Federal Government Rebate Program 2024 The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

Communities across the U S experiencing the most significant effects of poverty represent a quarter of applications received WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS in partnership with the Department of Energy DOE announced remarkable demand in the initial application period for solar and wind facilities through the Inflation Reduction Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Federal Government Rebate Program 2024

Federal Government Rebate Program 2024

https://vonradio.com/wp-content/uploads/2023/01/Peace-program-pic-1.png

Gainpoint Grant Specialists

https://gainpoint.com.au/wp-content/uploads/2022/12/Untitled-design-19-1024x1024.png

Mass Save Rebate Form 2021 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/12/Residential-Mass-Save-Rebate-Form-2021-768x513.png

High Efficiency Electric Home Rebate Act HEEHRA This provides rebates for low and middle income families to electrify their homes such as by installing heat pumps or electric clothes The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

HOME ENERGY REBATES Home Efficiency Rebates Program Sec 50121 Home Electrification and Appliance Rebates Program Sec 50122 PROGRAM REQUIREMENTS APPLICATION INSTRUCTIONS Applications Due by January 31 2025 VERSION 1 1 U S Department of Energy Office of State and Community Energy Programs 1000 Independence Avenue SW Washington DC 20585 The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Download Federal Government Rebate Program 2024

More picture related to Federal Government Rebate Program 2024

Government Rebate For Hybrid Cars Ontario 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/used-ev-rebate-going-away-for-phevs-in-ontario-by-end-of-this-weekend.jpg

Federal Government Solar Rebate Solar Rebate Australia

https://www.pioneersolar.com.au/wp-content/uploads/2020/09/Untitled-design-2-e1600757607431.png

Federal Government Not Considering Removing Medicare Rebate For After Hours GPs Despite Doctors

https://images.perthnow.com.au/publication/C-797734/358bf8194ff68266276b85415982505fe9012655-16x9-x0y78w1500h844.jpg?imwidth=1200

Stimulus checks from the federal government ended a couple of years ago but some states have provided financial relief through tax rebate checks or inflation relief payments Last year many The Bulletin Privacy Policy Direct Payments Are Still Available However just because federal stimulus checks aren t likely doesn t mean Americans can t grab new direct payments Depending on the

Fewer vehicles qualify for the 7 500 federal tax rebate in 2024 but it s now easier to access the credit at the time of purchase Tesla and Rivian have the most vehicles on the list of Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30

Awasome Tax Rebate On Health Insurance References

https://i2.wp.com/navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

Rebate Program Get Up To 5000 Mister Contractor

https://www.mistercontractor.ca/wp-content/uploads/2021/05/government-rebate-picture.jpg

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

https://home.treasury.gov/news/press-releases/jy1945

Communities across the U S experiencing the most significant effects of poverty represent a quarter of applications received WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS in partnership with the Department of Energy DOE announced remarkable demand in the initial application period for solar and wind facilities through the Inflation Reduction

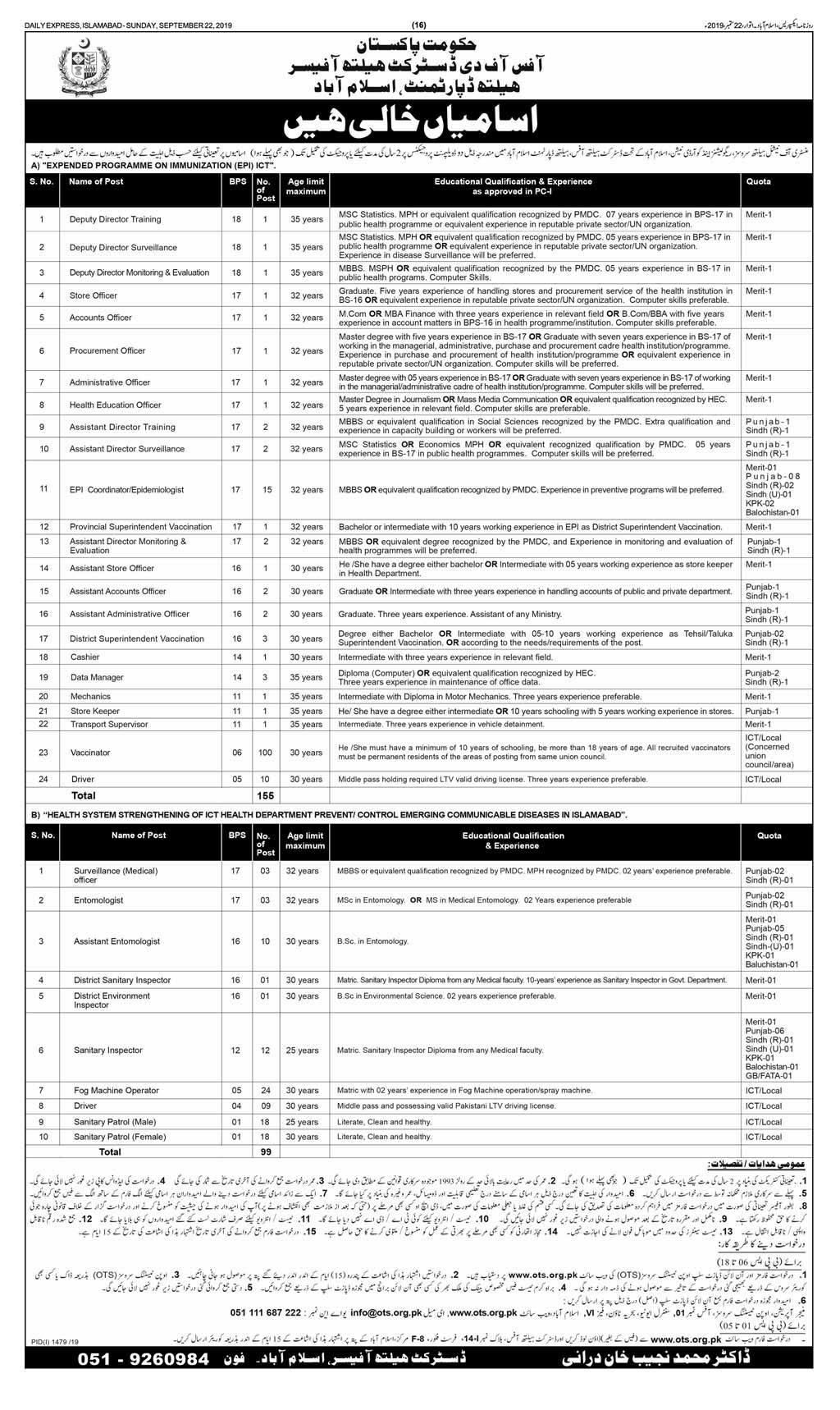

Government Of Pakistan Health Department Islamabad Jobs 2019 OTS

Awasome Tax Rebate On Health Insurance References

PA Rent Rebate Form Printable Rebate Form

:max_bytes(150000):strip_icc()/current-u-s-federal-government-spending-3305763_FINAL-97fae60c01ba4ca2b67a244ca2dcce58.gif)

Current U S Federal Government Spending

Issues On 774 000 Federal Government Special Public Work Program Will Be Resolved Soon Insight

Home Affairs Peter Dutton Speaks During A Press Conference On News Photo Getty Images

Home Affairs Peter Dutton Speaks During A Press Conference On News Photo Getty Images

Federal Government Department Jobs 2022 PO Box No 3104 Islamabad Filectory

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Senior Tax Rebate Program Downtown KCK 701 N 7th St Trfy Kansas City KS 66101 3035 United

Federal Government Rebate Program 2024 - High Efficiency Electric Home Rebate Act HEEHRA This provides rebates for low and middle income families to electrify their homes such as by installing heat pumps or electric clothes