State Of Illinois Property Tax Rebate 2024 Property tax On top of the income tax rebates some homeowners may receive more assistance Qualified property owners will receive a rebate equal to the property tax credit claimed

Residents with dependents will receive a rebate of up to 300 100 per dependent with a maximum of three Income limits of 200 000 per individual taxpayer or 400 000 for joint filers will Residents with dependents will receive a rebate of up to 300 100 per dependent with a maximum of three Income limits of 200 000 per individual taxpayer or 400 000 for joint filers will

State Of Illinois Property Tax Rebate 2024

State Of Illinois Property Tax Rebate 2024

https://files.illinoispolicy.org/wp-content/uploads/2017/02/IL-higher-property-taxes_Graphic-2--1024x885.png

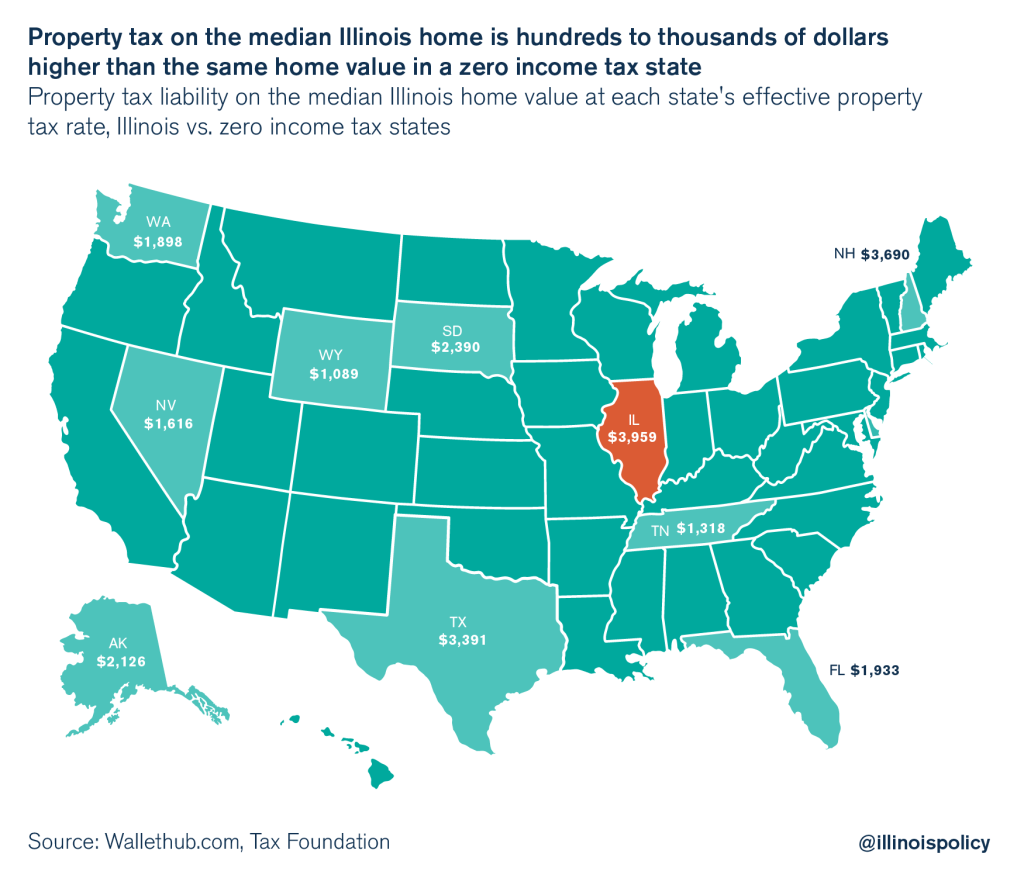

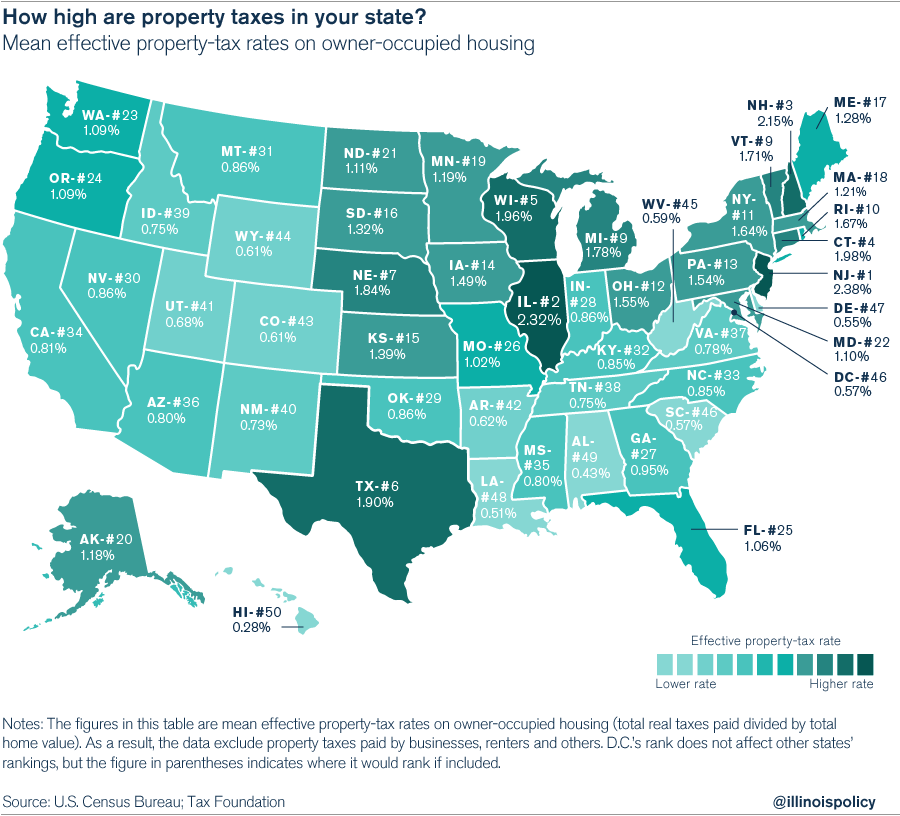

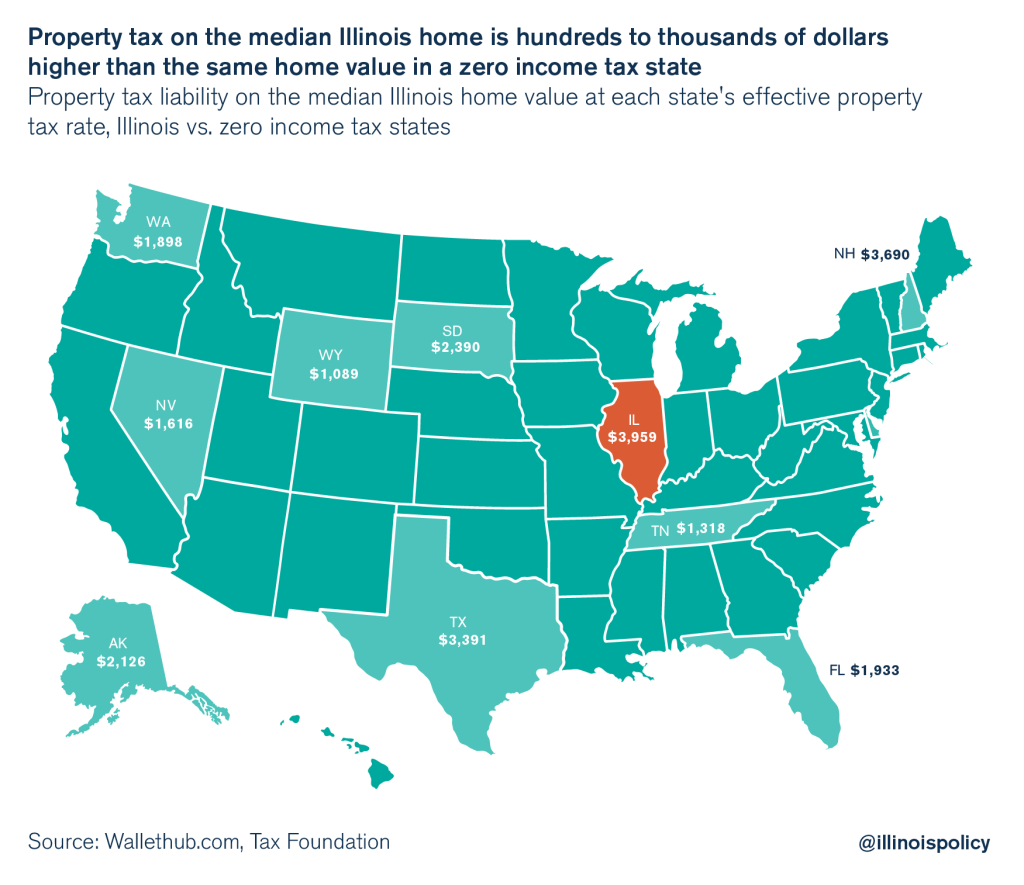

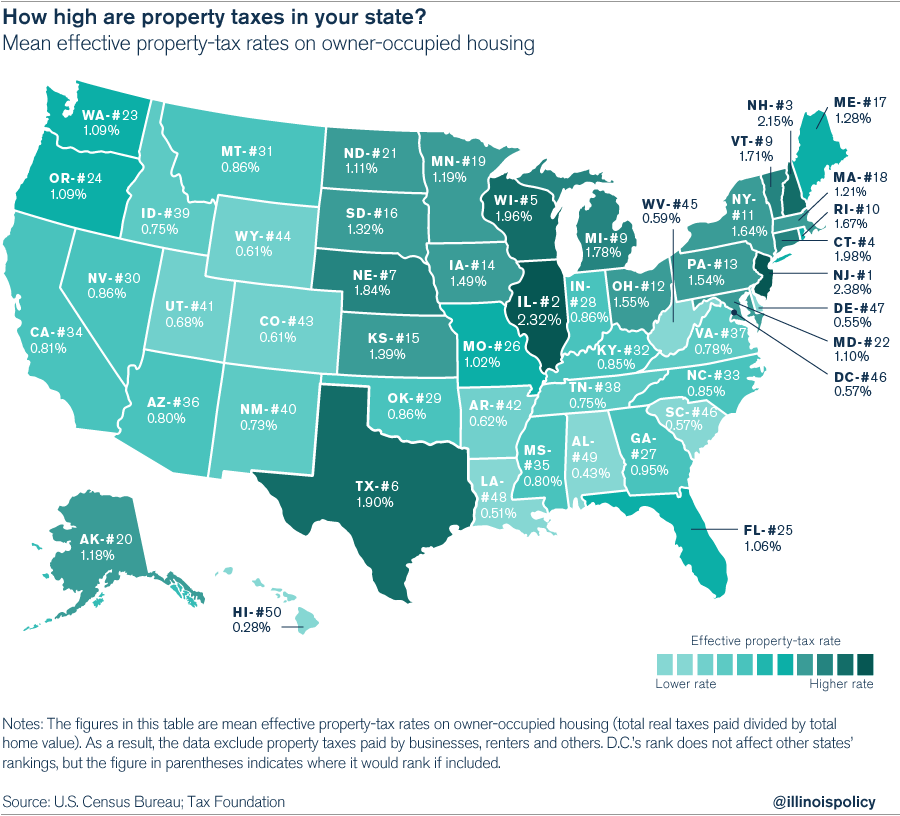

Illinois Homeowners Pay The Second highest Property Taxes In The U S

https://d2dv7hze646xr.cloudfront.net/wp-content/uploads/2015/08/01_PropertyTaxes_JobsGrowth.png

Illinois 1040 2017 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/453/14/453014487/large.png

