Child Care Rebate 2024 Child Tax Credit 2023 2024 What It Is Requirements and How to Claim For 2023 taxpayers may be eligible for a credit of up to 2 000 and 1 600 of that may be refundable Legislation in the

How Much Is the Child Tax Credit for 2024 Various family tax credits and deductions including the 2024 child tax credit have been adjusted for inflation Here s what they re worth Image Currently 1 600 of the 2 000 credit per child is refundable The credit s phaseout threshold is 400 000 for married earners filing jointly and 200 000 for head or single households At the

Child Care Rebate 2024

Child Care Rebate 2024

https://montessoriacademy.com.au/wp-content/uploads/2018/04/pic.jpg

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/child-care-tax-credit-payment-dates-2022-drift-hestia-bloger-1.jpg

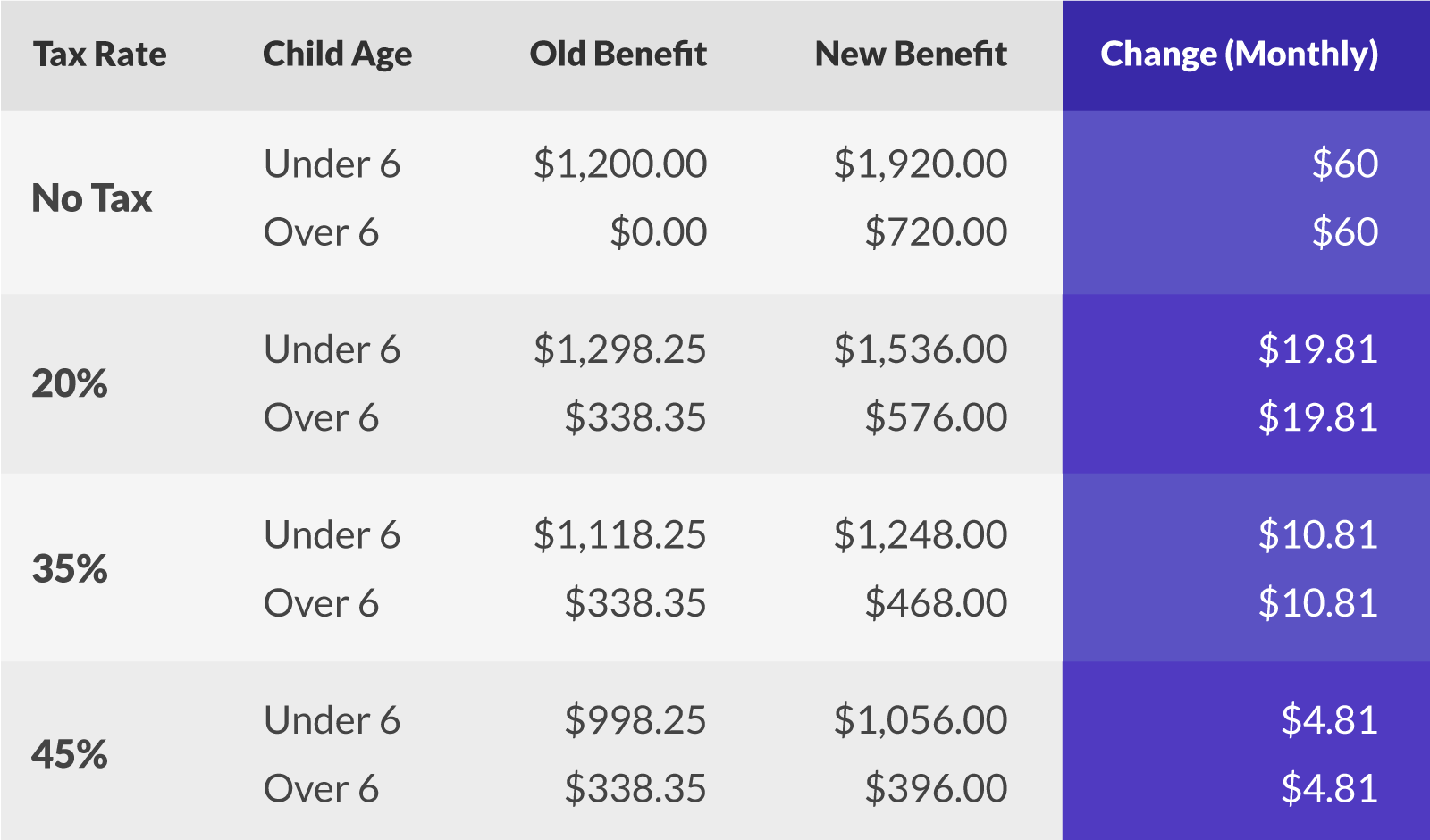

Child Care Rebate Tax Brackets 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/how-canada-s-revamped-universal-child-care-benefit-affects-you.png

