Fund to finance home repairs in 10 communities across the state that have been identified as having high levels of low income homeowners of color and homeowner distress For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on Federal Schedule C D E or F doesn t exceed 3 000 the net amount of any other separate category of loss doesn t exceed 3 000 and

Download Nys Homeowner Tax Rebate 2024

More picture related to Nys Homeowner Tax Rebate 2024

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1920&h=1080&crop=1

NYS 2023 Homeowner Tax Rebate Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/NYS-2023-Homeowner-Tax-Rebate.jpg?fit=996%2C728&ssl=1

Homeowner Tax Credits Historic Albany Foundation

https://images.squarespace-cdn.com/content/v1/5567269ce4b02c6f5096564d/1586809103087-AAKEYE3R1ZIATYR8Z948/58431583394__89A4E4F6-6C96-43C9-A4C5-EB2B09D98F12.jpg?format=1500w

The New York Department of Taxation and Finance will soon begin sending direct financial assistance to 1 75 million New Yorkers who received the Empire State Child Credit and or the Earned Income Credit on their 2021 state tax returns including a gas tax moratorium and a homeowner tax rebate credit Our families have felt the effects of a Publication 532 2024 A publication is an informational document that addresses a particular topic of interest to taxpayers Subsequent changes in the law or regulations judicial decisions Tax Appeals Tribunal decisions or changes in Department policies could affect the validity of the information contained in a publication

ALBANY N Y In June Governor Kathy Hochul announced the one time Homeowner Tax Rebate Credit would be sent out available to eligible New Yorkers The state s Department of Taxation and The credit will reduce the amount you can deduct on the property tax section Eligibility for the Homeowner Tax Rebate Credit Qualified for a 2022 STAR credit or exemption Income less than or

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

https://i.ytimg.com/vi/ZN9k_nErOQE/maxresdefault.jpg

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In NYS 2023 Budget WRGB

https://cbs6albany.com/resources/media2/16x9/full/1024/center/80/6df365a4-868a-491a-b350-4442a687917a-large16x9_thumb_196074.png

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit

https://www.tax.ny.gov/pit/credits/real-property-tax-relief-credit.htm

The amount of the credit is the product of the amount of real property tax which exceeds 6 of the taxpayer s qualified gross income QGI and a specified rate based on the taxpayer s QGI To claim the credit the computed amount must exceed 250 The maximum credit allowed is 350

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check CNYcentral

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

Nys Tax Rebate Checks 2023 Tax Rebate

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

Nys School Tax Relief Checks Printable Rebate Form

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

Virginia Tax Rebate 2024

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

Nys Homeowner Tax Rebate 2024 - Find the amount you ll receive for the homeowner tax rebate credit in the Albany City School District for example the amount ranges from 110 to 1 144 The state cannot legally issue checks