The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum credit of 300 State of Illinois The income tax rebate works in a similar manner allowing individuals to claim a credit of 50 each with an additional 100 per dependent up to 300 Many Illinois residents who filed 2021 state income taxes and claimed a property tax credit will automatically receive a property tax rebate under Governor Pritzker s Illinois Family Relief Plan said Illinois Department on Aging IDoA Director Paula Basta

Homeowners who were able to claim the property tax credit on their 2021 tax returns will receive an additional rebate equal to the credit they claimed up to a maximum of 300 Those rebates will go to filers who earned less than 250 000 or 500 000 for a couple filing jointly No further action is needed from eligible Illinoisans who filed The Illinois Department of Revenue DOR April 1 released 2021 Form IL 1040 PTR Illinois Property Tax Rebate and instructions The instructions include that 1 taxpayers must complete the form to request their property tax rebate only if they weren t required to file Form IL 1040 Illinois Individual Income Tax Return or didn t previously file Schedule ICR with Form IL 1040 2

Download State Of Illinois Property Tax Rebate 2024

More picture related to State Of Illinois Property Tax Rebate 2024

Illinois State Income Tax Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/453/611/453611818/large.png

Property Taxes By State County Median Property Tax Bills Tax Foundation Sulite Sui

https://files.taxfoundation.org/20220912162330/Median-property-taxes-by-county-paid-property-tax-rankings.png

How Does Illinois s Property Tax Rebate Work

https://media.marketrealist.com/brand-img/SxFDcHPyG/1600x837/illinois-property-tax-rebate-1659496759243.jpg?position=top

The maximum for the individual income and property tax rebates is 300 with up to three dependents qualifying as a dependent for the income tax rebate Who is eligible for 2022 Illinois residents who paid state property taxes last year on their primary 2020 residence are eligible for the rebate if their adjusted gross income on their 2021 Form IL 1040 is under 250 000

A maximum of a 300 property tax rebate or the equivalent of a 2021 qualified property tax credit can go to those reporting a gross income of 500 000 or less if filing jointly or 250 000 if You can check the status of your rebate by going to this site You will need your social security number and either Illinois tax PIN or 2021 Adjusted Gross Income as it appeared on your tax forms

Income Property Tax Rebate Payments Going Out Chronicle Media

https://chronicleillinois.com/wp-content/uploads/2022/09/ILLINOIS-092221-tax-rebates-PHOTO-2-scaled.jpg

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

https://npr.brightspotcdn.com/dims4/default/42b0372/2147483647/strip/true/crop/758x413+0+0/resize/1760x958!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Fcf%2F92%2Fc1613a8b4b4ba9b8b28ebd901285%2Ftaxrebate.png

https://www.nbcchicago.com/news/local/you-may-qualify-for-an-illinois-property-tax-rebate-heres-how-to-find-out-if-youre-eligible/2954022/

Property tax On top of the income tax rebates some homeowners may receive more assistance Qualified property owners will receive a rebate equal to the property tax credit claimed

https://www.nbcchicago.com/news/local/check-the-status-of-your-illinois-tax-rebates-state-sen-celina-villanueva-advises-heres-how/2953254/

Residents with dependents will receive a rebate of up to 300 100 per dependent with a maximum of three Income limits of 200 000 per individual taxpayer or 400 000 for joint filers will

How To Get Property Tax Rebate PropertyRebate

Income Property Tax Rebate Payments Going Out Chronicle Media

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained PrintableRebateForm

State Mailing Out 2 5M Property Tax Rebate Checks Newsday

Illinois Income Tax Rebate 2023 Tax Rebate

Illinois Income Tax Rebate 2023 Tax Rebate

Meaningful Substantive Property Tax Relief In Illinois Is Critical

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Homeowner Renters District 16 Democrats

State Of Illinois Property Tax Rebate 2024 - The Illinois Department of Revenue DOR April 1 released 2021 Form IL 1040 PTR Illinois Property Tax Rebate and instructions The instructions include that 1 taxpayers must complete the form to request their property tax rebate only if they weren t required to file Form IL 1040 Illinois Individual Income Tax Return or didn t previously file Schedule ICR with Form IL 1040 2