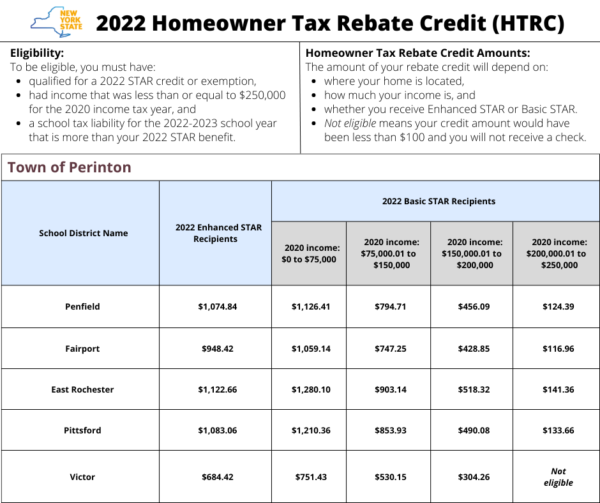

What Is The Nys Homeowner Tax Rebate For 2024 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks

You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either The amount of the credit is the product of the amount of real property tax which exceeds 6 of the taxpayer s qualified gross income QGI and a specified rate based on the taxpayer s QGI To claim the credit the computed amount must exceed 250 The maximum credit allowed is 350

What Is The Nys Homeowner Tax Rebate For 2024

What Is The Nys Homeowner Tax Rebate For 2024

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-600x503.png

NYS Homeowner Assistant Fund NYC MEA NYC Managerial Employees Association The ONLY Advocates

https://nycmea.org/wp-content/uploads/2021/12/NYS_homeownerfund.png

NYS Homeowner Tax Rebate Credit Checks Being Mailed Out

https://townsquare.media/site/497/files/2022/06/attachment-RS28849_ThinkstockPhotos-623211702-scr.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

The amount of the credit is between 250 and 350 and will be available through 2023 To be eligible homeowners must be Eligible for the 2022 School Tax Relief STAR credit or exemption Make less than 250 000 a year based on federal adjusted gross income from tax year 2020 and Have a school tax liability for the 2022 2023 school year The credit will reduce the amount you can deduct on the property tax section Eligibility for the Homeowner Tax Rebate Credit Qualified for a 2022 STAR credit or exemption Income less than or

Who is eligible You are entitled to this refundable credit if your household gross income is 18 000 or less you occupied the same New York residence for six months or more you were a New York State resident for the entire tax year you could not be claimed as a dependent on another taxpayer s federal income tax return Earlier this year the Governor accelerated the distribution of 2 2 billion in tax relief to more than 2 million New Yorkers through the new homeowner tax rebate credit Governor Hochul also announced a statewide gas and diesel tax holiday to provide New Yorkers relief at the pump as fuel prices hit record highs

Download What Is The Nys Homeowner Tax Rebate For 2024

More picture related to What Is The Nys Homeowner Tax Rebate For 2024

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1920&h=1080&crop=1

NYS 2023 Homeowner Tax Rebate Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/NYS-2023-Homeowner-Tax-Rebate.jpg?fit=996%2C728&ssl=1

Homeowner Tax Credits Historic Albany Foundation

https://images.squarespace-cdn.com/content/v1/5567269ce4b02c6f5096564d/1586809103087-AAKEYE3R1ZIATYR8Z948/58431583394__89A4E4F6-6C96-43C9-A4C5-EB2B09D98F12.jpg?format=1500w

Accelerates a 1 2 Billion Dollar Middle Class Tax Cut and Provides a Homeowner Tax Rebate Credit for Almost 2 5 Million New Yorkers Provides Up to 250 Million in Tax Credits and Relief for Small Businesses COVID 19 Related Expenses and Exempts 15 Percent in Eligible Small Business Income from Taxation Through a Tax Relief Program The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state

For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on Federal Schedule C D E or F doesn t exceed 3 000 the net amount of any other separate category of loss doesn t exceed 3 000 and The New York State homeowner tax rebate credit HTRC is a one year program benefitting nearly three million eligible homeowners in 2022 had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

https://i.ytimg.com/vi/ZN9k_nErOQE/maxresdefault.jpg

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In NYS 2023 Budget WRGB

https://cbs6albany.com/resources/media2/16x9/full/1024/center/80/6df365a4-868a-491a-b350-4442a687917a-large16x9_thumb_196074.png

https://www.tax.ny.gov/pit/property/htrc/lookup.htm

2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks

https://www.tax.ny.gov/star/

You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check CNYcentral

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

Nys Tax Rebate Checks 2023 Tax Rebate

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

Nys School Tax Relief Checks Printable Rebate Form

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

Virginia Tax Rebate 2024

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

What Is The Nys Homeowner Tax Rebate For 2024 - The credit will reduce the amount you can deduct on the property tax section Eligibility for the Homeowner Tax Rebate Credit Qualified for a 2022 STAR credit or exemption Income less than or