Energy Rebate 2024 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

Resources Inflation Reduction Act of 2022 Frequently asked questions about energy efficient home improvements and residential clean energy property credits Credits and deductions under the Inflation Reduction Act of 2022 Interactive guide to energy credits available under the Inflation Reduction Act About Home Energy Rebates On Aug 16 2022 President Biden signed the landmark Inflation Reduction Act The law includes nearly 400 billion to support clean energy and address climate change including 8 8 billion in Home Energy Rebates which will provide two separate rebates to consumers The Home Efficiency Rebates will provide 4 3 billion to discount the price of energy saving

Energy Rebate 2024

Energy Rebate 2024

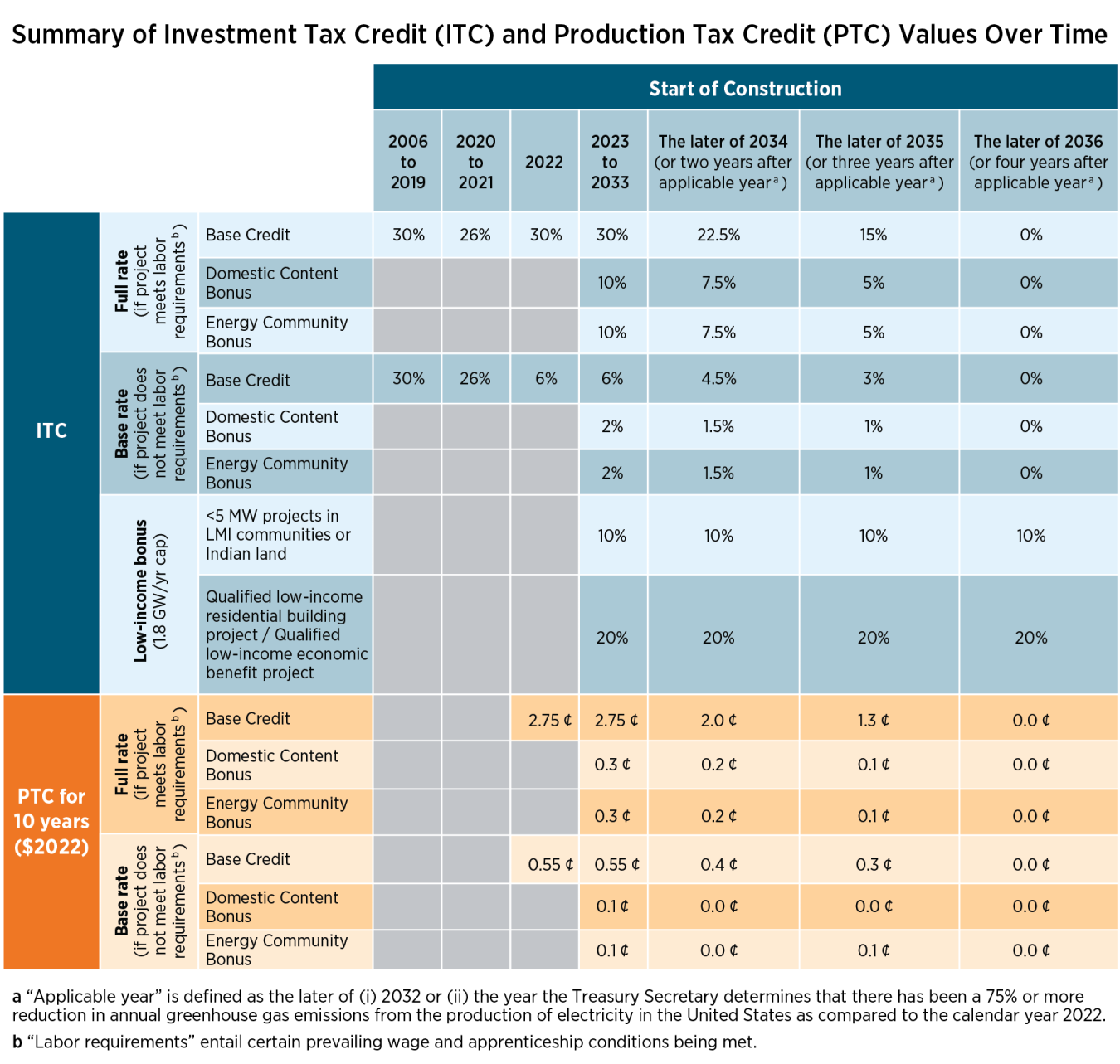

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

Edmonton Energy Rebate For Commercial Building Retrofits Solar Ninjas

https://solarninjas.energy/wp-content/uploads/2020/08/Rebate-rs-scaled-2560x1280.jpg

