Tax Rebate 2024 Nyc The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in one of two ways STAR credit If you are registered for the STAR credit the Tax Department will issue your STAR benefit via check or direct deposit

Property Property Tax Rebate Frequently Asked Questions FAQs 1 How will I know if I am eligible for the property tax rebate 2 When will I receive my property tax rebate check 3 My check was damaged How can I get a replacement check 4 I received a check that was addressed to someone else What should I do with it 5 The Cooperative and Condominium Tax Abatement reduces the property taxes of eligible condominium and co op owners Individual unit owners do not apply for the abatement Instead managing agents and boards apply on behalf of their entire development The Cooperative Condominium Abatement Portal is now open for tax year 2024 25 applications and

Tax Rebate 2024 Nyc

Tax Rebate 2024 Nyc

https://southarkansassun.com/wp-content/uploads/2023/07/QFVDBCFGXJETVNYWYD4CNRMM7E.jpg

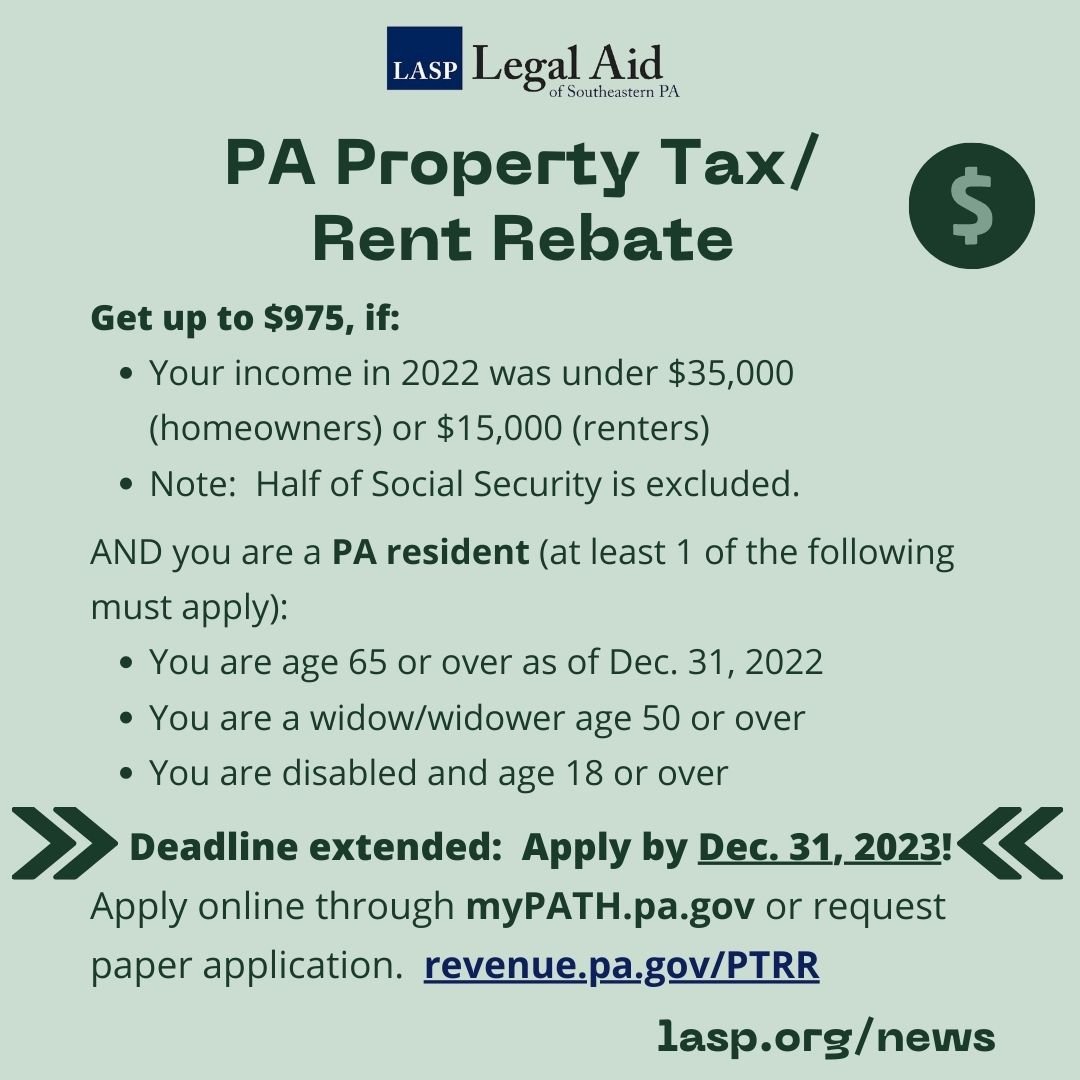

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

The federal government has now authorized three rounds of Economic Impact Payments stimulus checks through the IRS to help Americans get on more stable financial footing Individuals who received the first two payments will most likely not need to take additional action to receive their third payment Eligibility Amount The Senior Citizen Homeowners Exemption SCHE provides a reduction of 5 to 50 on New York City s real property tax to seniors age 65 and older To be eligible for SCHE you must be 65 or older earn no more than 58 399 for the last calendar year and the property must be your primary residence The exemption must be renewed every two years

Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions Lost stolen destroyed and uncashed checks On August 24 2022 Mayor Adams signed Local Law 82 into law The bill authorizes a one time property tax rebate up to 150 to hundreds of thousands of eligible New York homeowners The bill was introduced Intro 600 and voted on by the City Council in early August passing by a unanimous vote following a public hearing

Download Tax Rebate 2024 Nyc

More picture related to Tax Rebate 2024 Nyc

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

Missouri State Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Missouri-Tax-Rebate-2023-768x587.png

To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax liability for the 2022 2023 school year that is more than your 2022 STAR benefit Visit us to learn about your tax responsibilities check your refund status and use our online services anywhere any time Form IT 2104 is one of the forms your employer asks you to complete when you begin a new job in New York State And it s a powerful tool for managing what comes out of your pay check The 2024 Tax Preparer and

DCWP Consumers Manage Money Get Tax Credit Information IMPORTANT You must file your federal and New York State tax returns to claim tax credits If your family earned 85 000 or less or you re a single filer who earned 59 000 or less in 2023 you may qualify for NYC Free Tax Prep to file for free and keep your whole refund Virginia Tax Rebate 2023 By Kelley R Taylor last updated December 02 2023 Stimulus checks from the federal government ended a couple of years ago but some states have provided financial

