When Can I Expect My Renters Rebate Mn 2024 for each rental unit you lived in during 2023 You need this to calculate your refund Your property owner or managing agent must give you a completed 2023 CRP no later than January 31 2024 Include it with your completed return Property owners and managing agents will provide each adult living in the rental unit a separate CRP

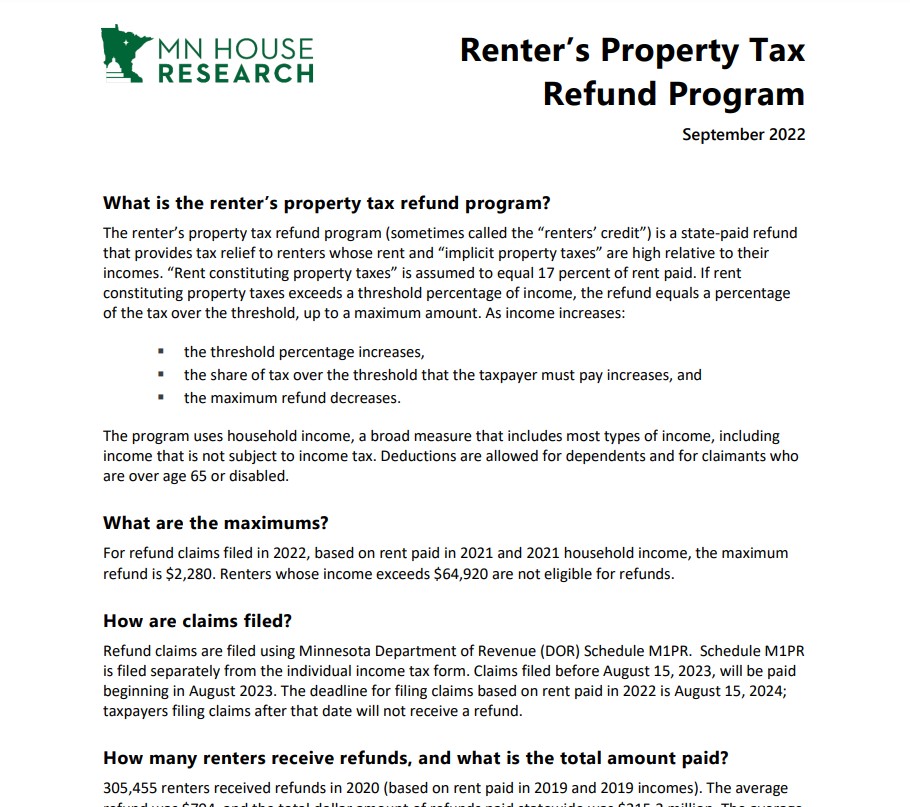

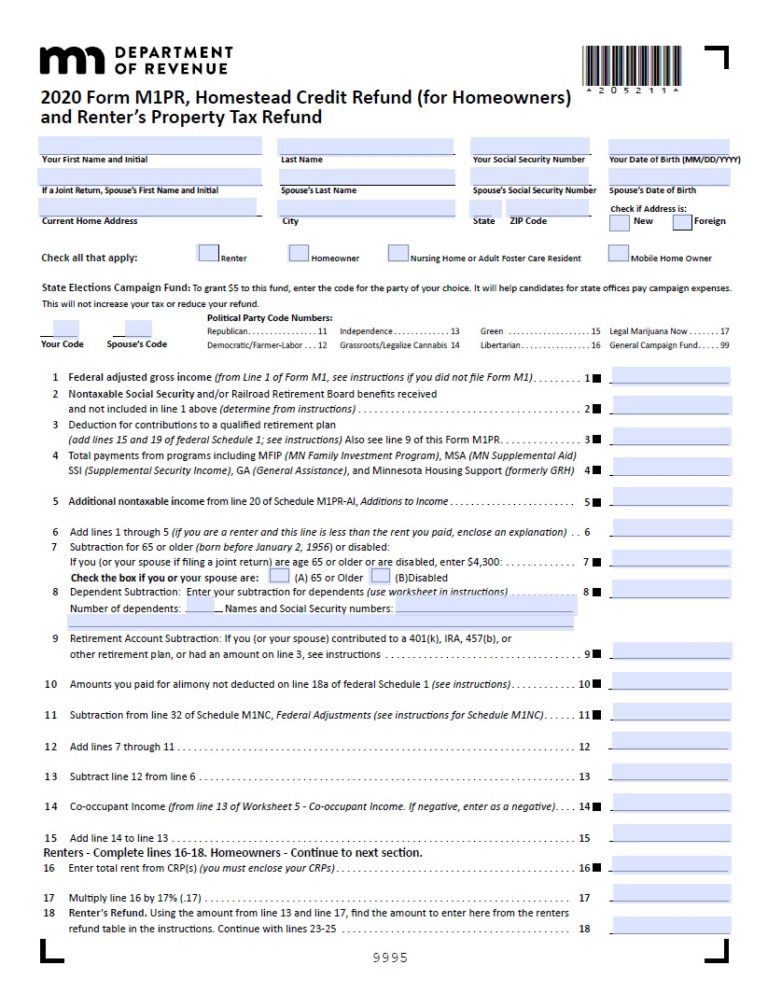

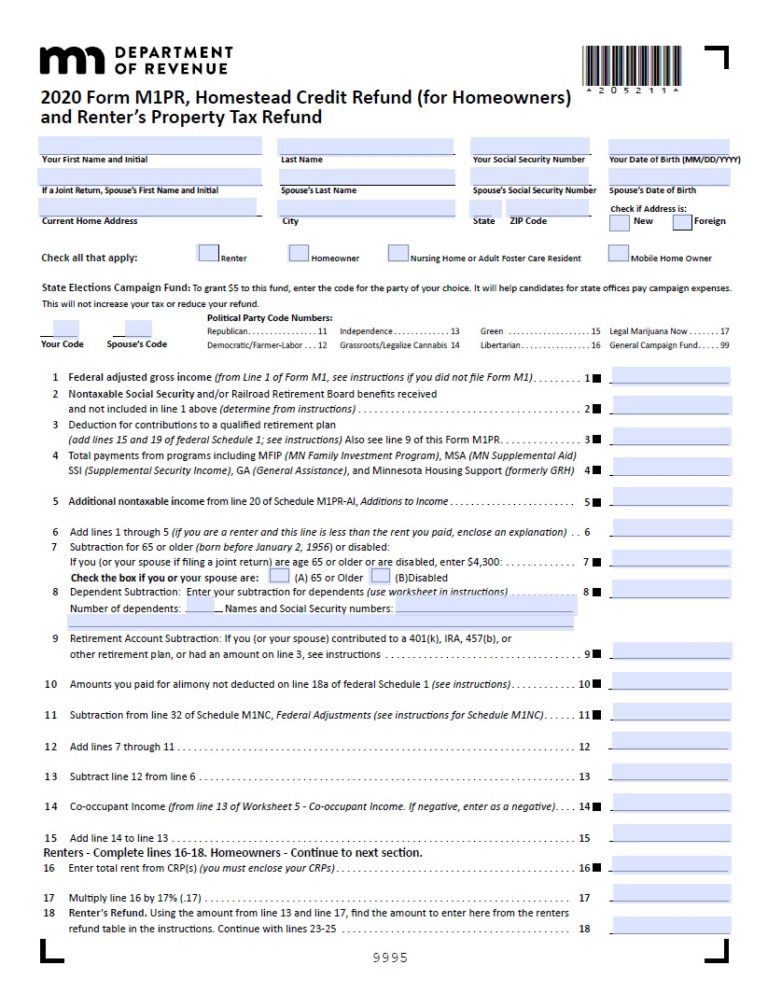

The renter s property tax refund program sometimes called the renters credit is a state paid refund that provides tax relief to renters whose rent and implicit property taxes are high relative to their incomes Rent constituting property taxes is assumed to equal 17 percent of rent paid If you rent your landlord must give you a Certificate of Rent Paid CRP by January 31 2024 If you own use your Property Tax Statement Get the tax form called the 2023 Form M 1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund You can call 651 296 3781 to get a form or write to Minnesota Tax Forms Mail Station 1421 600 N Robert St St Paul MN 55146 1421

When Can I Expect My Renters Rebate Mn 2024

When Can I Expect My Renters Rebate Mn 2024

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/where-is-my-renters-rebate-minnesota-pureanduniquedesigns-24.jpg?w=551&ssl=1

Track My Renters Rebate Mn RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2023/05/renters-rebate-form-mn-2022-printable-rebate-form-12.png