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax These states plan to send child tax credit checks to families in 2024 Note that not all are fully refundable which means you may need an income to receive the full amount owed to you California

Jan 19 2024 12 31 PM PST By Sahil Kapur and Scott Wong WASHINGTON The House Ways and Means Committee voted 40 3 on Friday to approve a bipartisan tax package that includes an expansion of Senate committee approves increased investment in our country s child care and early learning system ARLINGTON VA July 27 2023 The U S Senate Committee on Appropriations today approved with bipartisan support their proposed Labor Health and Human Services Education and Related Agencies Fiscal Year 2024 Appropriations bill including a 1 billion increase for early learning

Download Child Care Rebate 2024

More picture related to Child Care Rebate 2024

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/child-care-tax-credit-payment-dates-2022-drift-hestia-bloger.jpg

Your Ultimate Guide To The Child Care Benefit And Child Care Rebate Petit Journey

https://www.petitjourney.com.au/wp-content/uploads/2017/01/difference-between-child-care-rebate-and-benefit.jpg

Your Ultimate Guide To The Child Care Benefit And Child Care Rebate Petit Journey

https://www.petitjourney.com.au/wp-content/uploads/2017/01/how-to-apply-for-child-care-rebate-e1513120609516.jpg

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3 600 for children under the age of 6 and to 3 000 per child for children between ages 6 and 17 Before 2021 the credit was worth up to 2 000 per eligible child The new maximum credit is available to taxpayers with a modified adjusted gross income AGI of House of Representatives On July 13 appropriators in the House released their FY24 funding bill for the Labor Health and Human Services and Education subcommittee which provides 147 billion a 29 decrease in support for programs under the subcommittee s jurisdiction from FY23

The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age of six and from 2 000 to 3 600 for children under the age of six The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school

Changes To The Child Care Benefit And Child Care Rebate How Will They Affect You Grandma s Jars

https://grandmasjars.com/wp-content/uploads/2018/02/child-care-rebate-1024x701.jpg

Child Care Rebate Changes Why Means Testing Could Hurt Working Mothers Body soul

https://content.api.news/v3/images/bin/9eaa25a4956655198a5a5d2619d7759b

https://www.nerdwallet.com/article/taxes/qualify-child-child-care-tax-credit

Child Tax Credit 2023 2024 What It Is Requirements and How to Claim For 2023 taxpayers may be eligible for a credit of up to 2 000 and 1 600 of that may be refundable Legislation in the

https://www.kiplinger.com/taxes/how-much-is-the-child-tax-credit-for-2024

How Much Is the Child Tax Credit for 2024 Various family tax credits and deductions including the 2024 child tax credit have been adjusted for inflation Here s what they re worth Image

Child Care And Early Childhood Learning Future Options PC News And Other Articles

Changes To The Child Care Benefit And Child Care Rebate How Will They Affect You Grandma s Jars

Need For Child Care Isn t Going Away New Survey EducationNC

Illinois Child Care For All Coalition Launched As New Report Shows Depth Of Childcare Crisis

Changes To The Child Care Benefit And Child Care Rebate How Will They Affect You Grandma s Jars

How Parents Can Help To Discourage W siting Meet Our Experts To Learn More Visit Https

How Parents Can Help To Discourage W siting Meet Our Experts To Learn More Visit Https

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

Trifexis Rebate Form 2022 Printable Rebate Form

New Wearer Rebate Alcon New Wearers Can Save Up To 225 On Your Contact Lens Purchase

Child Care Rebate 2024 - The American Rescue Plan increased the amount of the Child Tax Credit from 2 000 to 3 600 for qualifying children under age 6 and 3 000 for other qualifying children under age 18 The credit was made fully refundable By making the Child Tax Credit fully refundable low income households will be entitled to receive the full credit benefit