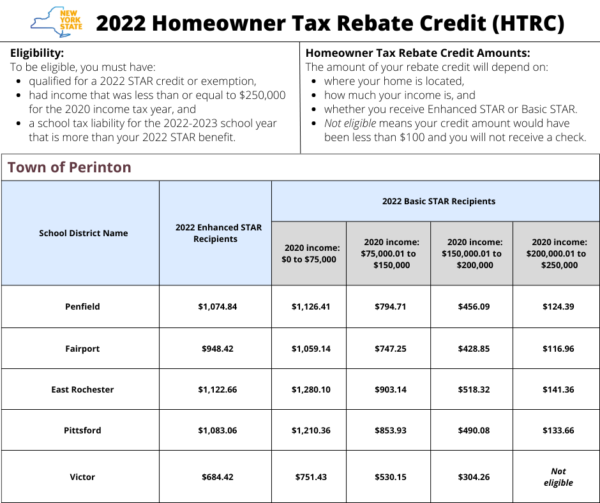

Ny Homeowner Tax Rebate 2024 Eligibility To be eligible for a homeowner tax rebate credit in 2022 you must have had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit Note You did not need to calculate your income to receive the homeowner tax

The amount of the credit is the product of the amount of real property tax which exceeds 6 of the taxpayer s qualified gross income QGI and a specified rate based on the taxpayer s QGI To claim the credit the computed amount must exceed 250 The maximum credit allowed is 350 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Homeowners used this lookup to determine the amount they would receive for the homeowner tax rebate credit HTRC Please note by law we cannot issue checks for the HTRC that are less than 100

Ny Homeowner Tax Rebate 2024

Ny Homeowner Tax Rebate 2024

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-600x503.png

The NY Homeowner Tax Rebate Credit Benefits Plus

https://bplc.cssny.org/assets/Tools-Puzzle-Piece-Only - clear background-bd0547fd151a7c846519968fecddde810372d2bd0a60b7c74e85109663f0482b.png

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1920&h=1080&crop=1

The FY 2024 Budget infuses New York s Emergency Rental Assistance Program with 391 million to support additional tenants and families including NYCHA and other public housing residents and recipients of federal Section 8 vouchers This funding will complement other investments in the Budget to support public housing residents such as a 135 Property tax relief credit The property tax relief credit directly reduced your property tax burden if you were a qualifying homeowner The amount of the credit was a percentage of your STAR savings The property tax relief credit has expired However if you were eligible for the credit in 2018 or 2019 but believe you did not receive it

Update on homeowner tax rebate credit checks Great news We ve mailed nearly two million homeowner tax rebate credit checks to eligible New York homeowners and many more are on their way For most of the remaining homeowners we only need 2022 2023 tax bill information from school districts so we can accurately calculate the checks school districts provide that information to us at the The New York Department of Taxation and Finance will soon begin sending direct financial assistance to 1 75 million New Yorkers who received the Empire State Child Credit and or the Earned Income Credit on their 2021 state tax returns including a gas tax moratorium and a homeowner tax rebate credit Our families have felt the effects of a

Download Ny Homeowner Tax Rebate 2024

More picture related to Ny Homeowner Tax Rebate 2024

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check WSTM

https://cnycentral.com/resources/media2/16x9/full/1024/center/80/bb776db9-9697-43c3-882f-8577bedc9e89-large16x9_tax_rebate.PNG

Over 3M New Yorkers To Receive Homeowner Tax Rebate Checks This Summer Port Washington NY Patch

https://patch.com/img/cdn20/shutterstock/23121104/20220610/034752/styles/patch_image/public/shutterstock-228062581___10154715779.jpg?width=1200

NY Homeowner Tax Rebate Checks Are In The Mail RBT CPAs LLP

https://www.rbtcpas.com/wp-content/uploads/2022/07/NY-Homeowner-Tax-Rebate-Checks-Are-in-the-Mail.jpg

NEW YORK New York City Mayor Eric Adams today signed legislation to provide a one time property tax rebate of up to 150 to hundreds of thousands of eligible New York homeowners The bill was passed by the New York City Council earlier this month I grew up on the edge of homelessness so I know the worry and fear that too many low and The credit will reduce the amount you can deduct on the property tax section Eligibility for the Homeowner Tax Rebate Credit Qualified for a 2022 STAR credit or exemption Income less than or

We recently began mailing nearly three million checks for the 2022 homeowner tax rebate credit HTRC to eligible New Yorkers The credit provides direct property tax relief in the form of checks to eligible homeowners The amount of the credit will depend on your home s location your income and whether you receive Basic or Enhanced STAR The amount of the credit is between 250 and 350 and will be available through 2023 To be eligible homeowners must be Eligible for the 2022 School Tax Relief STAR credit or exemption Make less than 250 000 a year based on federal adjusted gross income from tax year 2020 and Have a school tax liability for the 2022 2023 school year

The NY Homeowner Tax Rebate Credit Benefits Plus

https://bplc.cssny.org/assets/linkedin-icon-5ff5aa97efc0e889cb997abf2c0d0ef5c224dc9cafc8b9ea42fb089e17829e7a.svg

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

https://media.wgrz.com/assets/WGRZ/images/a07fcd1f-3754-4e57-bce5-9be83e9634c0/a07fcd1f-3754-4e57-bce5-9be83e9634c0_1140x641.jpg

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

Eligibility To be eligible for a homeowner tax rebate credit in 2022 you must have had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit Note You did not need to calculate your income to receive the homeowner tax

https://www.tax.ny.gov/pit/credits/real-property-tax-relief-credit.htm

The amount of the credit is the product of the amount of real property tax which exceeds 6 of the taxpayer s qualified gross income QGI and a specified rate based on the taxpayer s QGI To claim the credit the computed amount must exceed 250 The maximum credit allowed is 350

Virginia Tax Rebate 2024

The NY Homeowner Tax Rebate Credit Benefits Plus

The NY Homeowner Tax Rebate Credit Benefits Plus

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

Your Stories Q A Are You Still Waiting For Your Homeowner Tax Rebate Credit Check YouTube

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

Ny Homeowner Tax Rebate 2024 - The New York Department of Taxation and Finance will soon begin sending direct financial assistance to 1 75 million New Yorkers who received the Empire State Child Credit and or the Earned Income Credit on their 2021 state tax returns including a gas tax moratorium and a homeowner tax rebate credit Our families have felt the effects of a