2024 Recovery Rebate Credit IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before it s too late

If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit Those who didn t receive checks or received the wrong amount could claim them by filing a tax return and claiming the Recovery Rebate Credit If you missed out initially there s still

2024 Recovery Rebate Credit

2024 Recovery Rebate Credit

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEimxxHMVm4XxeDkVaSMSFoj9CX2XqGBjiPWj49fhO8klFSJrHN4Rbr5b3-zi4xSiAaa58C9r_f4Fc9AdeFh2CA51yQPsKTignpJ4wQvAhC7rp8drJR7xe5CxkmwSkVk1nWyZPNxWcqS2tVks6h4fP0QiW59YCZUG37lxHpjiqBAgggUng7A4gFgvhWK/s958/RRR.jpg

IRS Letters Explain Why Some 2020 Recovery Rebate Credits Are Different Than Expected The

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2021/04/Recovery-Rebate-Credit.png?fit=1200%2C675&ssl=1

Does A Tax Credit Give You Money Leia Aqui Do You Get Money From Tax Credit

https://img.money.com/2022/03/News-Recovery-Rebate-Credit.jpg

The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively The Recovery Rebate Credit is a refundable credit for those who missed out on one or more Economic Impact Payments Economic Impact Payments also referred to as stimulus payments were issued in 2020 and 2021 If you are considering buying an electric car in 2024 there s good news and bad news A hefty federal tax credit for electric vehicles is going to get easier to access this year but fewer

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax Taxpayers claiming the 2020 Recovery Rebate Credit must file a tax return by May 17 2024 Those taxpayers filing for 2021 must have been a U S citizen or resident alien in 2021 and cannot have been a dependent of another taxpayer during that tax year

Download 2024 Recovery Rebate Credit

More picture related to 2024 Recovery Rebate Credit

2020 Recovery Rebate Credits Bayshore CPA s P A

https://bayshorecpas.com/files/TaxTimeBlog-2.jpg

2023 Tax Rebate Credit Tax Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

2021 Recovery Rebate Credit R R Accountants RC SD

https://www.rnraccountants.com/wp-content/uploads/2022/02/Untitled-design-31-930x620.png

Fewer vehicles qualify for the 7 500 federal tax rebate in 2024 but it s now easier to access the credit at the time of purchase Tesla and Rivian have the most vehicles on the list of qualifying EVs for the tax rebate in 2024 The automotive world is in the middle of a seismic change Electric cars are becoming ever more prominent on our 3Excludes Recovery Rebate Credits associated with all Economic Impact Payments FY 2021 Budget Authority 38 512M of which 23 4 03M was obligated in FY 2021 12 673M was obligated in FY 2022 2 236M is estimated to be obligated in FY 2023 and 200M estimate d in FY 2024 Also excludes recoveries

The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 in 2025 as well as apply an inflation adjustment in 2025 that would make the cap match the credit maximum of 2 100 It would also quicken the phase in for taxpayers with multiple children and allow taxpayers an election to use If you file your 2021 tax credit before April 18 2025 you will automatically score the tax credit boost Colorado Those living in Colorado won t miss out on rebate payments in 2024 either

9 Easy Ways What Is The Recovery Rebate Credit 2021 Alprojectalproject

https://i1.wp.com/www.gannett-cdn.com/presto/2022/01/31/PDTF/ed4d450c-c21d-4e0c-8df6-4637a89241b9-Lett_6475.jpg

