Ev Tax Rebate 2024 You claim the credit using Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit and submit it with your individual tax return Beginning in 2024 buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use the credit amount as a down payment or a reduction of the manufacturer s suggested retail price

What cars qualify for the 7 500 tax credit in 2024 2022 2023 Chevrolet Bolt EUV with an MSRP limit of 55 000 2022 2023 Chevrolet Bolt EV with an MSRP limit of 55 000 2022 2024 Chrysler Beginning Jan 1 eligible consumers can take the federal EV tax credit as a discount at the point of sale when they purchase a qualifying vehicle In essence if you transfer the 2024 EV tax

Ev Tax Rebate 2024

Ev Tax Rebate 2024

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Union made EV Tax Rebate Could Erode Worker Freedom Institute For The American Worker

https://i4aw.org/wp-content/uploads/2022/01/electric-vehicle-scaled.jpeg

EV Tax Credit 2023 All You Need To Know Electric Vehicle Info

https://e-vehicleinfo.com/global/wp-content/uploads/2023/06/EV-Tax-Credit-2023-All-you-need-to-know-2-1024x536.png

The tax benefit which was recently modified by the Inflation Reduction Act for years 2023 through 2032 allows for a maximum credit of 7 500 for new EVs and up to 4 000 limited to 30 of the Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale rebate Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 The availability of the credit will depend on several factors including the vehicle s MSRP its final assembly location battery component and or critical

Download Ev Tax Rebate 2024

More picture related to Ev Tax Rebate 2024

Personal Tax Relief Y A 2023 L Co Accountants

https://landco.my/wp-content/uploads/2023/07/Personal-Tax-Relief-2023-731x1024.png

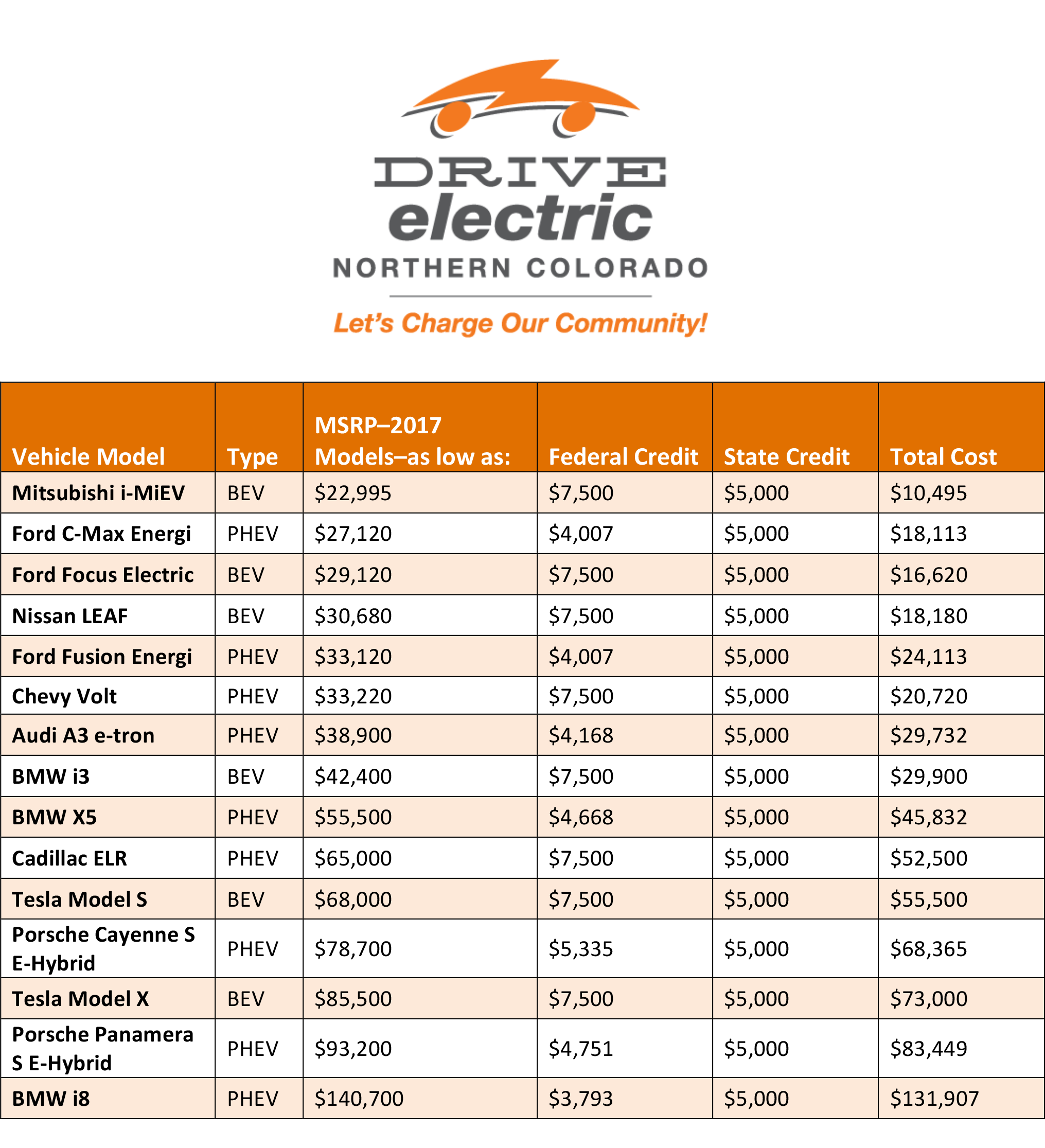

Ev Car Tax Rebate Calculator 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/tax-credits-drive-electric-northern-colorado.png

Tax Credits For Electric Cars 2021 ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/compare-electric-cars-ev-range-specs-pricing-more.png

Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses Consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing Starting in 2024 the Inflation Reduction Act establishes a mechanism that will allow car buyers to transfer the credit to dealers at the point of sale so that it can directly reduce the purchase price

A new federal tax credit of 4 000 for used EVs priced below 25k Subject to other requirements like lower annual income see below Revised credit applies to battery electric vehicles with an The Internal Revenue Service updated the rules for electric vehicle tax credits again starting with the first day of 2024 The bad news is that fewer vehicles are now eligible for tax credits and

Buying An Electric Car You Can Get A 7 500 Tax Credit But It Won t Be Easy NCPR News

https://media.npr.org/assets/img/2023/01/06/gettyimages-1243236963-1--742bba825bbd259580ed72411dbf7eae6b5409ca.jpg

Revamping The Federal EV Tax Credit Could Help Average Car Buyers Combat Record Gasoline Prices

https://theicct.org/wp-content/uploads/2022/06/epv-us-tax-credit-fig-jun22.png

https://www.irs.gov/newsroom/qualifying-clean-energy-vehicle-buyers-are-eligible-for-a-tax-credit-of-up-to-7500

You claim the credit using Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit and submit it with your individual tax return Beginning in 2024 buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use the credit amount as a down payment or a reduction of the manufacturer s suggested retail price

https://www.usatoday.com/story/money/cars/2024/01/03/cars-qualify-ev-tax-credit-2024/72088375007/

What cars qualify for the 7 500 tax credit in 2024 2022 2023 Chevrolet Bolt EUV with an MSRP limit of 55 000 2022 2023 Chevrolet Bolt EV with an MSRP limit of 55 000 2022 2024 Chrysler

Illinois EV Tax Credit Score Defined 2023 Electric Revolution The Latest News And

Buying An Electric Car You Can Get A 7 500 Tax Credit But It Won t Be Easy NCPR News

EV Tax Credit 2023 What s Changing With Biden s IRA The Week

Shannon Osaka Grist

Illinois Ev Tax Rebate 2023 Tax Rebate

Ev Tax Credit 2022 Cap Clement Wesley

Ev Tax Credit 2022 Cap Clement Wesley

EV Tax Credit Calculator 2023

Victoria s Electric Car Tax Robs Peter To Pay Peter SolarQuotes Blog

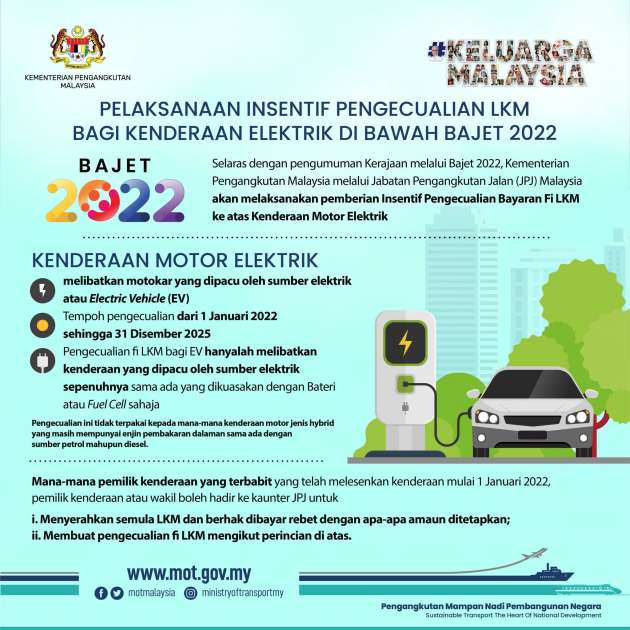

2022 EV LKM Road Tax Rebate Paul Tan s Automotive News

Ev Tax Rebate 2024 - Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act