What Are The Tax Rebates For 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

Qualifying children This policy would be effective for tax years 2023 2024 and 2025 Modification in Overall Limit on Refundable Child Tax Credit Under current law the maximum refundable child tax credit is limited to 1 600 per child for 2023 even if the earned income limitation described above is in excess of this amount Given the complexity of the new provision and the large number of individual taxpayers affected the IRS is planning for a threshold of 5 000 for tax year 2024 as part of a phase in to implement the 600 reporting threshold enacted under the American Rescue Plan ARP

What Are The Tax Rebates For 2024

What Are The Tax Rebates For 2024

https://bloggercreativa.com/wp-content/uploads/2022/08/Tax-Rebate-Calculator-2-scaled.jpg

Primary Rebate South Africa Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/02/Primary-Rebate-South-Africa-2022.png

Understanding Income Tax Reliefs Rebates Deductions And Exemptions In Malaysia

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/Tax-Rebates-800x534.jpg

Another group that could see bigger refunds are low income families with children given an expansion of the Earned Income Tax Credit The maximum credit for the 2023 tax year is 7 430 up from If you plan to make more or less money or change your circumstances including getting married starting a business or having a baby consider adjusting your withholding or tweaking your estimated

Tax Tip 2024 01 Jan 4 2024 Tax credits and deductions change the amount of a person s tax bill or refund People should understand which credits and deductions they can claim and the records they need to show their eligibility The bill would increase a tax credit for caregivers from 2 000 to 2 100 per child in 2024 and 2025 It would also increase the amount of that tax credit that is refundable or available as a

Download What Are The Tax Rebates For 2024

More picture related to What Are The Tax Rebates For 2024

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

Combien Vous Serez Impos En Afrique Du Sud En 2022 En Fonction De Ce Que Vous Gagnez

https://businesstech.co.za/news/wp-content/uploads/2022/02/Tax.png

Tax Rebates Worth At Least 75 To Start Going Out To 25 000 People This Week All You Need To

https://www.the-sun.com/wp-content/uploads/sites/6/2022/02/CW-COMP-MONEY-TIME-TO-ACT-US.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

1 Saver s Credit If you ve put money in an IRA 401 k 403 b or other eligible retirement account the Saver s Credit could get you a tax credit worth between 10 and 50 of your 2023 contribution amount Topping out at 1 000 for single filers and 2 000 for joint filers the specific amount depends on your contribution adjusted Earned Income Tax Credit EITC is a tax break for low to moderate income workers and families This credit can reduce the taxes you owe and maybe even result in a bigger refund For tax year 2023 this tax credit is worth up to 7 430 for a family with three kids The IRS is currently planning for a threshold of 5 000 for tax year 2024

