250 Child Tax Rebate 2024 Save up to 74 Sign up for Kiplinger s Free E Newsletters Profit and prosper with the best of expert advice on investing taxes retirement personal finance and more straight to your e mail

The new bill would give that parent 1 575 per child or a total of 3 150 For the 2024 and 2025 tax years families under the new bill would also be able to use earned income from the previous 7 min Comment 295 Congressional negotiators announced a roughly 80 billion deal on Tuesday to expand the federal child tax credit that if it becomes law would make the program more generous

250 Child Tax Rebate 2024

250 Child Tax Rebate 2024

https://www.the-sun.com/wp-content/uploads/sites/6/2022/05/hp-op-singleparent.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

Jimmy Tickey On Twitter Starting Today 250 Per Child Tax Rebates Are Available To

https://pbs.twimg.com/media/FUNcpk7XEAIy3dE?format=jpg&name=large

CT Child Tax Rebate Checks Are In The Mail Lamont Across Connecticut CT Patch

https://patch.com/img/cdn20/users/22994611/20220825/105526/styles/patch_image/public/money-bills___25105510368.jpg

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax The child tax credit is a federal tax benefit that plays an important role in providing financial support for taxpayers with children People with kids under the age of 17 may be eligible to

What the Child Tax Credit is and who qualifies for it 03 22 as well as to get more money back in their annual tax refund 1 900 in 2024 and 2 000 in 2025 Julia Glum News Editor Joined February 2018 A graduate of the University of Florida Julia has more than five years of experience in personal finance journalism In addition to overseeing news coverage she leads Money s tax coverage which includes extensive reporting on tax credits policy changes and the IRS Has also written

