What Is The Federal Rebate For Solar Panels For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows 18 000 0 30 5 400 State Tax Credit

Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe

What Is The Federal Rebate For Solar Panels

What Is The Federal Rebate For Solar Panels

https://thumbor.forbes.com/thumbor/fit-in/x/https://www.forbes.com/advisor/au/wp-content/uploads/2022/10/solarpanel-scaled.jpg

Federal Solar Tax Credit How Does It Work Live Smart Construction

https://www.livesmartconstruction.com/wp-content/uploads/2020/05/solar-tax-credit-768x519.jpg

Considering Getting Solar Panels Here Are The Right Questions To Ask

https://www.washingtonpost.com/wp-apps/imrs.php?src=https://arc-anglerfish-washpost-prod-washpost.s3.amazonaws.com/public/EKNBCFBDA4I6RFDMSQQAMDFXXU.jpg&w=1440

The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your federal tax bill If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit which directly reduces your tax bill President Biden signed the Inflation Reduction Act into law expanding the Federal Tax Credit for Solar Photovoltaics also known as the Investment Tax Credit ITC

The federal solar tax credit is back to 30 and there s never been a better time to install solar and start saving on energy costs On August 16 2022 President Biden signed the Inflation Reduction Act IRA of 2022 into law immediately activating the Residential Clean Energy Credit for solar battery storage and more The Investment Tax Credit ITC or solar federal tax credit is a nationwide incentive for homeowners and business owners who install solar panels The credit is worth 30 of your total

Download What Is The Federal Rebate For Solar Panels

More picture related to What Is The Federal Rebate For Solar Panels

California Landfills Are Filling Up With Toxic Solar Panels Los

https://ca-times.brightspotcdn.com/dims4/default/7dcff5f/2147483647/strip/true/crop/3000x2000+0+0/resize/2000x1333!/quality/80/?url=https:%2F%2Fcalifornia-times-brightspot.s3.amazonaws.com%2F77%2Fc2%2F4c3f1a1643868771d78c9615cefd%2Fla-fi-recycling-solar-panels.jpg

How The Government Rebate For Solar Power Works Solar Panels

https://www.powersmartsolutions.com.au/wp-content/uploads/2019/06/Business-Insider.jpg

The Federal Rebate For Solar Will Keep Your Installation Affordable

https://newyorkpowersolutions.com/wp-content/uploads/2022/12/Federal-Rebate-for-Solar-1030x808.jpg

Better yet Americans that installed solar in 2022 expecting a 26 credit will now be eligible for 30 That s an extra 1 000 in tax credit for purchasing a 25 000 solar or battery system See how much you can save by going solar with the 30 tax credit Dollar for dollar the federal solar tax credit is the greatest economic incentive for homeowners to invest in solar panels and or battery storage With a little extra paperwork during tax season you can effectively recover 30 of the total cost of your solar system with no maximum limit

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating Key takeaways The federal solar tax credit is a dollar for dollar income tax credit equal to 30 of solar installation costs Homeowners earn an average solar tax credit of 6 000 The 30 solar tax credit is available until 2032 before reducing to 26 in 2033 22 in 2034 and expiring completely in 2035 To qualify for the federal solar tax

Are Solar Panels Worth It Here s What You Should Know

https://designconundrum.com/wp-content/uploads/2022/06/solar-panels-on-the-roof.jpg

How To Build A DIY Solar Panel Ground Mount Tinktube

https://tinktube.com/wp-content/uploads/2022/07/featured-solar-panel-frame.jpg

https://www.energy.gov/sites/default/files/2023-03/...

For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows 18 000 0 30 5 400 State Tax Credit