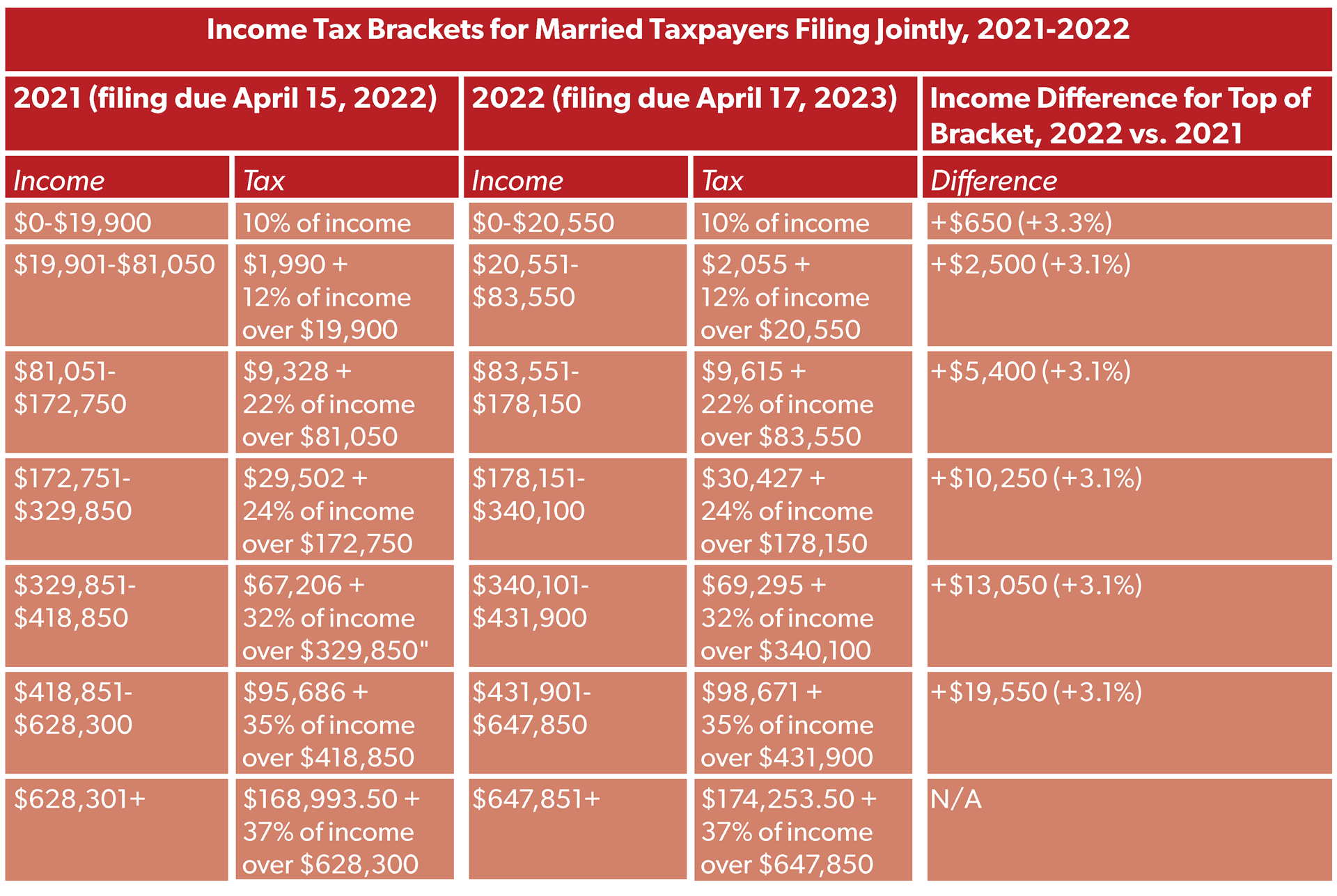

The federal income tax has seven tax rates in 2024 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 609 350 for single filers and above 731 200 for married couples filing jointly The five major 2024 tax changes cover income tax brackets the standard deduction retirement contribution limits the gift tax exclusion and phase out levels for Individual Retirement Account IRA deductions Roth IRAs and the Saver s Credit This annual inflation adjustment ensures that taxpayers aren t bumped into higher brackets due to cost of living increases rather than pay raises

EV Tax Credit Changes Mean Low income Buyers Can Soon Get Full 7 500 Electrek

https://electrek.co/wp-content/uploads/sites/3/2021/01/EV-Federal-Tax-Credits.jpg?quality=82&strip=all&w=1600

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

https://gop-waysandmeans.house.gov/wp-content/uploads/2024/01/The-Tax-Relief-for-American-Families-and-Workers-Act-of-2024-Technical-Summary.pdf

Qualifying children This policy would be effective for tax years 2023 2024 and 2025 Modification in Overall Limit on Refundable Child Tax Credit Under current law the maximum refundable child tax credit is limited to 1 600 per child for 2023 even if the earned income limitation described above is in excess of this amount

Tax Rebates Review Of Tax Credits On The Agenda For Senate GOP

EV Tax Credit Changes Mean Low income Buyers Can Soon Get Full 7 500 Electrek

Tax Rebates Who Will Start Receiving Checks Of Up To 1 000 From Today Marca

LHDN IRB Personal Income Tax Rebate 2022

1 000 Tax Rebate Residents In This State May Receive Extra Money This Summer Here s How To Be

Tax Rebates Are On The Way

Tax Rebates Are On The Way

Income Tax Filing With Printable Forms Printable Forms Free Online

Minnesota Fillable Tax Forms Printable Forms Free Online

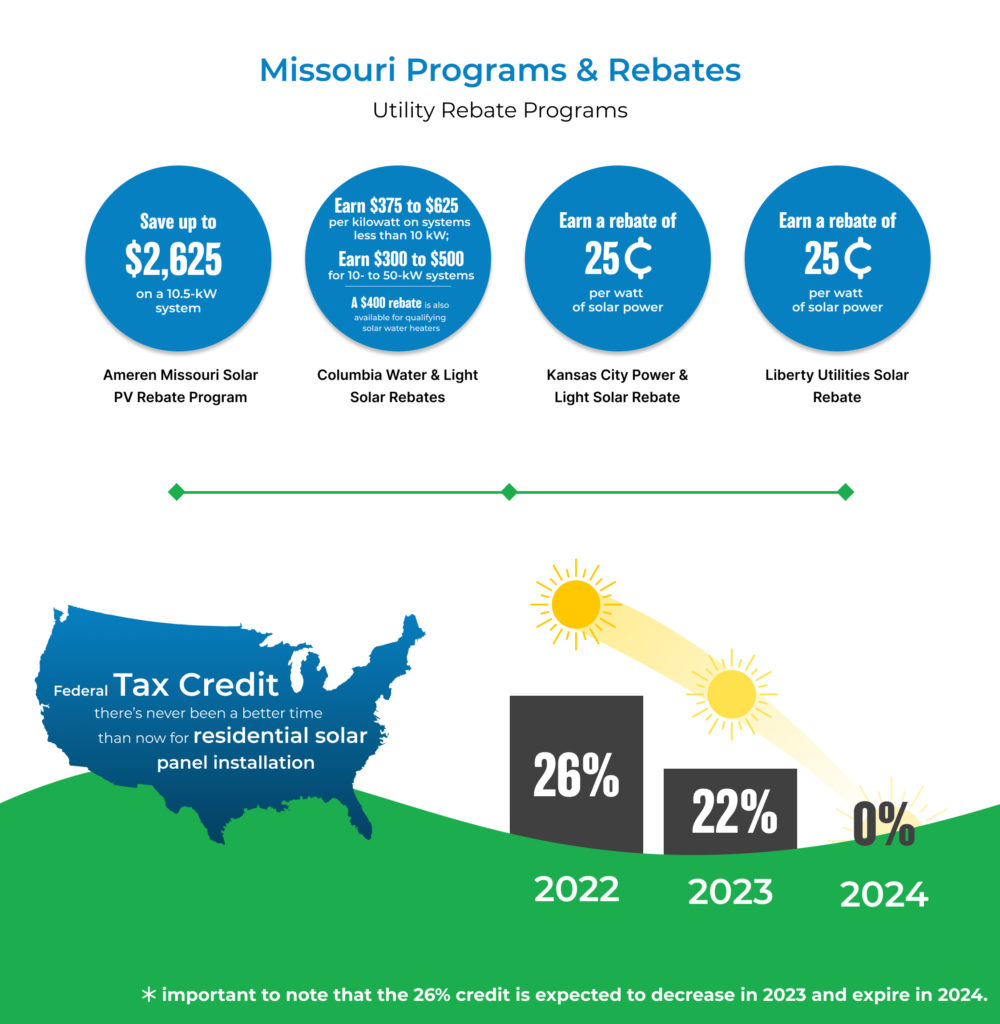

Solar Tax Credits Rebates Missouri Arkansas

What Are The Tax Rebates For 2024 - How to claim tax deductions Simple tax filing with a 50 flat fee for every scenario Powered by With this user friendly tax software registered NerdWallet members pay one fee regardless