Ev Tax Rebates 2024 Some of the models that no longer qualify for the partial or full tax credit in the new year include other versions of the Tesla Model 3 the Volkswagen ID 4 the Nissan Leaf the Ford Mustang

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit The EV tax credit was revised and modernized as part of the Inflation Reduction Act which passed in 2022 That legislation had a number of goals including possibly conflicting ones like

Ev Tax Rebates 2024

Ev Tax Rebates 2024

https://e-vehicleinfo.com/global/wp-content/uploads/2023/06/EV-Tax-Credit-2023-All-you-need-to-know-2-1024x536.png

Revamping The Federal EV Tax Credit Could Help Average Car Buyers Combat Record Gasoline Prices

https://theicct.org/wp-content/uploads/2022/06/epv-us-tax-credit-fig-jun22.png

EV Tax Credits And Rebates 2023 What Would Your State Provide You With Digital Market News

https://www.digitalmarketnews.com/wp-content/uploads/2022/01/stimulus-check-4.jpg

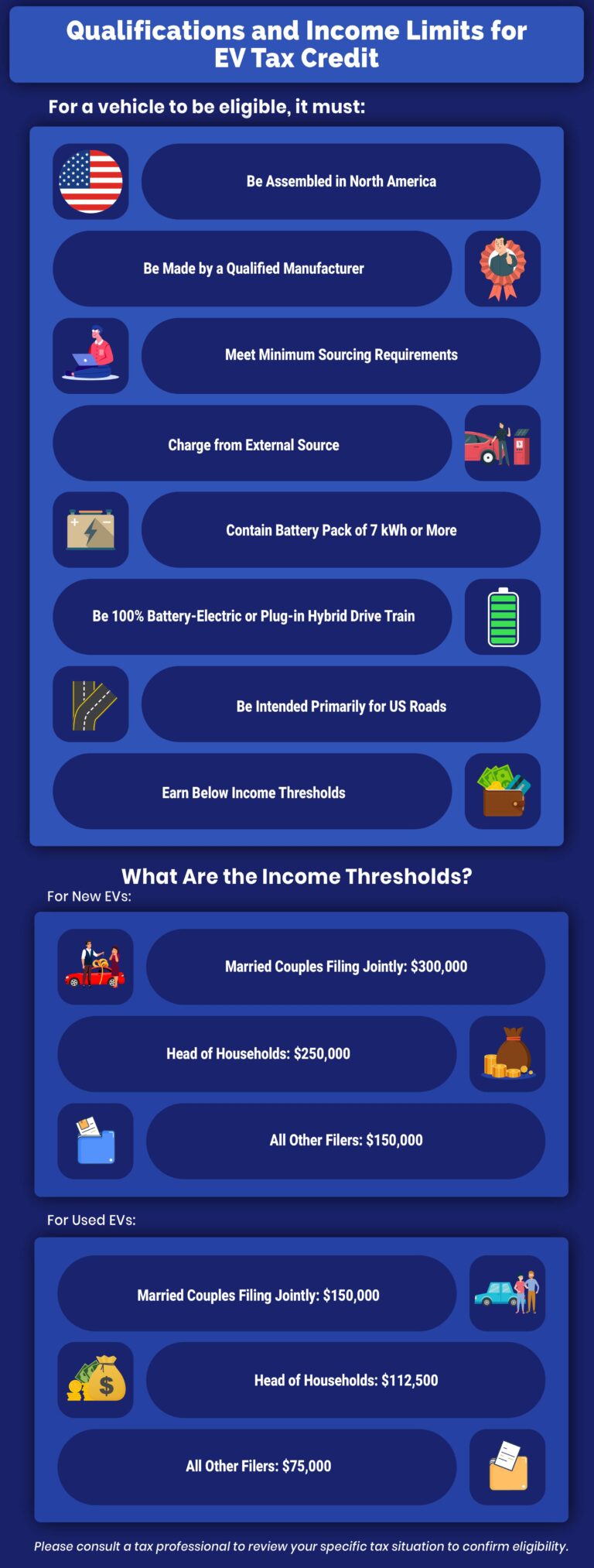

To qualify for the first 3 750 a portion of a vehicle s battery components must be produced or assembled in North America A new federal tax credit of 4 000 for used EVs priced below 25k Subject to other requirements like lower annual income see below Revised credit applies to battery electric vehicles with an

The Internal Revenue Service updated the rules for electric vehicle tax credits again starting with the first day of 2024 The bad news is that fewer vehicles are now eligible for tax credits and In 2024 the IRS will expand access to the tax benefit by allowing consumers to choose between claiming a nonrefundable credit on their tax returns to lower their tax liability or

Download Ev Tax Rebates 2024

More picture related to Ev Tax Rebates 2024

California EV Incentives Rebates A Breakdown EV America

https://ev-america.com/wp-content/uploads/2023/03/california-ev-tax-credit.png

What Are The Best Ways To Manage Tax Rebates

https://bloggercreativa.com/wp-content/uploads/2022/08/Tax-Rebate-Calculator-2-scaled.jpg

EV Tax Credit 2023 What s Changing With Biden s IRA The Week

https://cdn.mos.cms.futurecdn.net/2VJ2BzHfhP4HPh9fCVozw8-1600-80.jpg

Plug in electric vehicles and fuel cell vehicles placed in service in 2023 or later may be eligible for a federal income tax credit of up to 7 500 Under the Inflation Reduction Act consumers can choose to transfer their new clean vehicle credit of up to 7 500 and their previously owned clean vehicle credit of up to 4 000 to a car dealer

Save up to 74 Sign up for Kiplinger s Free E Newsletters Profit and prosper with the best of expert advice on investing taxes retirement personal finance and more straight to your e mail The Clean Vehicle Tax Credit up to 7 500 for electric vehicles can now be used at the point of sale like an instant rebate Effective this year the changes may help steer more potential

Electric Car EV Tax Incentives And Rebates Reliant Energy

https://www.reliant.com/content/dam/reliant/en/media/residential/electricity/renewable-energy/electric-vehicles/ev-rebates-and-incentives.jpg

EV Rebates The Raven 100 7

https://mmo.aiircdn.com/454/62ea9074c33ea.jpg

https://www.usatoday.com/story/money/cars/2024/01/03/cars-qualify-ev-tax-credit-2024/72088375007/

Some of the models that no longer qualify for the partial or full tax credit in the new year include other versions of the Tesla Model 3 the Volkswagen ID 4 the Nissan Leaf the Ford Mustang

https://www.irs.gov/newsroom/qualifying-clean-energy-vehicle-buyers-are-eligible-for-a-tax-credit-of-up-to-7500

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

Best Federal Tax Credits Rebates On EV Charging Stations

Electric Car EV Tax Incentives And Rebates Reliant Energy

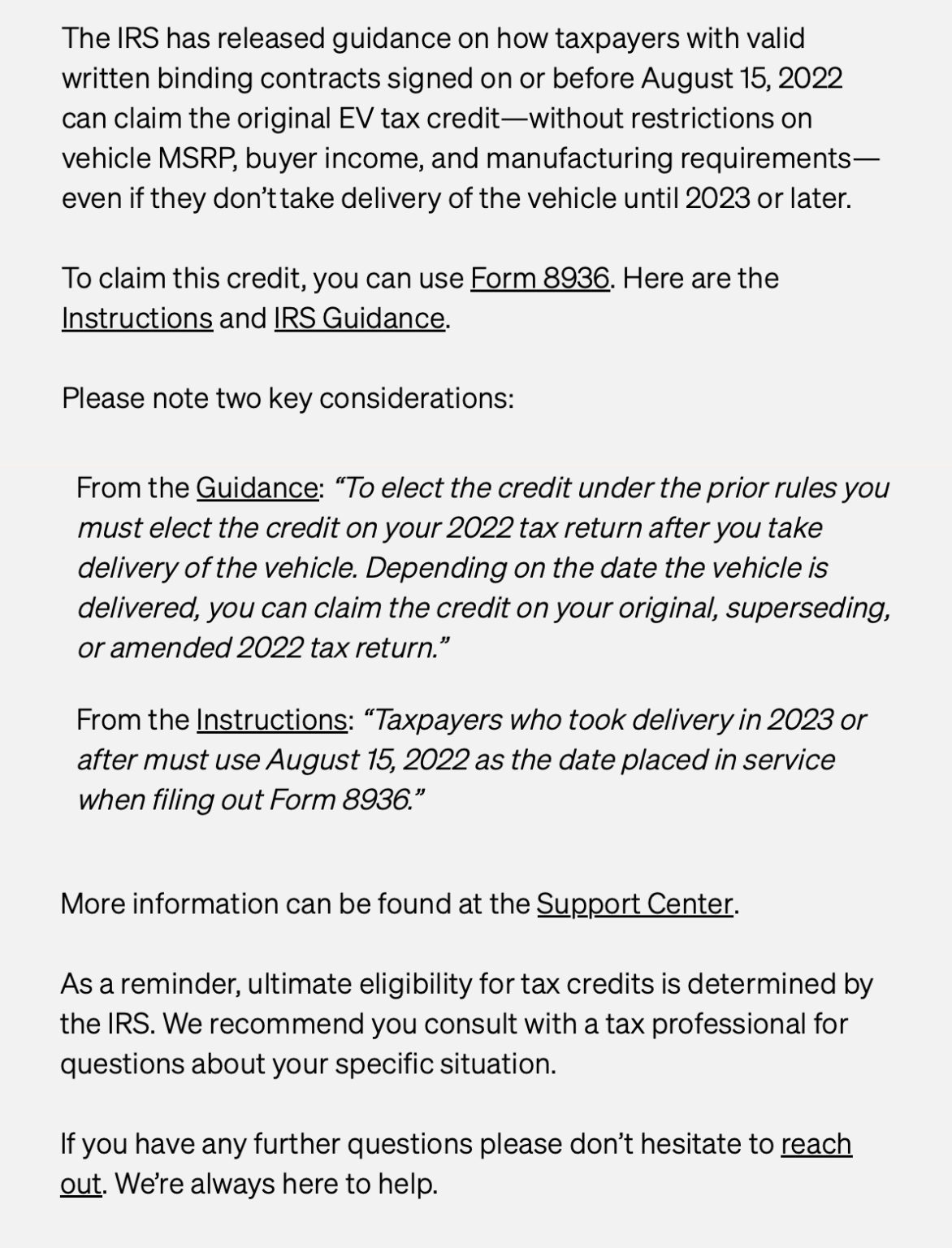

Rivian Informs Customers Of IRS Guidance On EV Tax Credits

EV Tax Credits Explained 2023 EV Tax Credit Calculator

Electric Car Tax Credits And Rebates Charged Future

2024 Chevy Silverado EV Unveiled 400 Mile Range Multi Flex Midgate Worksite home Backup Power

2024 Chevy Silverado EV Unveiled 400 Mile Range Multi Flex Midgate Worksite home Backup Power

Understanding Income Tax Reliefs Rebates Deductions And Exemptions In Malaysia

Tax Credits More Your Guide To The Inflation Reduction Act

EV Tax Credits And Rebates List 2022 Guide

Ev Tax Rebates 2024 - A new federal tax credit of 4 000 for used EVs priced below 25k Subject to other requirements like lower annual income see below Revised credit applies to battery electric vehicles with an