2024 Il Tax Rebate Illinois Department of Revenue Announces Start to 2024 Income Tax Season Mission Vision and Value FY 2024 18 What s New for Illinois Income Taxes FY 2024 15 New Payment Equals Agreement Statute Effective January 1 2024 for Sales Use and Excise Taxes and Fees Illinois Department of Revenue Announces Start to 2024 Income Tax Season

CHICAGO The Illinois Department of Revenue has announced the start of the 2024 tax season accepting 2023 tax returns beginning on January 29 That aligns with when the Internal Revenue IDOR s taxpayer assistance numbers are available for tax related inquiries and include automated menus allowing taxpayers to check the status of a refund identify an IL PIN or receive estimated payment information without having to wait for an agent To receive assistance taxpayers may call 1 800 732 8866 or 217 782 3336

2024 Il Tax Rebate

2024 Il Tax Rebate

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

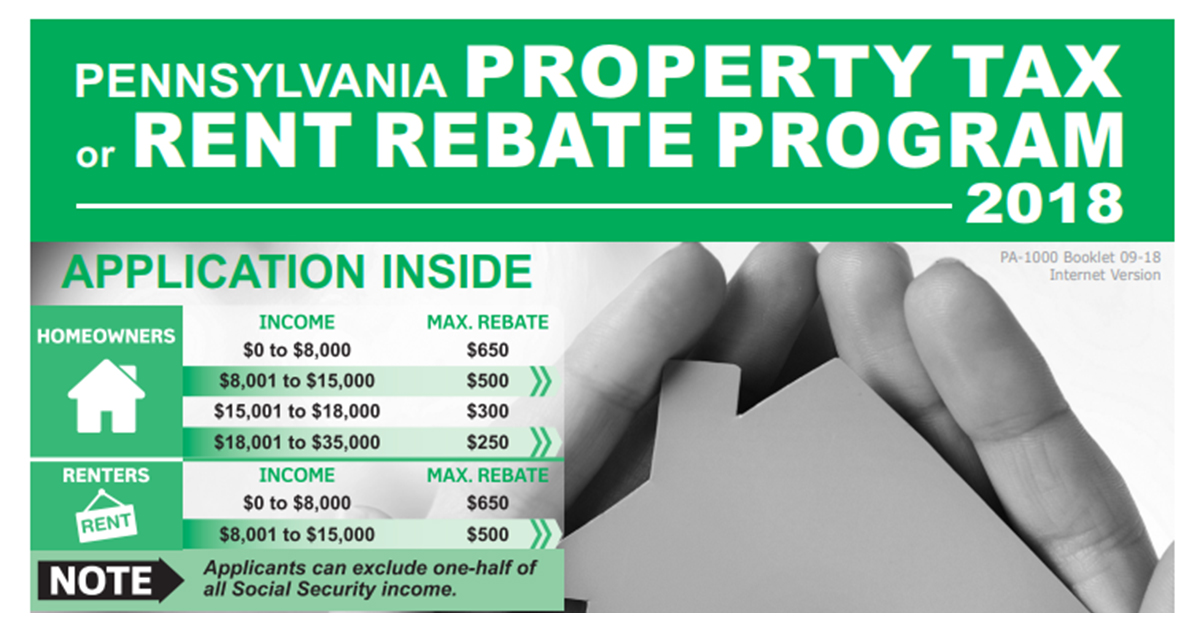

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

2024 This bulletin is written to inform you of recent changes it does not replace statutes rules and regulations or court decisions For information or forms Visit our website at tax illinois gov Register and file your return online at mytax illinois gov For registration questions call or email us at 217 785 3707 REV CentReg illinois gov The Illinois Department of Revenue IDOR announced on Thursday Jan 25 that it will begin accepting and processing 2023 tax returns on Monday Jan 29 the same date the Internal Revenue Service IRS begins accepting federal income tax returns We encourage taxpayers to file electronically as early as possible as this will speed processing

The amount of the credit is determined by your eligibility for the federal EITC For tax years 2022 and earlier filed by April 2023 the Illinois Earned Income Tax Credit is 18 of the federal credit amount For tax years 2023 and beyond filed in 2024 the Illinois EITC rises to 20 To find out if you qualify for benefits check the IRS The Internal Revenue Service IRS has set the official start date for the 2024 tax filing season The IRS announced it will begin accepting and processing 2023 tax returns on January 29 2024 The deadline to file 2023 federal and Illinois tax returns or an extension is April 15 2024 The IRS recommends visiting IRS gov for common questions

Download 2024 Il Tax Rebate

More picture related to 2024 Il Tax Rebate

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of What You Should Claim

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

Il Tax Rebate 2023 Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/Il-Tax-Rebate-2023.jpg?w=1005&ssl=1

In regard to the Individual Income Tax Rebate a person qualifies if they were an Illinois resident in 2021 and their adjusted gross income was under 400 000 if filing jointly or 200 000 if Generally state tax changes take effect either at the start of the calendar year January 1 or the fiscal year July 1 for most states with rate changes for major taxes typically implemented effective January 1 either prospectively as in these cases or retroactively as may happen under legislation enacted in the new year

The individual income tax rebate is 50 per individual 100 for couples who file married filing jointly provided their federal adjusted gross income is less than 200 000 or 400 000 married filing jointly An additional 100 per dependent up to three dependents will be included in the rebates January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to

