Federal Hvac Rebates 2024 Federal Tax Credit for HVAC Systems 2024 Today s Homeowner Home HVAC Federal Tax Credit for HVAC Systems Author Sarah Horvath Reviewer Roxanne Downer Updated On December 31 2023 Why You Can Trust Us

Which HVAC Systems Are Eligible for Tax Credit in 2024 How to Qualify for HVAC Tax Rebates How to Claim Your HVAC Energy Credit American Brands That Qualify for Federal Tax Credit How to Maximize Your HVAC Tax Credit People Also Ask FAQs Save Money on Taxes with the Best HVAC Systems What Is the Energy Efficient Home Improvement Credit Excellent Get Free Estimates

Federal Hvac Rebates 2024

Federal Hvac Rebates 2024

https://valleycomfortheatingandair.com/wp-content/uploads/2021/04/HVAC-tax-rebate-980x653.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

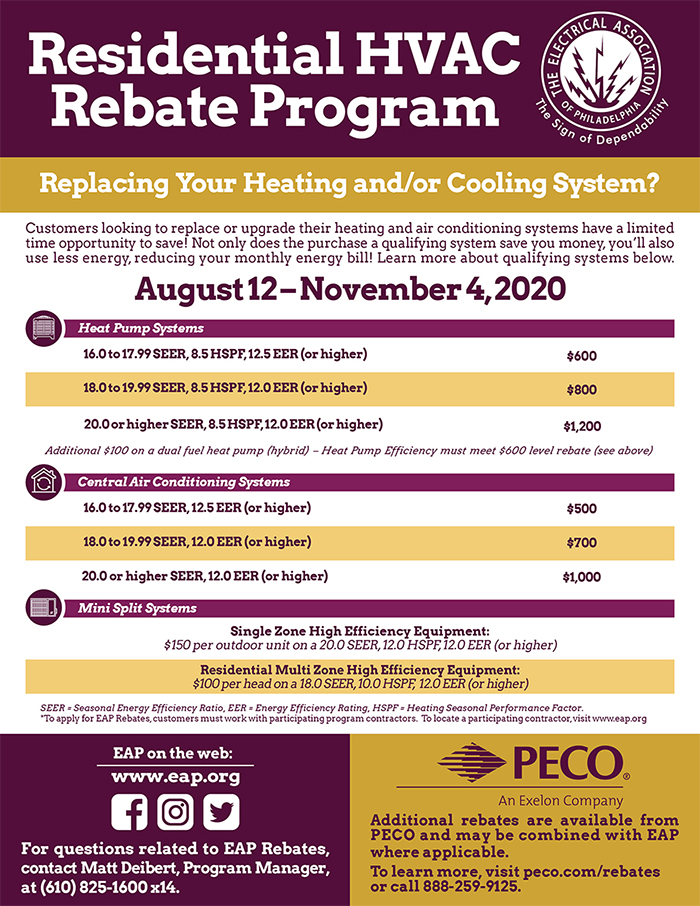

Residential HVAC Rebates

https://eap.org/images/Consumers/EAP-ResidentialHVAC.jpg

GUIDE 2024 Federal Tax GUIDE 2024 Federal Tax Credits for HVAC Systems Posted on December 21 2023 by Spurk HVAC Nothing disrupts daily life like an unexpected breakdown of your home s heating or cooling system That moment when you realize your HVAC unit has called it quits can be both frustrating and financially daunting On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit 2024 Rebates for Heating and Cooling Equipment These rates apply to equipment installed January 1 2024 through May 31 2024 Applications must be submitted within 60 days of installation and no later than June 30 2024 Rebates are subject to change Considering a federal tax credit Look for a unit that meets the above requirements and also

Download Federal Hvac Rebates 2024

More picture related to Federal Hvac Rebates 2024

The 2022 Inflation Reduction Act HVAC Federal Credit Rebates Explained PECO Heating Cooling

https://www.pecoair.com/wp-content/uploads/2022/10/HVAC-Federal-Credit-Rebates-Explained-3-1536x1025.jpg

HVAC Federal Tax Credits Rebates LennoxPROs

https://images.lennoxpros.com/is/image/LennoxIntl/tax-savings?scl=1&fmt=png-alpha

Taking Advantage Of HVAC Rebates Federal Tax Credits With An Efficient HVAC System In Dallas

https://149354076.v2.pressablecdn.com/wp-content/uploads/2020/10/Taking-Advantage-of-HVAC-Rebates-and-Federal-Tax-Credits-with-An-HVAC-System.png

2024 Government Rebates for HVAC Replacements New Federal Rebate Program Many Americans will save thousands of dollars on home renovations when new rebates for a range of energy efficient upgrades kick in later this year as part of a 9 billion federal program passed by Congress in last summer s Inflation Reduction Act The size of the The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 You may be able to take the credit if you

Distributors about home electrification and appliance rebates how consumers will access information and will be encouraged to participate in the program How will the bidder promote other federal programs and encourage stacking and braiding with non federal programs including other incentives and financing offerings Reduction Act Money Saving HVAC Federal Tax Credits and Rebates Helping Homeowners Save Money On August 16 2022 the U S government signed into law the Inflation Reduction Act IRA in an effort to reduce greenhouse gas GHG emissions by 40 by 2030

Taking Advantage Of HVAC Rebates Federal Tax Credits With An Efficient HVAC System In Dallas

https://i.pinimg.com/originals/85/f2/3f/85f23f50a468ed5dd95c75f797666d7d.jpg

The 2022 Inflation Reduction Act HVAC Federal Credit Rebates Explained PECO Heating Cooling

https://www.pecoair.com/wp-content/uploads/2022/10/HVAC-Federal-Credit-Rebates-Explained-1-1024x683.jpg

https://todayshomeowner.com/hvac/guides/hvac-tax-credit/

Federal Tax Credit for HVAC Systems 2024 Today s Homeowner Home HVAC Federal Tax Credit for HVAC Systems Author Sarah Horvath Reviewer Roxanne Downer Updated On December 31 2023 Why You Can Trust Us

https://airconditionerlab.com/what-hvac-systems-qualify-for-tax-credit/

Which HVAC Systems Are Eligible for Tax Credit in 2024 How to Qualify for HVAC Tax Rebates How to Claim Your HVAC Energy Credit American Brands That Qualify for Federal Tax Credit How to Maximize Your HVAC Tax Credit People Also Ask FAQs Save Money on Taxes with the Best HVAC Systems What Is the Energy Efficient Home Improvement Credit

How To Find Your Federal Tax Credits HVAC Rebates

Taking Advantage Of HVAC Rebates Federal Tax Credits With An Efficient HVAC System In Dallas

2020 HVAC Rebates Federal Tax Credits DTC Air Conditioning Heating

Carrier HVAC Federal Tax Credits And Rebates

Does My HVAC System Qualify For IID Or Federal Rebates

HVAC Rebates Available In 2021 Indoor Air Quality Inc

HVAC Rebates Available In 2021 Indoor Air Quality Inc

2023 Home Energy Federal Tax Credits Rebates Explained

HVAC System Rebates Incentives A Guide To Saving Money

Austin HVAC Rebates McCullough Heating Air Conditioning

Federal Hvac Rebates 2024 - On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates