Nc Income Tax Rebate 2024 It is a capital stock tax that is levied at a rate of 1 50 for every 1 000 of a corporation s North Carolina apportioned net worth The House passed budget would reduce this rate by 10 per year over five years starting in 2025 as shown in the table below Franchise Tax Reductions in House Passed Budget Year

Jan 27 2023 Today Governor Cooper joined the United States Department of the Treasury and Internal Revenue Service in recognizing January 27 as Earned Income Tax Credit EITC Awareness Day to encourage eligible North Carolinians to claim the tax credit on their upcoming federal taxes North Carolina s flat tax rate will decrease in 2024 the state revenue department said Dec 8 The tax rate decreases to 4 5 instead of 4 75 the department said on the first page of North Carolina s 2024 withholding methods The rate used for withholding including supplemental payments is 0 1 percentage points higher than the actual income tax rate meaning withholding uses a rate of

Nc Income Tax Rebate 2024

Nc Income Tax Rebate 2024

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of What You Should Claim

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

The standard deduction for a Widower Filer in North Carolina for 2024 is 25 500 00 North Carolina Widower Filer Tax Tables Federal Income Tax Tables in 2024 Federal Single Filer Tax Tables The federal standard deduction for a Single Filer in 2024 is 14 600 00 2023 1685 North Carolina law gradually reduces personal income tax rates starting in 2024 Under HB 259 enacted on October 3 2023 without the signature of Governor Roy Cooper the personal income tax rate is gradually reduced starting in 2024 until it reaches 3 99 in 2026

The North Carolina Tax Calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in North Carolina the calculator allows you to calculate income tax and payroll taxes and deductions in North Carolina This includes calculations for Employees in North Carolina to calculate their annual salary after tax As of January 2024 DEQ is applying for the planning grant funding for the Home Rebate programs With those funds DEQ will continue designing the state rebate program and application The State Energy Office will release more information as soon as it is available

Download Nc Income Tax Rebate 2024

More picture related to Nc Income Tax Rebate 2024

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://i0.wp.com/arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rebate-US-87A-for-AY-2024-25-FY-2023-24-1-1.png?w=1280&ssl=1

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

State Tax Changes Taking Effect January 1 2024 December 21 202317 min read By Manish Bhatt Benjamin Jaros Latest Updates See Full Timeline Thirty four states will ring in the new year with notable tax changes including 17 states cutting individual or corporate income taxes and some cutting both Are you ready for 2024 tax season Experts breaks down what you need to know before filing 05 47 Taxpayers in 14 states could get some financial relief this year thanks to lower individual tax

Massachusetts 62F Refunds Michigan Working Famlies Tax Credit Minnesota Rebate Checks Montana Tax Rebates New Mexico Rebate Checks Pennsylvania Rebate South Carolina Tax Rebate North Carolina Income Tax Rates for 2024 1 North Carolina Income Tax Table Note North Carolina s income tax has a single flat tax rate for all income Learn how marginal tax brackets work 2 North Carolina Income Tax Calculator How To Use This Calculator

Fortune India Business News Strategy Finance And Corporate Insight

https://images.assettype.com/fortuneindia/2023-02/3b8dd321-a9ba-4a6c-916b-573958eeef52/Tax_03160_copy.JPG?w=1250&q=60

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

https://taxfoundation.org/blog/nc-budget-north-carolina-tax-reform/

It is a capital stock tax that is levied at a rate of 1 50 for every 1 000 of a corporation s North Carolina apportioned net worth The House passed budget would reduce this rate by 10 per year over five years starting in 2025 as shown in the table below Franchise Tax Reductions in House Passed Budget Year

https://governor.nc.gov/news/press-releases/2023/01/27/governor-cooper-encourages-eligible-north-carolinians-claim-earned-income-tax-credit-eitc-federal

Jan 27 2023 Today Governor Cooper joined the United States Department of the Treasury and Internal Revenue Service in recognizing January 27 as Earned Income Tax Credit EITC Awareness Day to encourage eligible North Carolinians to claim the tax credit on their upcoming federal taxes

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check New Tax Rates BetaVersa

Fortune India Business News Strategy Finance And Corporate Insight

Income Tax Rebate Under Section 87A Union Budget 2023 YouTube

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief Of Tax In Hindi

Retirement Income Tax Rebate Calculator Greater Good SA

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And Rebate

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And Rebate

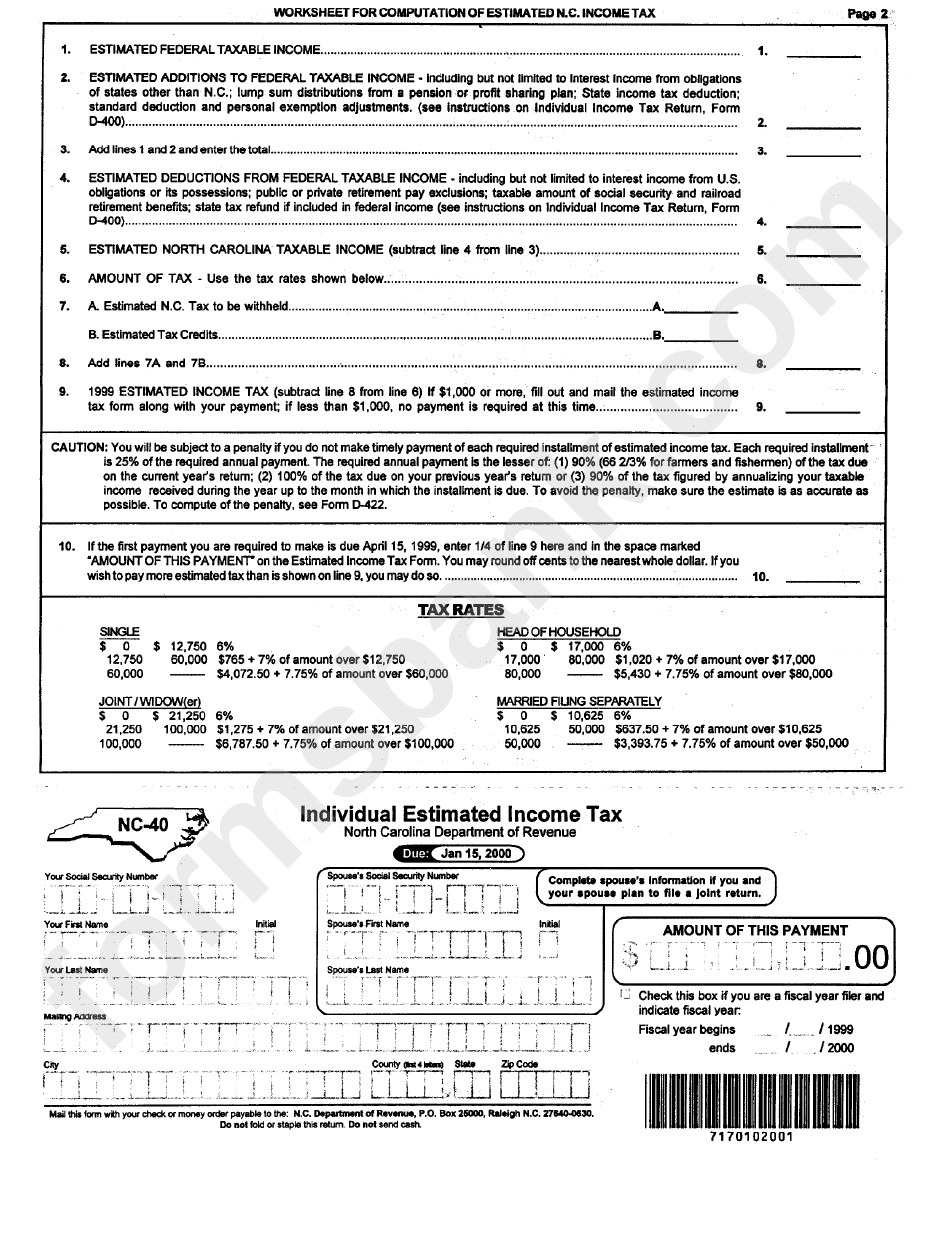

Fillable Form Nc 40 Individual Estimated Income Tax Printable Pdf Download

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax Calculation Examples FinCalC TV

Georgia Income Tax Rebate 2023 Printable Rebate Form

Nc Income Tax Rebate 2024 - The North Carolina Tax Calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in North Carolina the calculator allows you to calculate income tax and payroll taxes and deductions in North Carolina This includes calculations for Employees in North Carolina to calculate their annual salary after tax