Tax Rebate Air Conditioner 2024 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit Resources Inflation Reduction Act of 2022 Frequently asked questions about energy efficient home improvements and residential clean energy property credits Credits and deductions under the Inflation Reduction Act of 2022 The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners

Tax Rebate Air Conditioner 2024

Tax Rebate Air Conditioner 2024

https://www.nicksairconditioning.com/wp-content/uploads/2023/01/Adjusting-HVAC-System-Temperature.jpg

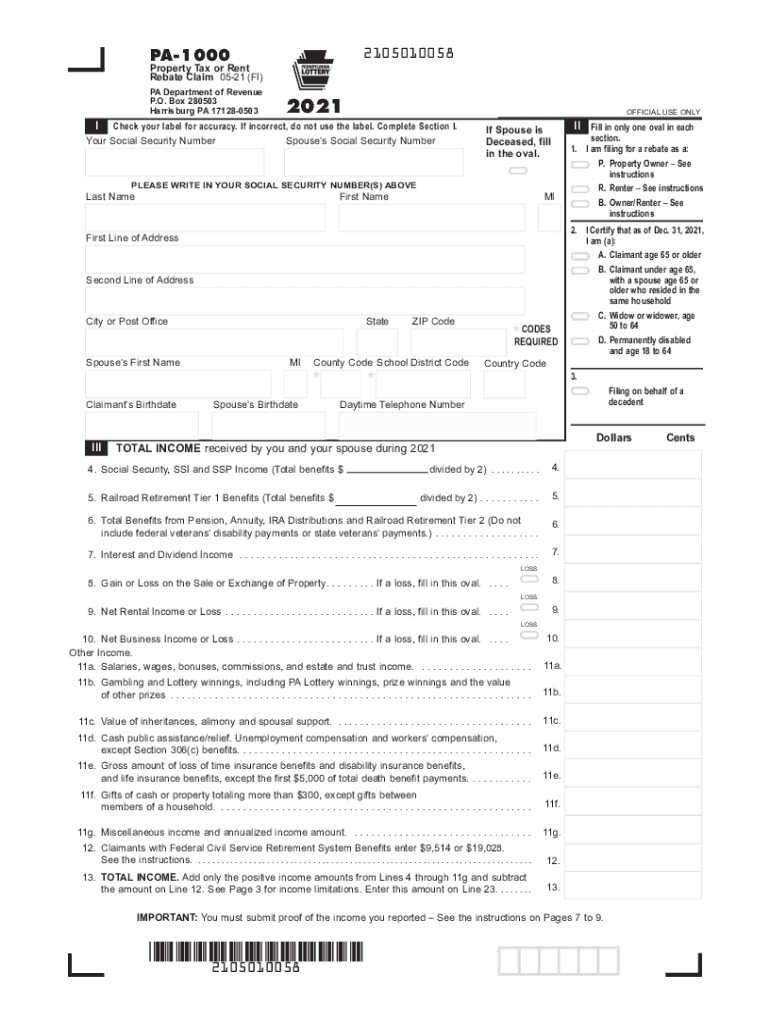

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project Enhanced tax credits through the Energy Efficient Home Improvement initiative are accessible for homeowners investing in energy efficient systems including central air conditioning systems boilers furnaces air source heat pumps and biomass stoves that meet high efficiency standards

This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air conditioners Any combination of heat pumps heat pump water heaters and biomass stoves boilers are subject to an annual total limit of 2 000 In the case of property placed in service after December 31 2022 and before January 1 2024 22 Energy efficient heating and air conditioning systems Water heaters natural gas propane or oil 2017 but was retroactively extended for tax years 2018 2019 and 2020 on December 20 2019 as part of the Further Consolidated

