Agriculture Rebate For Ay 2024 23 Continuing resolutions are funding Agriculture appropriations through March 1 2024 Source CRS using Congress gov OMB and agency websites Congressional Research Service https crsreports congress gov IN12158 CRS INSIGHT Prepared for Members and Committees of Congress

Home Real Estate Agricultural Income Sale of Agricultural land Tax Treatment Computation Implications Updated on 29 Aug 2023 Agriculture is the main occupation in India Two third of India s population is dependent on agriculture either directly or indirectly Agricultural income is exempt under the Income Tax Act Updated on Nov 21st 2023 10 min read CONTENTS Show Agriculture is said to be the primary occupation in India It is usually the only source of income for the large rural population in India The country as a whole is entirely dependent on agriculture for its basic food requirements

Agriculture Rebate For Ay 2024 23

Agriculture Rebate For Ay 2024 23

http://www.wiki.pathfindersonline.org/images/0/03/Agriculture_AY_Honor.png

Nebraska Commercial Rebates Black Hills Energy

https://www.blackhillsenergy.com/sites/blackhillsenergy.com/files/2022-01/agriculture-rebate-891x608.jpg

Mga Magsasaka Problemado Sa Presyo Ng Krudo Pataba ABS CBN News

https://sa.kapamilya.com/absnews/abscbnnews/media/2019/reuters/09/25/20180831-agriculture-rice-rtr-3.jpg

Agricultural income is exempt from Income Tax under section 10 1 of the Income Tax Act 1961 However its included for rate purposes in computing the Income Tax Liability if following two conditions are cumulatively satisfied 1 Net Agricultural income exceeds INR 5 000 for P Y 2019 20 and 2 How to calculate tax on agriculture income for AY 2023 24 But you might have to pay some tax on agriculture income in certain cases Treatment of Agricultural Land in Capital Gain What is agriculture Income Tax Exemption limit under Section 54B Which ITR to File for Agricultural Income How to show agricultural income in ITR 1

Income tax exemption limit is up to Rs 2 50 000 for Individuals HUF below 60 years aged and NRIs Surcharge and cess will be applicable as discussed above Income tax slab for individual aged above 60 years to 80 years NOTE Income tax exemption limit is up to Rs 3 lakh for senior citizens aged above 60 years but less than 80 years Agricultural Income up to 5 000 Forms Applicable 3 Form 16A Certificate u s 203 of the Income Tax Act 1961 for TDS on Income other than Salary 5 Form 26AS Note Information Advance Tax SAT Details of refund SFT Transaction TDS u s 194 IA 194 IB 194M TDS defaults which were available in 26AS will now be available in AIS mentioned below

Download Agriculture Rebate For Ay 2024 23

More picture related to Agriculture Rebate For Ay 2024 23

Farm 911 Rebate Niagara North Federation Of Agriculture

https://www.myniagarafarmer.ca/wp-content/uploads/2021/08/366834.jpg

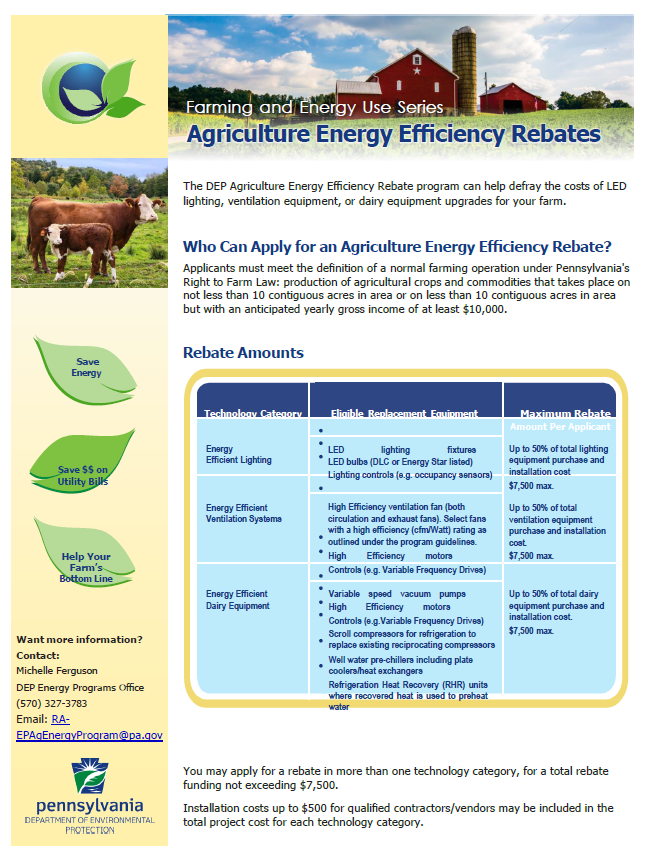

PA DEP Agriculture Energy Efficiency Rebate Program Warwick Township

https://www.warwicktownship.org/sites/g/files/vyhlif5151/f/imce/ag_energy_efficiency_image.png

