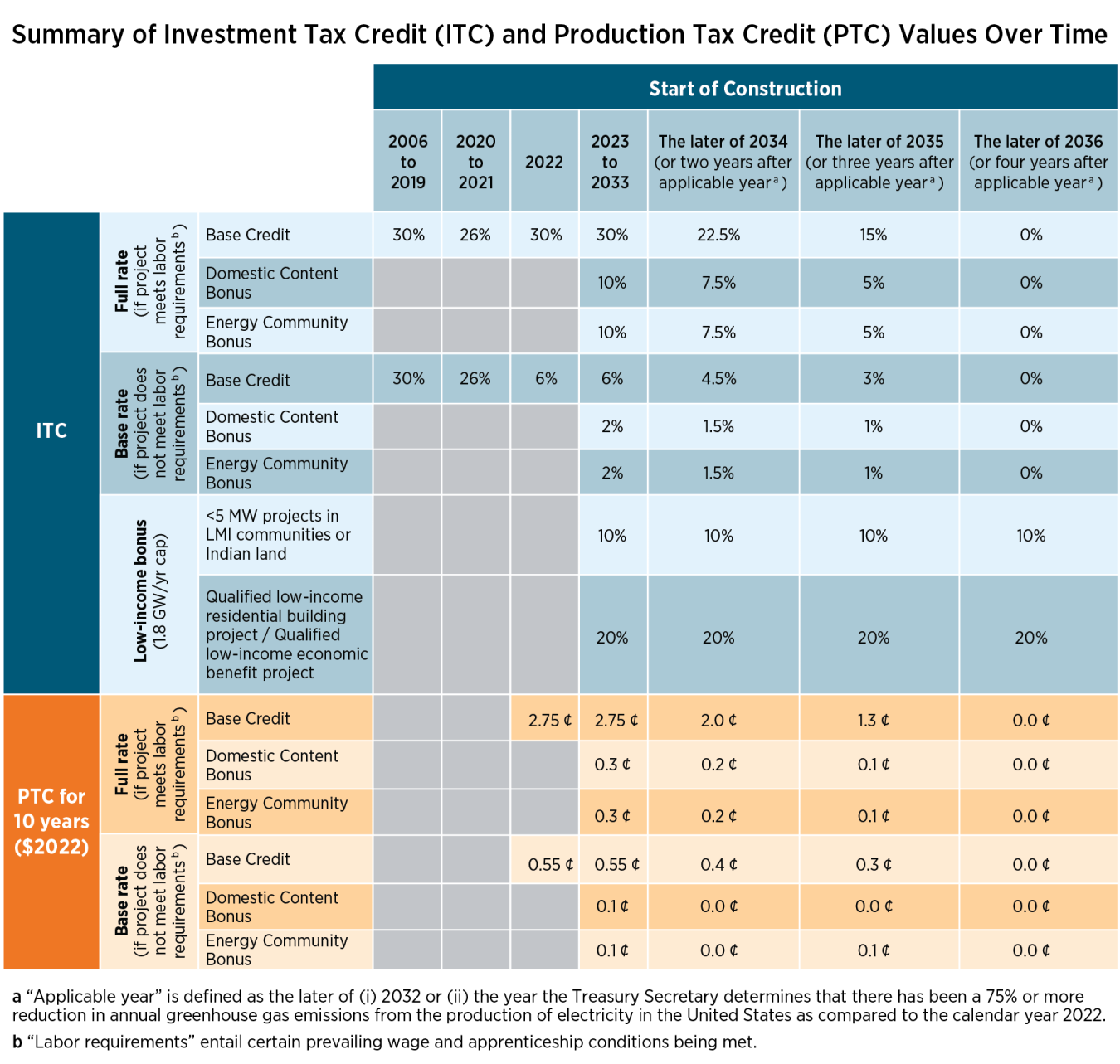

Tax Rebate For Solar 2024 Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit

The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit also covers other types of The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as

Tax Rebate For Solar 2024

Tax Rebate For Solar 2024

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

https://southarkansassun.com/wp-content/uploads/2023/07/QFVDBCFGXJETVNYWYD4CNRMM7E.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence

WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS in partnership with the Department of Energy DOE announced remarkable demand in the initial application period for solar and wind facilities through the Inflation Reduction Act s Low Income Communities Bonus Credit Program The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

Download Tax Rebate For Solar 2024

More picture related to Tax Rebate For Solar 2024

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

This webpage provides an overview of the federal investment and production tax credits for businesses that own solar facilities including both photovoltaic PV and The reduced base rate offered to solar systems starting construction in 2022 through 2024 that do not meet the prevailing wage and apprenticeship requirements has a value The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar

Key Takeaways When you purchase not lease new solar powered equipment that generates electricity or heats water or purchase solar power storage equipment you generally can claim the Residential Clean Energy Credit to lower your tax bill For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system your tax credit would be calculated as follows 0 26 18 000 1 000 4 420 Payment for Renewable Energy Certificates

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit

https://www.nerdwallet.com/article/taxes/solar-tax-credit

The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit also covers other types of

Best Tax Rebate Calculator In UK 2022 Business Lug

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

Income Tax Rebate Under Section 87A

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Illinois Ev Tax Rebate 2023 Tax Rebate

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

How To Increase The Chances Of Getting A Tax Refund CherishSisters

Tax Rebate For Solar 2024 - The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit