Hmrc Tax Return To Date Of Death The guide is useful for anyone who needs to have a basic understanding of the steps to take when dealing with HMRC after a death It gives a tailored guide with links to forms and more

Call HMRC for help with tax after someone dies if you re dealing with their Income Tax and Capital Gains Tax before they died estate in the administration period without sending a tax Complete an SA900 Trust and Estate tax return reporting the income that was received by the estate in the period from the date of death to the end of the tax year if

Hmrc Tax Return To Date Of Death

Hmrc Tax Return To Date Of Death

https://paulmaguirephoto.com/wp-content/uploads/2020/07/c40910-1024x683.jpg

HMRC Spends 250 000 plus On Targeted Cyber Training In 24 Months

https://securitymattersmagazine.com/uploads/smmw/articles/2021/06/17/1400220/16239370933324.jpg

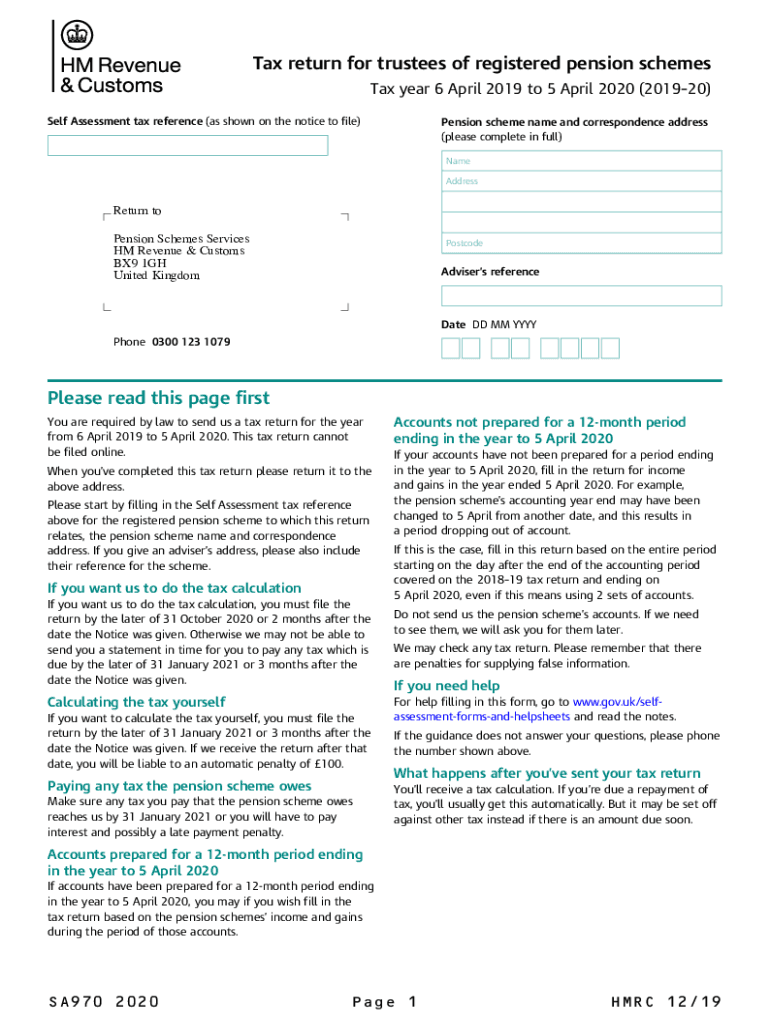

Sa970 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/535/1/535001105/large.png

TAX RETURN AFTER DEATH Do you deal with the tax affairs of someone who died If so you have to report the death to HM Revenue and Customs Even though it may be a difficult and sad time HMRC will need to know as soon as Any unpaid tax due at the date of the person s death should be paid by the personal representative dealing with the assets of the estate In other words their estate pays their tax bill Many banks will make a payment directly

HMRC should cancel the late filing penalty and re issue the 2022 23 tax return to Mark s executor to complete together with a tax return to the date of Mark s death It makes sense to try and finalise the tax position of the HMRC are advising that tax returns to date of death need to be submitted in paper form and hence by 31 October We have submited them electronically as

Download Hmrc Tax Return To Date Of Death

More picture related to Hmrc Tax Return To Date Of Death

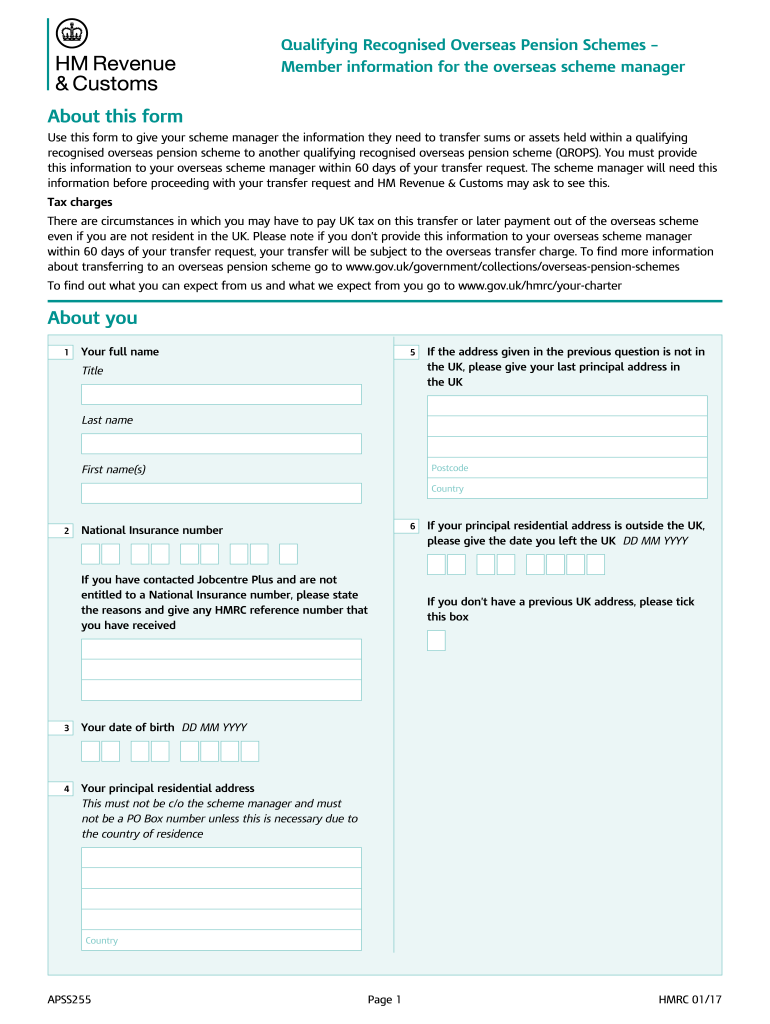

C1603 Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/454/115/454115474/large.png

HMRC Announce Breathing Space On Late Self Assessment Tax Returns

https://www.forres-gazette.co.uk/_media/img/G2UO83CJ0STY7VJ2UBX1.jpg

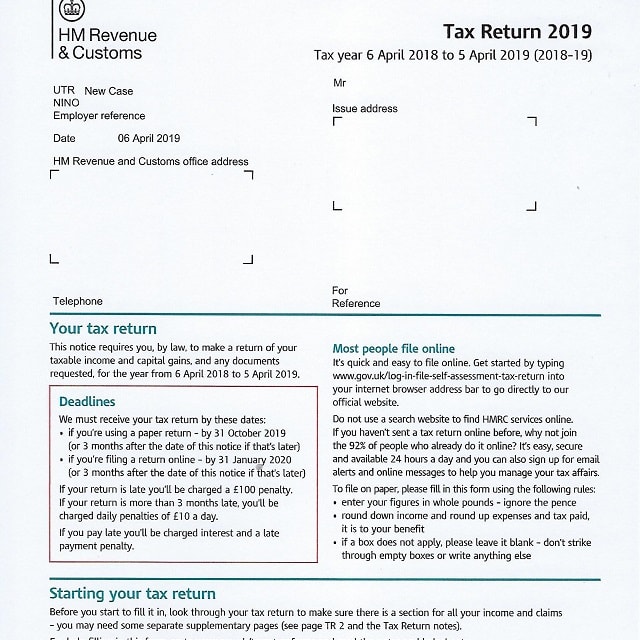

Hm Revenue And Customs Tax Return 2018 Tax Walls

https://taxhelp.uk.com/wp-content/uploads/2019-HMRC-Tax-Return-Form-SA100-m.jpg

PRs must send a paper return in respect of the tax year of death However authorised tax agents can file either a paper return or an electronic tax return covering the tax year of death Bereavement helpline and HMRC delays HMRC typically find out about the death of a taxpayer via the family or a personal representative PR through the Tell us Once service This service is accessed online or by

