Tax Rebate 2024 Pa There are three ways to apply for the Property Tax Rent Rebate Program online by mail or in person Applicants are encouraged to apply online for the fastest review process Learn more about your options to ensure your application is submitted correctly by the June 30 2024 filing deadline Apply Online

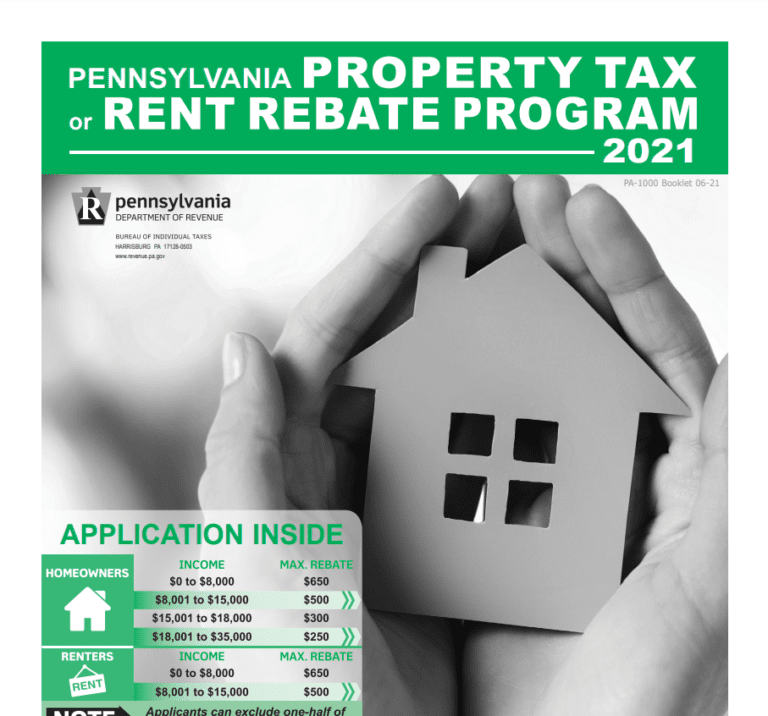

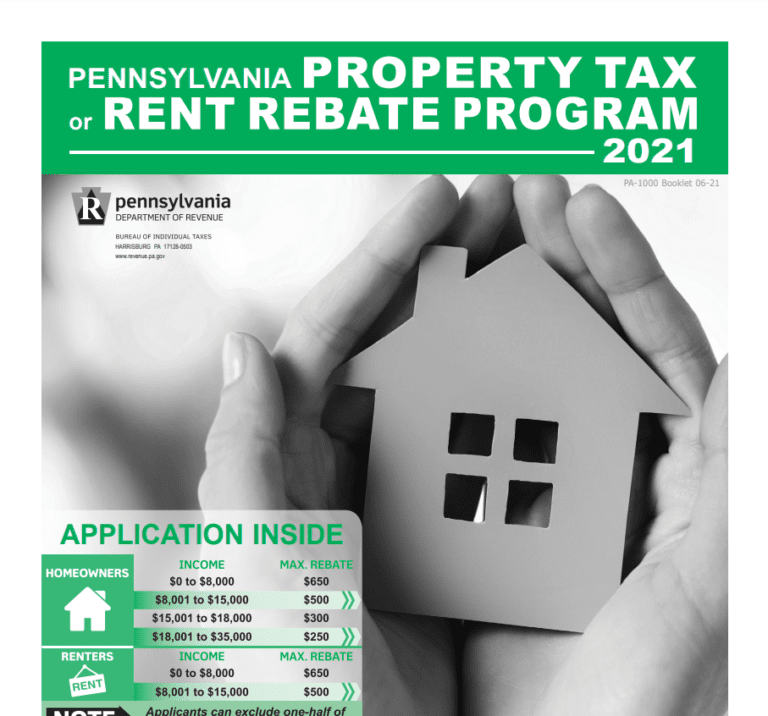

Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX REBATE 0 to 8 000 1 000 Property Tax Rent Rebate Program Online filing for the Property Tax Rent Rebate Program is now available for eligible Pennsylvanians to begin claiming rebates on property taxes or rent paid in 2022 Learn More PA Tax Talk

Tax Rebate 2024 Pa

Tax Rebate 2024 Pa

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

How To Get Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

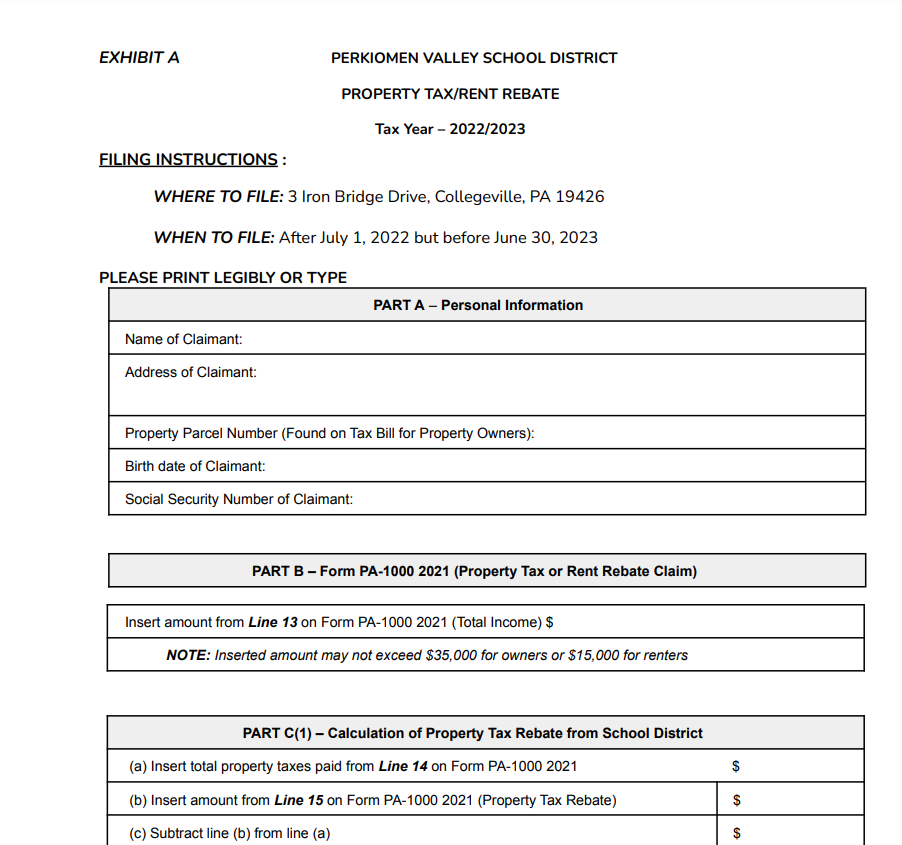

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Resources What s New Coming Soon for 2023 Claim Year House Bill 1100 signed August 2023 Maximum Eligibility Income increased to 45 000 Maximum Standard Rebate increased to 1 000 Future years will see increase based on annual inflation New Eligibility Table Supplemental Rebates for 2023 REBATE HOMEOWNERS 0 to 8 000 1 000 RENTERS 8 001 to 15 000 770 15 001 to 18 000 460 homeowners will be made equal and increase to 18 001 to 45 000 380 45 000 a year Exclude half of Social Security benefits Supplemental

First time filers who have filed by June 1 2024 should expect to receive their rebates between July 1 and September 1 2024 Some rebates may take additional time if DOR needs to correct or verify any information on a rebate application The maximum standard rebate is now 1 000 up from 650 thanks to bipartisan legislation Governor Shapiro championed and signed into law last year delivering on his promise to cut costs and deliver real relief for Pennsylvania seniors

Download Tax Rebate 2024 Pa

More picture related to Tax Rebate 2024 Pa

Income Tax Rates 2022 Vs 2021 Caroyln Boswell

http://thumbor-prod-us-east-1.photo.aws.arc.pub/r-5-lDAfA7hx2qRoVpXX6UhZ43k=/arc-anglerfish-arc2-prod-advancelocal/public/U5MVCZVZI5COTCDGVU3MWDQABQ.png

2023 Rent Rebate Form Printable Forms Free Online

https://www.pdffiller.com/preview/47/686/47686220/large.png

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

The property tax rebate program provides rent or property tax rebates to eligible older adults and adults with disabilities The rebates range from 380 to 1 000 with lower income residents receiving higher rebates and some applicants qualifying for additional money The program which is funded by the Pennsylvania Lottery and gaming was Pennsylvania State Treasurer Stacy Garrity Starting in 2024 the maximum standard rebate will increase from 650 to 1 000 Also in 2024 the household income limit for property tax rebates will increase to 45 000 up from the current 35 000 limit The household income limit for rent rebates will also increase to 45 000 up from 15 000

The deadline to apply is June 30 2024 For more information and to access forms instructions visit revenue pa gov ptrr or call 1 888 222 9190 for assistance Since its inception in 1971 the PTRR program has delivered more than 8 billion in property tax and rent relief to some of Pennsylvania s most vulnerable residents Harrisburg PA Governor Josh Shapiro recently delivered on a promise he made to Pennsylvanians when he signed a major expansion of the Property Tax Rent Rebate PTRR program into law This historic achievement which will deliver the largest targeted tax cut for Pennsylvania s seniors in nearly two decades is being celebrated by many people who recognize the impact this will make for

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189550-Z9C3QJVKXYFO4N04VXT7/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_2.jpg

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRentRebateProgram/Ways-to-Apply

There are three ways to apply for the Property Tax Rent Rebate Program online by mail or in person Applicants are encouraged to apply online for the fastest review process Learn more about your options to ensure your application is submitted correctly by the June 30 2024 filing deadline Apply Online

https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PTRR/Documents/2023_pa-1000_inst.pdf

Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX REBATE 0 to 8 000 1 000

2022 Pa Property Tax Rebate Forms PropertyRebate

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Minnesota Fillable Tax Forms Printable Forms Free Online

PA Property Tax Rebate Fillable Form Printable Rebate Form

Section 87A Tax Rebate Under Section 87A Rebates Financial Management Income Tax

Where To Mail Pa Property Tax Rebate Form Amended Printable Rebate Form

Where To Mail Pa Property Tax Rebate Form Amended Printable Rebate Form

2023 Pa Tax Form Printable Forms Free Online

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania How

Tax Rebate Checks What Eligible Recipients Need To Know

Tax Rebate 2024 Pa - Resources What s New Coming Soon for 2023 Claim Year House Bill 1100 signed August 2023 Maximum Eligibility Income increased to 45 000 Maximum Standard Rebate increased to 1 000 Future years will see increase based on annual inflation New Eligibility Table Supplemental Rebates for 2023