When Will I Get My Recovery Rebate Credit 2024 IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before it s too late

2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how we sent your Payment Where s My Refund An online tool that will track your tax refund Online Payment Agreements Apply for a payment plan to pay your balance over time If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Featured Partner Offers

When Will I Get My Recovery Rebate Credit 2024

When Will I Get My Recovery Rebate Credit 2024

https://img.money.com/2022/03/News-Recovery-Rebate-Credit.jpg

Claim My Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-stimulus-check-2021-after-filing-taxes-what-do-i-do-if-i.jpg

Recovery Rebate Credit How To Get It Taxes For Expats US Expat Tax Service

https://tfxstorageimg.s3.amazonaws.com/5e3fvtb5jcyeajll6crf0rq8uddk

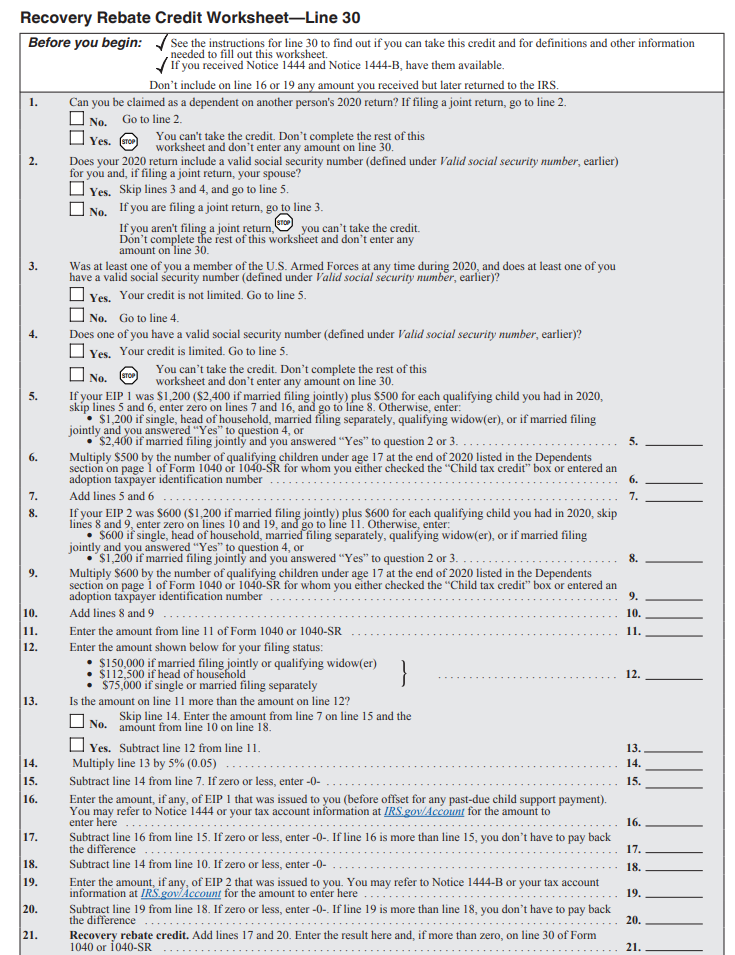

The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial stimulus payment provided up to 1 200 per qualifying adult and up to 500 per qualifying dependent Most of these payments went out to recipients in mid 2020 The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively The Recovery Rebate Credit is a refundable credit for those who missed out on one or more Economic Impact Payments Economic Impact Payments also referred to as stimulus payments were issued in 2020 and 2021

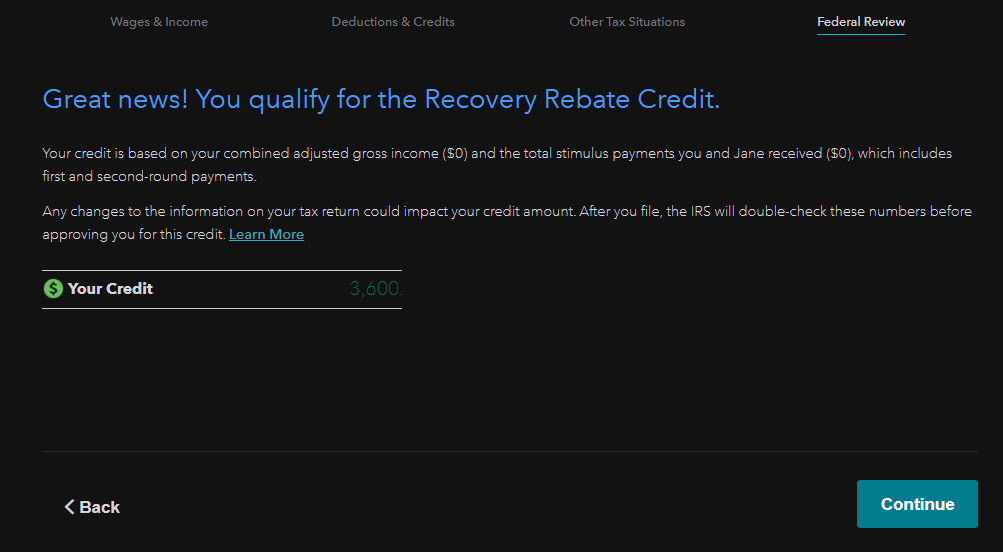

What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021 tax return Generally you are eligible to claim the Recovery Rebate Credit if You were a U S citizen or U S resident alien in 2021 You are not a dependent of another taxpayer for tax year 2021 You have a Social Security Number valid for employment that is issued before the due date of your 2021 tax return including extensions

Download When Will I Get My Recovery Rebate Credit 2024

More picture related to When Will I Get My Recovery Rebate Credit 2024

Can The IRS Keep My Recovery Rebate Credit

https://www.taxdefensenetwork.com/wp-content/uploads/2021/02/recovery-rebate-compressed.jpg

What Happens If I Make A Mistake When Claiming My Remaining Child Tax Credit CTC Or Stimulus

https://savingtoinvest.com/wp-content/uploads/2021/01/Recovery-Rebate-Worksheet.png

The Recovery Rebate Credit Calculator ShauntelRaya

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/de418507-0277-4b17-89a7-765557117ca4.default.png

The Tax Relief Act of 2020 enacted in late December 2020 authorized additional payments of up to 600 per adult for eligible individuals and up to 600 for each qualifying child under age 17 The We will see the Recovery Rebate Credit again for our 2021 tax return filed in 2022 because of the third stimulus payment How much should I have received as a third stimulus payment You should have received 1 400 per qualifying individual for this year s third stimulus payment

Who Is Eligible to Claim the Recovery Rebate Credit When considering the Recovery Rebate Credit the first question to answer is who was eligible for the Economic Impact Payments To qualify for any of the three stimulus payments all of the following had to apply at the time You were a US citizen or US resident alien Instead you will need to claim the 2021 Recovery Rebate Credit on your 2021 tax return if eligible If you lost your EIP card Best Tax Software For The Self Employed Of January 2024

Recovery Rebate Credit For 2023 Taxes Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-for-2022-taxes-recovery-rebate-1.jpeg?fit=682%2C1024&ssl=1

IRS Letters Explain Why Some 2020 Recovery Rebate Credits Are Different Than Expected The

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2021/04/Recovery-Rebate-Credit.png?fit=1200%2C675&ssl=1

https://www.irs.gov/newsroom/irs-reminds-eligible-2020-and-2021-non-filers-to-claim-recovery-rebate-credit-before-time-runs-out

IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before it s too late

https://www.irs.gov/coronavirus/coronavirus-tax-relief-and-economic-impact-payments-for-individuals-and-families

2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how we sent your Payment Where s My Refund An online tool that will track your tax refund Online Payment Agreements Apply for a payment plan to pay your balance over time

Is Recovery Rebate Taxable Find All Answers

Recovery Rebate Credit For 2023 Taxes Recovery Rebate

Instructions To File 1040 Form 2022 Recovery Rebate

How To Track My Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets Recovery Rebate

Why Did Irs Change My Recovery Rebate Credit Useful Tips

Why Did Irs Change My Recovery Rebate Credit Useful Tips

The Recovery Rebate Credit Explained Expat US Tax

Fill Free Fillable TheTaxBook PDF Forms Recovery Rebate

How To Claim Stimulus Recovery Rebate Credit On TurboTax

When Will I Get My Recovery Rebate Credit 2024 - To settle claims about a misleading administrative charge Verizon will pay 100 million into a fund if the agreement is approved You could be eligible for up to 100 in a Verizon settlement