Tax Rebate For Low Income Earners 2024 Eligibility for low income tax offset A taxpayer must be an Australian resident individual to be eligible for the low income tax offset Trustees assessable under Section 98 may also be eligible for the rebate if the

Come 1 July 2024 the stage 3 tax cuts will bring significant changes to tax brackets The 32 5 marginal tax rate will be lowered to 30 for a substantial bracket spanning from 45 000 to 200 000 Notably the 37 tax bracket will be abolished altogether Here s a breakdown Income up to 18 200 Nil tax payable Low income earners will get additional tax relief of up to 172 under changes to the Medicare levy The government is proposing to change the thresholds above which taxpayers are required to pay the 2 per cent levy The thresholds will increase by 7 1 per cent in line with inflation

Tax Rebate For Low Income Earners 2024

Tax Rebate For Low Income Earners 2024

https://melbourne.chan-naylor.com.au/wp-content/uploads/2020/10/Tax-Relief-Low-Income-earners.png

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Tax Strategies For High Income Earners First Financial Consulting

https://firstfinancial.is/wp-content/uploads/2022/09/Tax-Strategies-for-High-Income-Earners-1.jpg

Your Medicare levy is reduced if your taxable income is below a certain amount or you may not have to pay it at all Last updated 30 June 2024 Print or Download In 2023 24 you do not have to pay the Medicare levy if your taxable income is equal to or less than the lower threshold A tax credit usually reduces tax owed and may also result in a refund For tax year 2023 the EITC is as much as 7 430 for a family with three or more children 600 for taxpayers who don t have a qualifying child How to claim the EITC To get the EITC qualified workers must file a tax return and claim the credit

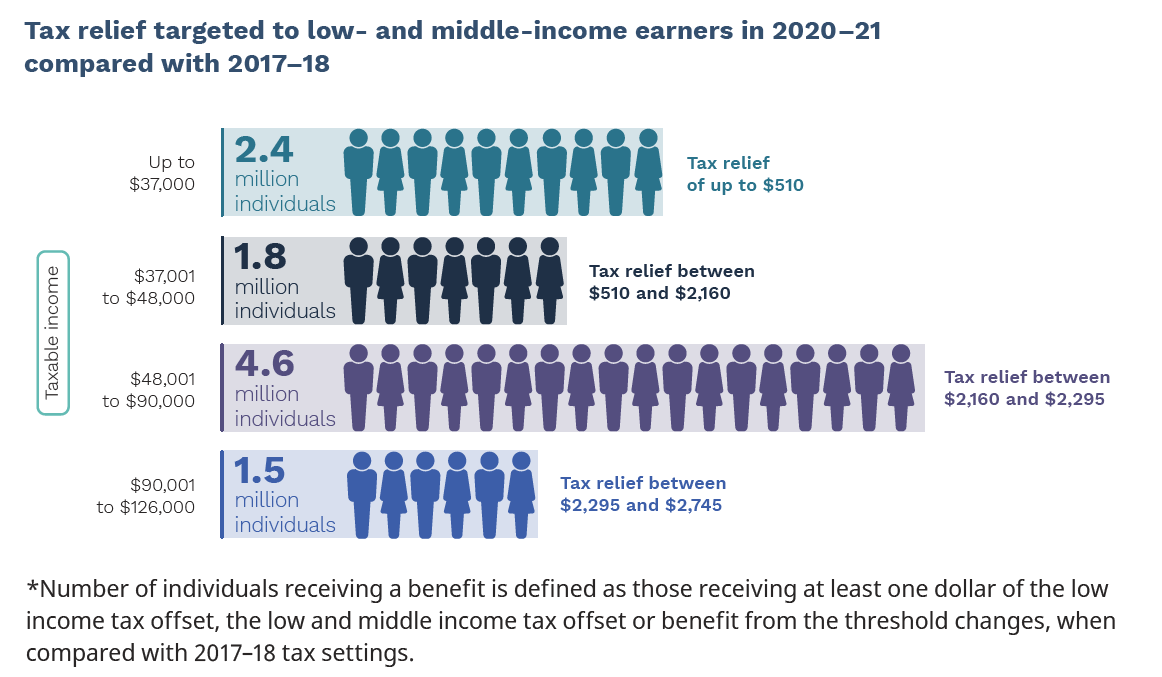

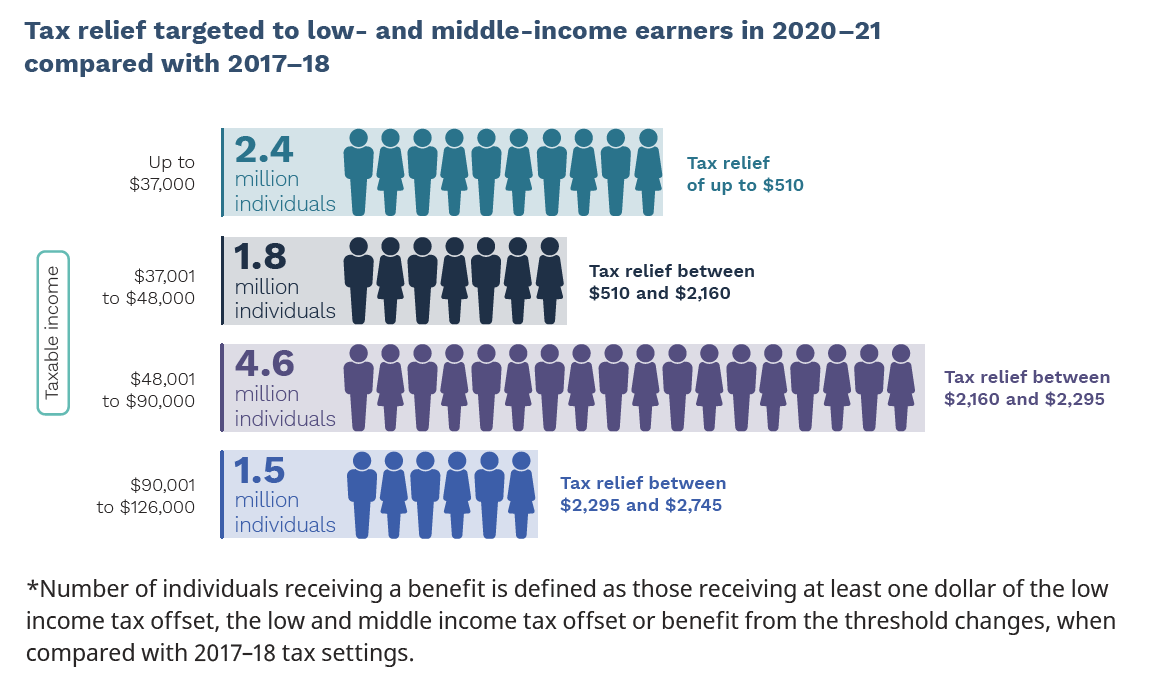

Compared to the original stage 3 tax cuts these changes give a break to low and middle income earners by lowering the tax withheld from their take home pay The result Australians get more money in their pockets each week If you earn up to 37 000 a year you may be eligible to receive a low income super tax offset LISTO payment of up to 500 You don t need to do anything to receive a LISTO payment Just make sure your super fund has your tax file number TFN

Download Tax Rebate For Low Income Earners 2024

More picture related to Tax Rebate For Low Income Earners 2024

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

Who Benefits More From Tax Breaks High Or Low Income Earners

https://www.pgpf.org/sites/default/files/Who-benefits-from-tax-breaks-hero.jpg

Tax Relief Restored For Michigan Retirees Low income Earners

https://www.freep.com/gcdn/presto/2023/01/26/PDTF/29741193-627f-4e20-93ed-13cfd4e869ca-230125_state_of_state_011a.JPG?crop=1999,1124,x1,y65&width=1999&height=1124&format=pjpg&auto=webp

The Government s tax cuts will return bracket creep and lower average tax rates for all taxpayers The plan delivers a permanent reduction in tax for all taxpayers with an average tax cut of 1 888 in 2024 25 By 2034 35 someone earning an average income will pay 21 635 less tax than they would without these cuts From July 1 2024 the government s so called stage three tax cuts will increase the income at which the top 45 per cent tax bracket begins from 180 001 to 200 001

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund Did you receive a letter from the IRS about the EITC Find out what to do The 700 Low Income Tax Offset LITO combined with the tax free threshold of 18 200 effectively allows working Australians to earn up to 21 884 for the 2022 23 financial year before they need to pay any income tax or Medicare Levy

Here s Why Low income Earners Are Not Getting A Tax Rebate And Why Some Are Upset About It

https://pic.briefly.co/anchor/Boston/story/heres-why-low-income-earners-are-not-getting-a-tax-rebate---and-why-some-are-upset-about-it?format=wide-twitter

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

https://atotaxrates.info/tax-offset/low-income-tax-offset

Eligibility for low income tax offset A taxpayer must be an Australian resident individual to be eligible for the low income tax offset Trustees assessable under Section 98 may also be eligible for the rebate if the

https://www.kpgtaxation.com.au/blog/low-income-tax...

Come 1 July 2024 the stage 3 tax cuts will bring significant changes to tax brackets The 32 5 marginal tax rate will be lowered to 30 for a substantial bracket spanning from 45 000 to 200 000 Notably the 37 tax bracket will be abolished altogether Here s a breakdown Income up to 18 200 Nil tax payable

Income Tax Rebate U s 87A For The Financial Year 2022 23

Here s Why Low income Earners Are Not Getting A Tax Rebate And Why Some Are Upset About It

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Income Tax Rebate Huge Relief For Wage Earners Increase In Income Tax Exemption Limit

5 Ways To Make Your Tax Refund Bigger The Motley Fool

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Georgia Income Tax Rebate 2023 Printable Rebate Form

Retirement Income Tax Rebate Calculator Greater Good SA

Fortune India Business News Strategy Finance And Corporate Insight

Tax Rebate For Low Income Earners 2024 - Your Medicare levy is reduced if your taxable income is below a certain amount or you may not have to pay it at all Last updated 30 June 2024 Print or Download In 2023 24 you do not have to pay the Medicare levy if your taxable income is equal to or less than the lower threshold