Tax Return 2024 Update 24 hours after receipt of a taxpayer s e filed tax year 2023 return Three to four days after receipt of an e filed tax year 2022 or 2021 return Four weeks after mailing a paper return Taxpayers should note that the IRS updates the tool once a day usually overnight so there s no need to check more often

Excel Utilities of ITR 1 ITR 2 ITR 3 ITR 4 ITR 5 and ITR 6 for AY 2024 25 are also live now 3 Attention Taxpayer Please compare the tax liability under the New Tax and Old Tax regime before filing of the return For more details please refer Latest Updates 4 This was the basis for the estimated 2024 IRS refund schedule calendar shown below which has been updated to reflect the Jan 29th 2024 start date of IRS tax return processing this year The refund processing schedule is organized by IRS WMR IRS2Go processing status

Tax Return 2024 Update

Tax Return 2024 Update

https://www.roadtax2290.com/images/3-3d.png

Tax Return Form And Notebooks On The Table Free Stock Photo

https://images.pexels.com/photos/6863517/pexels-photo-6863517.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=750&w=1260

Contact Us Tax O Bill

https://www.taxobill.com/wp-content/uploads/2021/04/1.png

How it works Where s My Refund shows your refund status Return Received We received your return and are processing it Refund Approved We approved your refund and are preparing to issue it by the date shown Refund Sent We sent the refund to your bank or to you in the mail It may take 5 days for it to show in IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax

To help you complete your tax return you may need the Individual tax return instructions 2024 Go to Tax return for individuals instructions on our Publications Ordering Service POS at iorder au to get a copy This is the instructions and 2 copies of the tax return You may also need the Supplementary tax return 2024 find out Do You will need your bank account details details of your income for the tax year details of any expenses you want to claim Types of individual expenses We ll provide you with details of income you received that had tax deducted like salary or wages If you complete your tax return through myIR these details will be automatically included

Download Tax Return 2024 Update

More picture related to Tax Return 2024 Update

Ga Refund Schedule 2024 Nance Anne Marie

https://www.2024calendar.net/wp-content/uploads/2023/01/2022-tax-refund-schedule-chart-caf-group.png

Election 2024 Update For March 7 WNEG

https://wnegradio.com/wp-content/uploads/2024/03/ballot-1294935_1280-1006x1024.png

2024 Market Outlook Fed Rates China Property More

https://files.onlinexperiences.com/FileLibrary/4472/34/Copy_of_BBGT_BBGT__202311-APACMarketOutlook2024_Webinar_2714400_SocialCardSpeaker_Card.gif

The last tax year started on 6 April 2023 and ended on 5 April 2024 Deadline for telling HMRC you need to complete a return You must tell HMRC by 5 October if you need to complete a tax return The deadline for most taxpayers to file a federal tax return was Monday April 15 2024 Because of the observances of Patriot s Day April 15 and Emancipation Day April 16 taxpayers in

The 20 tax rate starts at 583 751 for joint filers 551 351 for heads of household and 518 901 for single filers The 15 tax rate is for filers with taxable incomes between the 0 and 20 COMMON ITR ISSUES AND FAQ S FOR FILING RETURN FOR AY 2024 25 Q 1 Taxpayer is unable to choose ITR 1 4 from drop down for AY 2024 25 as the option is greyed Taxpayer should update the profile correctly before starting the new filing of return Taxpayer can file ITR using offline Ans From AY 2024 25 new tax regime

FREEBET SLOT 2023 2024

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=311740504800838

Tax Return Free Creative Commons Handwriting Image

http://www.picpedia.org/handwriting/images/tax-return.jpg

https://www.irs.gov/newsroom/tax-time-guide-irs...

24 hours after receipt of a taxpayer s e filed tax year 2023 return Three to four days after receipt of an e filed tax year 2022 or 2021 return Four weeks after mailing a paper return Taxpayers should note that the IRS updates the tool once a day usually overnight so there s no need to check more often

https://www.incometax.gov.in

Excel Utilities of ITR 1 ITR 2 ITR 3 ITR 4 ITR 5 and ITR 6 for AY 2024 25 are also live now 3 Attention Taxpayer Please compare the tax liability under the New Tax and Old Tax regime before filing of the return For more details please refer Latest Updates 4

