Energy Rebate 2024 How To Claim On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

1 What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5 About Home Energy Rebates On Aug 16 2022 President Biden signed the landmark Inflation Reduction Act The law includes nearly 400 billion to support clean energy and address climate change including 8 8 billion in Home Energy Rebates which will provide two separate rebates to consumers The Home Efficiency Rebates will provide 4 3 billion to discount the price of energy saving

Energy Rebate 2024 How To Claim

Energy Rebate 2024 How To Claim

https://claimmytaxback.co.uk/wp-content/uploads/2022/07/Energy-Rebate-Program-1536x2048.jpg

Set Up A Council Tax Direct Debit To Receive Energy Rebate Quickly Shropshire Council Newsroom

https://newsroom.shropshire.gov.uk/wp-content/uploads/energy-rebate-1024x576.jpg

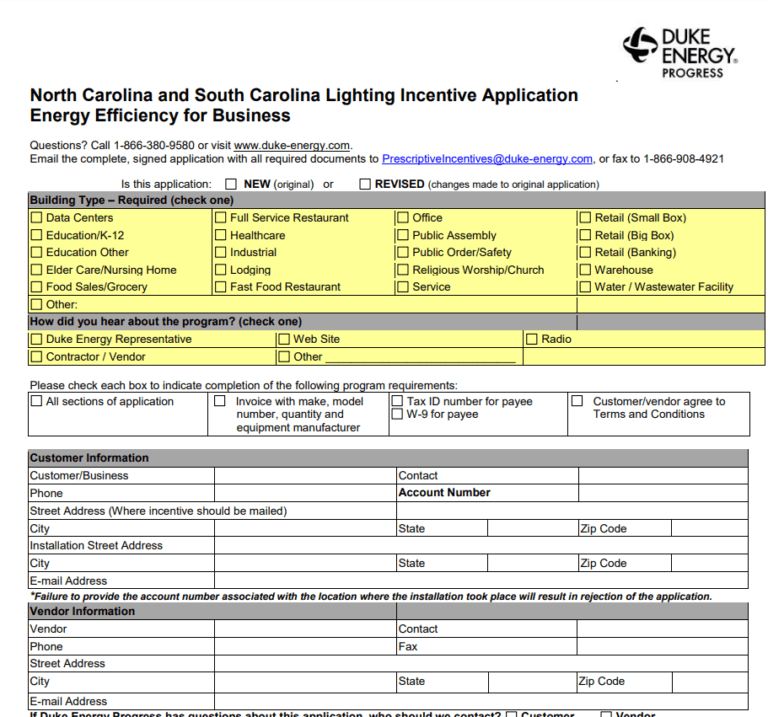

Duke Energy Window Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/08/Duke-Energy-Rebate-Form-768x717.png

Peter Butler Dec 25 2023 6 30 a m PT 3 min read Alternative energy improvements at your home can pay off when you file taxes the next year Petmal Getty Images It s almost time for tax season These energy efficiency and electrification rebates are expected to be rolled out in late 2024 and early 2025 and run through September 30 2031 Who qualifies for energy efficiency rebates Not all households will qualify for HEEHRA rebates

The IRA Home Energy Rebate is intended to increase You can claim the credit for improvements made through 2032 Beginning Jan 1 2023 the credit equals 30 of certain qualified expenses including qualified energy efficiency 1 25 2024 10 06 24 AM Electric Vehicle Tax Credit The IRA includes a 7 500 consumer tax credit for electric vehicle purchases you are eligible if your adjusted gross income is up to 150 000 for individuals or

Download Energy Rebate 2024 How To Claim

More picture related to Energy Rebate 2024 How To Claim

Rebate And Tax Credit Management Quick Electricity

https://quickelectricity.com/wp-content/uploads/2022/07/Energy-Rebates-and-Tax-Credits-Financial-Management-Services-for-Energy-1500x1000.jpg

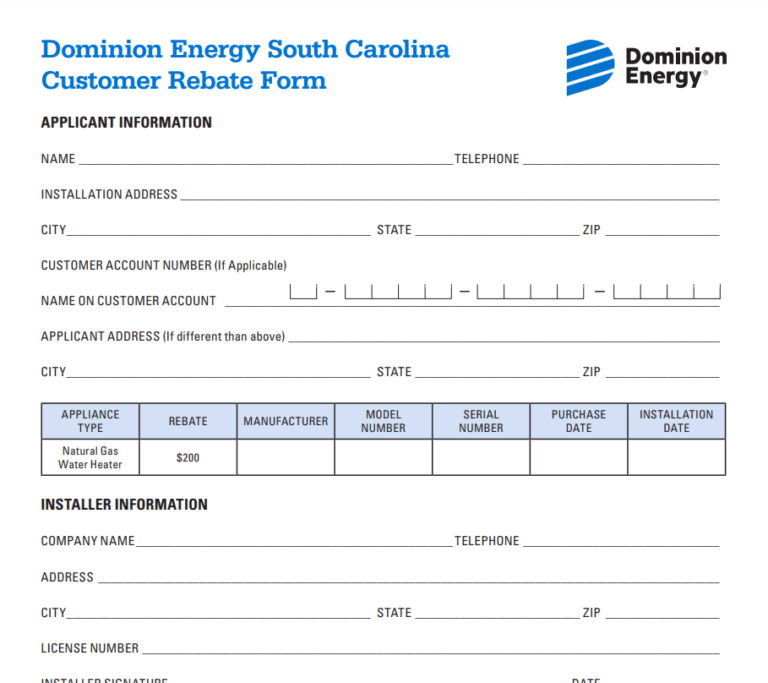

Mn Energy Rebate Forms Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Dominion-Energy-Rebate-Form-2023-768x683.png

Student News Energy Bill Rebate University Of Nottingham

https://www.nottingham.ac.uk/CurrentStudents/Images/News/2019/energy-rebate-1200x600.x353c334f.jpg

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings Home energy audits 150 Exterior doors 250 per door up to 500 per year Exterior windows and skylights central A C units electric panels and related equipment natural gas propane and oil water heaters furnaces or hot water boilers 600 In addition to the 1 200 credit limit above a separate aggregate yearly credit limit of 2 000

The tax credit is currently set at 30 of your total solar panel system installation cost Tax credits help to reduce the amount of money you owe in taxes So for example if you claim a tax credit of 4 000 the total amount you owe in income taxes will be reduced by 4 000 It s important to note that this is not a tax deduction which In 2024 you can claim 30 of the costs for all qualifying HVAC systems installed during the year as tax credits The maximum tax credit amount you can get back is 3 200 year Up to 1 200 for central air conditioners boilers furnaces and natural gas oil and propane water heaters up to 600 per item

Applications For Energy Rebate Scheme To Open Sandgate Parish Council

https://sandgatepc.org.uk/wp-content/uploads/sites/44/2022/06/related.png

How To Claim Solar Rebate In WA Energy Theory

https://energytheory.com/wp-content/uploads/2023/04/JAN23-How-to-Claim-Solar-Rebate-WA.jpg

https://www.energy.gov/scep/home-energy-rebates-programs

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

https://www.energy.gov/scep/home-energy-rebates-frequently-asked-questions

1 What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5

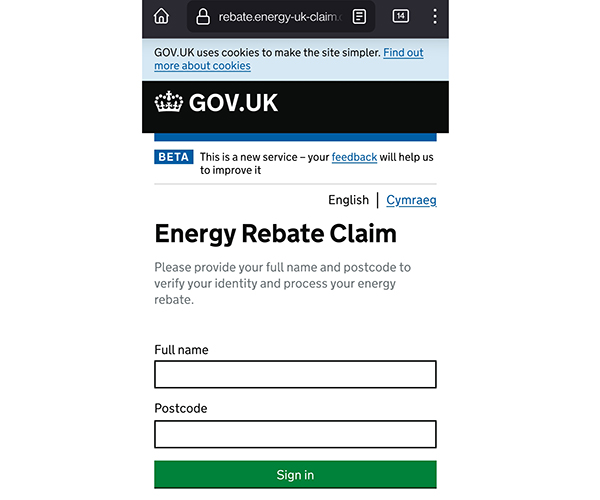

Energy Bills Support Scheme Scam Warning Fake Energy Rebate Claim Offers

Applications For Energy Rebate Scheme To Open Sandgate Parish Council

Will I Get The 400 Energy Rebate On A Prepayment Meter Who Can Claim The Payment And When It s

More Residents Are Made Eligible To Claim 150 Council Tax Rebate

Energy Savings Rebate Program Cozy Comfort Plus

Energy Rebate When Will You Receive The 400 Energy Rebate Personal Finance Finance

Energy Rebate When Will You Receive The 400 Energy Rebate Personal Finance Finance

How To Claim The Government s 400 Energy Bill Rebate

Mobil One Offical Rebate Printable Form Printable Forms Free Online

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

Energy Rebate 2024 How To Claim - These energy efficiency and electrification rebates are expected to be rolled out in late 2024 and early 2025 and run through September 30 2031 Who qualifies for energy efficiency rebates Not all households will qualify for HEEHRA rebates