Indiana Tax Rebates 2024 INDIANAPOLIS Residents of Indiana should know about changes to the state s tax policy that took effect on Jan 1 2024 House Bill 1001 accelerates previously planned rate cuts The individual income tax rate has been reduced from 3 15 percent to 3 05 percent in 2024 with further reductions to 3 0 percent in 2025 2 95 percent in 2026 and 2 9 percent in 2027 and beyond

95 3 MNC The Indiana State Treasurer s office announced a new tax credit worth up to 500 beginning taxable year 2024 for contributions into INvestABLE Indiana accounts All Indiana taxpayers who contribute to an Indiana ABLE account are eligible for the credit If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to know now The IRS has weighed in on

Indiana Tax Rebates 2024

Indiana Tax Rebates 2024

https://mediadc.brightspotcdn.com/dims4/default/c2a9223/2147483647/strip/true/crop/1254x658+0+0/resize/1200x630!/quality/90/?url=http:%2F%2Fmediadc-brightspot.s3.amazonaws.com%2F56%2F69%2Fd45cc77c4965b637702b70751a16%2Fistock-184851912.jpg

NJ ANCHOR Property Tax Rebates Who Can Qualify In 2024

https://www.northjersey.com/gcdn/-mm-/e12712590430b2876b51073aa0fd9d0df788d233/c=0-357-3866-2541/local/-/media/2017/05/08/Bergen/NorthJersey/636298617519756307-20170508-173344.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

Indiana Tax Rebates 2022 Who s Eligible For ATRs

https://www.panasiabiz.com/wp-content/uploads/2022/10/us-treasury-check-used-tax-752904886.jpg

Published Nov 22 2023 12 00pm We earn a commission from partner links on Forbes Home Commissions do not affect our editors opinions or evaluations Getty Images Table of Contents Indiana Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

Give now About 1 7 million tax rebate checks from Indianas big state budget surplus that have been delayed for months will be larger when they finally start hitting mailboxes Friday afternoon the Indiana House voted 93 2 on House Bill 1001 to send those relief checks to nearly every adult in the state All residents who file a tax return would automatically be eligible to receive the 225 450 for married couples filing jointly

Download Indiana Tax Rebates 2024

More picture related to Indiana Tax Rebates 2024

What Are The Best Ways To Manage Tax Rebates

https://bloggercreativa.com/wp-content/uploads/2022/08/Tax-Rebate-Calculator-2-scaled.jpg

2023 Indiana Tax Form Printable Forms Free Online

https://www.pdffiller.com/preview/536/231/536231109/large.png

Understanding Income Tax Reliefs Rebates Deductions And Exemptions In Malaysia

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/Tax-Rebates-800x534.jpg

What are the energy rebate programs There are 2 rebate programs Home Efficiency Rebates also known as HER or HOMES will provide rebates for qualified energy efficiency upgrades and retrofits that achieve at least 20 energy savings Both single family and multifamily buildings are eligible INDIANAPOLIS AP Indiana state tax rebate payments have started to be made by direct bank deposit or printed checks although some taxpayers will have to wait until October to receive the money The state Department of Revenue announced Thursday that it had already issued about 1 5 million direct deposits for the 200 per taxpayer rebates from the surging state budget surplus approved by

Thompson s bill proposes either a 50 decrease to the maximum levy growth quotient in 2024 and a 25 in 2025 or a drop to 3 each year whichever is lower Story continues below 1675883731 25905 The measure further limits too the total amount of operating referendum tax that can be levied by a school corporation for taxes due in 2024 Taxpayers in 14 states could get some financial relief this year thanks to lower individual tax rates enacted in 2024 according to an analysis from the Tax Foundation a think tank that focuses

Tax Rebates Worth At Least 75 To Start Going Out To 25 000 People This Week All You Need To

https://www.the-sun.com/wp-content/uploads/sites/6/2022/02/CW-COMP-MONEY-TIME-TO-ACT-US.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

https://news.yahoo.com/indiana-tax-cuts-significant-changes-014849426.html

INDIANAPOLIS Residents of Indiana should know about changes to the state s tax policy that took effect on Jan 1 2024 House Bill 1001 accelerates previously planned rate cuts The individual income tax rate has been reduced from 3 15 percent to 3 05 percent in 2024 with further reductions to 3 0 percent in 2025 2 95 percent in 2026 and 2 9 percent in 2027 and beyond

https://www.953mnc.com/2023/11/15/new-indiana-tax-credit-announced-for-2024/

95 3 MNC The Indiana State Treasurer s office announced a new tax credit worth up to 500 beginning taxable year 2024 for contributions into INvestABLE Indiana accounts All Indiana taxpayers who contribute to an Indiana ABLE account are eligible for the credit

1 000 Tax Rebate Residents In This State May Receive Extra Money This Summer Here s How To Be

Tax Rebates Worth At Least 75 To Start Going Out To 25 000 People This Week All You Need To

Primary Rebate South Africa Printable Rebate Form

Tax Rebates How To Get And Who Is Eligible For A 700 Rebate Marca

Tax Rebates Are On The Way

IRS Most Virginia 2022 Tax Rebates Aren t Taxable Kiplinger

IRS Most Virginia 2022 Tax Rebates Aren t Taxable Kiplinger

Mass W 4 Form 2023 Printable Forms Free Online

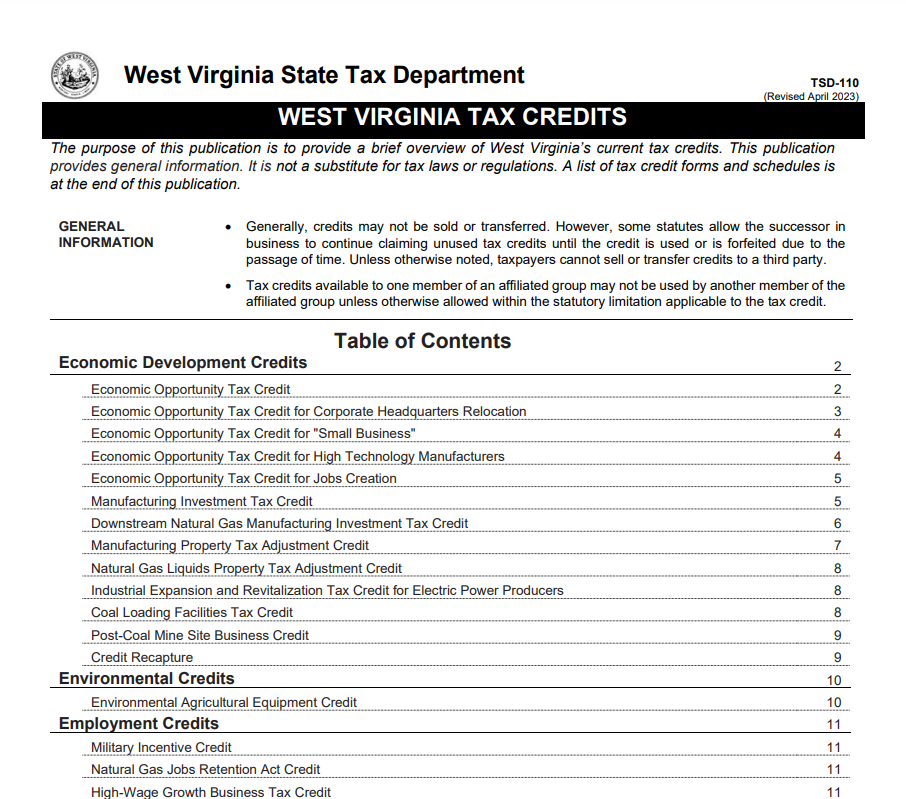

West Virginia Tax Rebate 2023 Claiming Tax Rebates WV Tax Relief PrintableRebateForm

Tax Rebates Review Of Tax Credits On The Agenda For Senate GOP

Indiana Tax Rebates 2024 - Friday afternoon the Indiana House voted 93 2 on House Bill 1001 to send those relief checks to nearly every adult in the state All residents who file a tax return would automatically be eligible to receive the 225 450 for married couples filing jointly