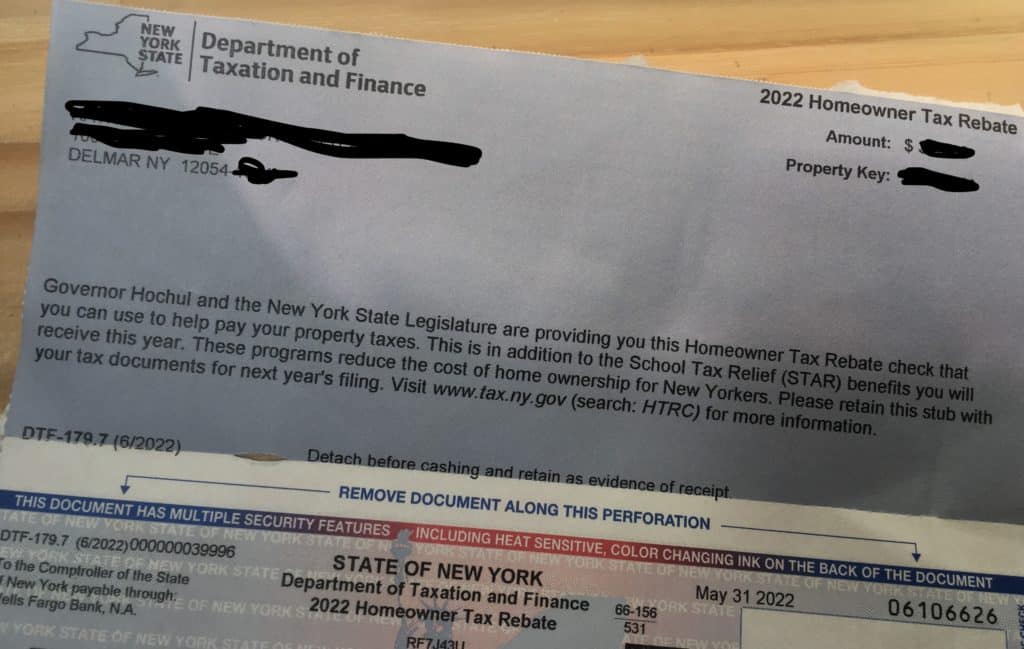

Ny Homeowner Tax Rebate Check 2024 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks

To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state

Ny Homeowner Tax Rebate Check 2024

Ny Homeowner Tax Rebate Check 2024

https://bplc.cssny.org/assets/Tools-Puzzle-Piece-Only - clear background-bd0547fd151a7c846519968fecddde810372d2bd0a60b7c74e85109663f0482b.png

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check WSTM

https://cnycentral.com/resources/media/bb776db9-9697-43c3-882f-8577bedc9e89-large16x9_tax_rebate.PNG?1659649234084

NY Homeowner Tax Rebate Checks Are In The Mail RBT CPAs LLP

https://www.rbtcpas.com/wp-content/uploads/2022/07/NY-Homeowner-Tax-Rebate-Checks-Are-in-the-Mail.jpg

Enhanced STAR is an extra benefit for seniors age 65 and older with incomes up to 93 200 for the 2023 2024 school year It exempts the first 81 400 of the full value of a home from school How much is the credit The amount of the credit is the product of the amount of real property tax which exceeds 6 of the taxpayer s qualified gross income QGI and a specified rate based on the taxpayer s QGI To claim the credit the computed amount must exceed 250 The maximum credit allowed is 350

Governor Hochul Announces Support for Homeowners Tenants and Public Housing Residents as Part of FY 2024 Budget Adds 391 Million for New York s Emergency Rental Assistance Program to Support Thousands More Tenants and Families Including New York City Housing Authority Residents and Section 8 Voucher Recipients For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on Federal Schedule C D E or F doesn t exceed 3 000 the net amount of any other separate category of loss doesn t exceed 3 000 and

Download Ny Homeowner Tax Rebate Check 2024

More picture related to Ny Homeowner Tax Rebate Check 2024

The NY Homeowner Tax Rebate Credit Benefits Plus

https://bplc.cssny.org/assets/linkedin-icon-5ff5aa97efc0e889cb997abf2c0d0ef5c224dc9cafc8b9ea42fb089e17829e7a.svg

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-600x503.png

Over 3M New Yorkers To Receive Homeowner Tax Rebate Checks This Summer Port Washington NY Patch

https://patch.com/img/cdn20/shutterstock/23121104/20220610/034752/styles/patch_image/public/shutterstock-228062581___10154715779.jpg?width=1200

To be eligible to receive a check residents must have qualified for a 2022 STAR credit or exemption have an income at or below 250 000 for the 2020 income tax year and a school tax ALBANY N Y In June Governor Kathy Hochul announced the one time Homeowner Tax Rebate Credit would be sent out available to eligible New Yorkers The state s Department of Taxation and

Recipients must have had a household income of 250 000 or less in 2020 to get a tax rebate credit this year Additionally they must have a school tax liability that is greater than the 1 How will I know if I am eligible for the property tax rebate 2 When will I receive my property tax rebate check 3 My check was damaged How can I get a replacement check 4 I received a check that was addressed to someone else What should I do with it 5 I received a letter asking me to provide more information

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=960&h=540&crop=1

The NY Homeowner Tax Rebate Credit Benefits Plus

https://bplc.cssny.org/assets/CSS_Logo-Primary_RGB-363335603cd0c3cf5b9d1fe47c61d9b44c382bb26e4d82ebafe30cabcebdaf94.svg

https://www.tax.ny.gov/pit/property/htrc/lookup.htm

2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit

Your Stories Q A Are You Still Waiting For Your Homeowner Tax Rebate Credit Check YouTube

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

When Will We Get The Extra Tax Rebate Checks In Montana Details

When Will We Get The Extra Tax Rebate Checks In Montana Details

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

One time Tax Rebate Checks For Idaho Residents KLEW

Ny Homeowner Tax Rebate Check 2024 - Enhanced STAR is an extra benefit for seniors age 65 and older with incomes up to 93 200 for the 2023 2024 school year It exempts the first 81 400 of the full value of a home from school