Federal Tax Credit 2024 You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for If you have qualified

While you may not be able to avoid paying all taxes there are tax breaks that allow you to lower your 2022 tax bill Tax deductions lower your taxable income how much of your income you actually pay tax on while Find out the federal and provincial territorial tax credits for 2024 including the basic personal amount the age amount the disability amount and the caregiver amount See the indexation

Federal Tax Credit 2024

Federal Tax Credit 2024

https://www.moneydigest.com/img/gallery/evs-that-are-eligible-for-a-federal-tax-credit-in-2024/l-intro-1706717045.jpg

Setc Tax Credit 2023 1099 Expert

http://1099.expert/wp-content/uploads/2023/12/image-title-Generate-high-resolution-50941.png

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

https://i.ytimg.com/vi/Hg0fOlxqHpU/maxresdefault.jpg

Tax credits can come in handy when tax filing season rolls around Here s a breakdown of common ones including the earned income credit child tax credit and clean energy credits For 2024 the maximum Earned Income Tax Credit EITC amount available is 7 830 for married taxpayers filing jointly who have three or more qualifying children it was

As of December 2024 about 23 million workers and families received about 64 billion from the federal earned income tax credit according to IRS data Claiming the credit can reduce the tax We re going to look at seven of the big tax credits in 2024 and 2025 The new changes to the tax code increase the amount of tax credits and deductions for millions of Americans

Download Federal Tax Credit 2024

More picture related to Federal Tax Credit 2024

Contact Us Tax O Bill

https://www.taxobill.com/wp-content/uploads/2021/04/1.png

Simplifying The Complexities Of R D Tax Credits TriNet

https://images.contentstack.io/v3/assets/blt9ccc5b591c9e2640/blt64bfb078a74eaa48/643963cd9074ca2928c792b6/RD-Tax-Credits-thumbnail.jpg

Estimate Your Tax Credit Deduction Alliantgroup

https://www.alliantgroup.com/wp-content/uploads/2022/05/web-photo_aglogo-04-scaled-1.jpg

The 2024 Tax Tables included within the 1040 instruction booklet offer a simplified method to calculate your federal income tax for the 2024 tax year What are the Tax Tables The Tax And here s the very best part some tax credits are partly or fully refundable

For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids For the tax year 2024 the some portion of the earned income tax credit is available for filers with three or more qualifying children with an adjusted gross income up to 59 899 if

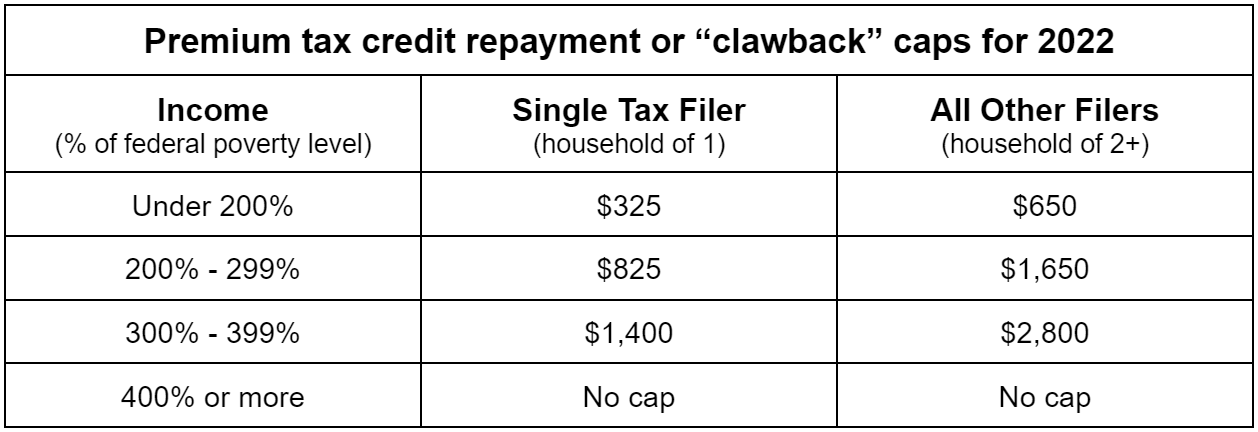

The Premium Tax Credit subsidy Clawback

https://uploads-ssl.webflow.com/5f8b3b580a028fb03a114a0c/635e8110482d4a62090ff7d0_premium tax credit repayment caps 2022.png

Used Car Tax Credit 2024 Donnie Jessalyn

https://andersonadvisors.com/wp-content/uploads/2023/04/Electric-vechiles.jpg

https://www.irs.gov › credits

You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for If you have qualified

https://www.policygenius.com › taxes › tax …

While you may not be able to avoid paying all taxes there are tax breaks that allow you to lower your 2022 tax bill Tax deductions lower your taxable income how much of your income you actually pay tax on while

Tax Credit Universal Credit Impact Of Announced Changes House Of

The Premium Tax Credit subsidy Clawback

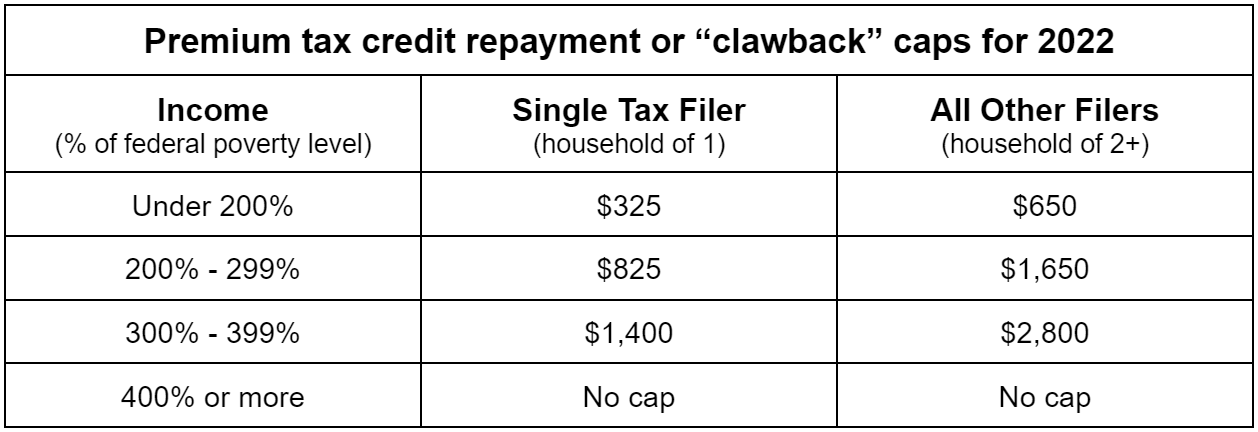

House GOP Tax Plan Details Analysis Tax Foundation

Federal Tax Rates By Income Group And Tax Source

Solar Tax Credit Extended 2 More Years SunWork

Federal Tax News For Businesses PKF Mueller

Federal Tax News For Businesses PKF Mueller

What s New For 2023 Tax Year Get New Year 2023 Update

Tax Financial Accounting Solutions

EV Tax Credit 2024 Federal Tax Credit How To Claim EV Tax Credit 2023

Federal Tax Credit 2024 - A refundable tax credit is a credit you can get as a refund even if you don t owe any tax Tax credits are amounts you subtract from your bottom line tax due when you file your