Download 250 Child Tax Rebate 2024

More picture related to 250 Child Tax Rebate 2024

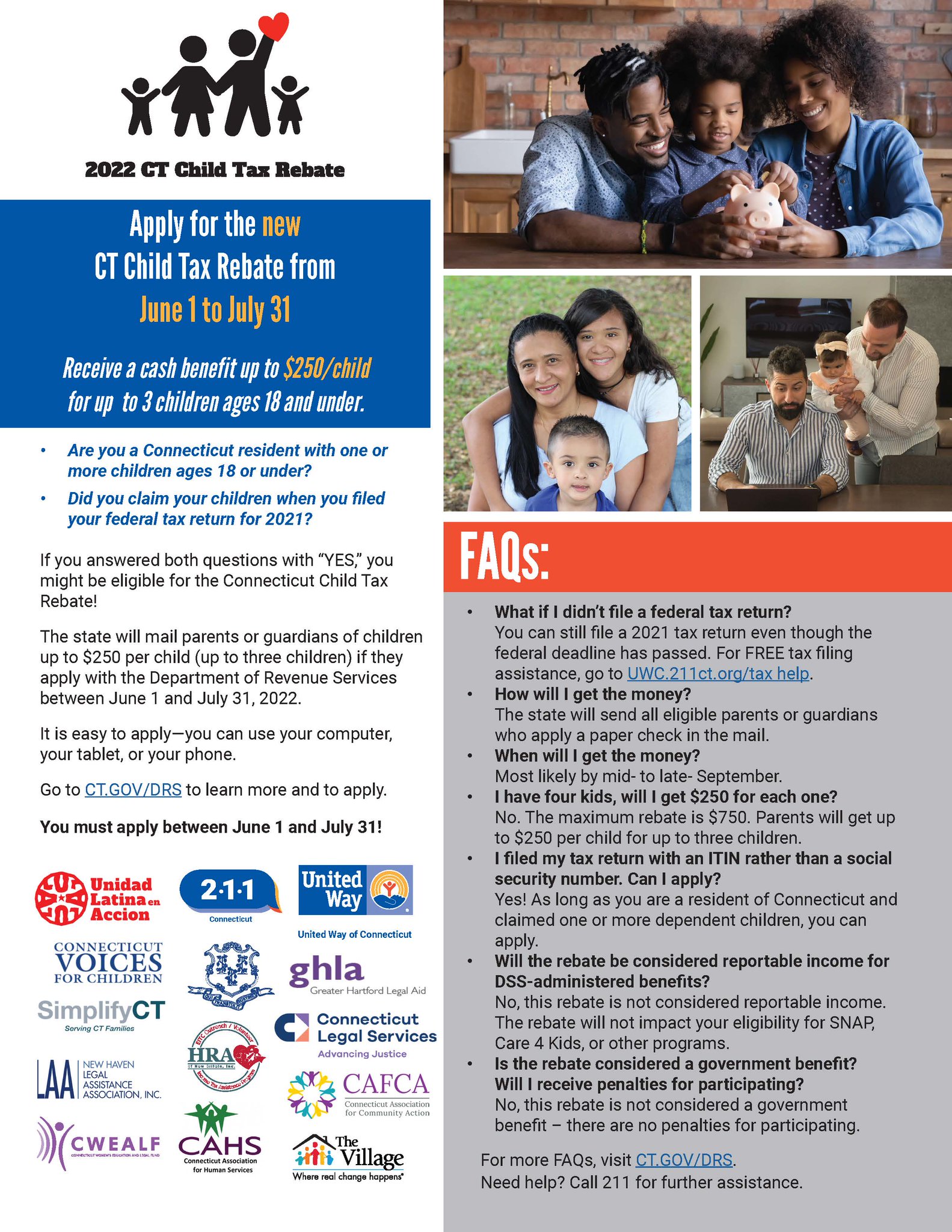

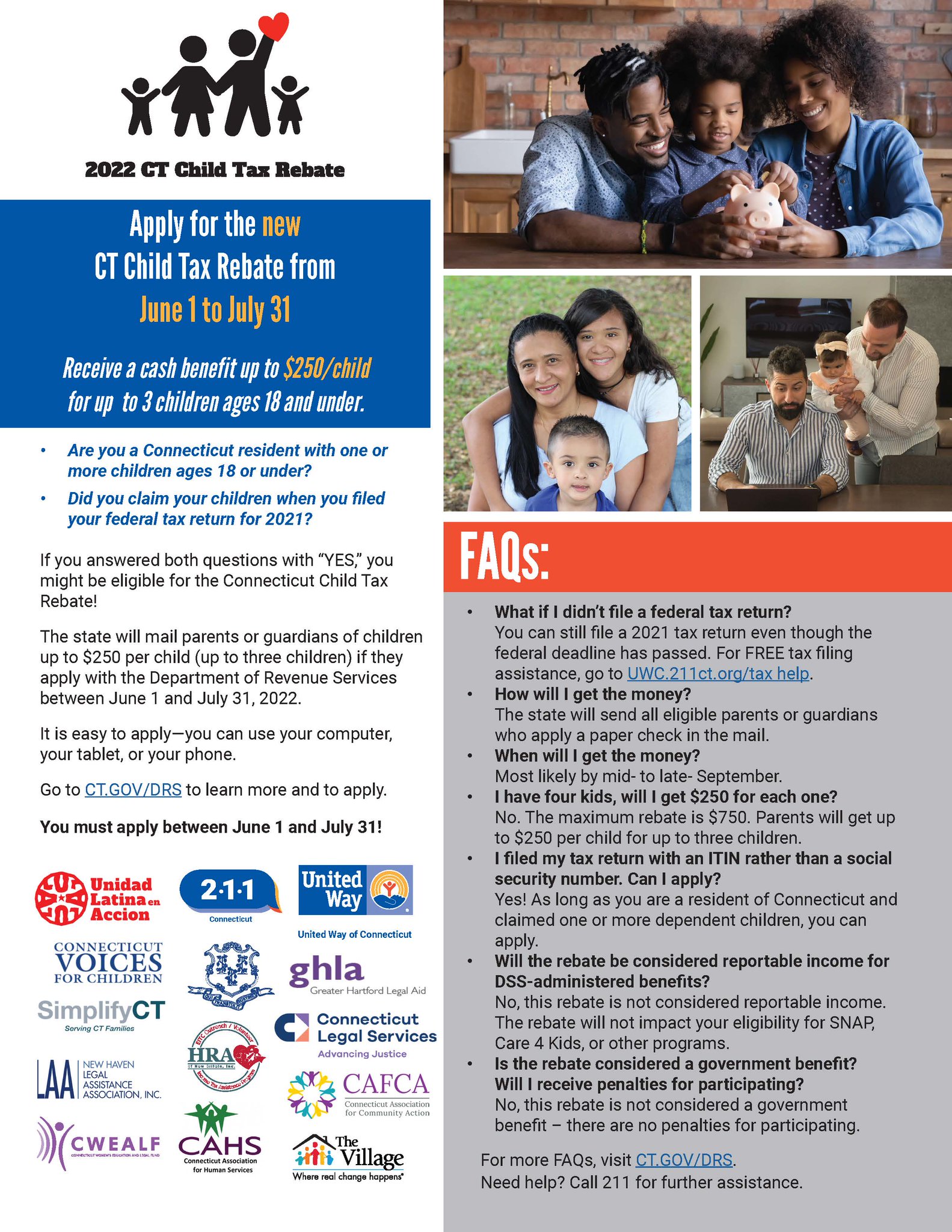

2022 Connecticut Child Tax Rebate Bailey Scarano

https://baileyscarano.com/wp-content/uploads/2022/06/Depositphotos_329030836_XL.jpg

CT Families Should Begin Receiving Child Tax Rebates This Week Governor NBC Connecticut

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate.jpg

Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 Currently 1 600 of the 2 000 credit per child is refundable The credit s phaseout threshold is 400 000 for married earners filing jointly and 200 000 for head or single households At the

Key Takeaways The Child Tax Credit CTC can reduce the amount of tax you owe by up to 2 000 per qualifying child If you end up owing less tax than the amount of the CTC you may be able to get a refund using the Additional Child Tax Credit ACTC ACTC is refundable for the unused amount of your Child Tax Credit up to 1 600 per qualifying child tax year 2023 and 2024 The Child Tax Credit The White House The Child Tax Credit En Espa ol