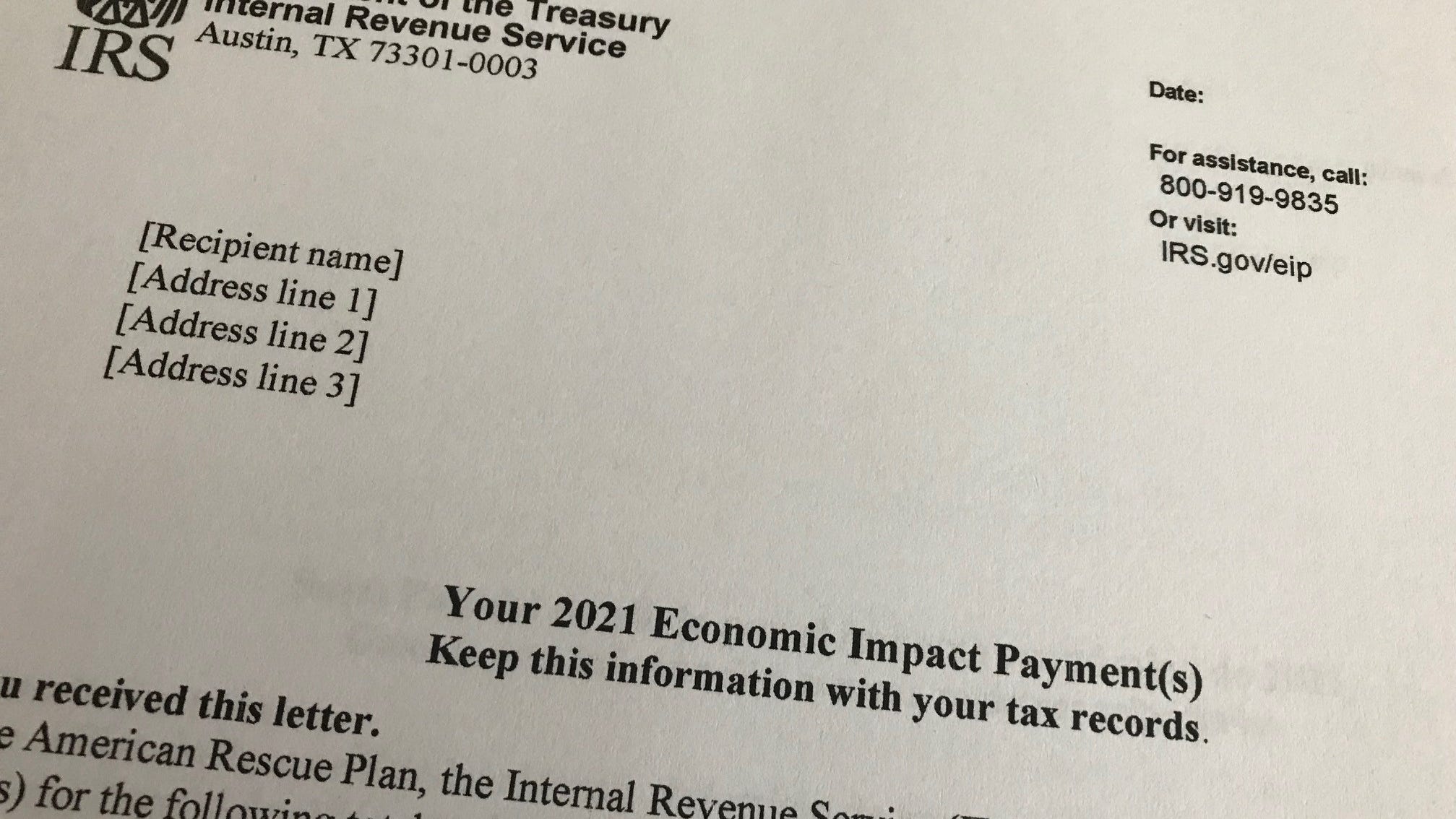

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

https://www.irs.gov/newsroom/irs-reminds-eligible-2020-and-2021-non-filers-to-claim-recovery-rebate-credit-before-time-runs-out

IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before it s too late

https://www.irs.gov/pub/irs-pdf/p5486a.pdf

If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

9 Easy Ways What Is The Recovery Rebate Credit 2021 Alprojectalproject

Do Dependents Get Recovery Rebate Credit Leia Aqui Why Did I Get A Letter From The IRS About