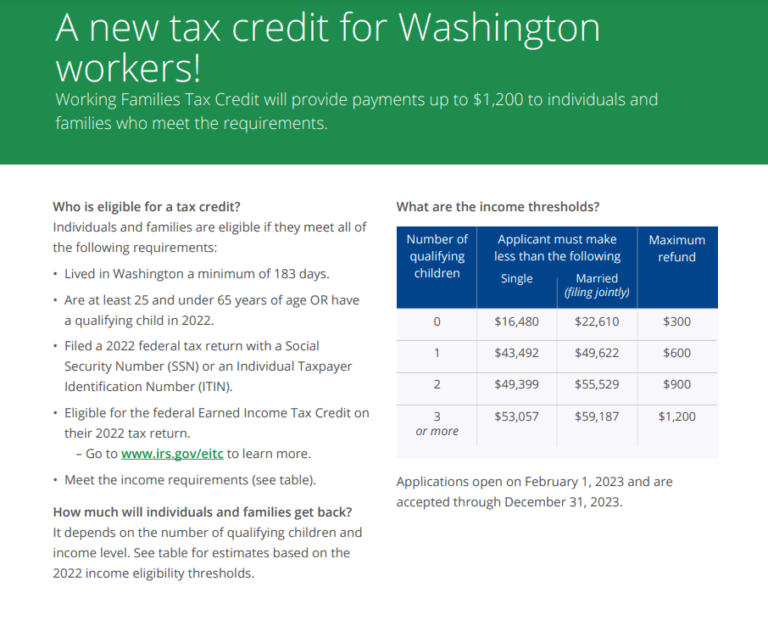

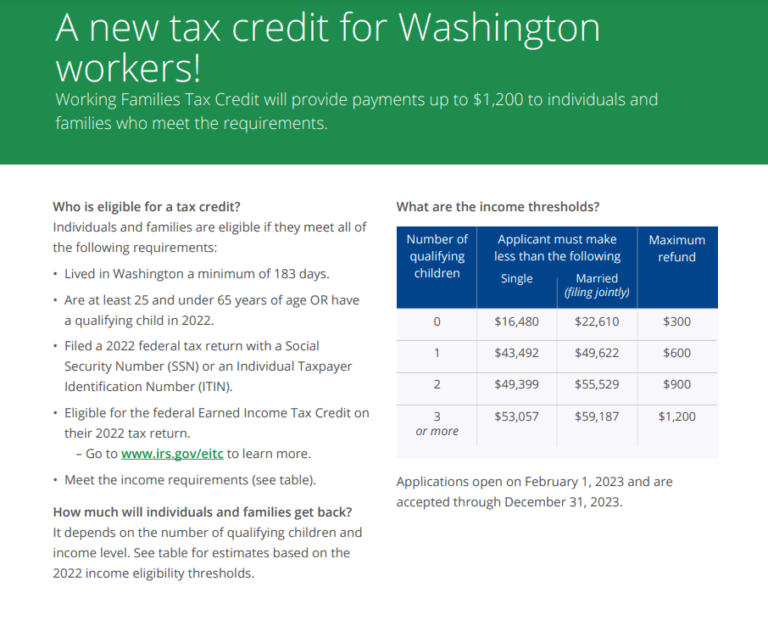

Understanding The Washington Tax Rebate 2023 A Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/05/Washington-Tax-Rebate-2023-768x626.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

https://www.tax.ny.gov/star/

The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in one of two ways STAR credit If you are registered for the STAR credit the Tax Department will issue your STAR benefit via check or direct deposit

https://www.nyc.gov/site/finance/property/property-tax-rebate-faqs.page

Property Property Tax Rebate Frequently Asked Questions FAQs 1 How will I know if I am eligible for the property tax rebate 2 When will I receive my property tax rebate check 3 My check was damaged How can I get a replacement check 4 I received a check that was addressed to someone else What should I do with it 5