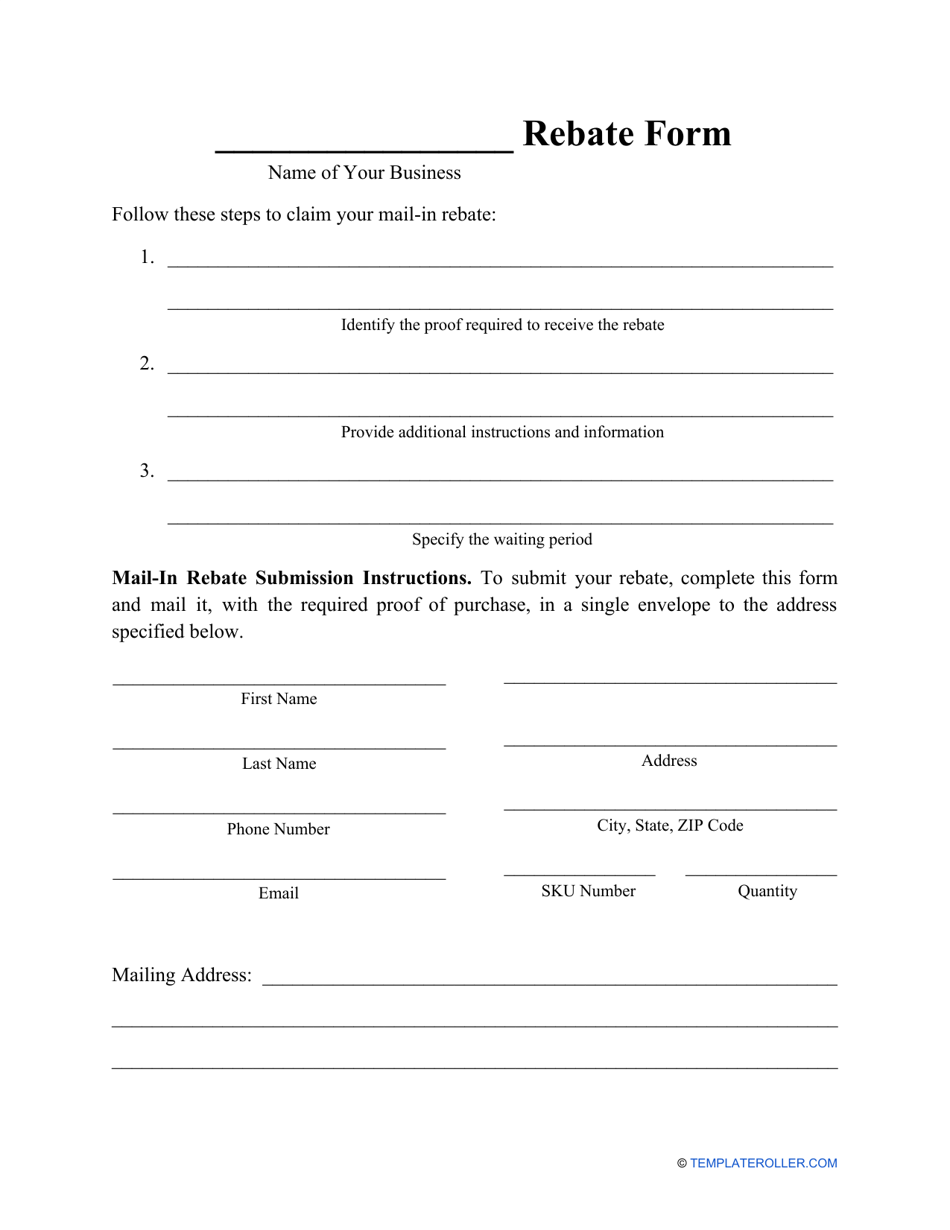

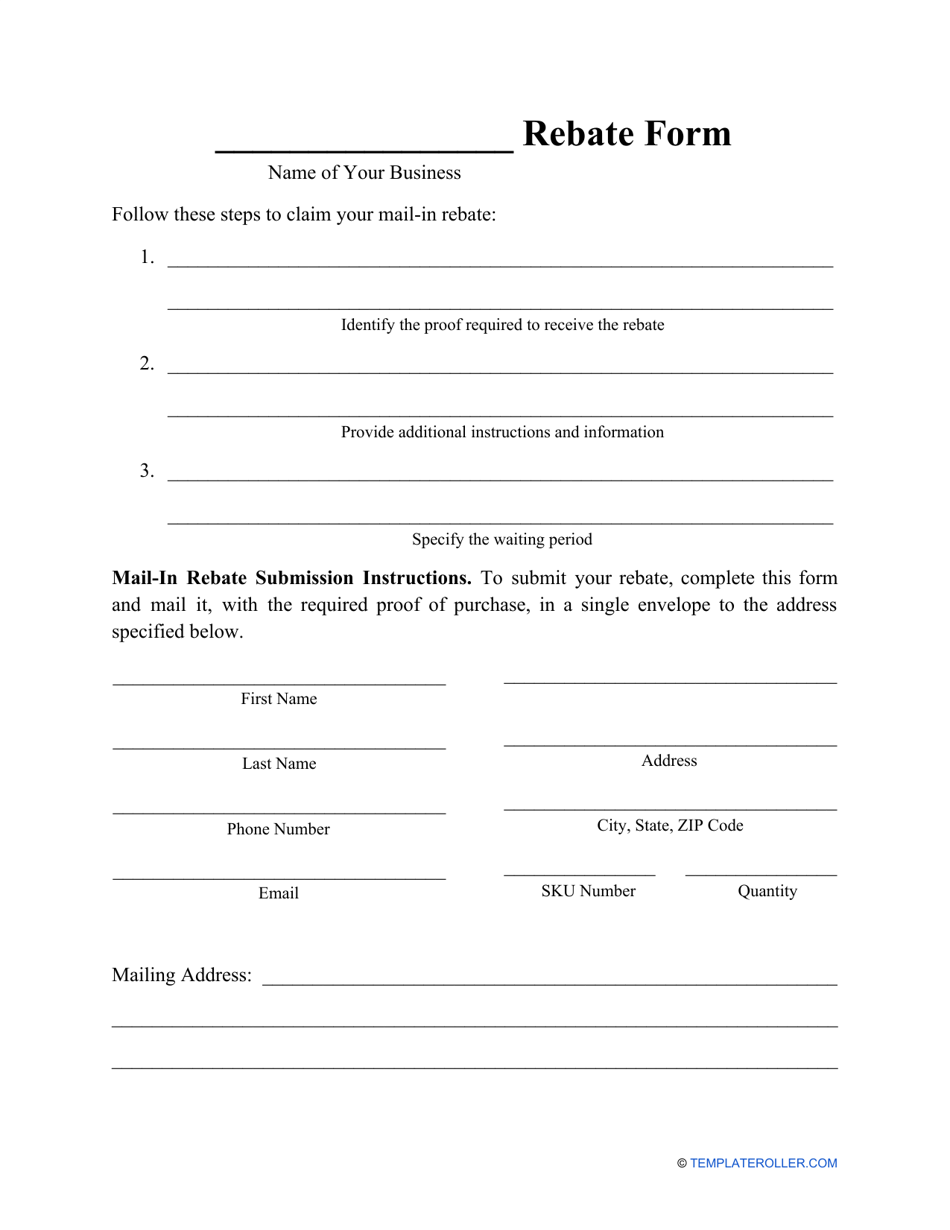

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

https://data.templateroller.com/pdf_docs_html/2100/21003/2100371/rebate-form_print_big.png

Minnesota Rebate Checks And Child Tax Credit Coming Soon Kiplinger

https://cdn.mos.cms.futurecdn.net/6s7GLrUiaDFw4PtLwHLk5U-1024-80.jpg

https://www.kiplinger.com/taxes/how-much-is-the-child-tax-credit-for-2024

Save up to 74 Sign up for Kiplinger s Free E Newsletters Profit and prosper with the best of expert advice on investing taxes retirement personal finance and more straight to your e mail

https://www.marketplace.org/2024/01/17/heres-whats-in-the-new-bill-to-expand-the-child-tax-credit/

The new bill would give that parent 1 575 per child or a total of 3 150 For the 2024 and 2025 tax years families under the new bill would also be able to use earned income from the previous

Child Tax Credit 2022 Huge Direct Payments Up To 750 Already Going Out To Families See Full

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

Child Tax Credit 2023 Can You Claim CTC With No Income YouTube

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried Parents

Opinion CT Must Enact A Permanent Refundable Child Tax Credit

New Haven CSA On Twitter Applications For The Child Tax Rebate Are Open June 1st To July 31st

New Haven CSA On Twitter Applications For The Child Tax Rebate Are Open June 1st To July 31st

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate Before July 31 Deadline

Connecticut Child Tax Rebate Beginning June 1 Connecticut Lamont Governor

Military Journal Ri Child Tax Rebate Child Tax Credits Are One Of The Most Important Ways

250 Child Tax Rebate 2024 - Tax season starts in days and relief for parents remains in limbo LAWMAKERS IN D C CONSIDERING CHANGES TO CHILD TAX CREDIT In days Americans can file their taxes One way to get relief is