Require information and tips on filing a Self Assessment Tax Return for a deceased person If a someone died in October 2018 i e during the tax year ended 5th April To make sure that the correct amount of Income Tax is paid it s important to contact HM Revenue Customs HMRC as soon as possible so that they can adjust the deceased s tax

HMRC Self Assessment Tax Return Web Site Page On Screen Stock Photo Alamy

https://c8.alamy.com/comp/H6FBY1/hmrc-self-assessment-tax-return-web-site-page-on-screen-H6FBY1.jpg

Pay Your Personal Tax Return By The End Of January Alterledger

https://www.alterledger.com/wp-content/uploads/2022/01/Pay-your-tax-by-end-of-Jan.gif

https://www.hmrc.gov.uk › tools › bereavement

The guide is useful for anyone who needs to have a basic understanding of the steps to take when dealing with HMRC after a death It gives a tailored guide with links to forms and more

https://www.gov.uk › government › organisations › hm...

Call HMRC for help with tax after someone dies if you re dealing with their Income Tax and Capital Gains Tax before they died estate in the administration period without sending a tax

HMRC Self Assessment tax return SPICe Spotlight Solas Air SPICe

HMRC Self Assessment Tax Return Web Site Page On Screen Stock Photo Alamy

HMRC Tax Overview Online Self Document Templates Documents

HMRC Give Tax Relief Pre approval Save The Thorold Arms

HMRC 2021 Paper Tax Return Form

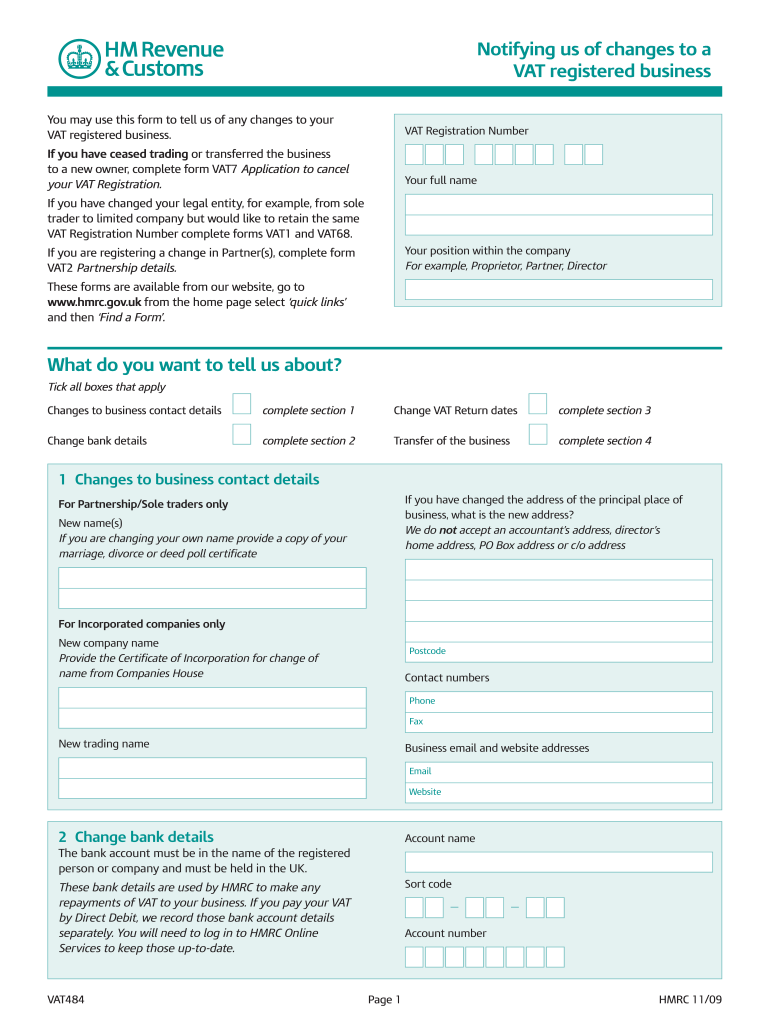

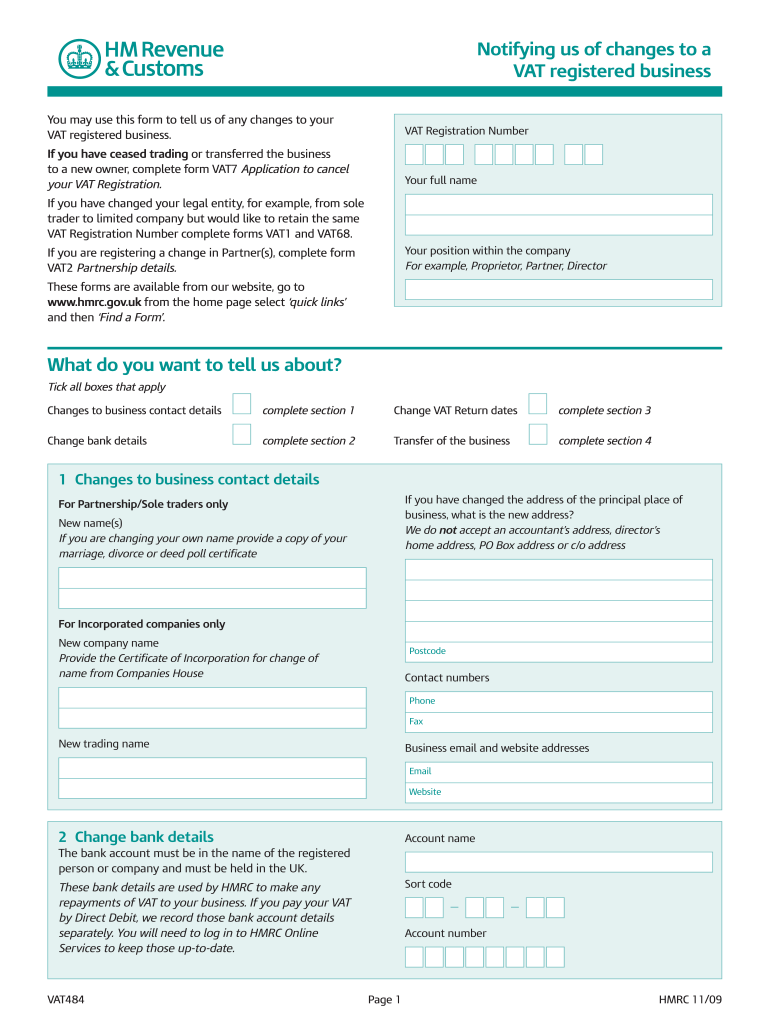

UK HMRC VAT484 2009 Fill And Sign Printable Template Online US

UK HMRC VAT484 2009 Fill And Sign Printable Template Online US

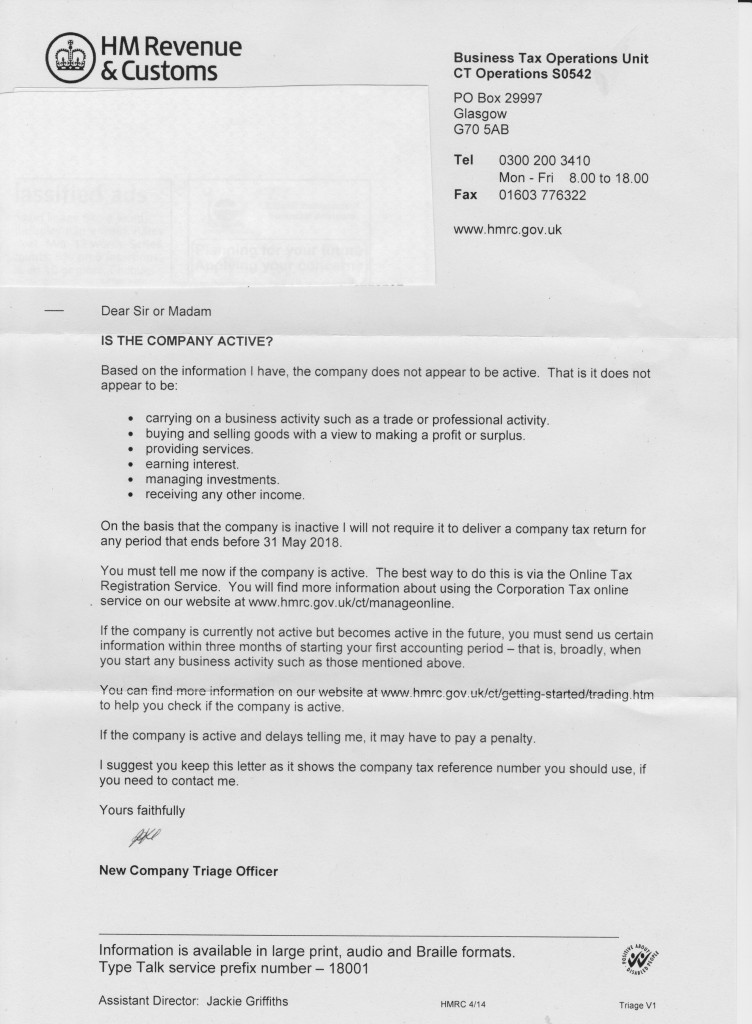

HMRC Really Do Not Want To Collect Corporation Tax

How To Report Cryptocurrency To HMRC Koinly

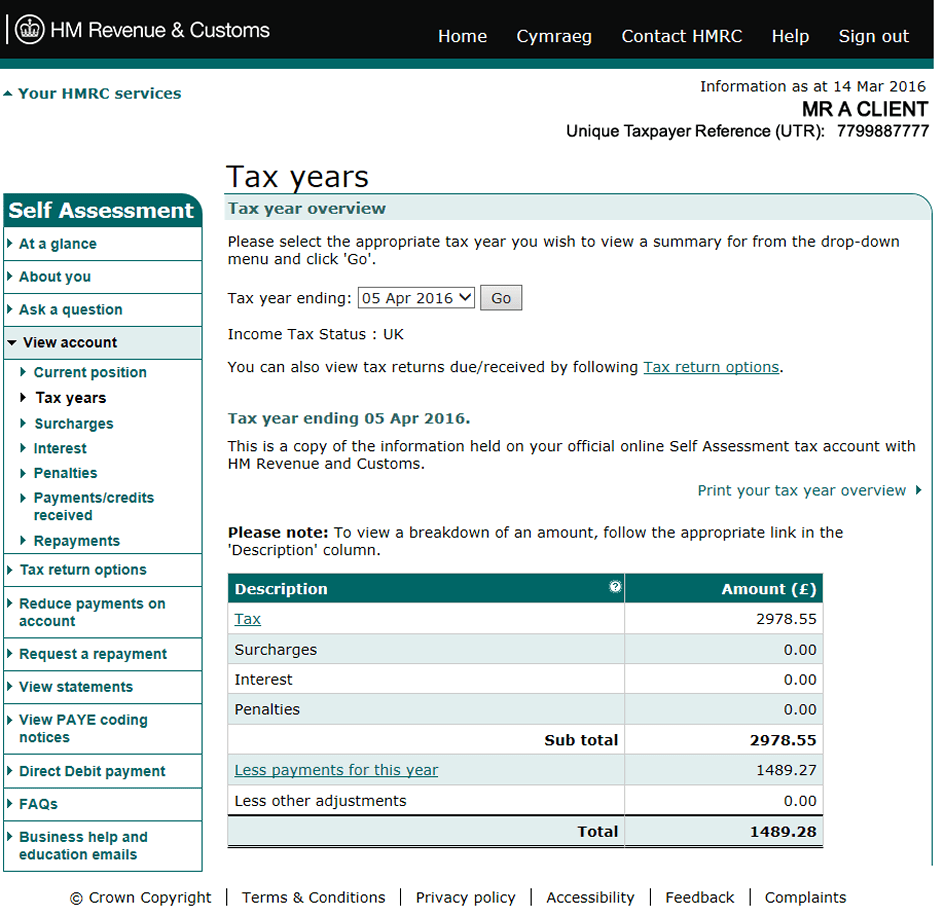

How To Print Your Tax Calculations Better co uk formerly Trussle

Hmrc Tax Return To Date Of Death - There is no CGT charge when someone dies Instead there are special rules The assets the deceased owned on the date of their death are treated as though they had passed