Fuel Tax Rebate 2024 Fuel Tax Credits Reinstated and Extended Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits through December 31 2024 Alternative fuel credit Alternative fuel mixture credit Second generation biofuel producer credit

FUEL ECONOMY GUIDE 2024 3 Federal Tax Credits You may be eligible for a federal income tax credit of up to 7 500 if you purchase a qualifying all electric vehicle EV plug in hybrid or fuel cell vehicle in 2023 2024 Qualifying EVs and plug in hybrids have been eligible for a federal income tax credit for over a decade but the Ination WASHINGTON The Internal Revenue Service and the Department of the Treasury today issued Notice 2024 20 PDF to provide guidance on eligible census tracts for the qualified alternative fuel vehicle refueling property credit and to announce the intent to propose regulations for the credit

Fuel Tax Rebate 2024

Fuel Tax Rebate 2024

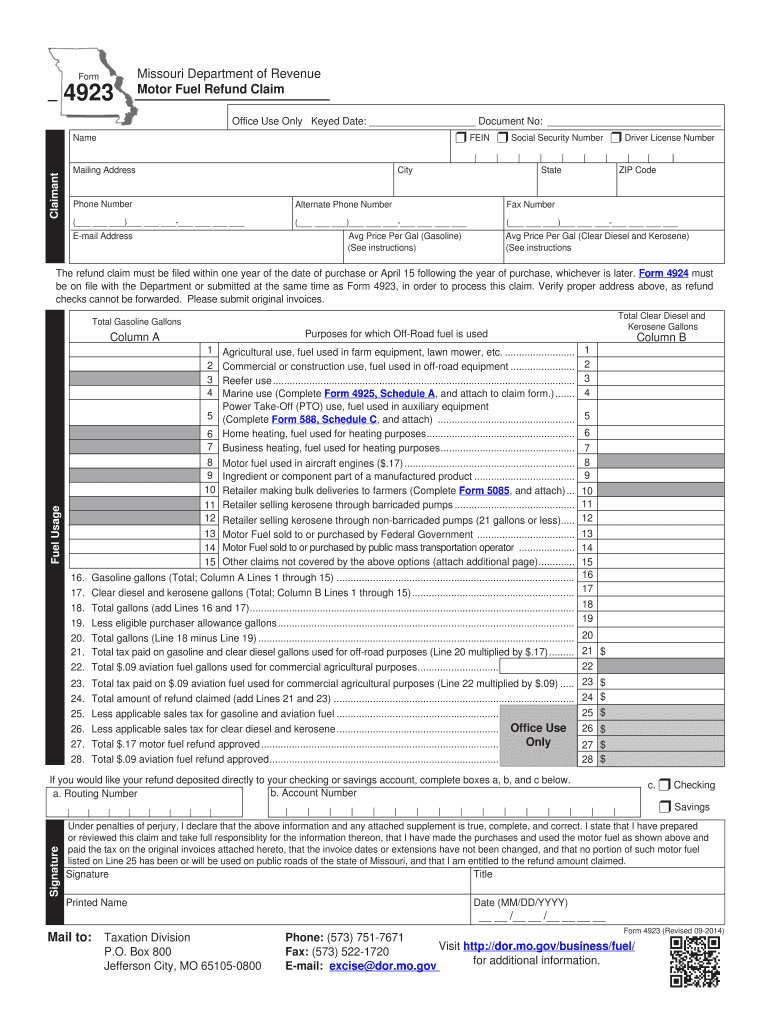

https://www.signnow.com/preview/468/470/468470575/large.png

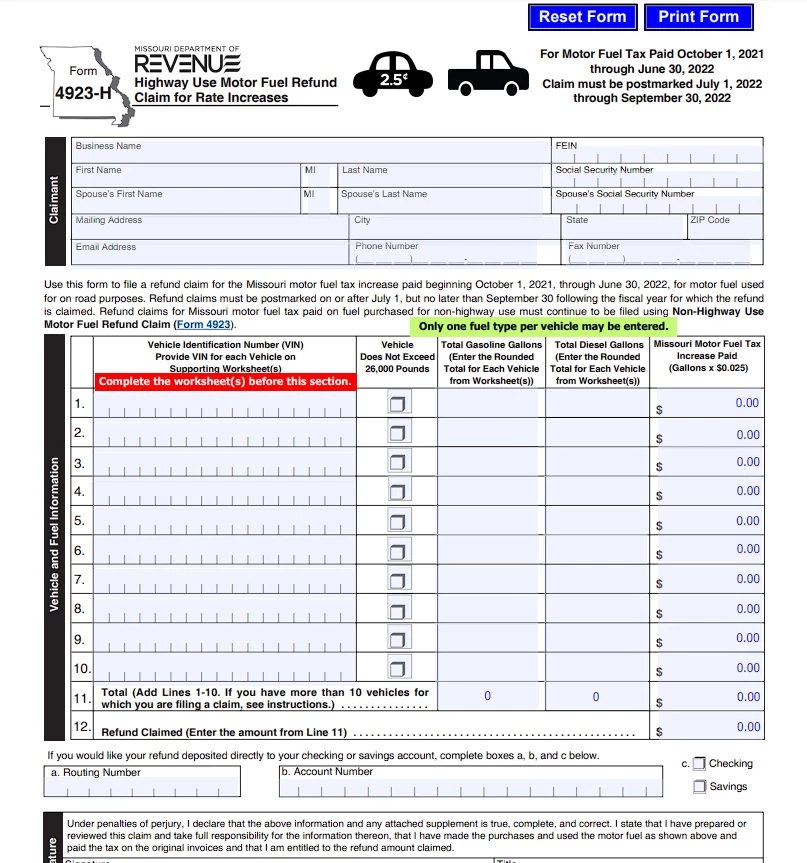

Missouri Gas Tax Refund Form Veche info 16

https://i2.wp.com/data.formsbank.com/pdf_docs_html/255/2552/255274/page_1_thumb_big.png

Increase Tax Savings With The Fuel Tax Credit Landmark CPAs

https://www.landmarkcpas.com/wp-content/uploads/2022/12/Fuel-Tax-Credit-1024x640.jpg

Plug in electric vehicles and fuel cell vehicles placed in service in 2023 or later may be eligible for a federal income tax credit of up to 7 500 The IRS first started handing out tax credits to EV buyers in 2022 after the passing of the Inflation Reduction Act up to 7 500 for new cars The policy was a key part of President Biden s

WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS released additional guidance under President Biden s Inflation Reduction Act IRA to lower Americans energy bills by providing clarity on eligibility for incentives to install electric vehicle charging stations and other alternative fuel refueling stations The Department of Energy is also The vehicle is an electric vehicle plug in hybrid electric vehicle or fuel cell vehicle and the model year is at least two years earlier than the calendar year of your purchase How to Claim the New Clean Vehicle Tax Credit Starting on Jan 1 2024 eligible consumers will have the option to transfer the value of the tax credit to

Download Fuel Tax Rebate 2024

More picture related to Fuel Tax Rebate 2024

Missouri s Motor Fuel Tax Should You Claim A Refund Smith Patrick CPAs

https://smithpatrickcpa.com/wp-content/uploads/2022/03/motor-fuel-tax-rebate.jpg

National Fuel Furnace Rebate 2023 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2022/08/get-the-rebate-application-for-homeowners-national-fuel-s-conservation.jpg

Fuel Tax Credit Changes Cotchy

https://cotchy.com.au/wp/wp-content/uploads/2022/05/Blog-image-7.png

The Clean Vehicle Tax Credit up to 7 500 for electric vehicles can now be used at the point of sale like an instant rebate Effective this year the changes may help steer more potential Fewer vehicles qualify for the 7 500 federal tax rebate in 2024 but it s now easier to access the credit at the time of purchase If you buy a qualified used EV or fuel cell vehicle from a

The IRS today released Notice 2024 20 PDF 113 KB providing a list of census tracts eligible for the alternative fuel vehicle refueling property credit under section 30C as amended by H R 5376 commonly called the Inflation Reduction Act IRA in Appendix A PDF 571 KB and Appendix B PDF 1 5 MB and explaining how to identify the 11 digit census tract identifier for the location Get a tax credit of up to 7 500 for new vehicles purchased in or after 2023 Pre Owned Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a credit of up to 4 000 for used vehicles purchased from a dealer for 25 000 or less The amount equals 30 of purchased price with a maximum credit of 4 000 Other requirements apply

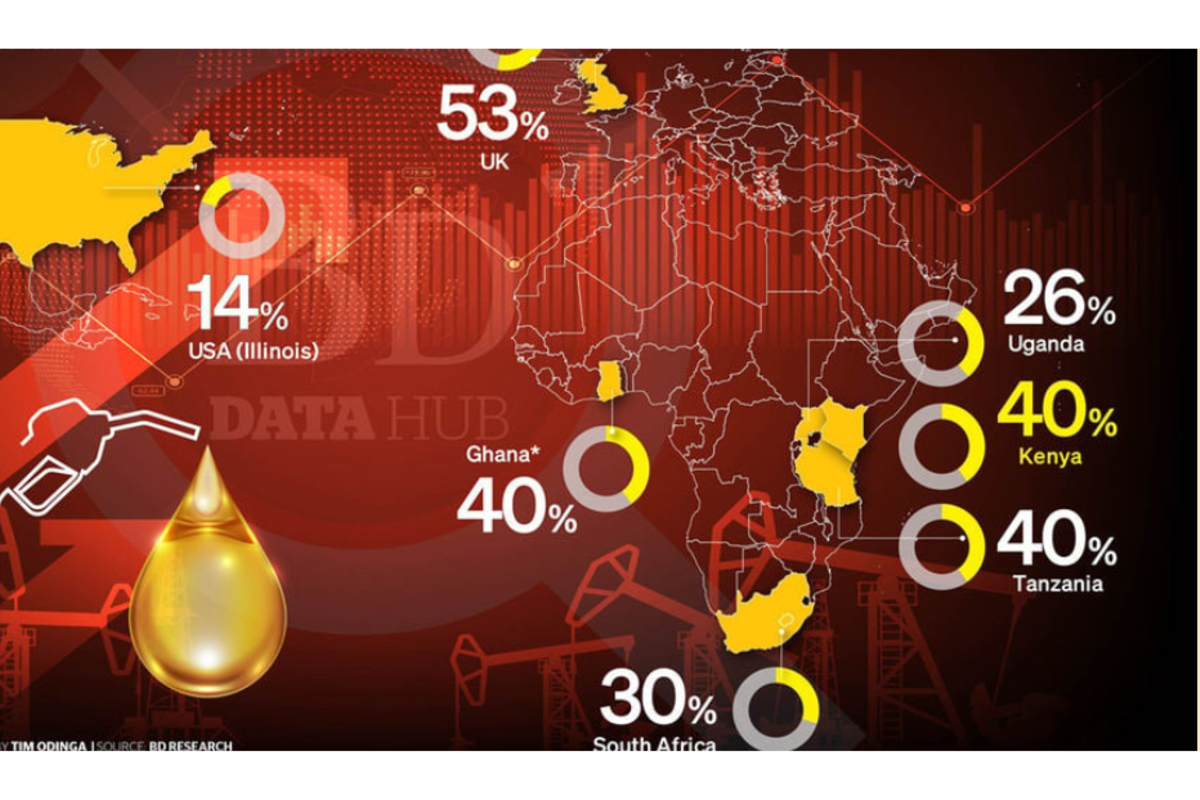

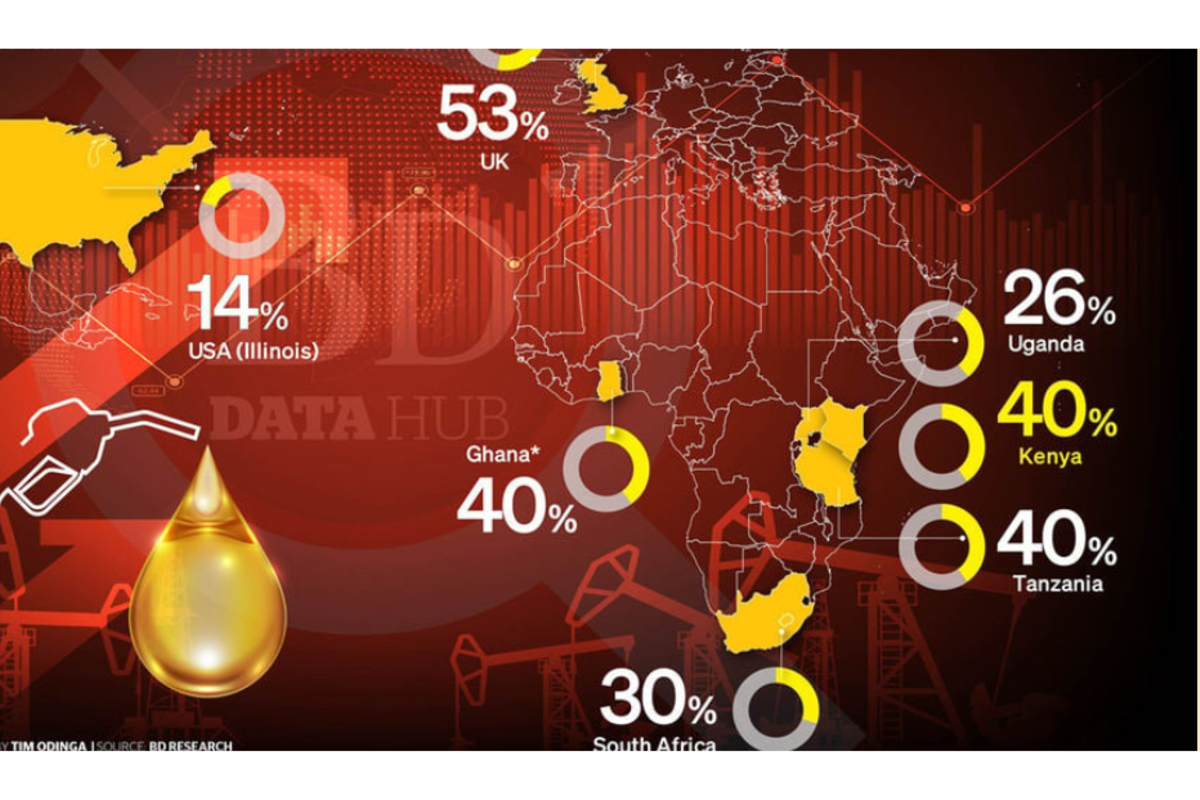

Tanzania And Kenya Collect Highest Taxes On Fuel The Citizen

https://www.thecitizen.co.tz/resource/image/4300098/landscape_ratio3x2/1200/800/2630f0fba82d61b6e8c1117daa1b38ef/Vn/fuel-tax.png

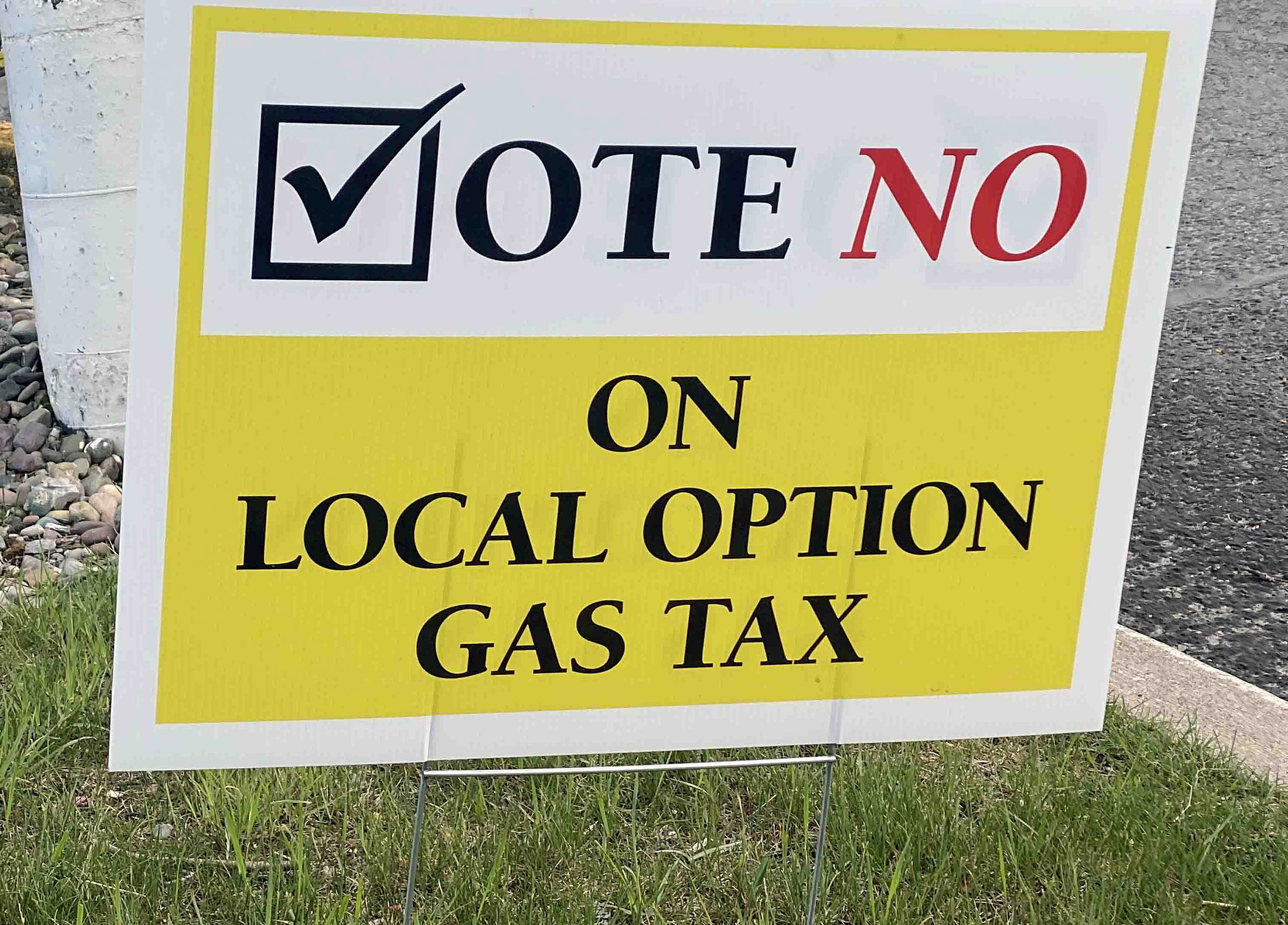

Campaign Posters Opposing 2 cent Fuel Tax Prompt Complaint To Montana COP Missoula Current

https://missoulacurrent.com/wp-content/uploads/2020/05/fuel-tax-scaled.jpg

https://www.irs.gov/businesses/small-businesses-self-employed/fuel-tax-credits

Fuel Tax Credits Reinstated and Extended Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits through December 31 2024 Alternative fuel credit Alternative fuel mixture credit Second generation biofuel producer credit

https://www.fueleconomy.gov/feg//pdfs/guides/FEG2024.pdf

FUEL ECONOMY GUIDE 2024 3 Federal Tax Credits You may be eligible for a federal income tax credit of up to 7 500 if you purchase a qualifying all electric vehicle EV plug in hybrid or fuel cell vehicle in 2023 2024 Qualifying EVs and plug in hybrids have been eligible for a federal income tax credit for over a decade but the Ination