Make The Most Of Your 2021 Tax Return Cascade Community Credit Union

FREEBET SLOT 2023 2024

Tickets For TOLMINATOR 2024 DAILY TICKET THURSDAY 25 7 2024 25 07

IRS Commissioner Says Tax Return Backlog Will Clear By End Of 2022

What Expenses Can Reduce My Tax Bill 2023 Tax Return

Irs Tax Return 2023 Form Printable Forms Free Online

Irs Tax Return 2023 Form Printable Forms Free Online

Tax Return Deadline Extension

Tax Rates For The 2024 Year Of Assessment Just One Lap

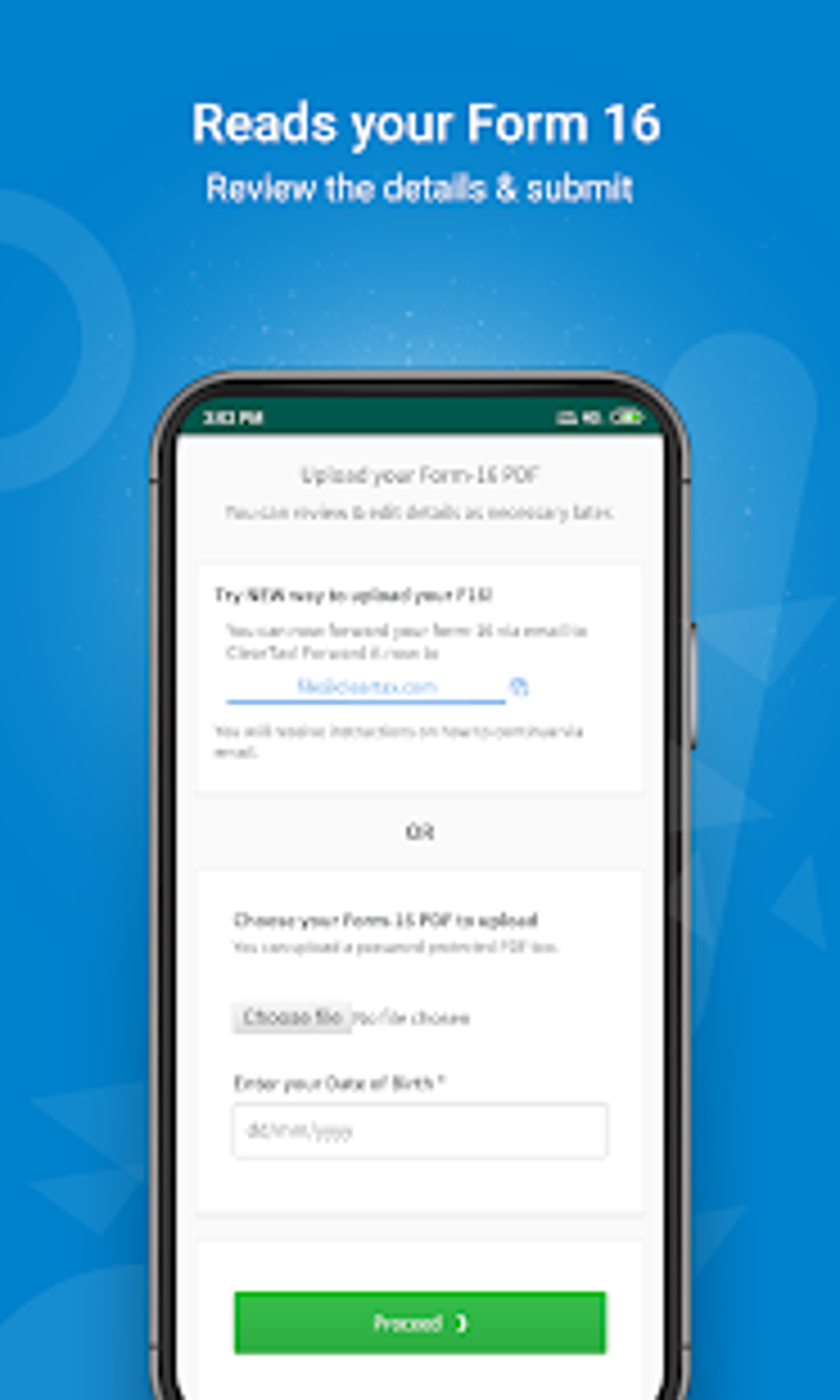

Android File FREE Income Tax Return ClearTax ITR E filing

Tax Return 2024 Update - This is the fastest and easiest way to track your refund The systems are updated once every 24 hours You can contact the IRS to check on the status of your refund If you call wait times to speak with a representative can be long But you can avoid the wait by using the automated phone system Follow the message prompts when you