Nj Homestead Rebate 2024 Deadline New Jersey s ANCHOR tax rebate program was a hallmark of the 2023 budget and the Department of the Treasury is already looking ahead to 2024 As of last month more than 1 638 million

The Anchor program June 15 2022 Gov Phil Murphy announces agreement with Assembly Speaker Craig Coughlin and Senate President Nick Scutari on property tax relief measures A former state treasurer and the chief data officer for a key state department are among the policy experts Gov Phil Murphy and lawmakers picked to advance a planned Tax Year 2020 Filing Information What is the filing deadline If you received the ANCHOR Benefit Confirmation Letter notifying you that you qualify and you do nothing else we will file the application for you and pay the benefit based on information in that letter

Nj Homestead Rebate 2024 Deadline

Nj Homestead Rebate 2024 Deadline

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/property-tax-rebates-check-if-you-are-eligible-for-anchor-program-3.jpg

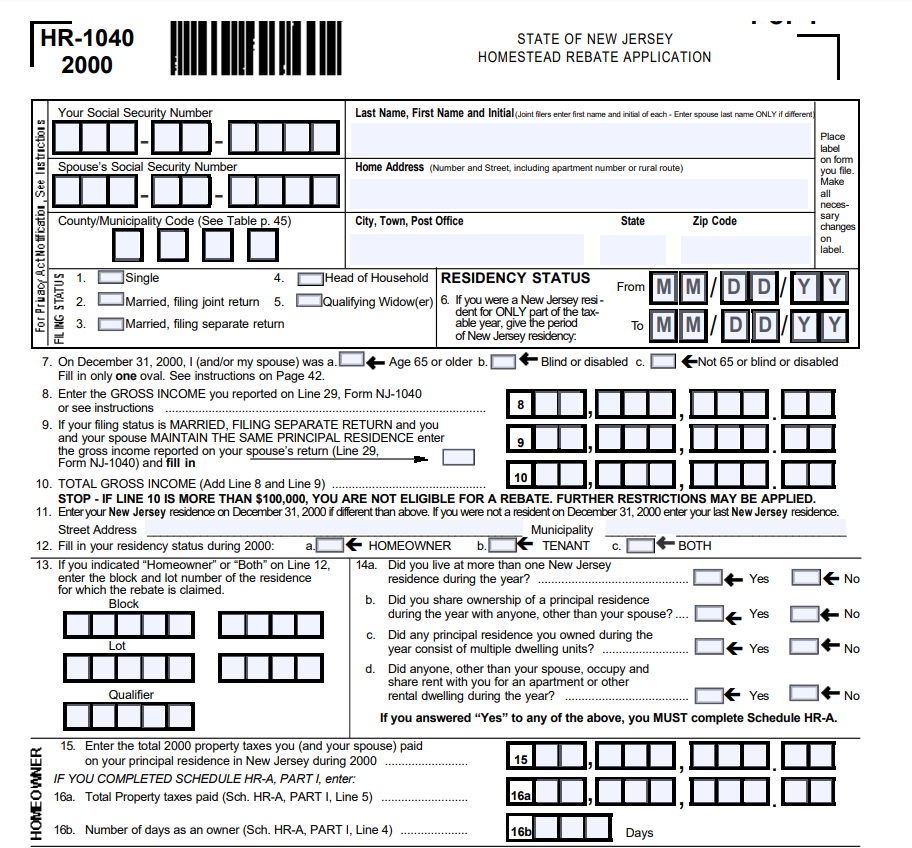

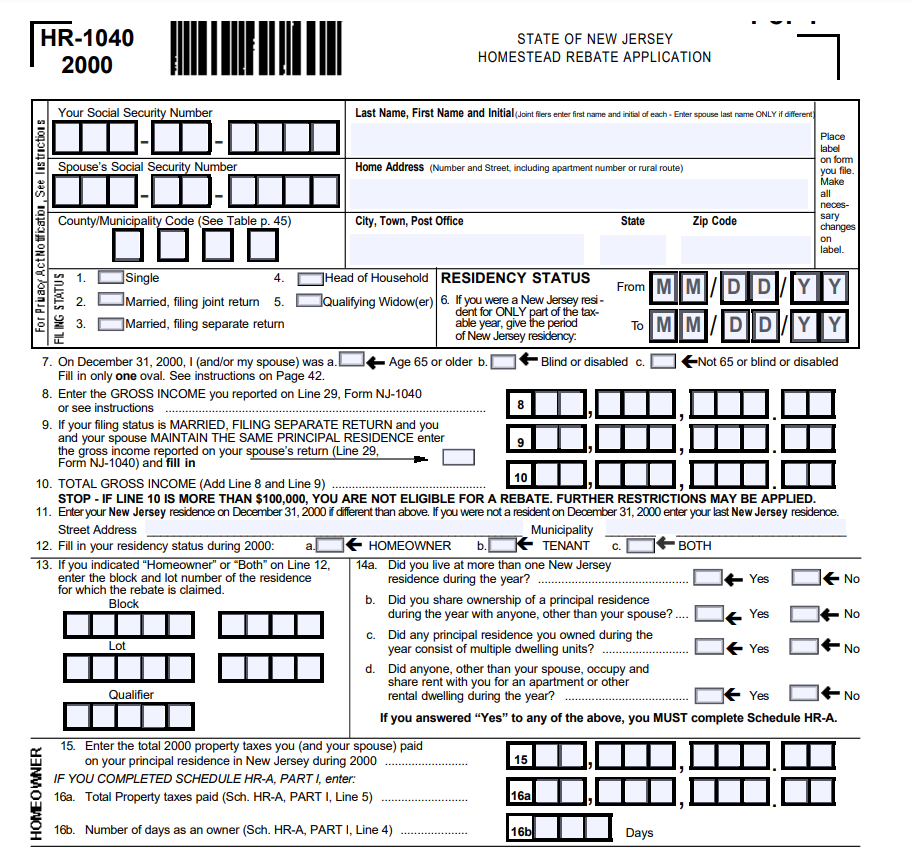

NJ Homestead Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/File-NJ-Homestead-Rebate-Form-Online.png