When Can I Expect My Renters Rebate MN YouTube

https://i.ytimg.com/vi/M2apAewJ_5g/maxresdefault.jpg

The renter s property tax refund program sometimes called the renters credit is a state paid refund that provides tax relief to renters whose rent and implicit property taxes are high relative to their incomes Rent constituting property taxes is assumed to equal 17 percent of rent paid Minnesota allows a property tax credit to renters and homeowners who were residents or part year residents of Minnesota during the tax year Who can claim the credit Homeowners with household income less than 135 410 can claim a refund up to 3 310 Homeowners and mobile home owners must have owned and lived in your home on January 2 2024

Here are the check totals 260 for individuals with adjusted gross income of 75 000 or less 520 for married couples who filed a joint return with an adjusted gross income of 150 000 or less An additional 260 added for each dependent filed on the tax return with a maximum of three dependents totaling 780 You can get your refund up to 30 days earlier if you file electronically and do the following things File by April 30th if you own your home File by July 31st if you rent or own a mobile home Choose direct deposit option This means the money is put directly into your bank account

Download When Can I Expect My Renters Rebate Mn 2024

More picture related to When Can I Expect My Renters Rebate Mn 2024

Maine Renters Rebate 2023 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/02/Maine-Renters-Rebate-2023.png

Renters Rebate 2022 California RentersRebate

https://www.rentersrebate.net/wp-content/uploads/2022/12/here-are-5-houses-for-sale-in-historic-ardmore-pa.jpg

How To Fill Out Renters Rebate Mn RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/renter-s-property-tax-refund-minnesota-department-of-revenue-fill-out-1.png?w=770&ssl=1

Last Updated November 30 2023 by Cameron Smith Find out what rental relief assistance is available through nationwide programs as well as state and local programs alabama alaska arizona arkansas california colorado connecticut delaware florida georgia hawaii idaho illinois indiana iowa kansas kentucky louisiana maryland massachusetts michigan Both the Renter s Property Tax Refund and Homestead Credit Refund are expected to increase by 20 572 with the refund being sent automatically The final deadline to claim the 2022 refund is

You probably don t think of August as tax time but you should if you rent your place of residence That s because Aug 15 is the deadline to file for the renter s credit which isn t really a credit but a property tax refund that applies to those who pay rent But you must remember to file for it and a lot of renters don t That permanent change would be effective for property taxes payable in 2024 but the bill would beef up the refund program even more on a onetime basis For refunds on taxes payable in 2023 the increase in property taxes would only need to be 6 and the maximum refund would be 2 500 Minnesota House of Representatives 100 Rev Dr

Electronically File Mn Renters Rebate RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2023/05/where-is-my-renters-rebate-minnesota-pureanduniquedesigns-6.png

Ohio Renters Rebate 2023 Printable Rebate Form RentersRebate

https://www.rentersrebate.net/wp-content/uploads/2023/05/ohio-renters-rebate-2023-printable-rebate-form-28.jpg

https://www.revenue.state.mn.us/sites/default/files/2023-12/m1pr-inst-23.pdf

for each rental unit you lived in during 2023 You need this to calculate your refund Your property owner or managing agent must give you a completed 2023 CRP no later than January 31 2024 Include it with your completed return Property owners and managing agents will provide each adult living in the rental unit a separate CRP

https://www.house.mn.gov/hrd/pubs/ss/ssrptrp.pdf

The renter s property tax refund program sometimes called the renters credit is a state paid refund that provides tax relief to renters whose rent and implicit property taxes are high relative to their incomes Rent constituting property taxes is assumed to equal 17 percent of rent paid

Kentucky Renters Rebate 2023 PrintableRebateForm

Electronically File Mn Renters Rebate RentersRebate

How To File My Renters Rebate RentersRebate

Minnesota Renters Rebate 2023 Printable Rebate Form

Mn Renters Rebate Refund Table RentersRebate RentersRebate

Renters Rebate Form Printable Rebate Form

Renters Rebate Form Printable Rebate Form

Mn Renters Rebate Refund Table RentersRebate

Form For Renters Rebate RentersRebate

Renters Printable Rebate Form

When Can I Expect My Renters Rebate Mn 2024 - Here are the check totals 260 for individuals with adjusted gross income of 75 000 or less 520 for married couples who filed a joint return with an adjusted gross income of 150 000 or less An additional 260 added for each dependent filed on the tax return with a maximum of three dependents totaling 780