Federal Government Rebates 2024 Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

How to maximize your 2024 tax refund according to a CPA 02 34 Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax The federal government is the largest purchaser of goods and services in the world making federal contracts a powerful tool to build wealth in underserved communities and ensure that the federal

Federal Government Rebates 2024

Federal Government Rebates 2024

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1cGWIS.img?w=1920&h=1080&m=4&q=94

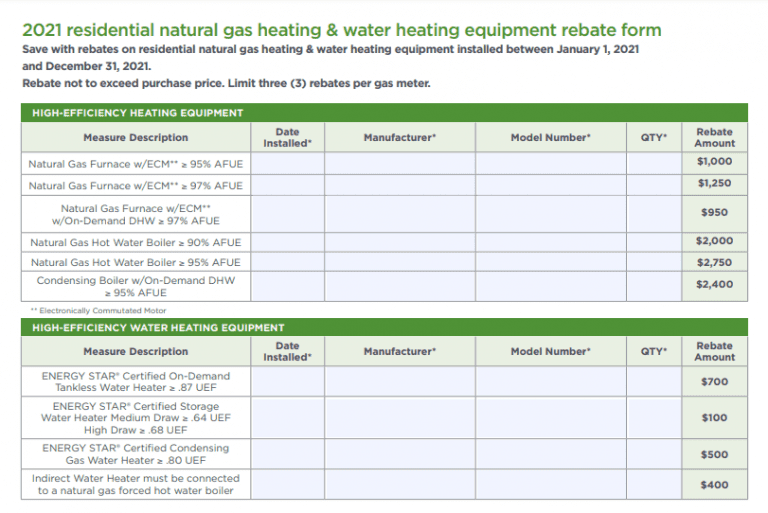

Mass Save Rebate Form 2021 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/12/Residential-Mass-Save-Rebate-Form-2021-768x513.png

Federal Rebates Homesol Building Solutions

http://homesolbuildingsolutions.com/wp-content/uploads/2021/08/homesol-federal-rebates-thumbnail.jpg

IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline In 2024 Gov Josh Shapiro said that older residents would receive more financial help courtesy of his signed Act 7 of 2023 The law expanded the Property Tax Rent Rebate to provide a larger tax

A roughly 80 billion tax package under consideration in the US Congress includes an expansion of the child tax credit a mechanism by which American families reduce the federal taxes they owe Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax

Download Federal Government Rebates 2024

More picture related to Federal Government Rebates 2024

The Federal Government Wants To Regulate Tampons For Men The Counter Signal

https://thecountersignal.com/wp-content/uploads/2022/10/MEN-1024x576.jpeg

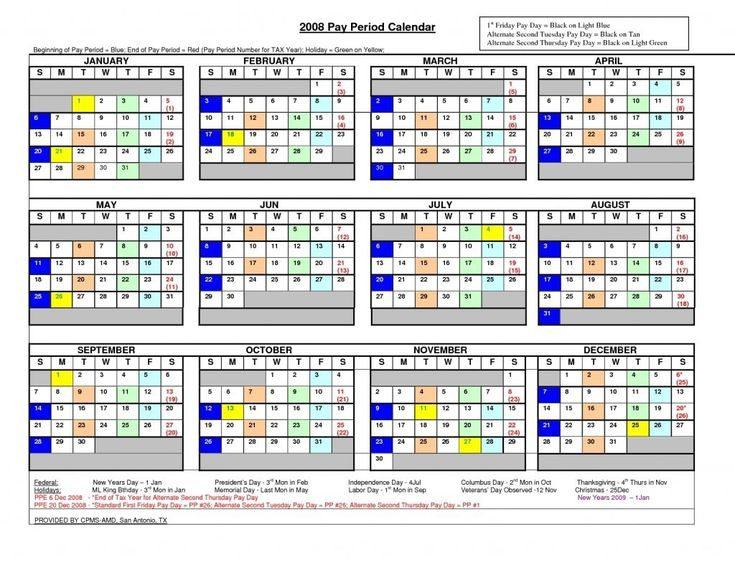

Federal Government Pay Period Calendar 2024 2024 Calendar Printable

https://www.2024calendar.net/wp-content/uploads/2022/08/federal-pay-period-calendar-for-2020-period-calendar-payroll.jpg

Government Rebates Armidale Montessori Preschool

https://www.armidalemontessori.nsw.edu.au/wp-content/uploads/2020/11/Government-Rebates-1920X650.png

The third short term funding bill for fiscal year 2024 funds the federal government in two tranches four appropriations bills will expire March 1 and the remaining eight bills will expire March 8 The American Rescue Plan increased the Child Tax Credit from 2 000 to 3 000 per child for children age 6 and over and to 3 600 per child for Congressional negotiators announced a roughly 80 billion deal on Tuesday to expand the federal child tax credit that if it becomes law would make the program more generous primarily for low

Tax Tip 2024 03 Jan 22 2024 IRS Free File is now available for the 2024 filing season With this program eligible taxpayers can prepare and file their federal tax returns using free tax software from trusted IRS Free File partners This tax credit has a much lower income cap 150 000 for a household 75 000 for a single person Again that s adjusted gross income meaning an individual s salary may be higher than that and

Home Affairs Peter Dutton Speaks During A Press Conference On News Photo Getty Images

https://media.gettyimages.com/id/1070877454/photo/federal-government-discusses-plans-to-strip-citizenship-from-australians-with-extremist-links.jpg?s=1024x1024&w=gi&k=20&c=wk9RcUl9YPijeGB7qu_naBv6TM-m3xcM1TDvTVwiIjM=

:max_bytes(150000):strip_icc()/current-u-s-federal-government-spending-3305763_FINAL-97fae60c01ba4ca2b67a244ca2dcce58.gif)

Current U S Federal Government Spending

https://www.thebalancemoney.com/thmb/GkC_zgbAJ29k0wzlO_DMi-UaZE8=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/current-u-s-federal-government-spending-3305763_FINAL-97fae60c01ba4ca2b67a244ca2dcce58.gif

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

https://www.cbsnews.com/news/tax-refund-2024-what-to-expect-when-will-i-get/

How to maximize your 2024 tax refund according to a CPA 02 34 Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax

District Of Columbia Student Loan Forgiveness Programs Washington Dc State District Of

Home Affairs Peter Dutton Speaks During A Press Conference On News Photo Getty Images

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The Inflation Reduction Act

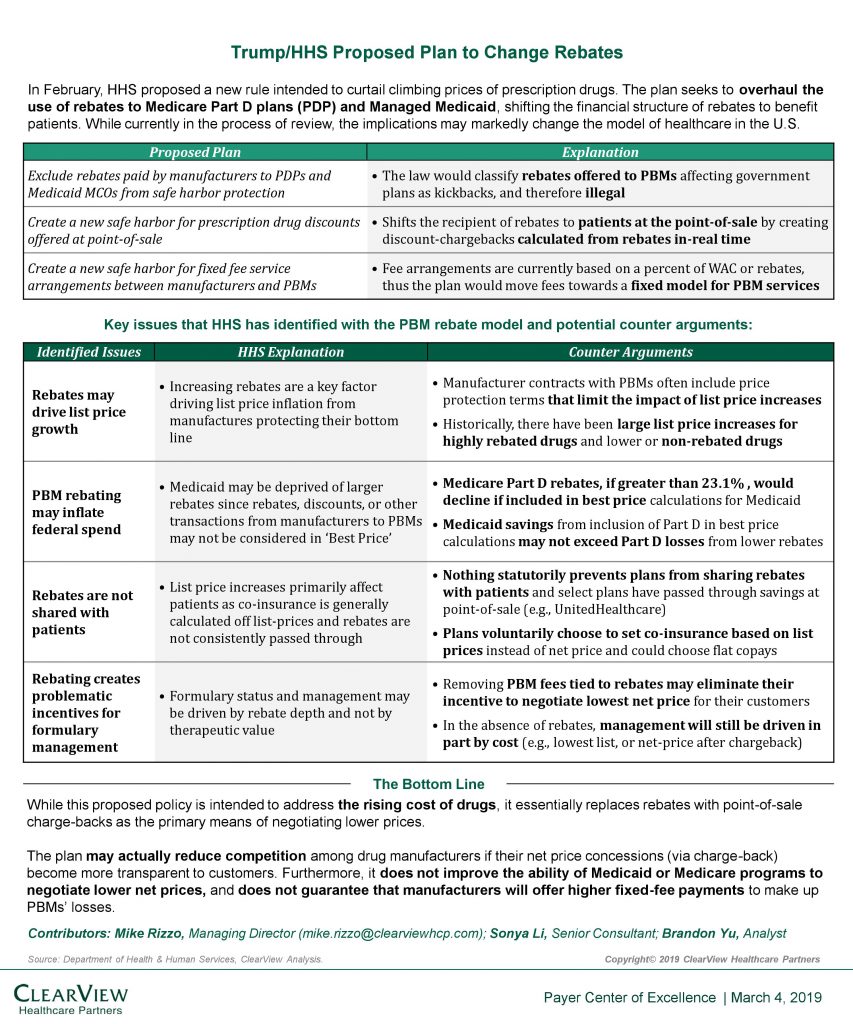

Trump HHS Proposal To Change Federal Drug Rebates Clearview Clearview

Federal Tax Rebates Electric Vehicles ElectricRebate

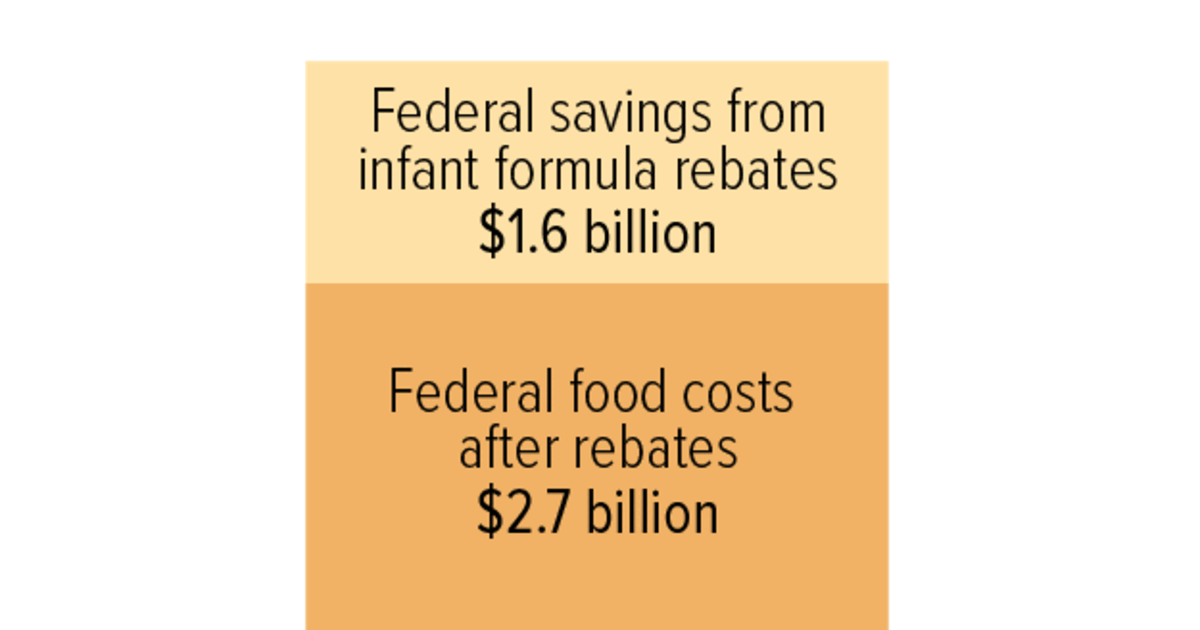

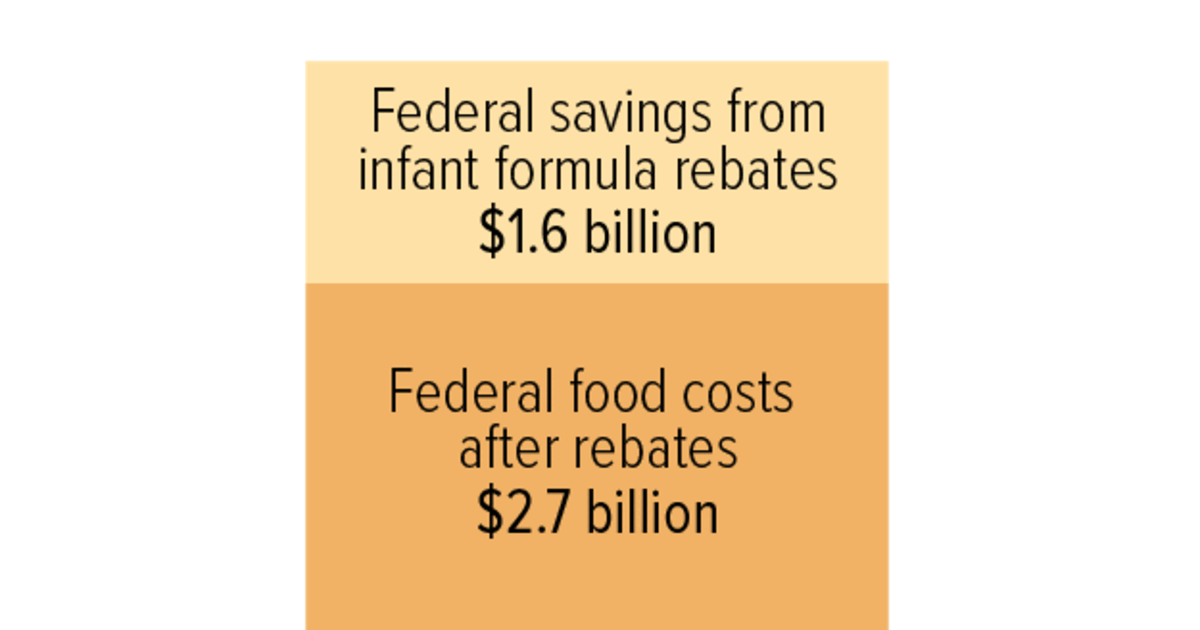

Infant Formula Rebates Reduce Federal WIC Costs Considerably Center On Budget And Policy

Infant Formula Rebates Reduce Federal WIC Costs Considerably Center On Budget And Policy

Rebates For Seniors Mark Coure MP

CTV News On Twitter Most Canadians Got More From Carbon price Rebates Than They Spent In 2021

Federal Government Organization Jobs 2019 Latest Apply Online OTS

Federal Government Rebates 2024 - IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline