Heehra Rebates 2024 Texas On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

The High Efficiency Electric Homes and Rebates Act HEEHRA allocates 4 5 billion dollars to the states to create point of sale rebates for home electrification projects for low and moderate income households Program specifics are still being determined and will vary from state to state 1 What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5

Heehra Rebates 2024 Texas

Heehra Rebates 2024 Texas

https://i0.wp.com/www.usrebate.com/wp-content/uploads/2023/06/Heehra-Rebates.jpg

What To Know About HEEHRA Rebates

https://media.angi.com/s3fs-public/Couple-home-getting-letters-bills-1395273146-.jpeg

HEEHRA Rebates SafeAire Heating Cooling

https://tlchelps.com/wp-content/uploads/2023/02/HEEHRA-Rebate-Amounts-American-Mechanical-1.png

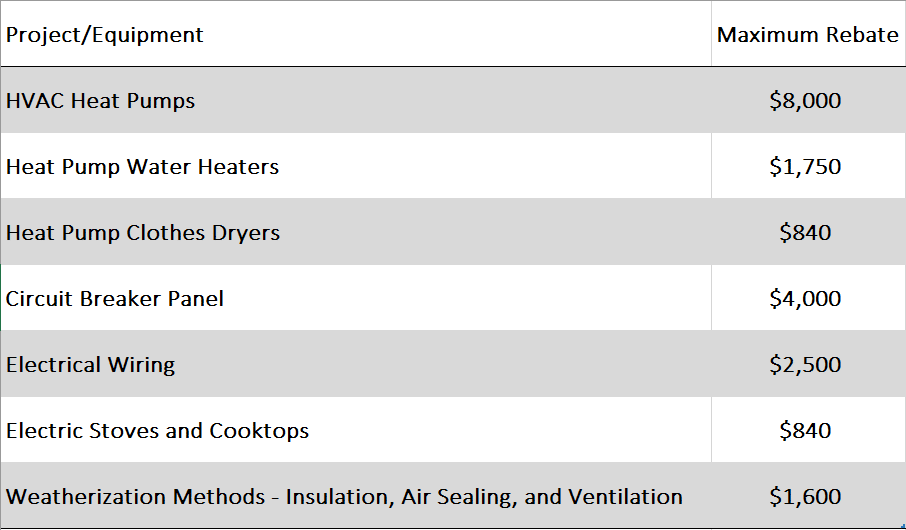

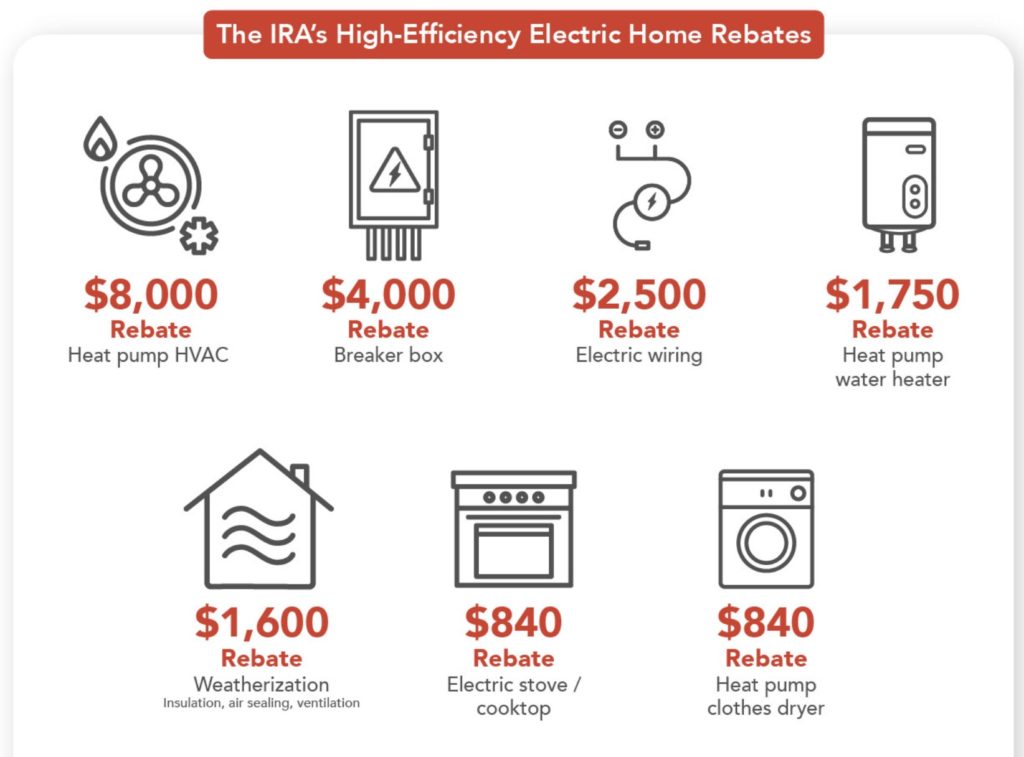

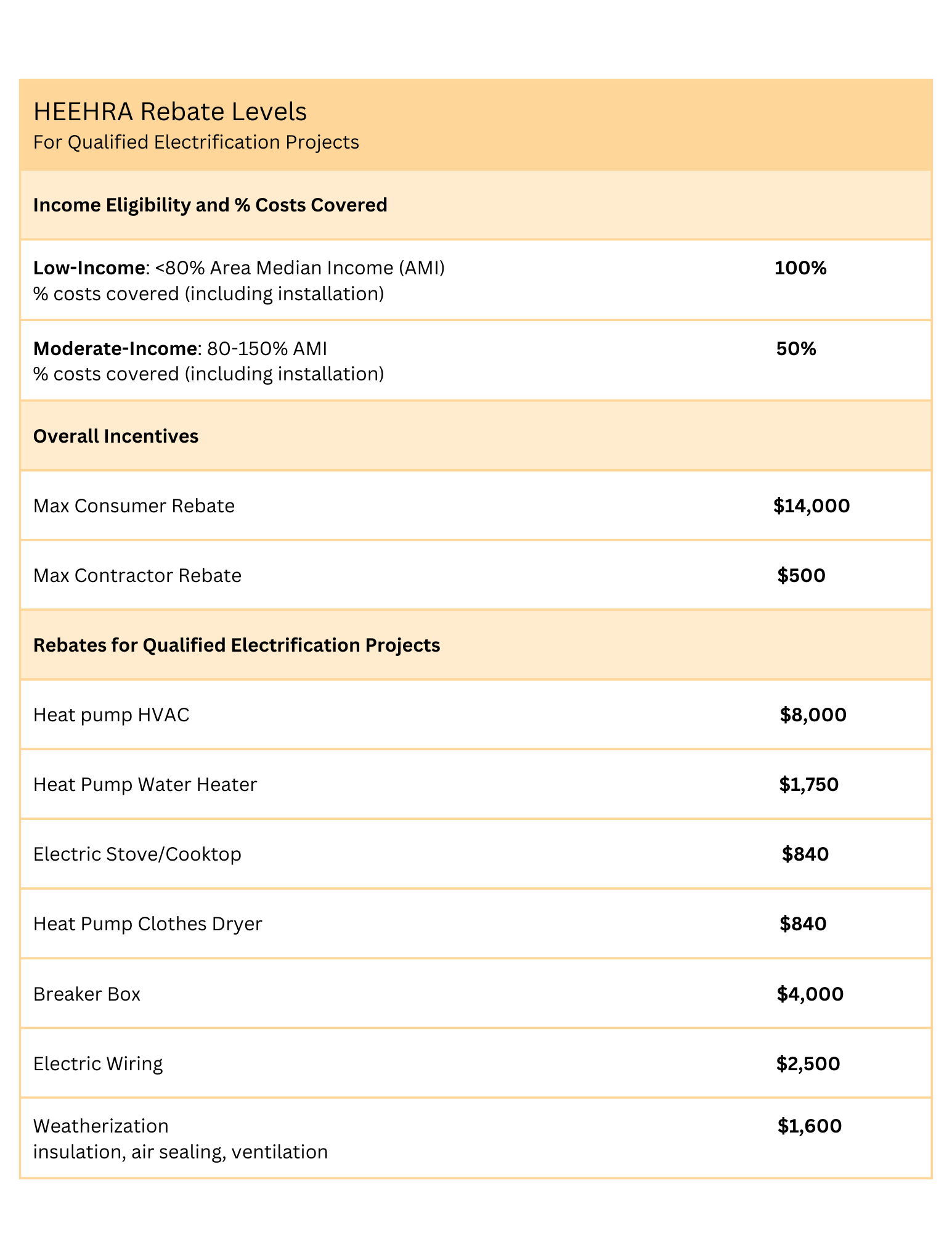

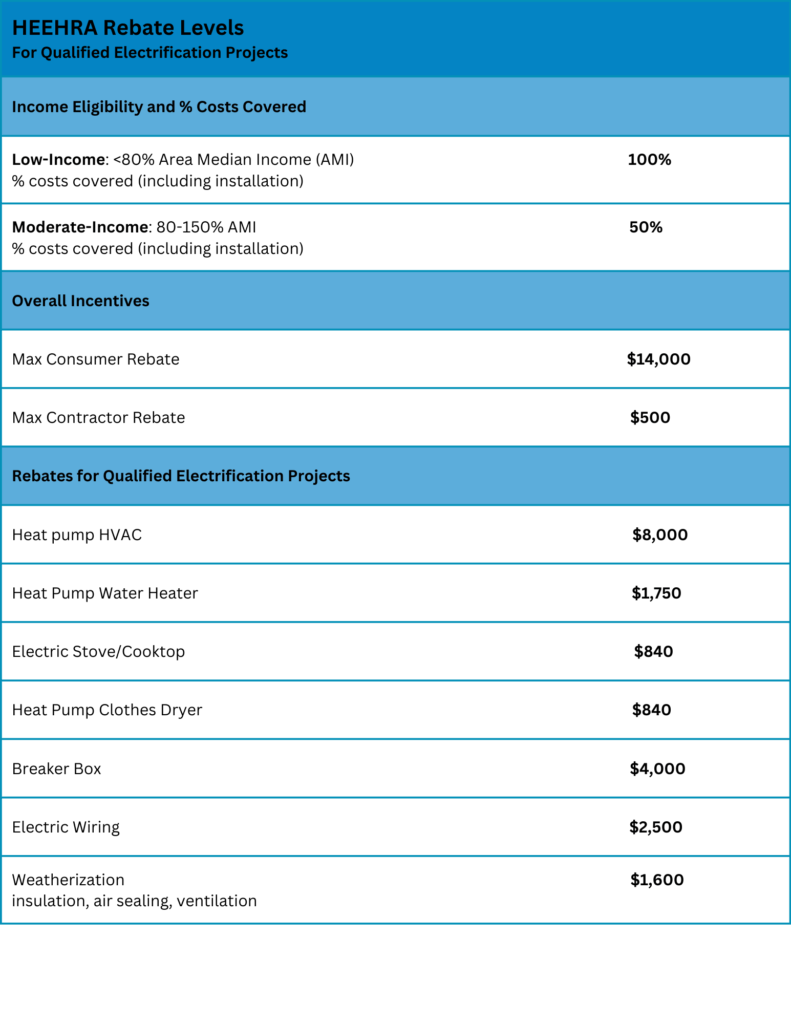

The High Efficiency Electric Home Rebate Act HEEHRA provides point of sale consumer rebates to enable low and moderate income households across America to electrify their homes HEEHRA will help American families save money on their monthly energy bills create healthier indoor air environments and reduce their carbon emissions 1 Find out if you re eligible The HEEHRA program provides up to 14 000 per household in point of purchase rebates for low and moderate income families who are looking to replace

The HEEHRA program is only applicable to low to moderate income households Low income families have annual incomes less than 80 of the local median income and are eligible for 100 discounts up to 14 000 Moderate income families have annual incomes of 80 to 150 of the local median income and are eligible for 50 discounts up to 14 000 The Electrification Rebates provide point of sale consumer discounts to enable low and moderate income households across America to electrify their homes Notably households will experience HEEHRA s point of sale rebates as immediate off the top discounts when making qualifying electrification purchases Funding available to DOE in 2022

Download Heehra Rebates 2024 Texas

More picture related to Heehra Rebates 2024 Texas

TikToker Shares How HEEHRA Rebates Can Save You 14 000 Lower Bills Heat Pump Water Heater

https://i.pinimg.com/originals/4d/1d/42/4d1d427598fb7c7f965f3d1248218cf6.jpg

2023 HVAC Rebates And Tax Incentives HEEHRA Rebates 2023

https://airetexas.com/wp-content/uploads/2023/01/HEEHRA-REBATES.jpg

HEEHRA Rebate Program 2023 Get Full Details Here

https://www.acdirect.com/media/wysiwyg/what-is-heehra3.jpg

Mar 27 2023 Understanding the High Efficiency Electric Home Rebate Act HEEHRA The HEEHRA creates a winning combination of rebates that specifically address the concerns of America s most energy vulnerable households and goes farther than ever before to make home electrification possible for everyone Improving equity through electrification The High Efficiency Electric Home Rebate Act HEEHRA is a 10 year rebate program for low to moderate income LMI households that encourages homeowners to switch to electric home appliances and systems

HEEHRA rebates are a huge game changer for households with low and moderate income levels who want powerful home energy upgrades Consider this your guide to understanding how the HEEHRA program can help you electrify your home and save money HEEHRA offers up to 8 000 in rebates for heat pump installations and up to 14 000 as their maximum consumer rebate HOMES offers up to 8 000 for installing energy efficient projects These rebates may allow you to collect a refund even if you don t typically qualify A rebate is applied to your tax return regardless of your tax liability

Climate Incentives Timeline Depends On Government Guidelines State Adoption

https://www.anndyl.com/wp-content/uploads/2023/03/Contractor-Survey-Pie-Chart.png

What To Know About HEEHRA Rebates

https://media.angi.com/s3fs-public/Couple-paying-bills-online-1283779141-.jpeg?impolicy=leadImage

https://www.energy.gov/scep/home-energy-rebates-programs

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

https://www.solar.com/learn/home-energy-efficiency-rebates-and-tax-credits/

The High Efficiency Electric Homes and Rebates Act HEEHRA allocates 4 5 billion dollars to the states to create point of sale rebates for home electrification projects for low and moderate income households Program specifics are still being determined and will vary from state to state

BPA Journal Understanding The High Efficiency Electric Home Rebate Act HEEHRA Building

Climate Incentives Timeline Depends On Government Guidelines State Adoption

HVAC Tax Credits Rebates In Salt Lake City HEEHRA

Understanding The High Efficiency Electric Home Rebate Act HEEHRA CleanTechnica

High Efficiency Electric Home Rebate Act HEEHRA Rewiring America

2023 Heat Pump Rebate For Texas HEEHRA

2023 Heat Pump Rebate For Texas HEEHRA

Primary Rebate South Africa Printable Rebate Form

Tax Credits And Rebates Mauzy

Smith Wesson Shield EZ Holiday Rebate H H Shooting Sports Oklahoma City

Heehra Rebates 2024 Texas - The High Efficiency Electric Home Rebate Act HEEHRA provides point of sale consumer rebates to enable low and moderate income households across America to electrify their homes