Tax Rebate Slab 2024 IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

Tax Rebate Slab 2024

Tax Rebate Slab 2024

https://www.valueresearchonline.com/content-assets/images/47951_20220601-tax_slabs-old_and_new__w1000__.png

New Income Tax Slabs FY 2023 2024 Update New Income Tax Slabs No Tax Till 7 Lakh TeacherNews

https://teachernews.in/wp-content/uploads/2023/02/New-Income-Tax-Slabs-FY-2023-2024-Update.jpg

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com Www vrogue co

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3.jpg

If you have a personal finance question for Washington Post columnist Michelle Singletary please call 1 855 ASK POST 1 855 275 7678 Last year that came to 3 167 on average The 2024 tax The tax year 2024 adjustments described below generally apply to income tax returns filed in 2025 The tax items for tax year 2024 of greatest interest to most taxpayers include the following dollar amounts The standard deduction for married couples filing jointly for tax year 2024 rises to 29 200 an increase of 1 500 from tax year 2023

When tax filing season opens on January 29 some taxpayers will have the option of filing their 2023 federal tax returns with a brand new government run system Known as Direct File the free Tap the Banking tab on the bottom left side of your screen It s the one shaped like a building 3 Scroll down and select Direct Deposit It ll note that you can get your money two days faster 4

Download Tax Rebate Slab 2024

More picture related to Tax Rebate Slab 2024

Income Tax Slabs Gambaran

https://inmarathi.com/wp-content/uploads/2020/02/tax-slabs-2.jpg

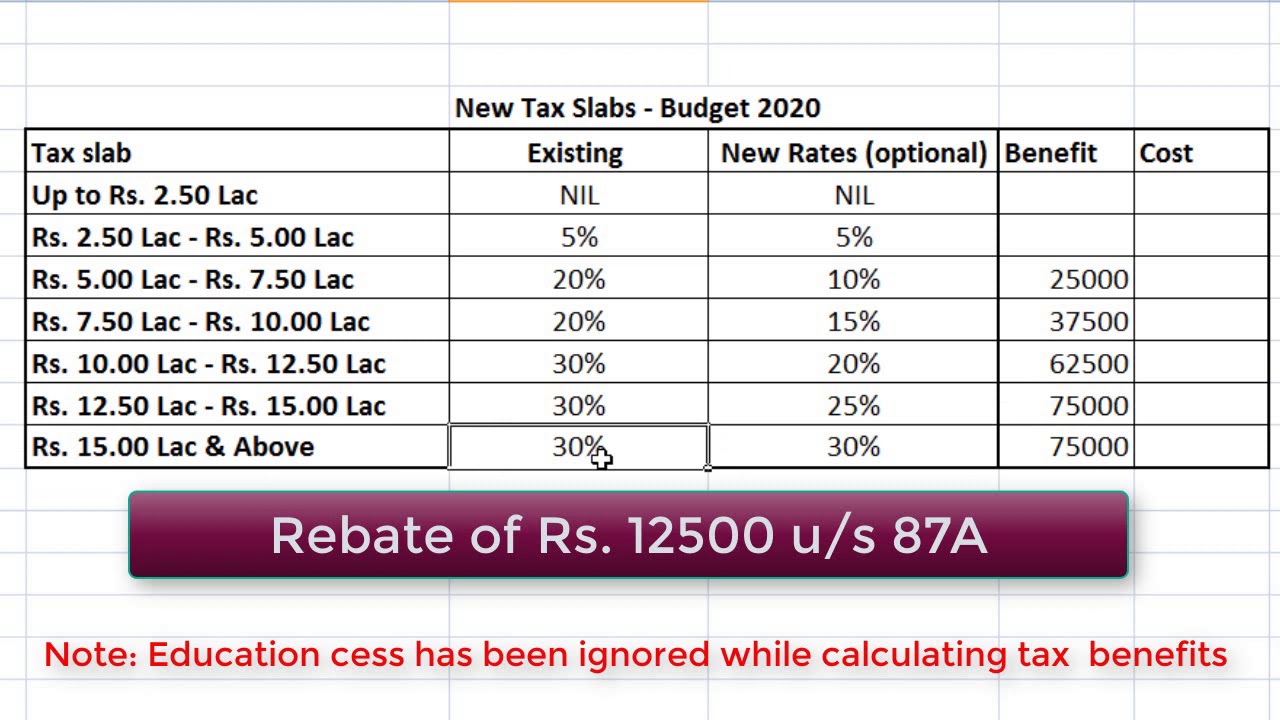

New Income Tax Slab And Tax Rebate Credit Under Section 87A With Automated Income Tax Revised

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

The AMT exemption rate is also subject to inflation The AMT exemption amount for tax year 2024 for single filers is 85 700 and begins to phase out at 609 350 in 2023 the exemption amount for The rates currently are set at 10 12 22 24 32 35 and 37 For 2024 the lowest rate of 10 will apply to individual with taxable income up to 11 600 and joint filers up to 23 200 The

In 2024 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 The federal income tax has seven tax rates in 2024 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable January 23 2024 Image Got an email or text message about a tax refund It s a scam IRS impersonators are at it again This time the scammers are sending messages about your tax refund or tax refund e statement It might look legit but it s an email or text fake trying to trick you into clicking on links so they can steal

New Income Tax Slab 2023 24

https://moneyexcel.com/wp-content/uploads/2023/02/incometax-slab-2023-24.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

Know The New Income Tax Slab Rates For FY 2023 24 AY 2024 25 Academy Tax4wealth

New Income Tax Slab 2023 24

Income Tax 2023 24 FY 2024 25 AY New IT Slab Rates Online Income Tax Calculator 2023 24

Budget 2023 How Much Income Tax Do You Pay Now Under New Tax Regime Quick Guide India Today

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Income Tax Rates Slab For FY 2023 24 AY 2024 25 Ebizfiling

Income Tax Rates Slab For FY 2023 24 AY 2024 25 Ebizfiling

Income Tax Slab Fy 2022 23 Ay 2023 24 Old New Regime Home Interior Design

Income Tax Slab Budget 2023 LIVE Updates Highlights Tax Rebate New Tax Regime Vs Old

Tax Calculator Income Tax Calculator How

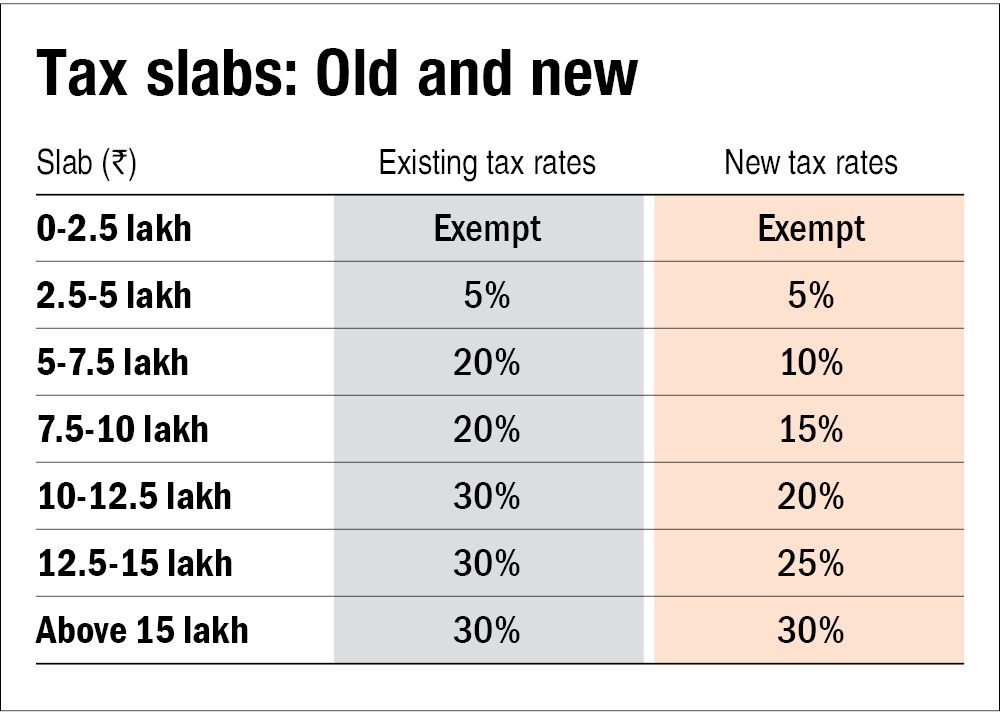

Tax Rebate Slab 2024 - The income tax slabs are revised periodically typically during each budget These slab rates vary for different groups of taxpayers Let us take a look at all the slab rates applicable for FY 2022 23 AY 2023 24 and FY 2023 24 AY 2024 25 Income Tax Slab Rates For FY 2022 23 AY 2023 24 a New Tax regime