Taxability On Agriculture Income 2023 24 How To Show Agriculture Income In ITR Rebate

https://i.ytimg.com/vi/4iSEtAB95i4/maxresdefault.jpg

July 1 2024 and 100 of rewards may be requested starting November 1 2024 Rewards will expire April 30 2025 Growers living in Alaska California or Hawaii do not qualify for Bayer PLUS Rewards Scan QR Code to see how your rewards can add up 1 500 in Bayer PLUS Rewards In order to qualify for redemption you must have at least Scan AY 2024 25 Section Nature of deduction Who can claim 1 2 3 Against salaries 16 ia Capital gains on transfer of land used for agricultural purposes by an individual or his parents or a HUF invested in other land for agricultural purposes subject to certain conditions and limits Rebates 87A Tax rebate in case of

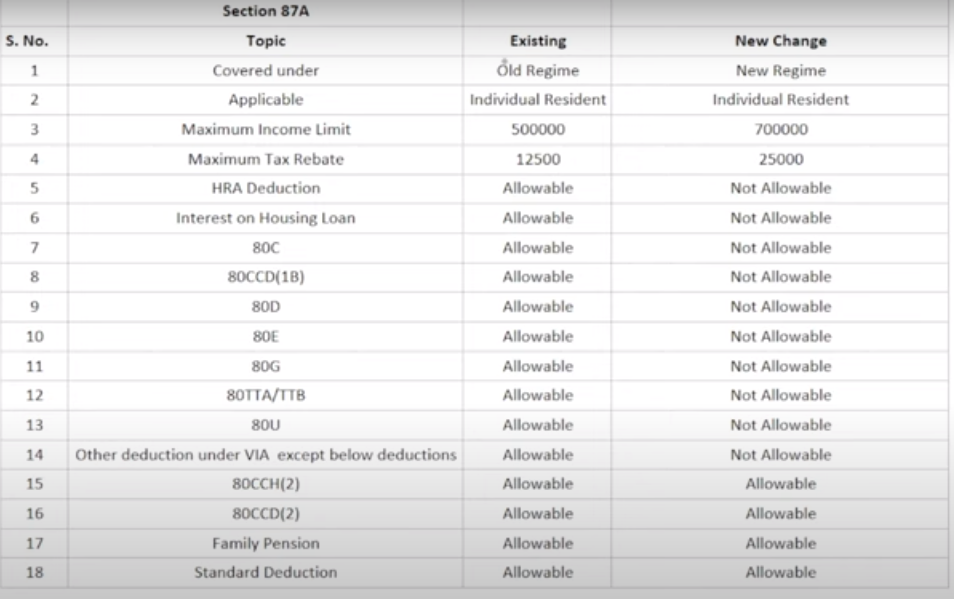

It is a benefit provided by the government to incentivize and provide relief to certain categories of taxpayers The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 WASHINGTON March 31 2023 U S Department of Agriculture USDA Secretary Tom Vilsack today announced that USDA is accepting applications starting on April 1 for 1 billion in grants to help agricultural producers and rural small businesses invest in renewable energy systems and make energy efficiency improvements

Rebate U s 87A Of Income Tax Act Rebate AY 2023 24 Income Tax Computation YouTube

https://i.ytimg.com/vi/A87Fr71lYIw/maxresdefault.jpg

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://i0.wp.com/arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rebate-US-87A-for-AY-2024-25-FY-2023-24-1-1.png?resize=1024%2C576&ssl=1

https://crsreports.congress.gov/product/pdf/IN/IN12158

Continuing resolutions are funding Agriculture appropriations through March 1 2024 Source CRS using Congress gov OMB and agency websites Congressional Research Service https crsreports congress gov IN12158 CRS INSIGHT Prepared for Members and Committees of Congress

https://www.relakhs.com/agricultural-income-land-tax-treatment/

Home Real Estate Agricultural Income Sale of Agricultural land Tax Treatment Computation Implications Updated on 29 Aug 2023 Agriculture is the main occupation in India Two third of India s population is dependent on agriculture either directly or indirectly Agricultural income is exempt under the Income Tax Act

County Of San Diego Promotional Printing

Rebate U s 87A Of Income Tax Act Rebate AY 2023 24 Income Tax Computation YouTube

