Rebates For Hvac 2024 For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

Rebates For Hvac 2024

Rebates For Hvac 2024

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

Tri Cities HVAC Rebates To Take Advantage Of Before The Summer

https://apolloheatingandair.com/wp-content/uploads/2022/08/carrier-experts-hvac-rebates.jpg

HVAC Rebates Available In 2021 Indoor Air Quality Inc

https://iaqcolorado.com/wp-content/uploads/2021/06/2021-hvac-rebates-768x512.jpg

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates Enhanced tax credits through the Energy Efficient Home Improvement initiative are accessible for homeowners investing in energy efficient systems including central air conditioning systems boilers furnaces air source heat pumps and biomass stoves that meet high efficiency standards

2024 Rebates for Heating and Cooling Equipment These rates apply to equipment installed January 1 2024 through May 31 2024 Applications must be submitted within 60 days of installation and no later than June 30 2024 Rebates are subject to change Check focusonenergy for current rebate amounts This program which is run by the U S Environmental Protection Agency EPA and U S Department of Energy DOE to promote energy efficiency offers rebates and special offers based on a homeowner s location Find out if you re eligible for savings by visiting ENERGY STAR s Rebate Finder HVAC Replacement Cost Calculator

Download Rebates For Hvac 2024

More picture related to Rebates For Hvac 2024

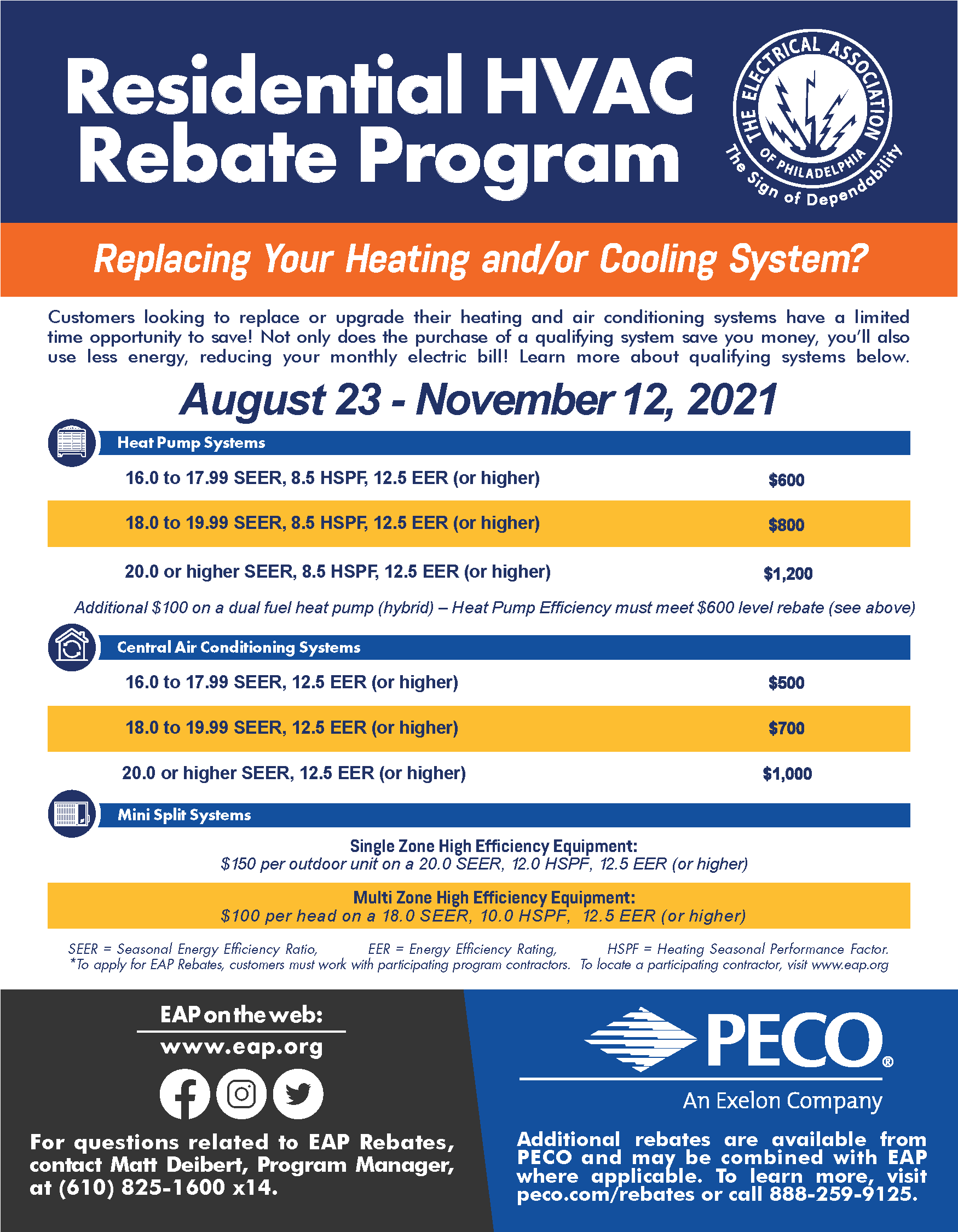

Residential HVAC Rebates

https://eap.org/images/Consumers/Fall 2021 Rebate Flyer Back final Edit.png

Austin HVAC Rebates McCullough Heating Air Conditioning

http://coolmenow.com/wp-content/uploads/2021/06/JBEN268-Hexagons-Revised-v22.png

2023 Rebates And Tax Credits For HVAC Upgrades Alsip IL

https://doornbos.com/wp-content/uploads/2023/01/BDekEMBc.jpeg

There s also a 1 750 rebate for heat pump water heaters 840 cash back for induction stoves and heat pump clothes dryers and 4 000 for electrical system upgrades The federal government wants Greg Siedschlag the Department of Energy s chief communications strategist for the home energy rebates said the hope is to have the first rebate programs go live in the spring of 2024 with the majority of states and territories issuing rebates by the end of 2024

IR 2023 97 May 4 2023 The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could qualify them for home energy tax credits 2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit Resources Inflation Reduction Act of 2022 Frequently asked questions about energy efficient home improvements and residential clean energy property credits Credits and deductions under the Inflation Reduction Act of 2022

Current HVAC Rebates Air Conditioning Myrtle Beach Heating Residential Commercial HVAC

https://www.tricountymechanicalinc.com/wp-content/uploads/2021/02/Hvac-Rebates.jpeg

Why Carrier Cool Cash Is The Best 2023 HVAC Rebate Apollo

https://apolloheatingandair.com/wp-content/uploads/2023/02/Carrier-–-Turn-to-the-Experts-of-HVAC-Systems-.jpg

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

HVAC Rebates Carrier Cool Cash Rebate Allison Air Conditioning

Current HVAC Rebates Air Conditioning Myrtle Beach Heating Residential Commercial HVAC

Utility Rebates HVAC Contractors Near Me Air Comfort Systems

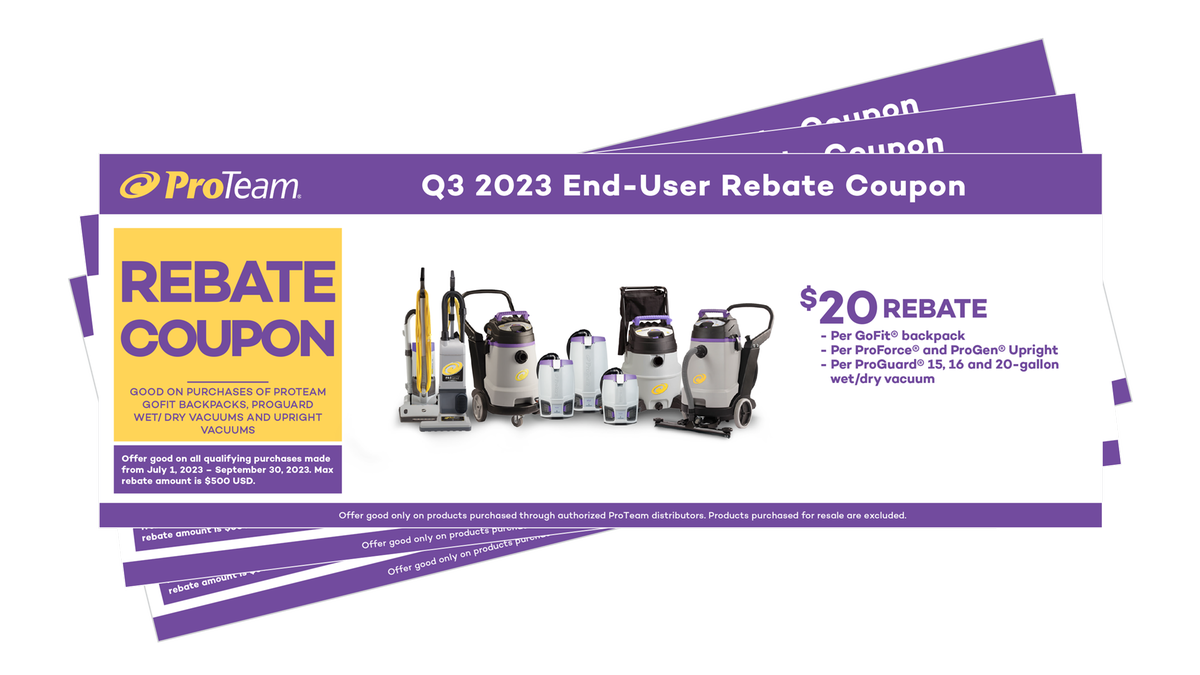

Manufacturer Rebates CleanFreak

The 2022 Inflation Reduction Act HVAC Federal Credit Rebates Explained PECO Heating Cooling

Energy Rebates Don t Leave Money On The Table Schmidt Associates

Energy Rebates Don t Leave Money On The Table Schmidt Associates

Milwaukee Tool Rebates Printable Rebate Form

.png)

Why Are Rebates And Rebate Management Important For Manufacturers And Distributors Enable

Taking Advantage Of HVAC Rebates Federal Tax Credits With An Efficient HVAC System In Dallas

Rebates For Hvac 2024 - This program which is run by the U S Environmental Protection Agency EPA and U S Department of Energy DOE to promote energy efficiency offers rebates and special offers based on a homeowner s location Find out if you re eligible for savings by visiting ENERGY STAR s Rebate Finder HVAC Replacement Cost Calculator