Ny State Property Tax Rebate 2024 Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less

For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on Federal Schedule C D E or F doesn t exceed 3 000 the net amount of any other separate category of loss doesn t exceed 3 000 and To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit

Ny State Property Tax Rebate 2024

Ny State Property Tax Rebate 2024

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Property Tax And Rent Rebate Program Will Soon Serve More Older Pennsylvanians

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1eNUrw.img?w=1620&h=1080&m=4&q=81

The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in one of two ways STAR credit If you are registered for the STAR credit the Tax Department will issue your STAR benefit via check or direct deposit 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks

2024 Election Results Washington D C Bureau In Focus By Susan Arbetter New York State PUBLISHED 2 55 PM ET Aug 29 2022 PUBLISHED 2 55 PM EDT Aug 29 2022 SHARE If you haven t yet received your STAR property tax rebate check there s an easy way to find out what its status is Simply visit this website https Taxes January 5 2022 Albany NY Governor Hochul Announces New Tax Relief for Thousands of Small Businesses and Millions of Middle Class New Yorkers 100 Million in Tax Relief for 195 000 Small Businesses Across the State Accelerates Middle Class Tax Cut to Provide Relief for 6 1 Million New Yorkers by 2023

Download Ny State Property Tax Rebate 2024

More picture related to Ny State Property Tax Rebate 2024

Florida Tax Rebate 2023 Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Florida-Tax-Rebate-2023.jpg

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Under this program basic School Tax Relief STAR exemption and credit beneficiaries with incomes below 250 000 and Enhanced STAR recipients are eligible for the property tax rebate where the benefit is a percentage of the homeowners existing STAR benefit The FY 2024 Budget adds 50 million for a Homeowner Stabilization Fund to finance home repairs in 10 communities across the state that have been identified as having high levels of low income homeowners of color and homeowner distress

2 15 New York homeowners should watch their mailboxes this month for a one time property tax credit thanks to a 2 2 billion tax relief program approved in New York s budget The Homeowner ALBANY N Y NEWS10 The state s budget is now providing 2 5 million eligible New Yorkers a property tax rebate The credit is available for low and middle income households as well as

Homeowner Renters District 16 Democrats

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

New York State Property Tax Rebate 2022 PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/new-york-state-property-tax-rebate-2022.jpg?w=1065&ssl=1

https://www.tax.ny.gov/pit/credits/real-property-tax-relief-credit.htm

Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less

https://www.tax.ny.gov/pit/property/property-tax-relief.htm

For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on Federal Schedule C D E or F doesn t exceed 3 000 the net amount of any other separate category of loss doesn t exceed 3 000 and