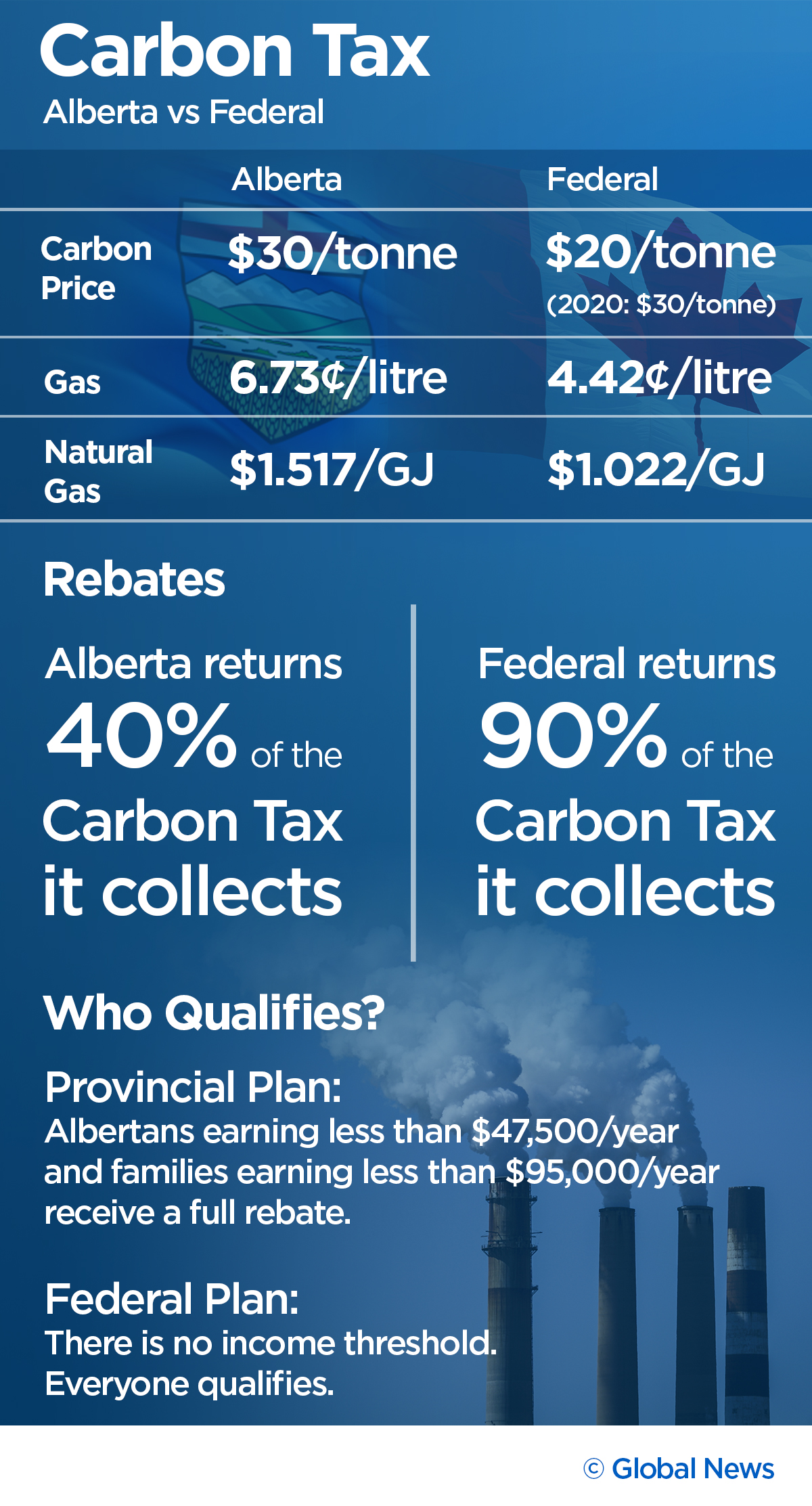

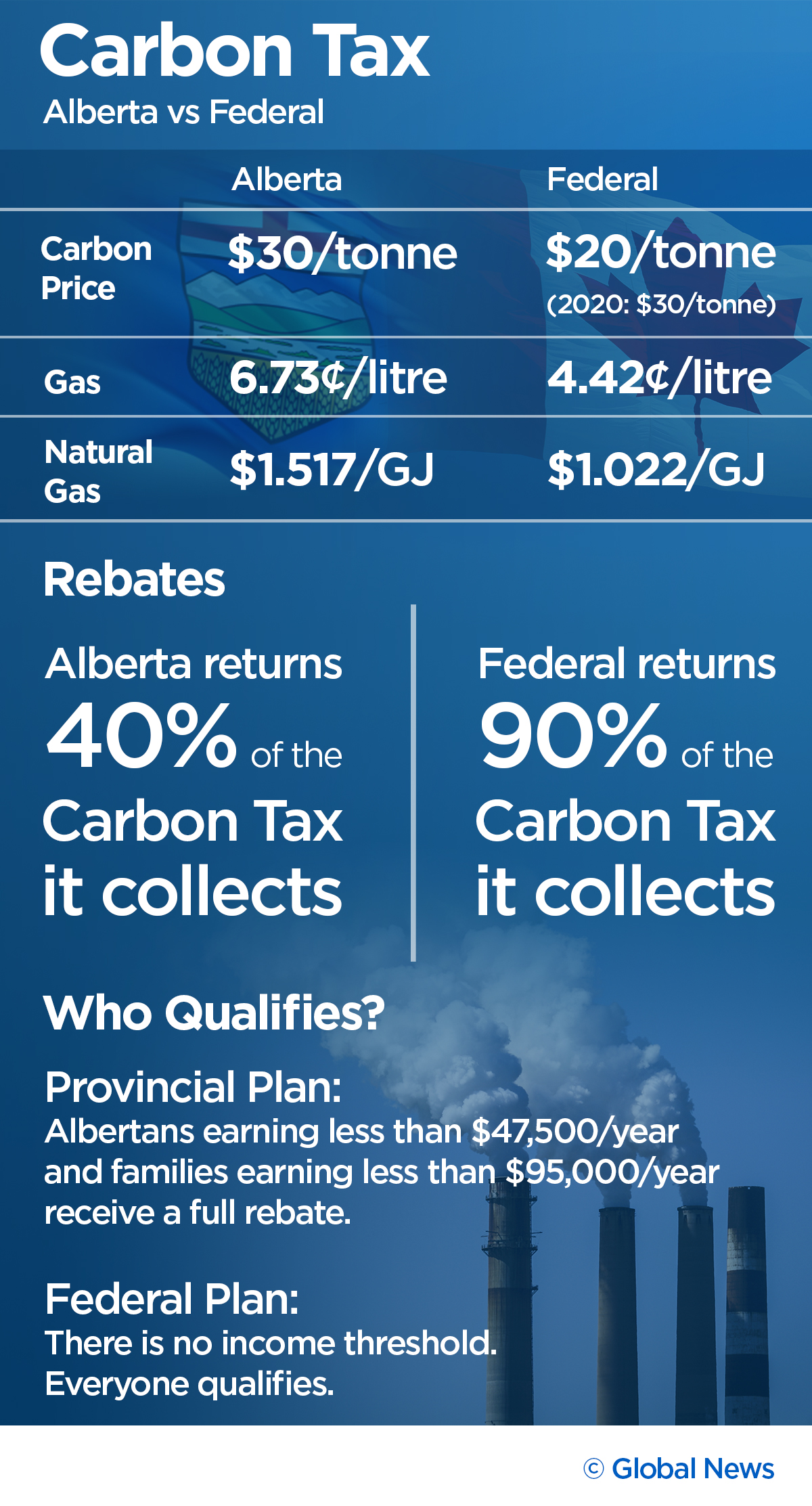

Albertans Will Pay Either Provincial Or Federal Carbon Tax Which Will Hurt Less Globalnews ca

https://globalnews.ca/wp-content/uploads/2019/05/infogfx_carbon_tax_comparison_1.jpg?quality=85&strip=all&w=1200

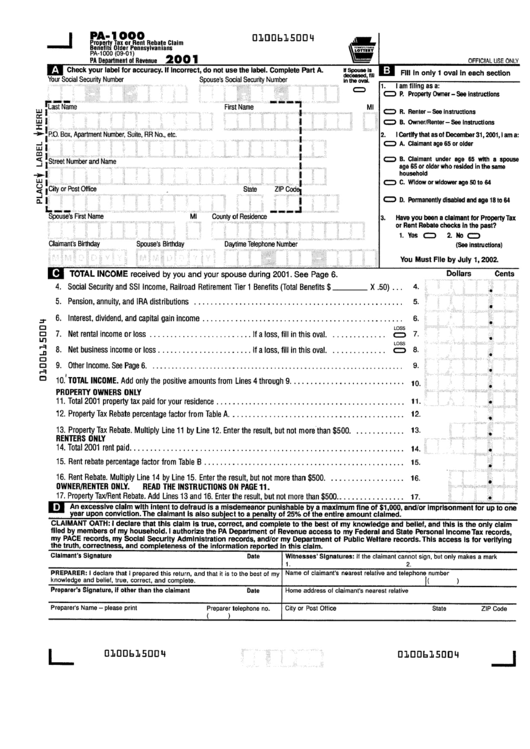

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

https://tax.illinois.gov/research/news/illinois-department-of-revenue-announces-start-to-2024-income-ta.html

Illinois Department of Revenue Announces Start to 2024 Income Tax Season Mission Vision and Value FY 2024 18 What s New for Illinois Income Taxes FY 2024 15 New Payment Equals Agreement Statute Effective January 1 2024 for Sales Use and Excise Taxes and Fees Illinois Department of Revenue Announces Start to 2024 Income Tax Season

https://news.yahoo.com/illinois-tax-season-2024-heres-210017466.html

CHICAGO The Illinois Department of Revenue has announced the start of the 2024 tax season accepting 2023 tax returns beginning on January 29 That aligns with when the Internal Revenue

Property Tax Rebate Program Montgomery IL Official Website

Albertans Will Pay Either Provincial Or Federal Carbon Tax Which Will Hurt Less Globalnews ca

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

5 Ways To Make Your Tax Refund Bigger The Motley Fool

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

2023 Tax Rebate Ev Printable Rebate Form

Il W 4 Form 2023 Printable Forms Free Online

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

2024 Il Tax Rebate - Form IL 1040 PTR the Property Tax Rebate Form Once in a lifetime cidada emergence set for 2024 and Illinois is at the center of it Joliet Joliet police provide update after 7 people