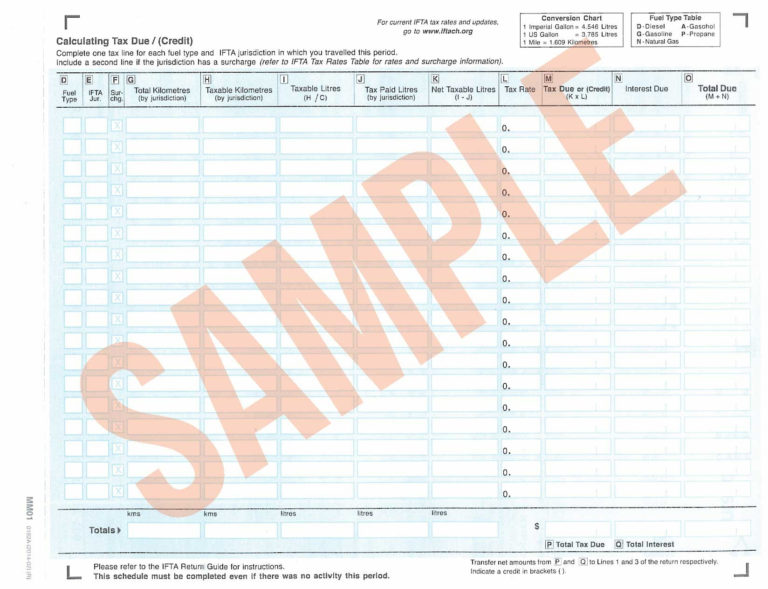

IFTA Quarterly Fuel Tax Filing Payhip

Tanzania And Kenya Collect Highest Taxes On Fuel The Citizen

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Ruto s Proposal To Reinstate The 16 Percent Fuel Tax Exposes His Doublespeak AfrinewsKE

Why Do We Have A Fuel Tax Fuel Express

Fuel Taxes Greater Auckland

Fuel Taxes Greater Auckland

Here s How To Claim Your Missouri Gas Refund On July 1st

Ifta Fuel Tax Spreadsheet Db excel

The Latest Disability News

Fuel Tax Rebate 2024 - Plug in electric vehicles and fuel cell vehicles placed in service in 2023 or later may be eligible for a federal income tax credit of up to 7 500