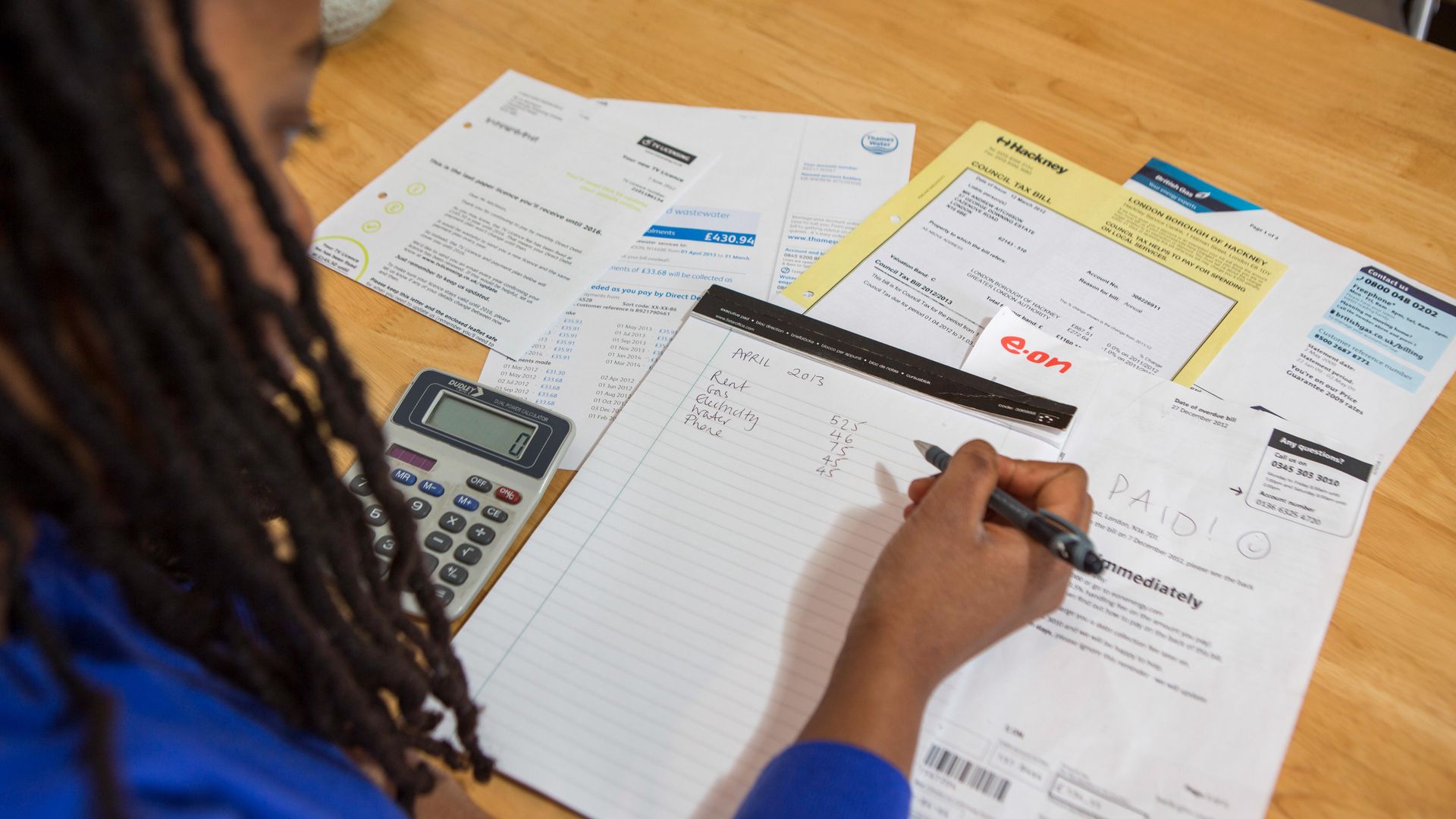

Student News Energy Bill Rebate University Of Nottingham

https://www.nottingham.ac.uk/CurrentStudents/Images/News/2019/energy-rebate-1200x600.x353c334f.jpg

The following are questions and answers regarding the Home Energy Rebates administered by the U S Department of Energy DOE and funded by the Inflation Reduction Act IRA For more information please visit the Home Energy Rebates page Question Categories January 2024 VERSION 1 1 Published on January 11 2024 Modification Note This version modifies sample responses for some of the questions below Recommendations for Home Energy Rebate Program Administrators webpage Home Efficiency Rebates State Programs Sec 50121 Use of Funds and Rebate Eligibility Section 3 1 1 Use of Funds 1

Here s how making energy efficiency part of your 2024 New Year s Resolutions could help you lower your energy costs and save our planet Resolution 1 Save Money Thanks to the Department of Energy s Savings Hub you can easily help determine what clean energy and energy efficiency incentives for home upgrades and appliances are best for you Home Energy Rebate Programs Requirements Application Instructions i INFLATION REDUCTION ACT HOME ENERGY REBATES Home Efficiency Rebates Program Sec 50121 Home Electrification and Appliance Rebates Program Sec 50122 PROGRAM REQUIREMENTS APPLICATION INSTRUCTIONS Applications Due by January 31 2025 VERSION 1 1

Download Energy Rebate 2024

More picture related to Energy Rebate 2024

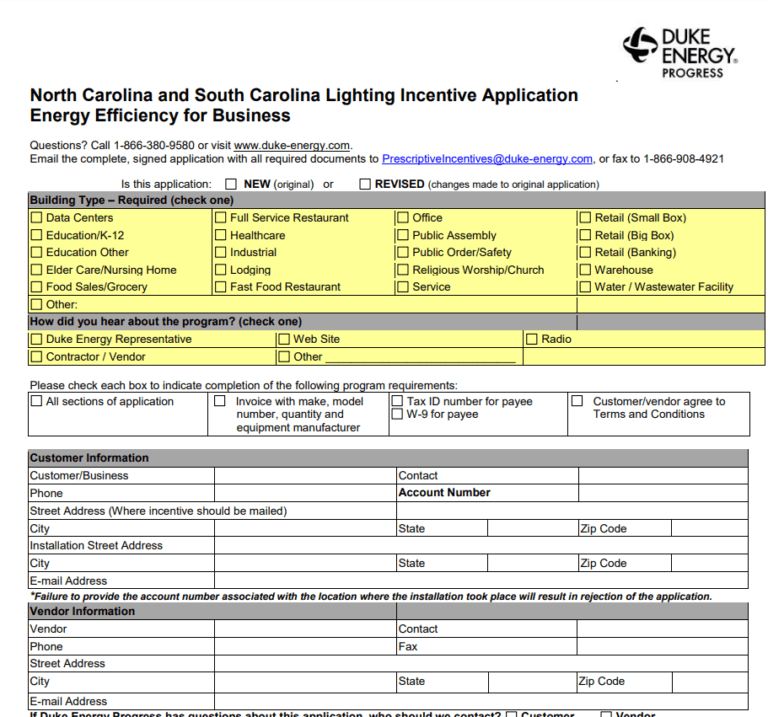

Duke Energy Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/08/Duke-Energy-Rebate-Form-768x717.png

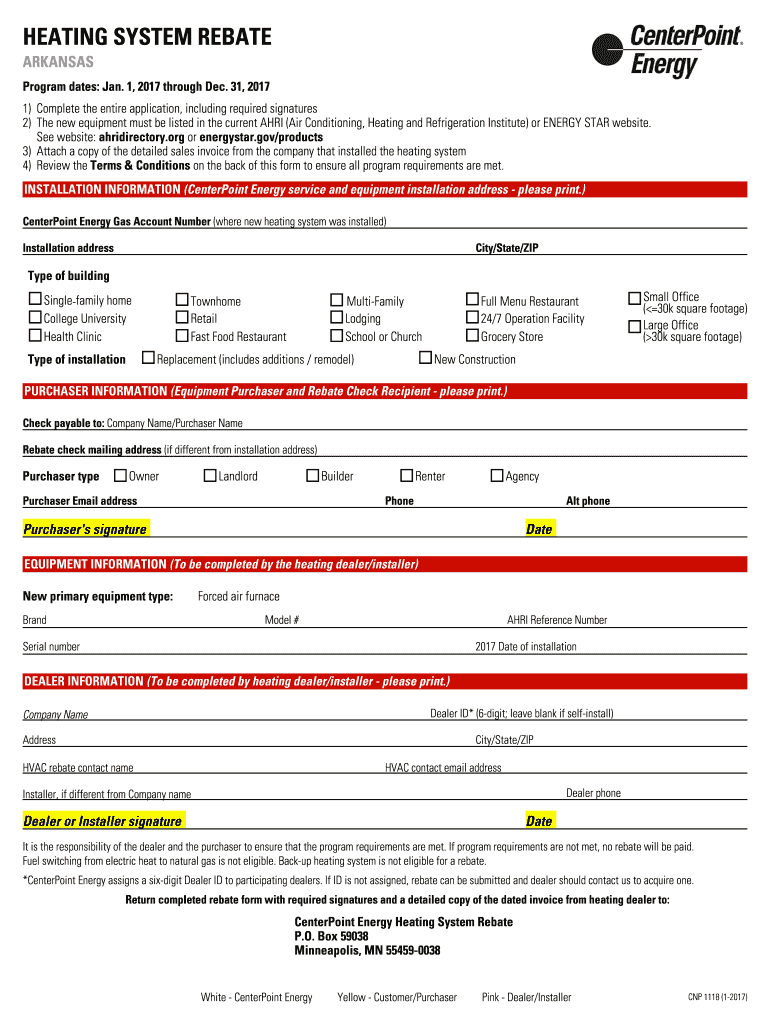

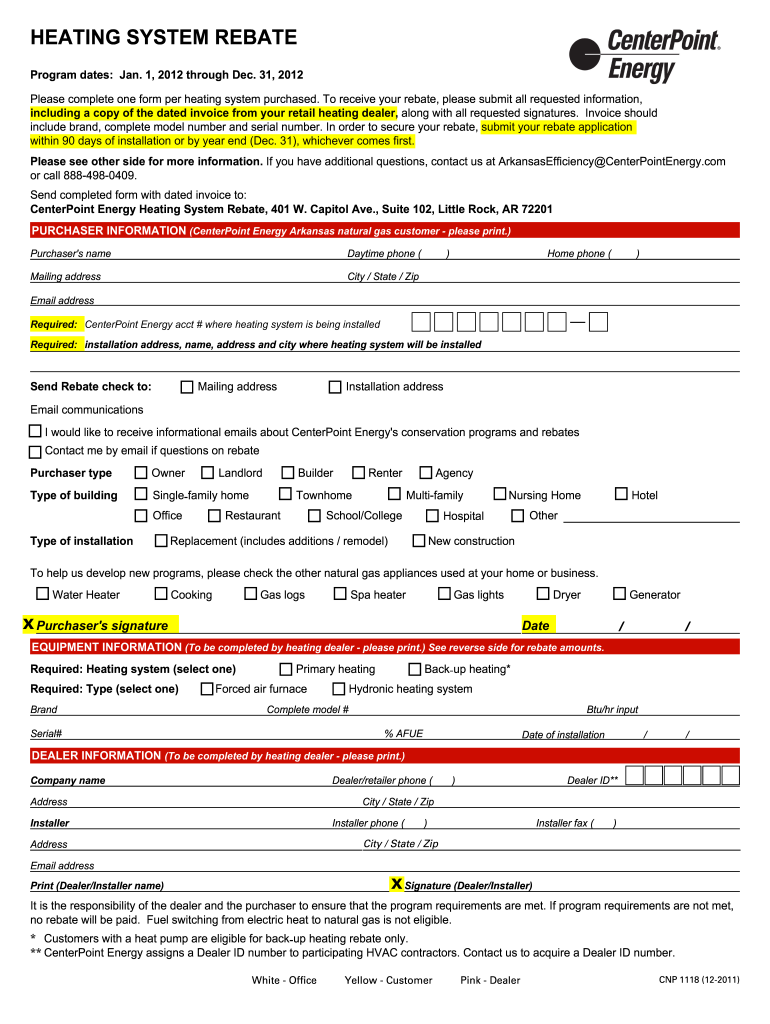

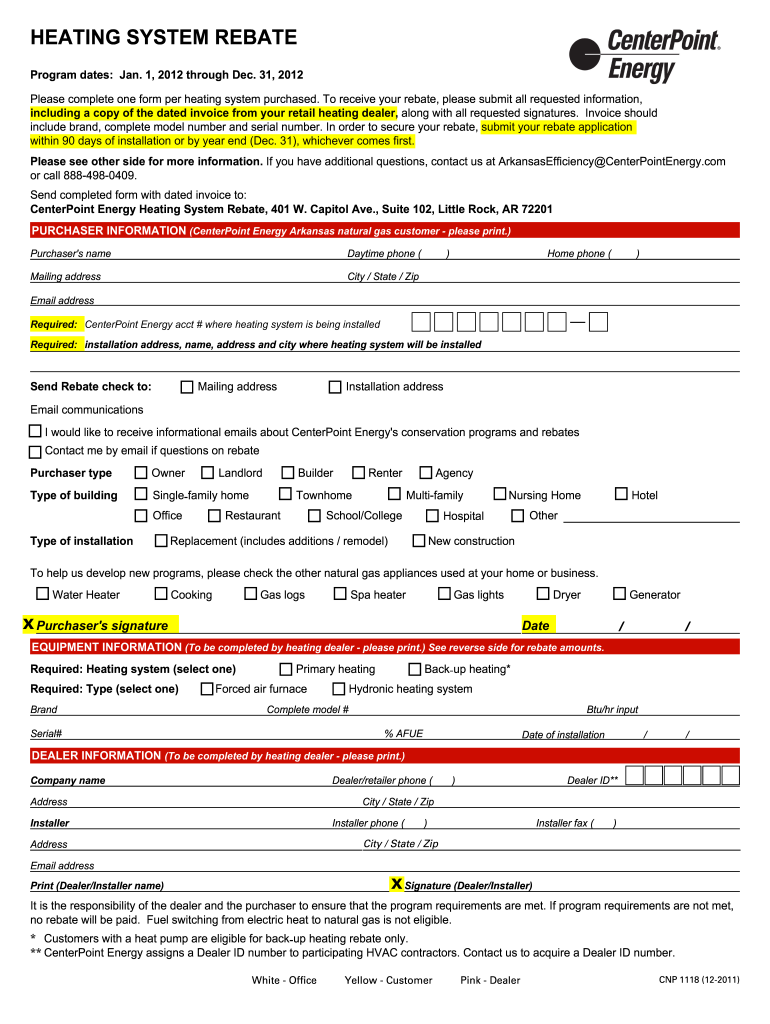

Centerpoint Rebate 2017 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/6/969/6969646/large.png

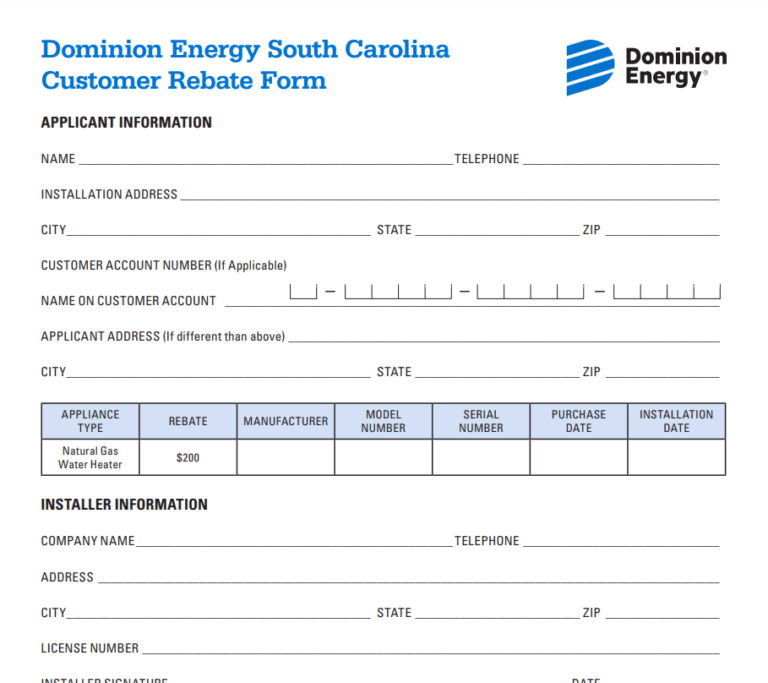

Mn Energy Rebate Forms Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Dominion-Energy-Rebate-Form-2023-768x683.png

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings

Western New York Get information on the money saving rebates available with National Fuel s energy efficiency rebate program 2024 Rebate Levels for 2024 Program Year Check out the rebate information for those appliances installed between January 1 2024 and December 31 2024 1 Installed between January 1 and December 31 2024 2 Annual Fuel Utilization Efficiency 3 Electronically Commutated Motor 4 One tune up service per furnace boiler per year 5 Uniform Energy Factor 6 In order to qualify for the enhanced furnace rebate the furnace w ECM must be installed with a heat pump with a SEER of at least 15 be AHRI certified A furnace installed with a traditional air

Center Point Energy Rebate Forms Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/6/360/6360648/large.png

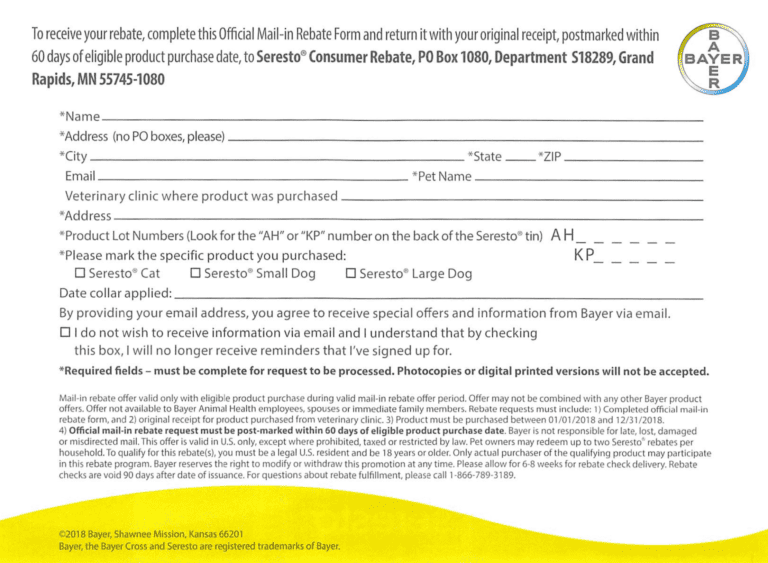

Seresto Rebate Form PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/09/Seresto-Rebate-Form-768x563.png

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Resources Inflation Reduction Act of 2022 Frequently asked questions about energy efficient home improvements and residential clean energy property credits Credits and deductions under the Inflation Reduction Act of 2022 Interactive guide to energy credits available under the Inflation Reduction Act

Mobil One Offical Rebate Printable Form Printable Forms Free Online

Center Point Energy Rebate Forms Fill Out And Sign Printable PDF Template SignNow

The 200 Energy Bills Rebate Everything You Need To Know TechRadar

2024 YouTube

Maryland Energy Rebates 2023 Printable Rebate Form

Lensrebates Alcon Com

Lensrebates Alcon Com

Buy 2024 Wall 2024 Jan 2024 Dec 2024 12 X 24 Open 12 Month Wall 2024 With Unruled

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

Alcon Rebate Form 2023 Printable Rebate Form

Energy Rebate 2024 - Home Focus on Energy Taking Advantage of Federal Tax Credits Starting in 2023 residents in Wisconsin can save more than ever before on energy efficient home upgrades Not only will these upgrades save you money on your utility bill but they may also be eligible for a rebate from Focus on Energy or a federal income tax credit Read More