New Income Tax Slab Rate For FY 2023 2024 AY 2024 2025 Stocks Mantra

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Agriculture And Food Processing Rebate Catalog Pacific Gas And Electric Company

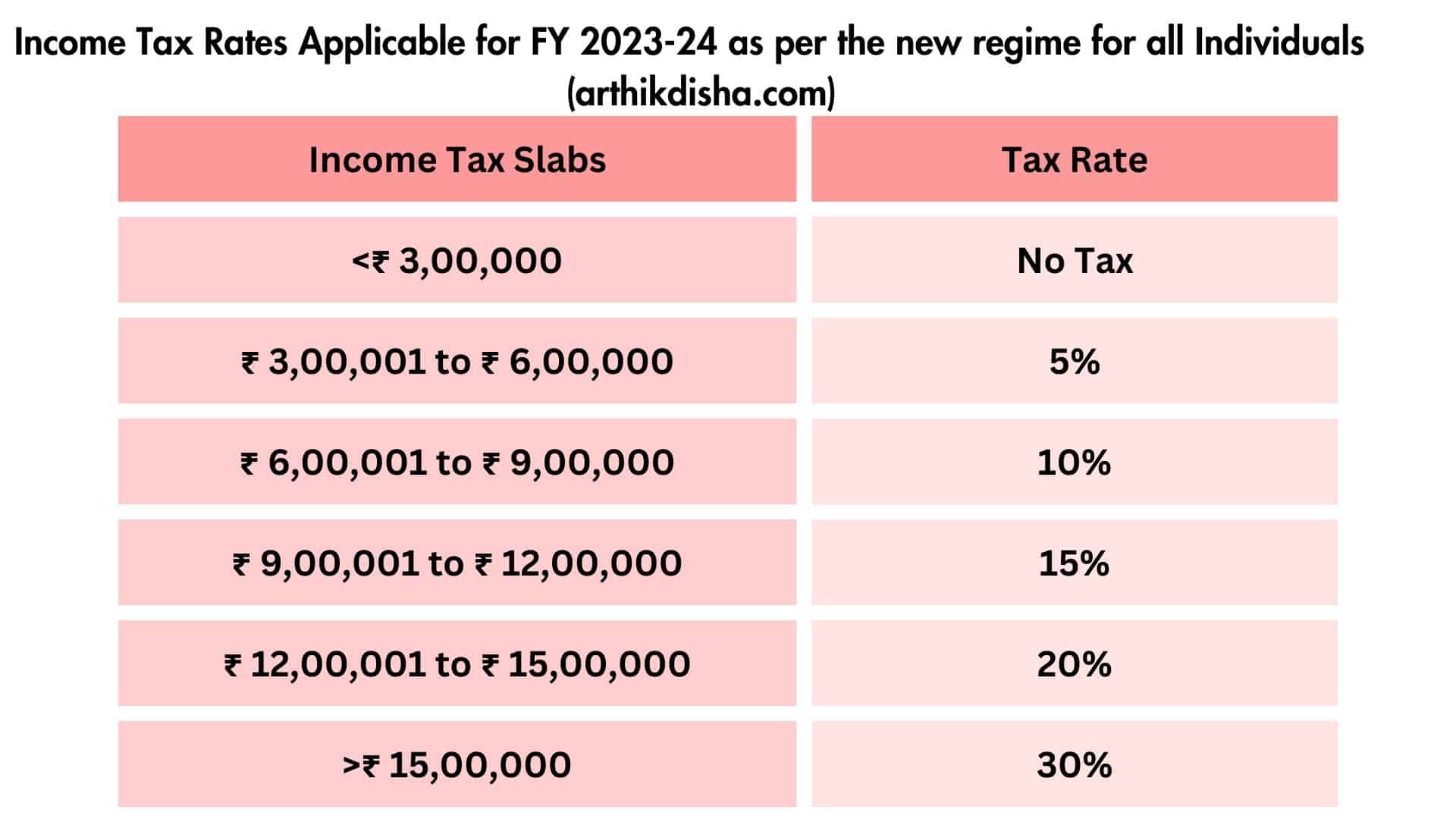

New Income Tax Slab 2023 24

New Income Tax Slab 2023 24

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

What Will Be The Tax Allowance For 2020 21 Tutorial Pics

Income Tax Calculation Ay 2023 24 In Hindi PELAJARAN

Agriculture Rebate For Ay 2024 23 - Rebates for hybrid and electric fleet vehicles placed into service on or after July 1 2024 The bill requires the Department of Agriculture and Consumer Services DACS to update its rules by December 31 2024 to provide for the changes required under th is bill The bill also provides