Download Tax Rebate Air Conditioner 2024

More picture related to Tax Rebate Air Conditioner 2024

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

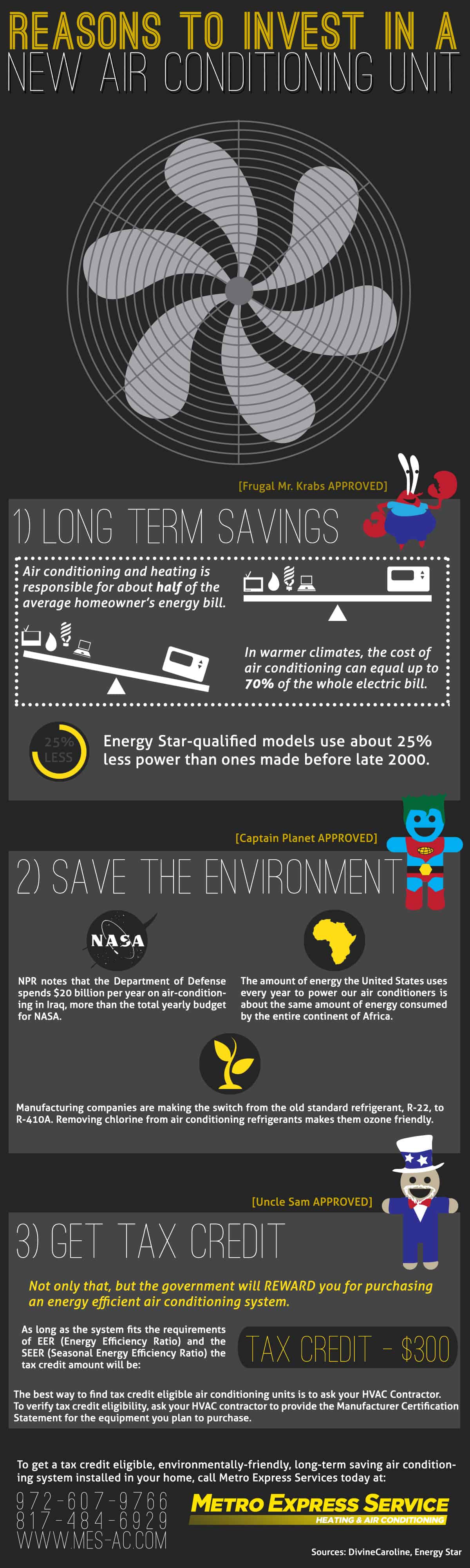

Air Conditioner Tax Rebate Air Conditioner Tax Credits Beaufort Air Conditioning Services

https://mes-ac.com/wp-content/uploads/Reasons-to-invest-in-a-new-air-conditioner-unit-infographic.jpg

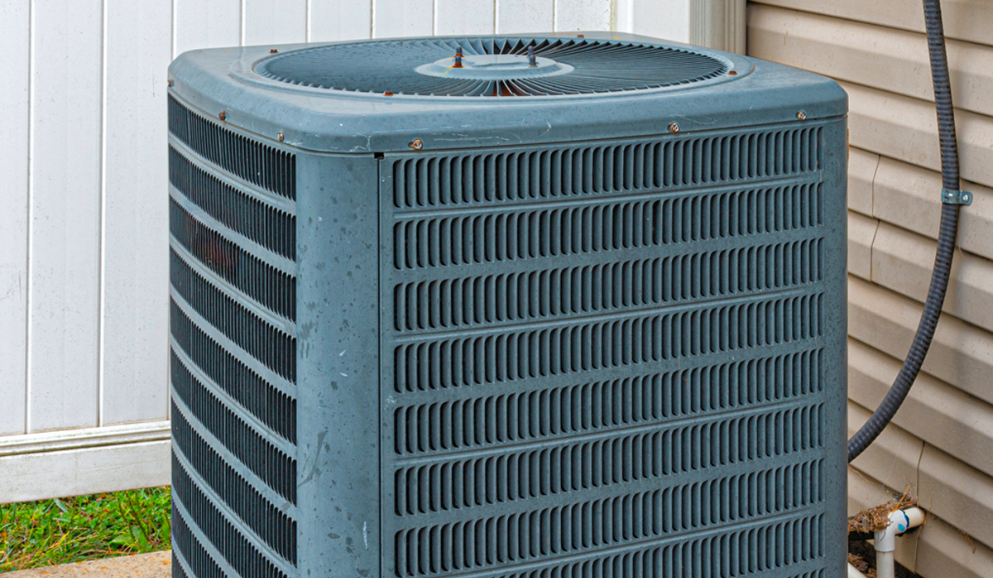

Air Conditioning Heat Pump Rebate

https://cdn11.bigcommerce.com/s-ih6ina3dd8/product_images/uploaded_images/airconditionheatpump.png

The good news is that rebates worth up to 14 000 to slash the cost of decarbonizing a home are expected to be available for years to come at least until the budget runs out The bad news is High Efficiency Electric Home Rebate Program An income dependent rebate to eligible homeowners Homeowners can receive Up to 8 000 for all electric heat pumps Up to 4 000 for electrical load service center upgrade Up to 2 500 for electric wiring Up to 14 000 maximum for all eligible measures

The IRA can help homeowners reduce their tax bill through rebates and tax credits for energy efficient windows doors water heaters furnaces and heating and cooling systems December 31 2032 The 25C credit has an annual cap of 30 of the installed costs with a maximum of 1 200 Qualified air conditioners or furnaces may receive up to Federal Tax Credits an air conditioner or heat pump and thermostat Get up to 200 in combined rebates on air purification zoning and a smart thermostat 2024 11 59 59 p m ET Rebate is paid in the form of a Lennox Consumer Rebate Visa Prepaid Card Prepaid card is governed by the Cardholder Agreement and some fees may apply

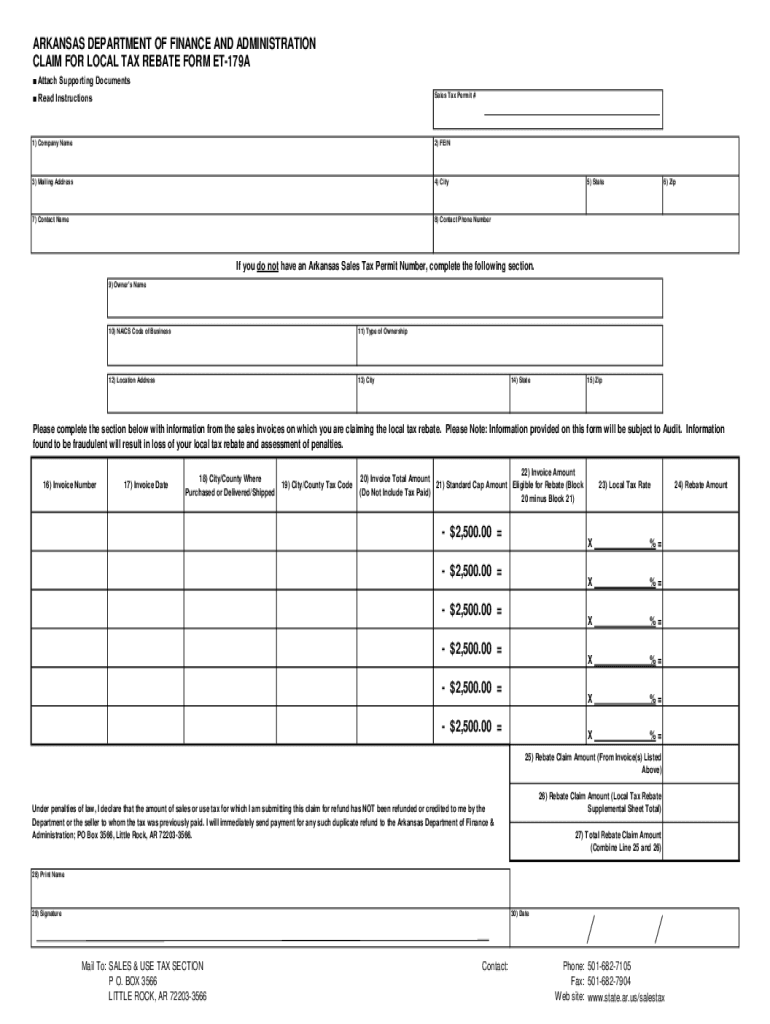

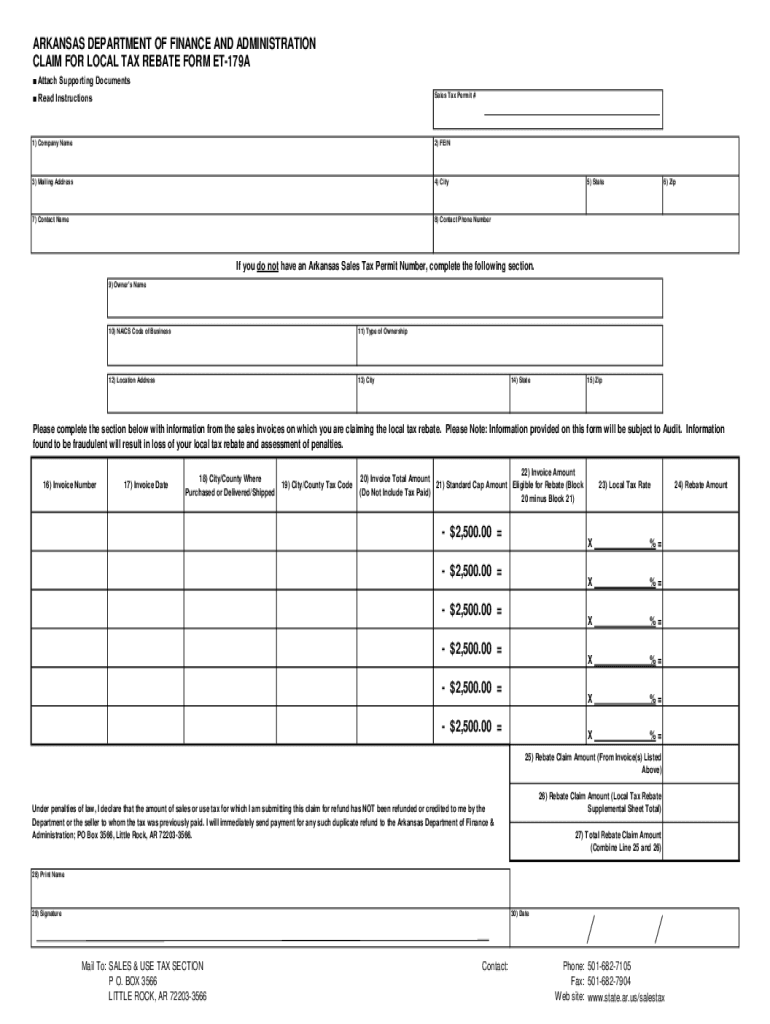

Claim For Local Tax Rebate Arkansas Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/620/550/620550056/large.png

Srp Air Conditioner Rebate

https://lh3.googleusercontent.com/proxy/MB8ggVHVOGNl9XWz_mtzqt4fhpKFRjAHNCIocjmWKNAyx5R9qX_IUjIAddJTf4QoVdcM15j2Yq0GKfWR8tlaA4L5wVJO-_V6hBpReYkSnsHFGaU3Z8zMnUFzaVz4fpbRtx24SpaatWTpnQ=s0-d

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit Resources Inflation Reduction Act of 2022 Frequently asked questions about energy efficient home improvements and residential clean energy property credits Credits and deductions under the Inflation Reduction Act of 2022

Room Air Conditioner Rebate

Claim For Local Tax Rebate Arkansas Fill Out And Sign Printable PDF Template SignNow

P55 Tax Rebate Form By State PrintableRebateForm

Home Depot Rebate Air Conditioner Homedepotrebate11

300 Federal Tax Credit For Air Conditioners Kobie Complete

Printable Blank Form 4923h Mo Printable Forms Free Online

Printable Blank Form 4923h Mo Printable Forms Free Online

BUDGET 2023 New Reforms In Tax Rebate Leaving You Confused Check This Out

Air Conditioner Tax Rebate Air Conditioner Tax Credits An Eligible Indoor Air Quality

Air Conditioner Tax Rebate Energy Tax Credit Which Home Improvements Qualify Turbotax Tax Tips

Tax Rebate Air Conditioner 2024 - Federal Tax Credit Overview Annual Limits 30 of the project cost up to a 3 200 annual maximum for all energy efficiency improvements claimed under this credit subject to aggregate limits This breaks down to Up to 2 000 annual limit toward the purchase of any combination of air source heat pumps heat pump water heaters and biomass