The Recovery Rebate Credit Calculator ShauntelRaya

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

IRS Updates Info On Recovery Rebate Credit And Pandemic Response Scott M Aber CPA PC

IRS Updates Info On Recovery Rebate Credit And Pandemic Response Scott M Aber CPA PC

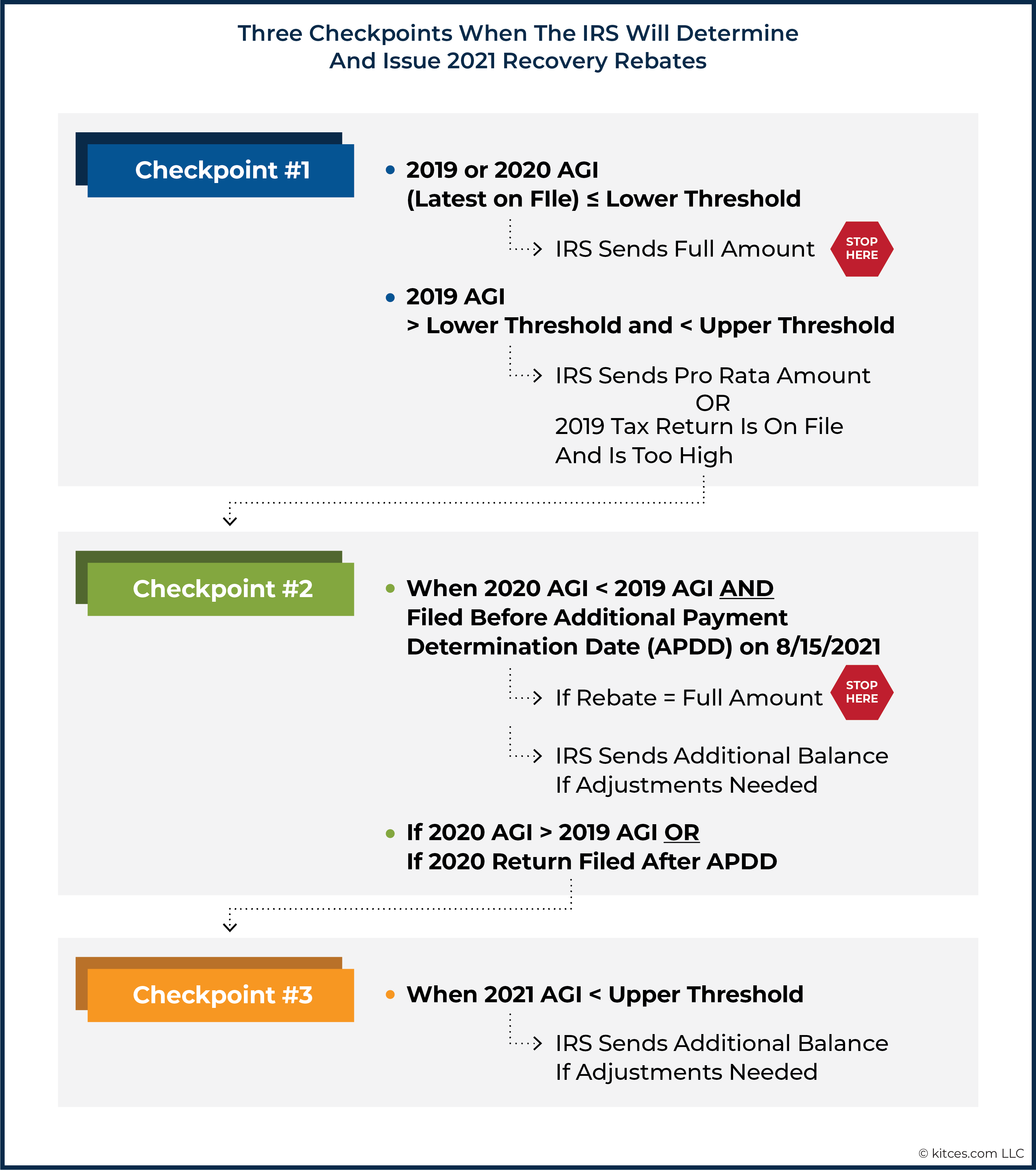

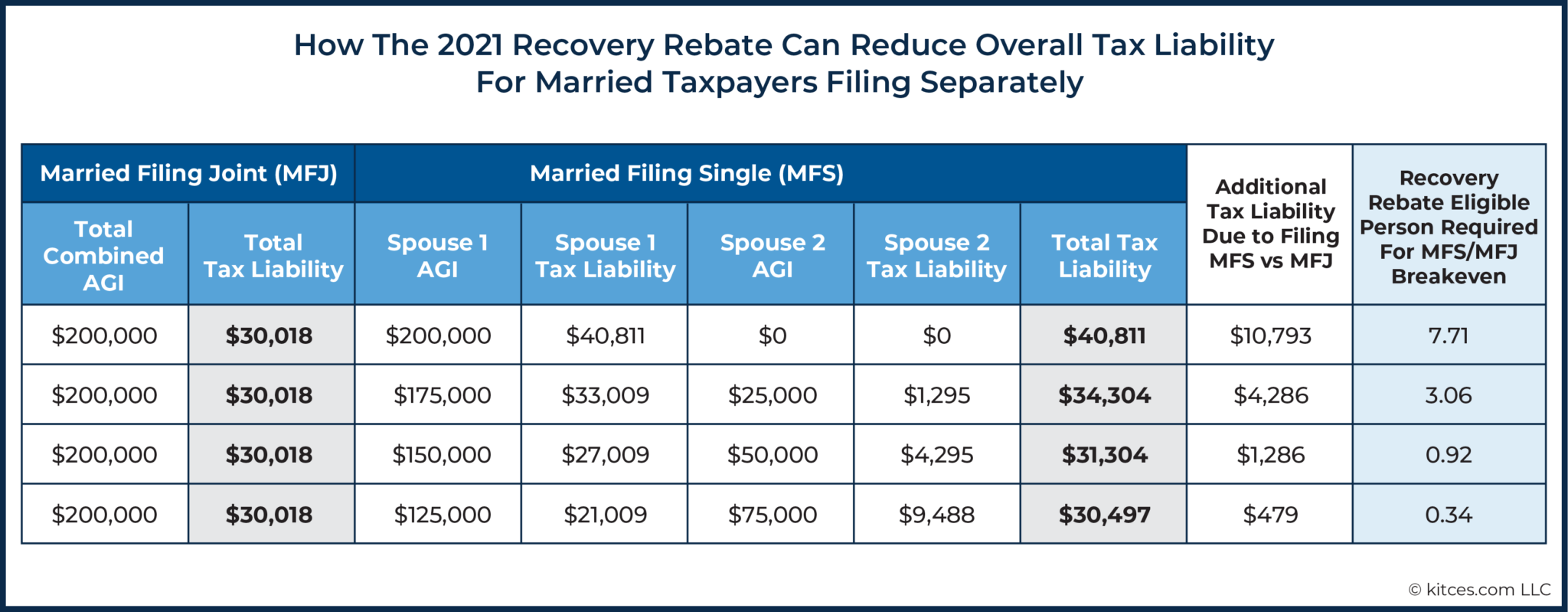

Strategies To Maximize The 2021 Recovery Rebate Credit

How To Claim The 2021 Recovery Rebate Credit On Tax Return

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

2024 Recovery Rebate Credit - Taxpayers claiming the 2020 Recovery Rebate Credit must file a tax return by May 17 2024 Those taxpayers filing for 2021 must have been a U S citizen or resident alien in 2021 and cannot have been a dependent of another taxpayer during that tax year