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

Homeowner Renters District 16 Democrats

Taxes American Tax Savings

State Mailing Out 2 5M Property Tax Rebate Checks Newsday

Property Tax Rebate New York State Printable Rebate Form

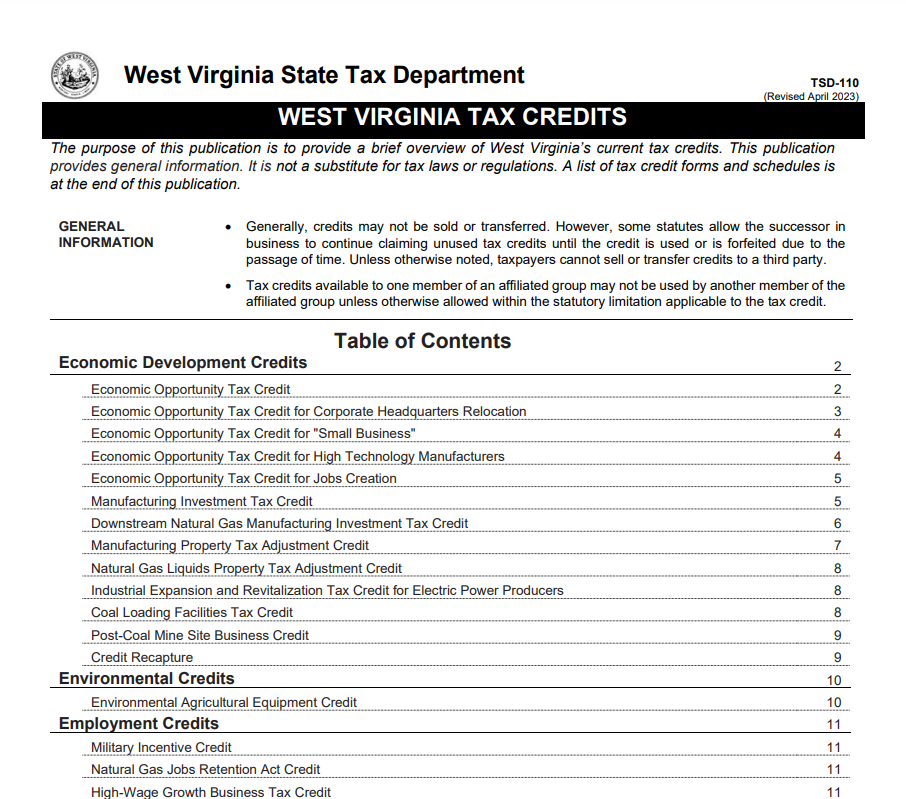

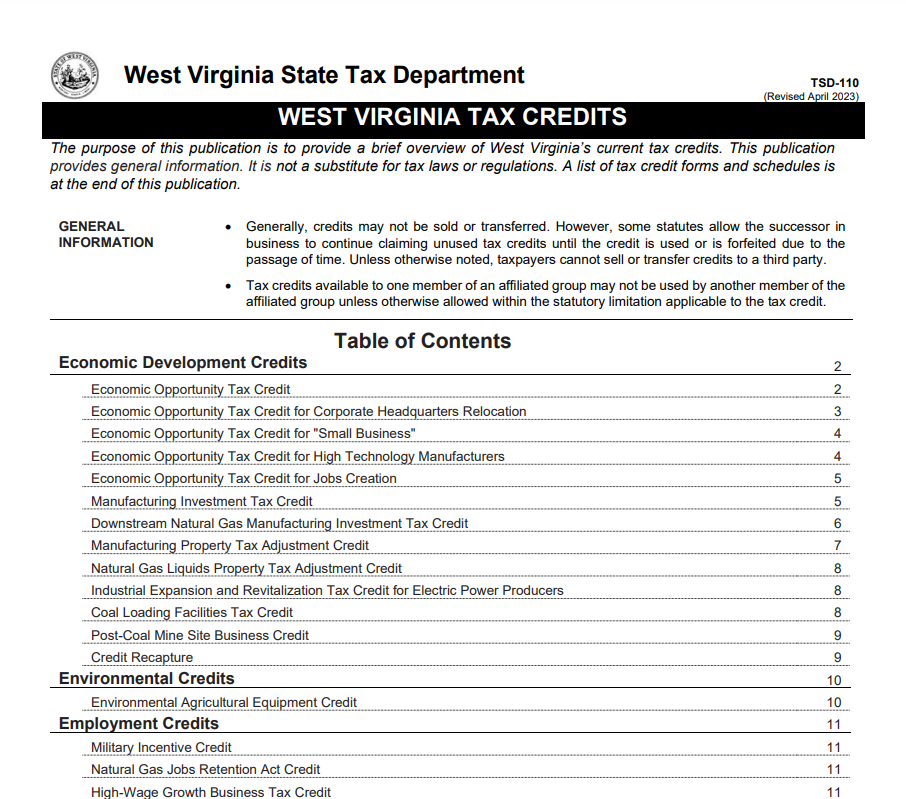

West Virginia Tax Rebate 2023 Claiming Tax Rebates WV Tax Relief PrintableRebateForm

West Virginia Tax Rebate 2023 Claiming Tax Rebates WV Tax Relief PrintableRebateForm

Deadline For Tax And Rent Relief Extended

NY Homeowner Tax Rebate Checks Are In The Mail RBT CPAs LLP

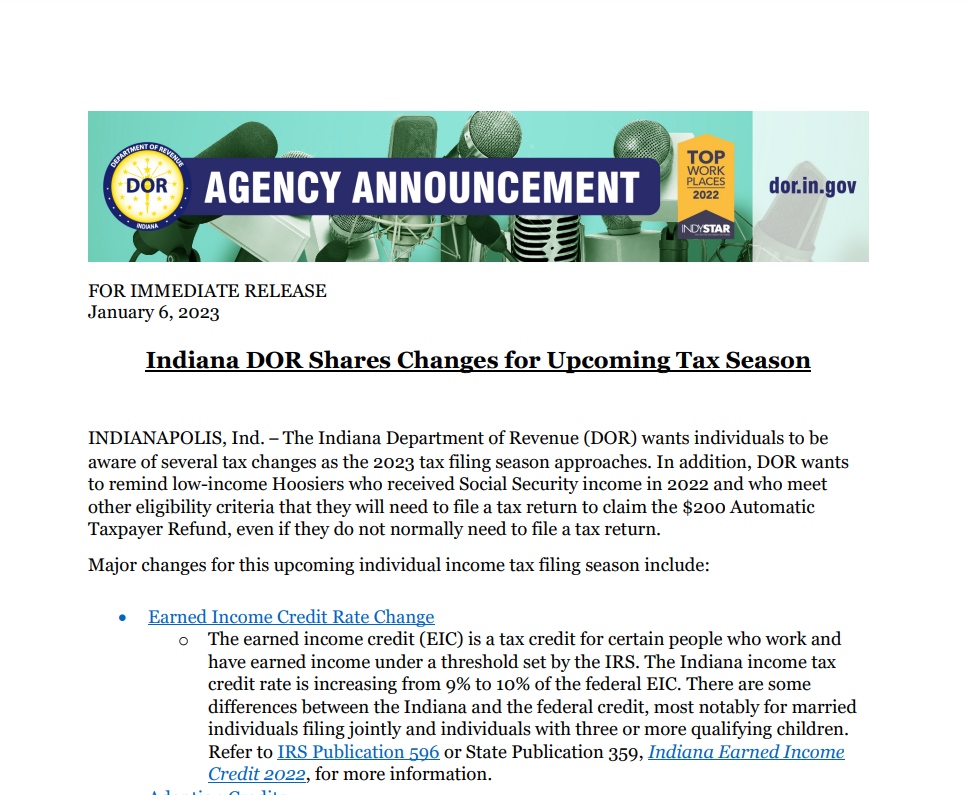

Indiana Tax Rebate 2023 Tax Rebate

Ny State Property Tax Rebate 2024 - 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks