Rebate On Home Loan Budget 2024 There are certain Deductions Allowed in New Tax Regime in FY 2024 25 AY 2025 26 and FY 2025 26 AY 2026 27 C Home Loan Interest 1 50 000 1 50 000 D 30 Standard Deduction Section 87A Rebate Note that where the total income of a resident individual is chargeable to tax under section 115BAC

On one side the Rs 1 5 lakh deduction on a home loan has increased home purchases the need of the hour is to increase the home loan interest rebate in budget 2023 Adding this as a special provision or amending the act can give a Expectations center around amendments to tax rebates and home loan interest rates with a proposed increase in the maximum deduction for home loan interest and additional benefits for

Rebate On Home Loan Budget 2024

Rebate On Home Loan Budget 2024

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/FeatureImage_Income-tax-rebate-on-home-loan-750x512.jpg

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News Live

https://theviralnewslive.com/wp-content/uploads/2023/02/for-income-tax-rebate-home-loan-Exemption_11zon.jpg

Budget 2019 Home Loan Tax Rebate Budget 2019

https://img.naidunia.com/naidunia/home_loan_in_budget_05_07_2019.jpg

Budget 2024 Expectations Home loan borrowers are hoping that the Union Budget will increase the tax concession on home loan interest paid Other demands include a separate tax deduction for To increase the demand for affordable housing the government may consider raising the limit of the stamp duty value of the property from INR 45 Lakh as this would expand the benefits for home buyers and boost end user demand

Atul Monga CEO and Co Founder of Basic Home Loan calls for increasing the tax rebate on home loan interest under Section 24 of the Income Tax Act from 2 lakh to 5 lakh to stimulate Additionally rebate is increased from Rs 25 000 to Rs 60 000 due to which you will have zero tax liability for income upto Rs 12 00 000 What is the Tax Slab Rate for FY 2024 25 Is there any Change in Standard Deduction for FY 2024 25

Download Rebate On Home Loan Budget 2024

More picture related to Rebate On Home Loan Budget 2024

Zee Biz Demands To FM Why Only 2 Lakh Annual Rebate On Home Loan Budget Interest budget2023

https://i.ytimg.com/vi/1wrfVuqg3XI/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYTiBiKGUwDw==&rs=AOn4CLA6mewtCjali2SunzRtSjYkBSnTWg

Home Loan In Budget Tax Benefits For FY2023 24

https://www.nobroker.in/blog/wp-content/uploads/2022/01/home-loan-budget.jpg

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary Home Loan 3

https://new-img.patrika.com/upload/2022/03/24/home_loan.jpg

Atul Monga CEO and Co Founder of Basic Home Loan also said A primary expectation is to enhance the tax rebate on home loan interest under Section 24 of the Income Tax Act from 2 lakh Budget 2024 promises relief for the urban poor when it comes to home loan EMIs PTI Finance Minister Nirmala Sitharaman during her presentation of Budget 2024 said that there will be a scheme for an interest subsidy of Rs 10 lakh crore interest for urban housing for the poor

Chairman of ANAROCK Group Anuj Puri emphasises the need to enhance the deduction for home loans u s 24 by increasing the current 2 lakh tax rebate on home loan interest rates to at least 5 lakh Increased tax exemptions on home loan interest and principal repayments in Budget 2024 25 could greatly reduce tax burdens for homebuyers

Budget 2024 Grant Thornton

https://www.grantthornton.ie/globalassets/1.-member-firms/ireland/budget/2024/budget-2024-hub-open-graph.jpg

4 000 Home Loan Refinance Rebate Minimum 250 000 Loan LVR Less Than 80 St George OzBargain

https://files.ozbargain.com.au/n/81/703481x.jpg?h=2f42ee61

https://www.taxheal.com › list-of-deductions-allowed...

There are certain Deductions Allowed in New Tax Regime in FY 2024 25 AY 2025 26 and FY 2025 26 AY 2026 27 C Home Loan Interest 1 50 000 1 50 000 D 30 Standard Deduction Section 87A Rebate Note that where the total income of a resident individual is chargeable to tax under section 115BAC

https://www.nobroker.in › blog › home-loan-budget

On one side the Rs 1 5 lakh deduction on a home loan has increased home purchases the need of the hour is to increase the home loan interest rebate in budget 2023 Adding this as a special provision or amending the act can give a

Latest Income Tax Rebate On Home Loan 2023

Budget 2024 Grant Thornton

Important Tips To Remember While Applying For A Home Loan Online Techno FAQ

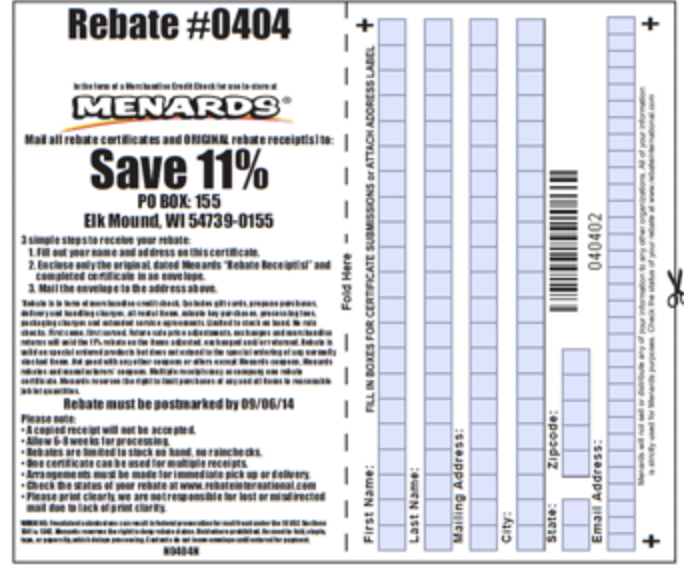

Printable Menards Rebate Form 2023 Rebate For October 2023

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And

Home Loan Tax Rebate 4 Income Tax Benefits For Home Loan Borrowers

Home Loan Tax Rebate 4 Income Tax Benefits For Home Loan Borrowers

Va Home Loan 40 Years 2022 Cuanmologi

Budget 2019 5

Home Loan In Budget 2023 Home Loan Tax Benefits In New Budget 2023

Rebate On Home Loan Budget 2024 - Budget 2024 Middle class taxpayers wishlist Higher basic income exemption limit of Rs 5 lakh standard deduction of Rs 1 lakh