Tax Rebates For 2024 Tax Year For single taxpayers and married individuals filing separately the standard deduction rises to 14 600 for 2024 an increase of 750 from 2023 and for heads of households the standard deduction will be 21 900 for tax year 2024 an increase of 1 100 from the amount for tax year 2023

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695 Beginning Jan 1 2023 the credit equals 30 of certain qualified CIT Rebate for the Year of Assessment YA 2024 and a CIT Rebate Cash Grant UPDATED As announced in Budget 2024 to help companies manage rising costs a CIT Rebate of 50 of the corporate tax payable will be granted to all taxpaying companies whether tax resident or not for YA 2024

Tax Rebates For 2024 Tax Year

Tax Rebates For 2024 Tax Year

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/Tax-Rebates-800x534.jpg

What Is A Refundable Tax Credit The Motley Fool

https://g.foolcdn.com/editorial/images/421025/tax-credit_gettyimages-504572064.jpg

Section 13 OF THE INCOME TAX ACT

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

In view of cost of living concerns a PIT Rebate of 50 of tax payable will be granted to all tax resident individuals for YA 2024 The rebate will be capped at 200 per taxpayer However with the Tax Cuts and Jobs Act of 2017 TCJA the IRS now uses the Chained Consumer Price Index C CPI to adjust income thresholds deduction amounts and credit values accordingly The new inflation adjustments are for tax year 2024 for which taxpayers will file tax returns in early 2025

New As announced in Budget 2024 a Personal Tax rebate will be granted to all tax residents for Year of Assessment 2024 The rebate will be 50 of tax payable capped at 200 Amount of tax rebate The tax rebate is calculated based on the following The amount of tax payable after double taxation relief and other credits and The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades SEE TAX

Download Tax Rebates For 2024 Tax Year

More picture related to Tax Rebates For 2024 Tax Year

NJ ANCHOR Property Tax Rebates Who Can Qualify In 2024

https://www.northjersey.com/gcdn/-mm-/e12712590430b2876b51073aa0fd9d0df788d233/c=0-357-3866-2541/local/-/media/2017/05/08/Bergen/NorthJersey/636298617519756307-20170508-173344.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

New Federal Tax Brackets For 2023

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA16eFiq.img

1 000 Tax Rebate Residents In This State May Receive Extra Money This Summer Here s How To Be

https://1075914428.rsc.cdn77.org/data/thumbs/full/270850/820/0/0/0/tax-rebates-2023-eligible-americans-to-receive-up-to-3-000-heres-when-and-how.jpg

What s new for 2024 instant rebate EV buyers no longer have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead there s a new option Tax rebates A taxpayer is entitled to so called tax rebates that are deducted from tax payable The rebates have the effect of establishing tax thresholds below which no tax is payable For the 2025 tax year i e the tax year commencing on 1 March 2024 and ending on 28 February 2025 the following rebates apply

Taxpayers eligible for recovery rebate credits for tax year 2020 have until May 17 2024 to file a tax return to claim the payment By law taxpayers can make a claim for refund up to As per the old tax regime the applicable rebate limit is Rs 12 500 for incomes up to Rs 5 lakhs However under the new tax regime this rebate limit has increased to Rs 25 000 if the taxable income is less than or equal to Rs 7 lakhs Note that the Section 87A rebate is applicable under both income tax regimes

Tax Rates For The 2024 Year Of Assessment Just One Lap

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?w=1526&ssl=1

Tax Rebates Worth At Least 75 To Start Going Out To 25 000 People This Week All You Need To

https://www.the-sun.com/wp-content/uploads/sites/6/2022/02/CW-COMP-MONEY-TIME-TO-ACT-US.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

https://www.irs.gov/newsroom/irs-provides-tax...

For single taxpayers and married individuals filing separately the standard deduction rises to 14 600 for 2024 an increase of 750 from 2023 and for heads of households the standard deduction will be 21 900 for tax year 2024 an increase of 1 100 from the amount for tax year 2023

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695 Beginning Jan 1 2023 the credit equals 30 of certain qualified

Tax Rebates Review Of Tax Credits On The Agenda For Senate GOP

Tax Rates For The 2024 Year Of Assessment Just One Lap

Primary Rebate South Africa Printable Rebate Form

Self Assessment Tax Returns Threshold To Change For 2023 2024 Tax Year Ashford Partners

LHDN IRB Personal Income Tax Rebate 2022

Tax Rebates Are On The Way

Tax Rebates Are On The Way

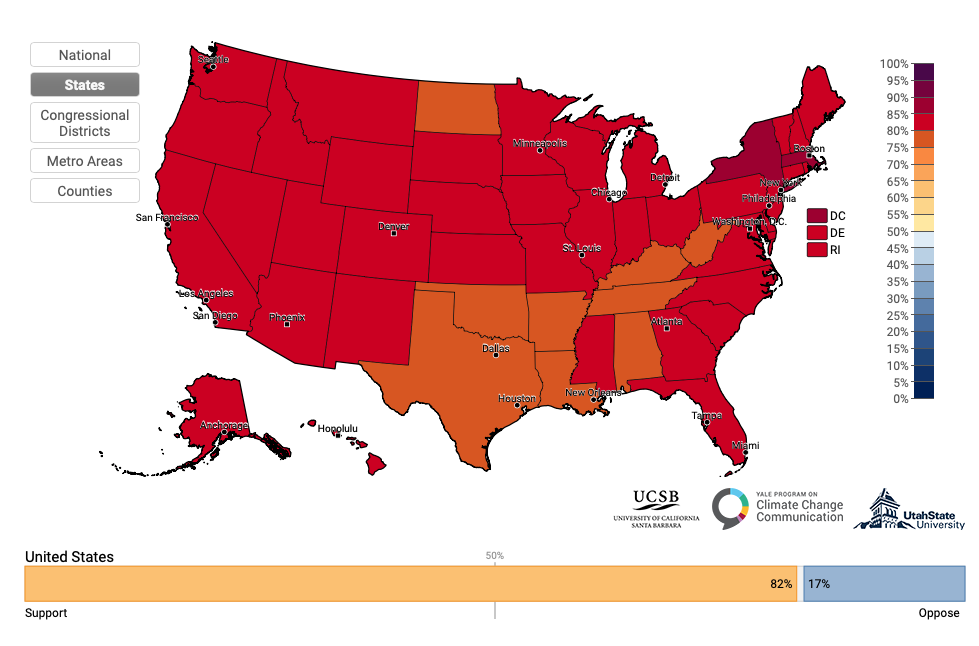

Americans Care About Climate Change These Maps Prove It Grist

Four Tax Rebates Going Out In December Between 200 And 1 050 Full List Of States Sending The

Over 80mn Americans To Receive Tax Rebates Directly In Their Accounts In 24 Hrs Ummid

Tax Rebates For 2024 Tax Year - This service covers the current tax year 6 April 2024 to 5 April 2025 This page is also available in Welsh Cymraeg Use the service to check your tax code and Personal Allowance see