What Happens To The Homestead Rebate And My Tax Return NJMoneyHelp

http://njmoneyhelp.com/wp-content/uploads/2019/03/Homestead-968x643.jpg

The state says up to 2 million taxpayers both homeowners and renters should get an average rebate of 971 from the ANCHOR program which is short for the Affordable New Jersey Communities Applications must be filed no later than Dec 29 The application deadline is quickly approaching for the latest round of Anchor property tax relief benefits offered to New Jersey homeowners and renters under the state funded program Department of Treasury officials say more than 1 6 million residents have already received Anchor benefits

More than 870 000 homeowners with incomes up to 150 000 will be eligible to receive 1 500 in relief more than 290 000 homeowners with incomes over 150 000 and up to 250 000 will be eligible to Over 870 000 homeowners with incomes up to 150 000 will receive 1 500 in relief over 290 000 homeowners with incomes over 150 000 and up to 250 000 will receive 1 000 and over 900 000 renters with incomes up to 150 000 will receive 450 to help offset rent increases

Download Nj Homestead Rebate 2024 Deadline

More picture related to Nj Homestead Rebate 2024 Deadline

File NJ Homestead Rebate Form Online PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2022/09/File-NJ-Homestead-Rebate-Form-Online-2023.png

I Missed The Homestead Rebate Deadline What Now Nj PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/i-missed-the-homestead-rebate-deadline-what-now-nj.jpg?w=1280&ssl=1

What Happened To My Homestead Rebate Nj

https://www.nj.com/resizer/lnFRLLMV-oHSml1s4d1b8o7uJnc=/800x0/smart/image.nj.com/home/njo-media/width600/img/business_impact/photo/old-man-3617304-1920jpg-452fcfe731a60d12.jpg

2 34 Homeowners and renters have a little more time to apply for the ANCHOR tax relief program Gov Phil Murphy announced Tuesday during his annual State of the State address that the deadline The program will provide credits of up to 1 500 to taxpayers with 2019 gross incomes up to 150 000 and 1 000 for those with gross incomes between 150 000 and 250 000 Tenants also can

The administration says it can reach more residents in 2024 New Jersey residents are just beginning to receive the first payments under the state s new Anchor property tax relief program but attention is already shifting to finding ways to improve the program in year two A key provision of the envisioned program is the funding of tax credits that would be used to cut property taxes in half for many homeowners ages 65 and older up to a maximum of 6 500 annually Right now senior homeowners making up to 500 000 annually would be eligible for the promised benefits The cost of Stay NJ could eventually rise to

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

https://www.nj.com/resizer/jJAPV02xTaR1P0hhatjhgxAAHAg=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/OCDIN5URIBBRVLQX5ZOGNBVHZI.jpg

NJ Property Tax Relief Program Updates Access Wealth

https://access-wealth.com/wp-content/uploads/2020/10/homestead-rebate-m-2048x1344.jpeg

https://www.msn.com/en-us/money/realestate/this-is-who-can-qualify-for-nj-anchor-rebates-in-2024/ar-AA1emGXe

New Jersey s ANCHOR tax rebate program was a hallmark of the 2023 budget and the Department of the Treasury is already looking ahead to 2024 As of last month more than 1 638 million

https://www.njspotlightnews.org/2024/01/big-nj-property-tax-relief-nj-2023-more-promised-will-murphy-lawmakers-deliver-2024/

The Anchor program June 15 2022 Gov Phil Murphy announces agreement with Assembly Speaker Craig Coughlin and Senate President Nick Scutari on property tax relief measures A former state treasurer and the chief data officer for a key state department are among the policy experts Gov Phil Murphy and lawmakers picked to advance a planned

What Happens To The Homestead Rebate And My Tax Return NJMoneyHelp PropertyRebate

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

Do I Qualify For The Homestead Rebate Or The Senior Freeze Nj

New Jersey Renters Rebate 2023 Printable Rebate Form

State Freezes Payments For Homestead Rebate Program Video NJ Spotlight News

What s The Maximum For The Homestead Rebate Nj

What s The Maximum For The Homestead Rebate Nj

Am I Entitled To The Homestead Rebate NJMoneyHelp

NJ Homestead Rebate What To Know Credit Karma

NJ Homestead PrintableRebateForm

Nj Homestead Rebate 2024 Deadline - Over 870 000 homeowners with incomes up to 150 000 will receive 1 500 in relief over 290 000 homeowners with incomes over 150 000 and up to 250 000 will receive 1 000 and over 900 000 renters with incomes up to 150 000 will receive 450 to help offset rent increases