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Understanding The Washington Tax Rebate 2023 A Comprehensive Guide Printable Rebate Form

Georgia Income Tax Rebate 2023 Printable Rebate Form

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

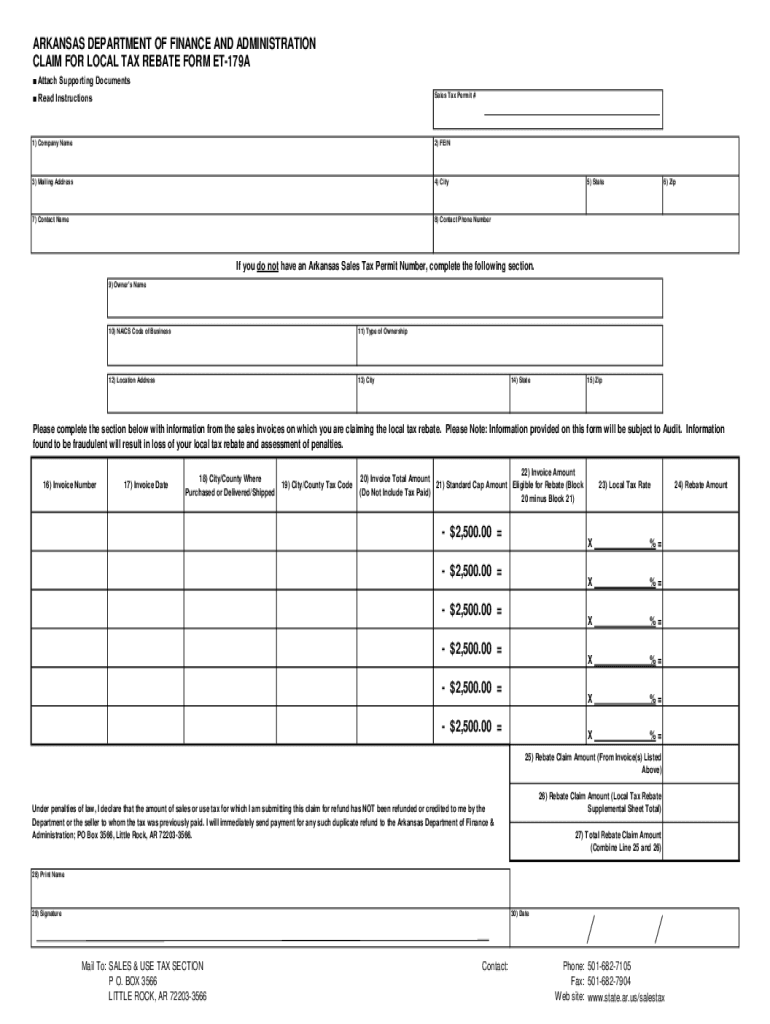

Claim For Local Tax Rebate Arkansas Fill Out And Sign Printable PDF Template SignNow

Income Tax Rebate Under Section 87A

Tax Rebate 2024 Nyc - Consult the Internal Revenue Service IRS guidance for taxpayers on credits and deductions and your tax advisor to determine IRA eligibility Income eligible New Yorkers may be able to receive additional State and federal rebates along with the incentives and rebates listed below Home Clean Electricity Products Heating Cooling and Water Heating