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

Rebate On Solar Panels For New Homes Corowa Free Press

Are Solar Panels Worth It Here s What You Should Know

A Guide To The Federal Solar Panel Tax Credit BestInfoHub

What Is 87 A Rebate Free Tax Filer Blog

Is Your RV Eligible For A Solar Tax Credit

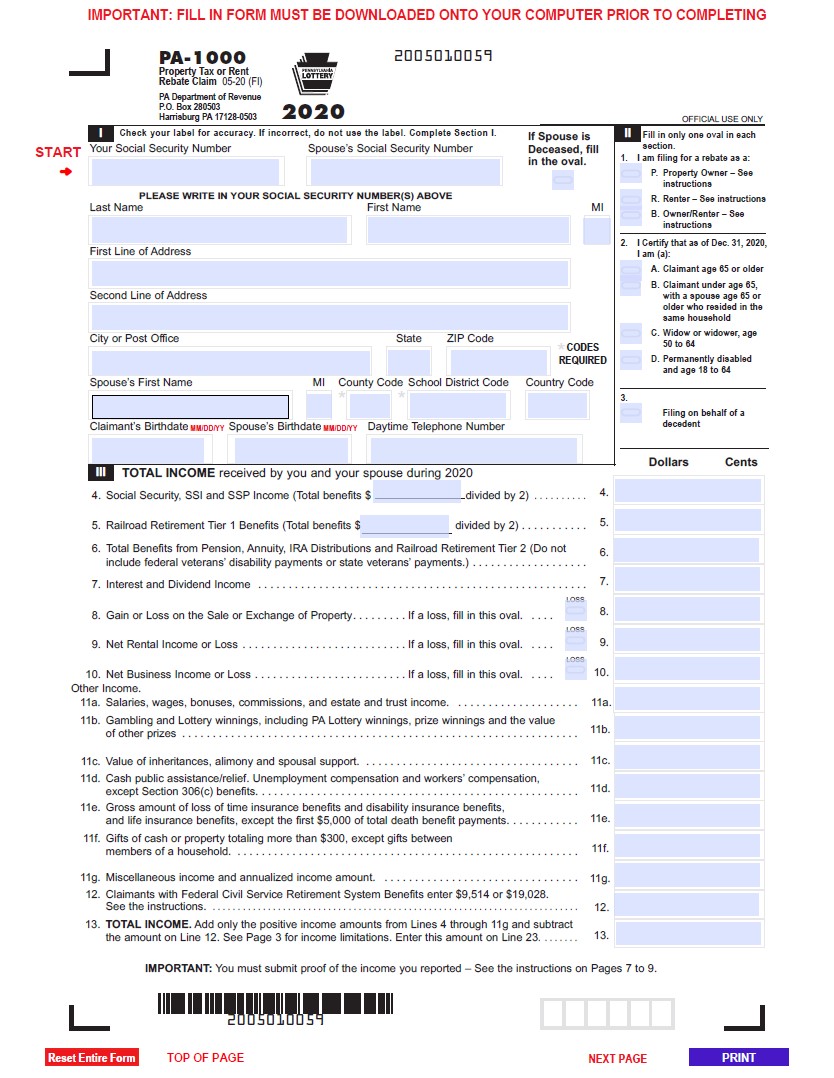

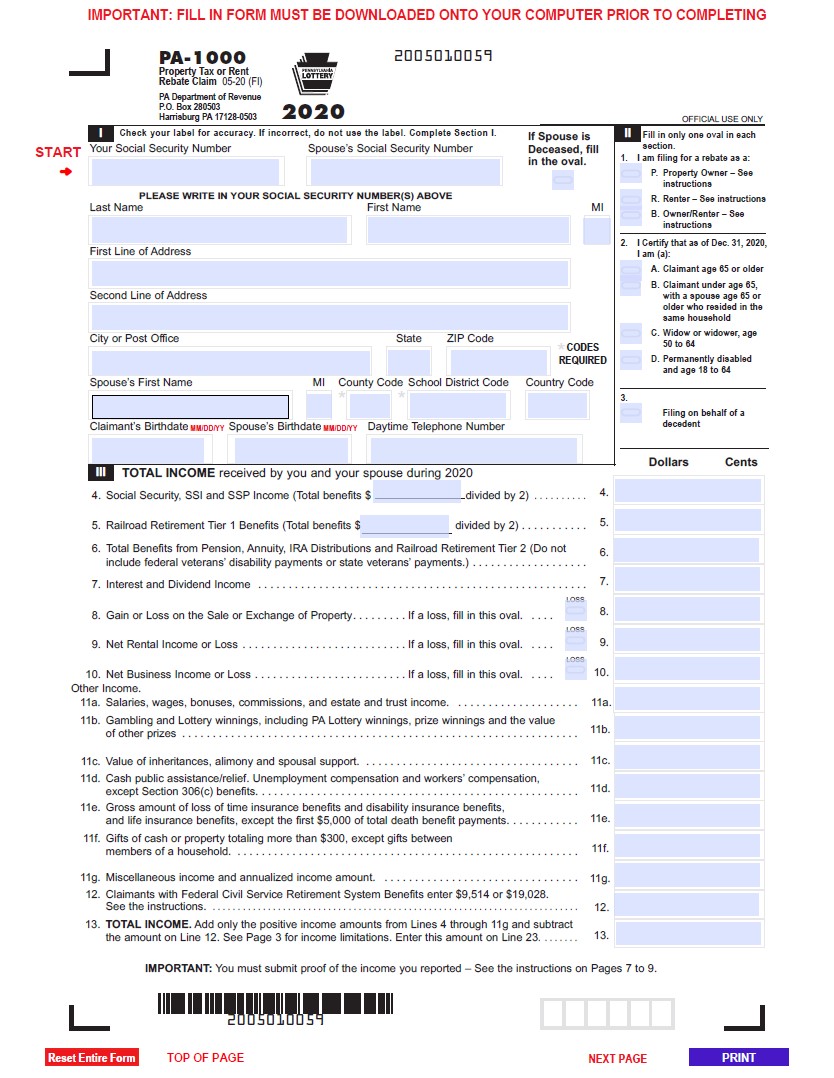

PA Rent Rebate Form Printable Rebate Form

PA Rent Rebate Form Printable Rebate Form

Complete Glossary Of Solar Energy Terms IPower Energy

Solar Panels QLD How To Get 3600 QLD Solar Rebate Quotes YouTube

Solar Panels Rebate 2022 Rebate2022

What Is The Federal Rebate For Solar Panels - The federal solar tax credit is back to 30 and there s never been a better time to install solar and start saving on energy costs On August 16 2022 President Biden signed the Inflation Reduction Act IRA of 2022 into law immediately activating the Residential Clean Energy Credit for solar battery storage and more